Getting 0% APR business cards can help your business cash flow tremendously in case a recession hits, or even just to generally weather a storm. Luckily, both Chase and Amex are approving huge limits on their business credit cards. This gives you the opportunity to get approved for credit limits of $100k+ on 0% APR by applying for just 4 business credit cards.

Huge limits approved by Chase and Amex on business cards

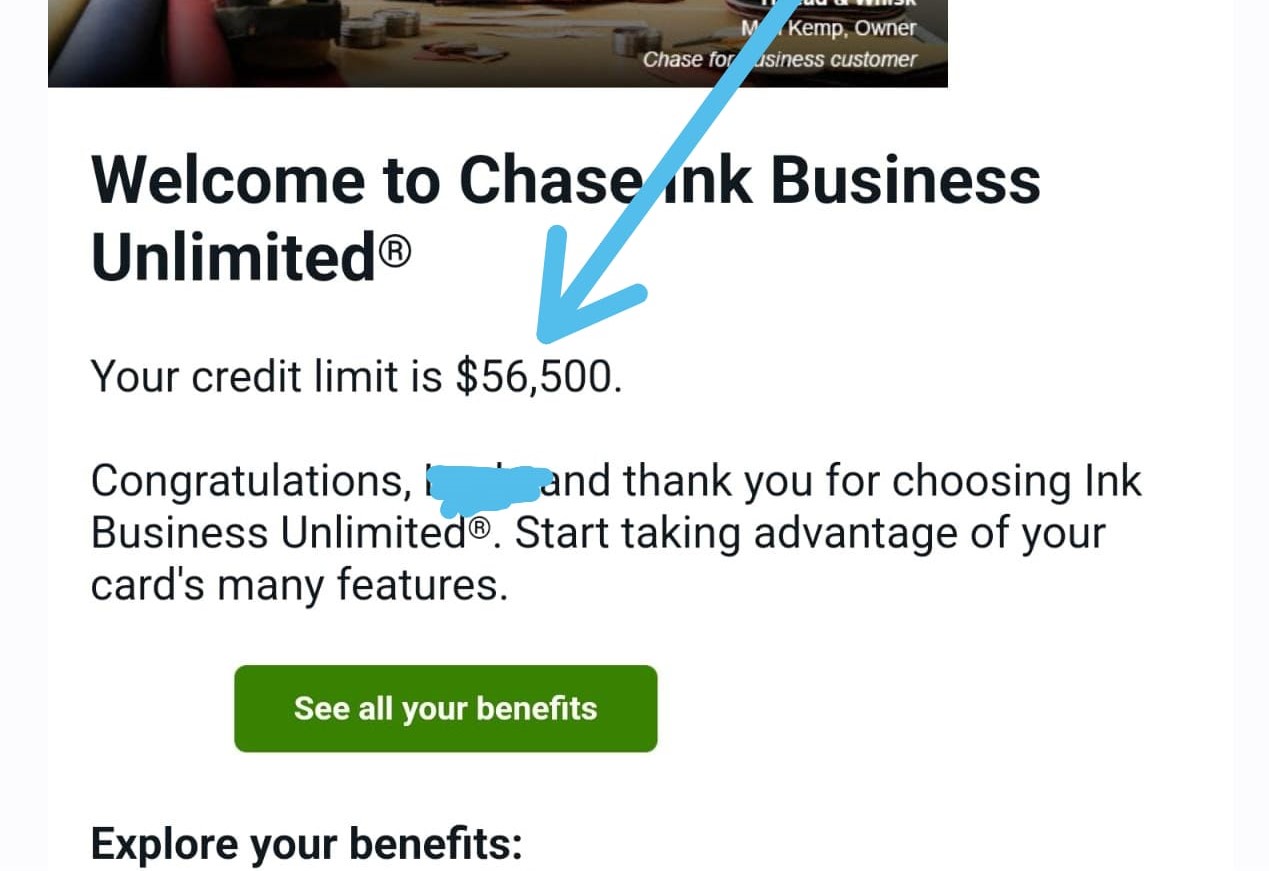

Many people are currently getting approved for $30k-$50k on a single Chase business card.

Plus, after getting approved for one Chase business card, they are able to get the same or similar credit limit approved on a second Chase business card as well.

The same is true with Amex. You can apply for two cards the same day and get approved for both with similar limits.

The 4 cards you should apply for

So if you’re looking to get high limits approved on 0% APR cards then I would recommend you apply for the following 4 cards in the following order.

As long as you have good credit and a minimum of one year credit history, you should not have an issue getting approved for all 4 cards at the same time, all with great credit limits.

1. Ink Business Cash ($0)

0% APR for 12 months on purchases, plus you get 90,000 points after spending $6,000 within the first 3 months.

Then, wait until it is approved before you go to the second application. If the first application is pending then wait till it actually gets approved (usually does not take more than 2-3 days). Do not apply for the second card while the first application is pending.

2. Ink Business Unlimited Credit Card ($0)

0% APR for 12 months on purchases, plus you get 90,000 points after spending $6,000 within the first 3 months. On top of all this, the card earns an unlimited 1.5 points on all purchases!

3. Blue Business Plus Credit Card from American Express ($0)

0% APR for 12 months on purchases, plus you get 15,000 points after spending $3,000 within the first 3 months. Plus, you can earn 2 points on up to $50,000 spent annually, then 1 point.

4. American Express Blue Business Cash Card ($0)

0% APR for 12 months on purchases, plus you get $500 after spending a total of $15,000 within the first year. Plus, you can earn 2% cashback on up to $50,000 spent annually, then 1%.

You would love to apply for a business credit card. But the problem is, your business is not registered as an LLC or C-Corp. No problem! Tune in for a step by step gui...

If you still don’t reach $100k in 0% APR after applying for these cards, then you can apply for the GM Business Card.

You can also apply for the M&T Business Credit Card but to get approved, you’ll have to show business financial, including tax return, etc.

Choose both Chase Ink Business cards and both Amex Blue Business cards

As we pointed out previously, both Chase and Amex are currently approving nice limits and they are approving both cards at the same time with pretty similar limits on each. It would be recommended for you to go for both Chase Inks and both Amex Blue Business cards in order to gain the most credit limits, all on 0% APR. Just remember to follow the order pointed out previously.

Reallocating your existing credit limits to also become 0% APR

If you currently have existing great credit limits with either Chase or Amex, then you can reallocate (aka transfer) your credit limits from your old card to the new card and gain an even higher credit limit, all on 0% APR.

Here are the rules to keep in mind.

Chase: You can reallocate Chase credit limits only from personal to personal or from business to business. Chase will do a hard credit pull If the new credit limit will exceed $35,000.

Amex: You can reallocate credit limits from personal to personal, business to business, and from personal to business cards. You cannot transfer from business to personal. You cannot reallocate your credit limits more than once in 30 days.

Balances will not affect your credit score

Both Chase and Amex do not report their business credit cards on your personal credit report. Therefore, even if you max out the card, it will not affect your credit score.

Will the credit inquiries combine?

Luckily, applications made with one bank on the same day, in many cases, may all be combined to only one inquiry.

Here is how it works:

Chase: The data points are mixed. Some data points suggest that applications for all Business Chase cards within the same day will result in only one credit inquiry. However, there are data points that suggest that Chase credit inquiries are not combining.

Amex: Amex credit inquiries will be combined for the same-day applications. For 99% of existing Amex credit cardholders, Amex will not do a hard credit pull when applying for a new credit card at any time.

Good luck on getting approved!

P. S. you can research many data points on credit card approvals in our credit card database.

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments