Amex has one of the strictest rules against receiving a welcome bonus again on the same card you’ve already had in the past.

Officially, you can only receive a welcome bonus on each Amex card once in a lifetime but in real life we see the number to be once in 7 years (that’s the Amex lifetime, or maybe rather their memory timespan).

Amex has added family rules to many of their cards

Amex is going a step further and has recently added language to many cards that even if you never had this card but you received a bonus on a similar card then you’re still not eligible for the welcome bonus.

For example, these are the new welcome offer terms on the card_name:

“You may not be eligible to receive a welcome offer if you have or have had this Card, the Premier Rewards Gold Card, the Platinum Card®, the Platinum Card® from American Express Exclusively for Charles Schwab, the Platinum Card® from American Express Exclusively for Morgan Stanley or previous versions of these Cards. You also may not be eligible to receive a welcome offer based on various factors, such as your history with credit card balance transfers, your history as an American Express Card Member, the number of credit cards that you have opened and closed and other factors. If you are not eligible for a welcome offer, we will notify you prior to processing your application so you have the option to withdraw your application.”

The new rules

These are the cards that so far have the new rules added:

Delta cards family

Delta Platinum: You’re not eligible for the welcome offer if you had the card_name or card_name

Delta Gold: You’re not eligible for the welcome offer if you had the card_name, card_name, or card_name

Delta Blue: You’re not eligible for the welcome offer if you had the card_name, card_name, card_name, or card_name

Gold/Platinum card family

Gold card: You’re not eligible for the welcome offer if you had the card_name or any of card_name (including Morgan Stanley Amex Platinum or The American Express Platinum Card for Schwab)

Platinum card: You’re not eligible for the welcome offer if you had card_name, Morgan Stanley Amex Platinum, or The American Express Platinum Card for Schwab

Blue Cash cards family

Blue Cash Everyday: You’re not eligible for the welcome offer if you had the card_name, Cash Magnet Card, card_name or the Morgan Stanley Blue Cash Preferred® American Express

Blue Cash Preferred: You’re not eligible for the welcome offer if you had the card_name or Morgan Stanley Blue Cash Preferred® American Express

Amex wants you to climb the ladder

With these new rules, in order to get the welcome bonus on all Amex cards you need to climb the ladder upwards not downwards.

For example, if you get the card_name first, then the card_name, and then card_name, then you are eligible for all three welcome bonuses.

But if you get card_name first then you’re no longer eligible for a welcome bonus on the card_name.

The same is with the Delta cards and the Blue Cash cards; You always need to first get the card with the lower annual fee then climb the ladder upwards.

If this trend continues and these new rules will be added to more Amex cards then this will sooner or later be the new strategy for all Amex cards. Climb the ladder upwards not downwards.

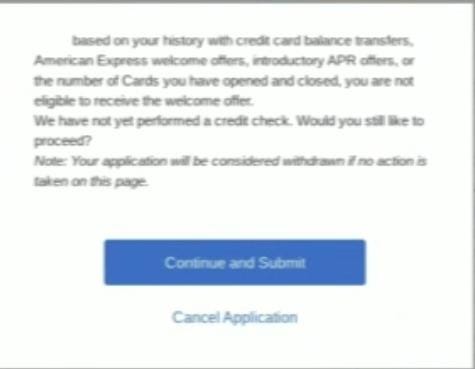

Remember that the popup is what ultimately decides

Amex has a very famous popup that lets you know if you’re eligible for the welcome bonus before they pull your credit. This popup is controlled based on the rules above but they also take much more into account to determine eligibility for a welcome bonus. In the past, I’ve seen reports of people who never had any Amex cards at all and still got that popup. Ultimately, that popup determines if you will get the bonus or not. So always take note to see if you bump into that popup when you apply.

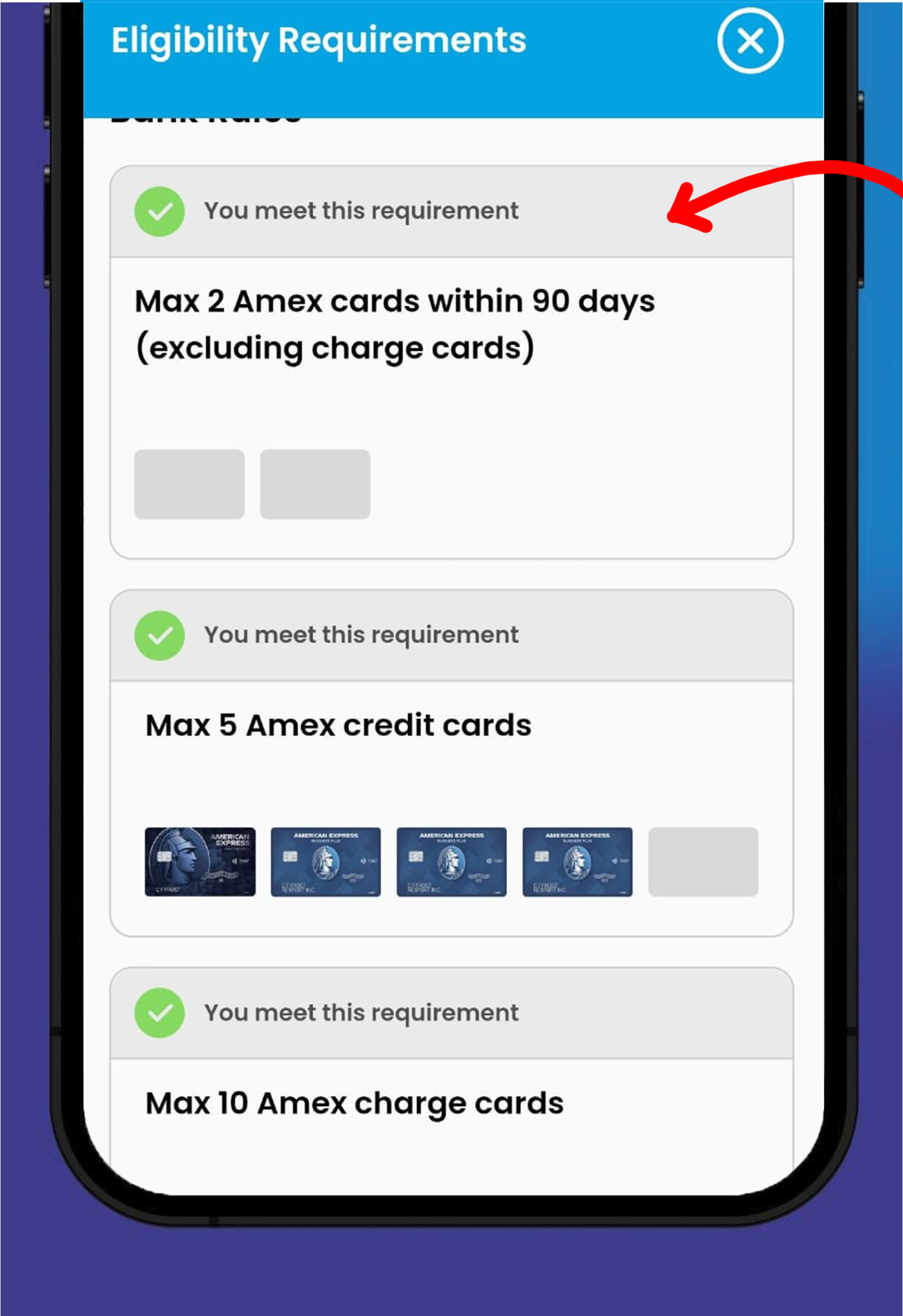

Let our app help you keep track of these rules

The good news is that our app, CardRight, is already trained to know the new Amex family rules. So with us, everything is on autopilot. If these rules sound too complicated for you, make sure you download our app asap and let us keep track of them for you!

Download it here:

Or you can use a Desktop Web version (no smartphone needed) at cardright.com.

![Primary CDW Insurance: Which Credit Cards Still Offer Them? [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/04/post-on-cards-that-have-primary-cdw-insurance.png)

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

0 Comments