Help Me Build Credit has partnered with CardRatings for our coverage of credit card products. Help Me Build Credit and CardRatings may receive a commission from card issuers. The editorial content on this page is not provided by any of the companies mentioned, and have not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are the author’s alone.

The Delta SkyMiles Blue American Express Card (American Express is a HelpMeBuildCredit advertiser) is a no annual fee Delta credit card. You will earn 2 points on every dollar spent at restaurants and 2 points on all Delta purchases.

- Credit: Good credit needed

- Amex 90-day rule: In a time span of 90 days, you can only get approved for 2 Amex cards. No Preset Spending Limit* cards are not included in this rule and do not get counted.

- Max cards: You can only get approved for up to - and including- 5 Amex credit cards (including personal and business), but this rule isn’t always enforced (please note the total of 5 credit cards excludes some Amex cards that are No Preset Spending Limit* cards like the Amex Platinum, Amex Gold, etc)

- Apply for two cards: If you apply for one Amex card and get approved, it is recommended to apply for a second card since Amex is very good about approving for two cards, even within the same day

- Credit bureau: Amex will usually pull your Experian credit report. With the new "Apply With Confidence" feature, Amex will first do only a soft pull on your credit report and will let you know if approved or not. Only after you accept the approval will Amex do a hard pull on your credit (this feature is currently only available on Amex consumer cards. See more details below)

- Combining same-day credit inquiries: Credit inquiries for same-day applications will be combined, as long as they are both approved for on the same day. Note, for some existing Amex credit cardholders, Amex will not do a hard credit pull when applying for a new credit card at any time

- Check application status: You can check your application status here or call 1 800 567 1083

- Reconsideration: If declined you can call 1 800 567 1083 to be reconsidered

Quickest way to get my card: Amex will sometimes give you an instant credit card number after approval, but not always. Amex physical credit cards cannot be expedited (except for the platinum cards) and will arrive after 5-7 business days

Approval Monitor (submitted by HelpMeBuildCredit users)

Credit limit range $1,000-$8,000

Avg. Credit limit$2,700

Disclosure: These results are based on information submitted by HelpMeBuildCredit users. Credit card approval results are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. Neither HelpMeBuildCredit nor the bank advertiser's take any responsibility on the accuracy of the information.

HelpMeBuildCredit credit ranges are a variation of FICO®️ Score 8, one of many types of credit scores lenders may use when considering your credit card application

Secondary worldwide coverage on rentals up to 30 days (excluding Australia, Italy, and New Zealand). Max $50,000. You can purchase a premium plan from Amex that will offer primary coverage up to 42 days. Max $100,000.

Get one additional year to your original manufacturer’s warranty time. (Will only cover if the original warranty is for 5 years or less). Max $10,000 per claim, $50,000 per year.

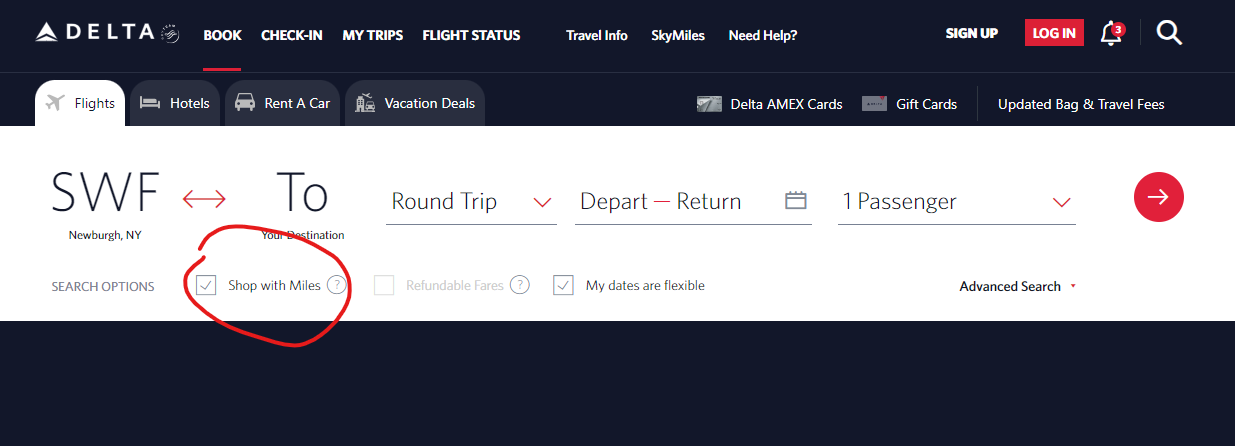

Points are worth a minimum of 1 cent per mile on Delta flights when you book flights with the Pay With Miles program.

Receive a 20% discount on inflight purchases.

Get refunded if your purchase is damaged or stolen, up to 90 days from the date of purchase. Max $1,000 per claim, $50,000 per year.

The points can be used at approximately 1 penny per point to book award flights with one of the following Delta airline partners:

- Delta

- Aeroflot

- Aeromexico

- Aerolineas Argentinas

- Air France

- China Airlines

- China Eastern

- Czech Airlines

- Garuda Indonesia

- ITA Airways

- Kenya Airways

- KLM Royal Dutch Airlines

- Korean Air

- LATAM

- Saudia Airlines

- Tarom Airlines

- Vietnam Airlines

- Xiamen Airlines

You can book award flights using your Delta miles with Delta airlines and its partners here.

To book award flights with the following Delta airline partners call 1-800-323-2323:

- Air Europa

- Air Tahiti Nui

- Czech Airlines

- Kenya Airways

The Delta redemption scheme is completely revenue-based now for all redemptions, both on its own metal and the partners’.

There are no predictable sweet spots, or even predictable good redemptions anymore, and Delta also adds fuel surcharges to many of its partners. However, since there are people (me included) who still have miles in the Delta SkyMiles program, here is what we can do in the confines of this extremely overpriced program.

Look for domestic coach awards

Even though Delta award tickets are revenue-based, there is no single formula that would explain why some awards price higher once others price lower even though they might cost about the same in cash. So whenever you need a cheap domestic ticket, check Delta first. While I have no love for its loyalty program, it’s just a better airline operationally, and when the price is right, it’s a win-win. I prefer flying on Delta to both American or United, although not to JetBlue.

Check Delta Flash Sales

Delta rarely has Business Class tickets on sale, but their so-called flash sales can be dirt-cheap, so when you see an email touting Delta flash sales, don’t rush to discard it. You might find something in there worth checking.