You would love to apply for a business credit card. But the problem is, your business is not registered as an LLC or C-Corp. No problem! Tune in for a step by step guide on how to apply for a business credit card without an LLC or corporation.

First, go to the business credit card application and click on apply now. Next, you will need to put in your business information. Do it as follows.

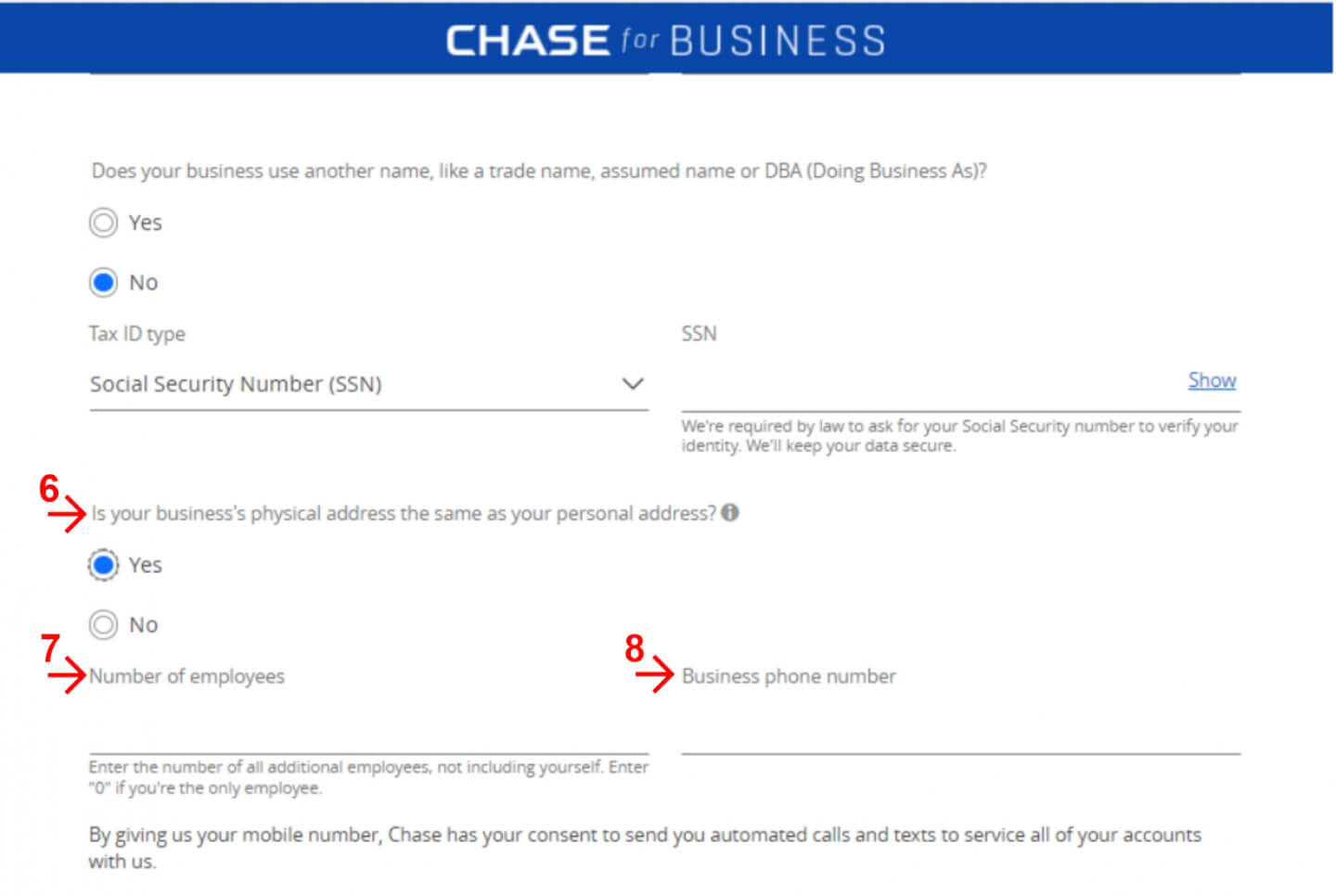

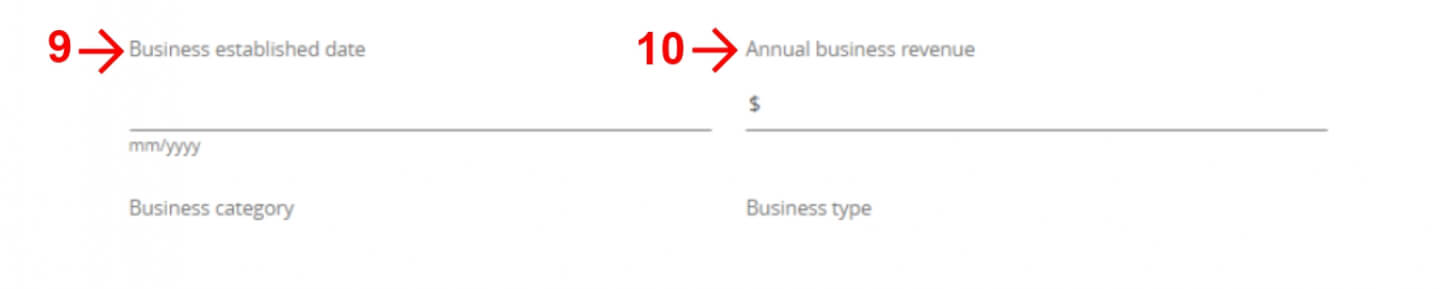

Chase business card applications

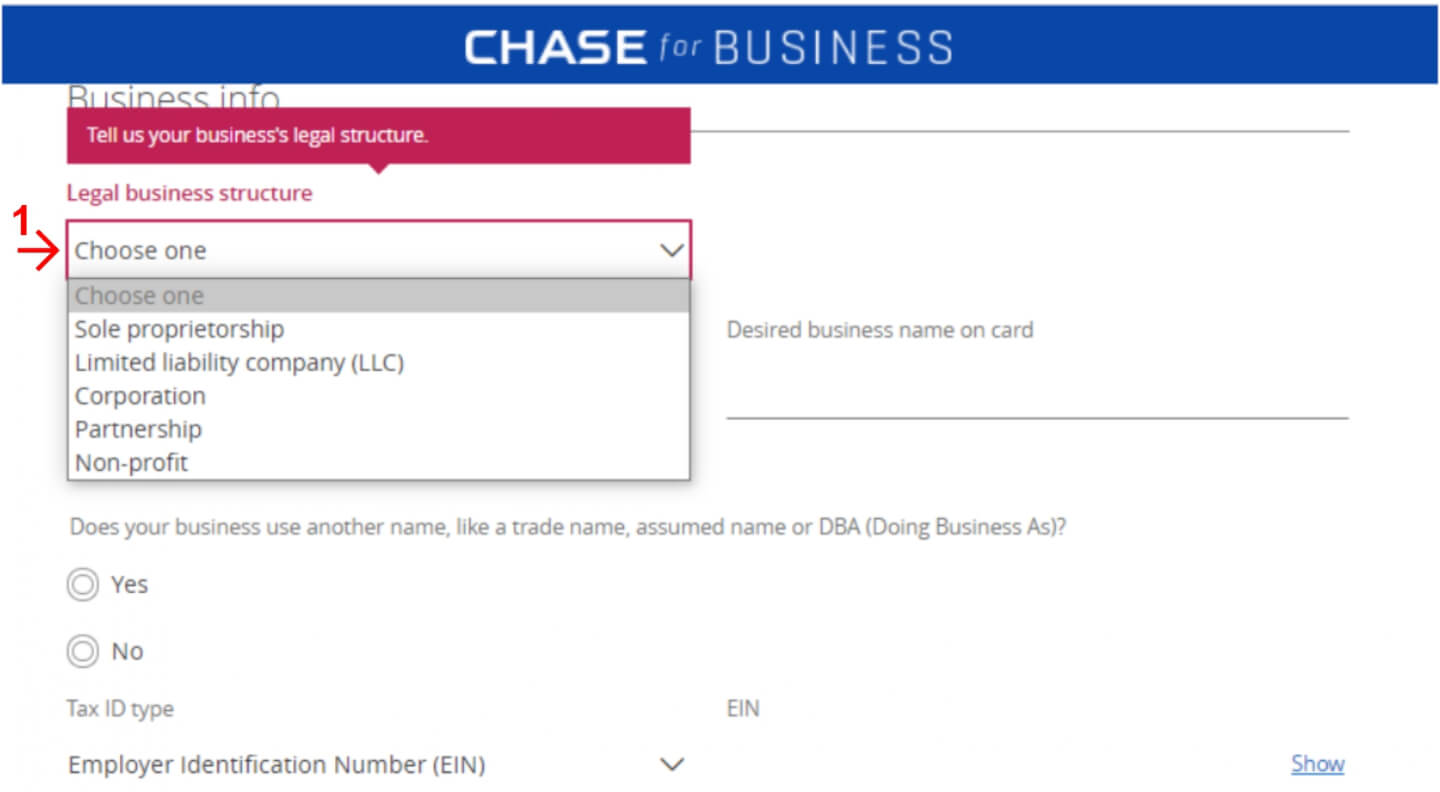

First, fill out your personal information. Then, once you hit the screen to fill out your business info, here’s how to enter it (some Chase cards might have a slightly different structure but should be similar).

- Legal business structure: Choose “sole proprietorship”.

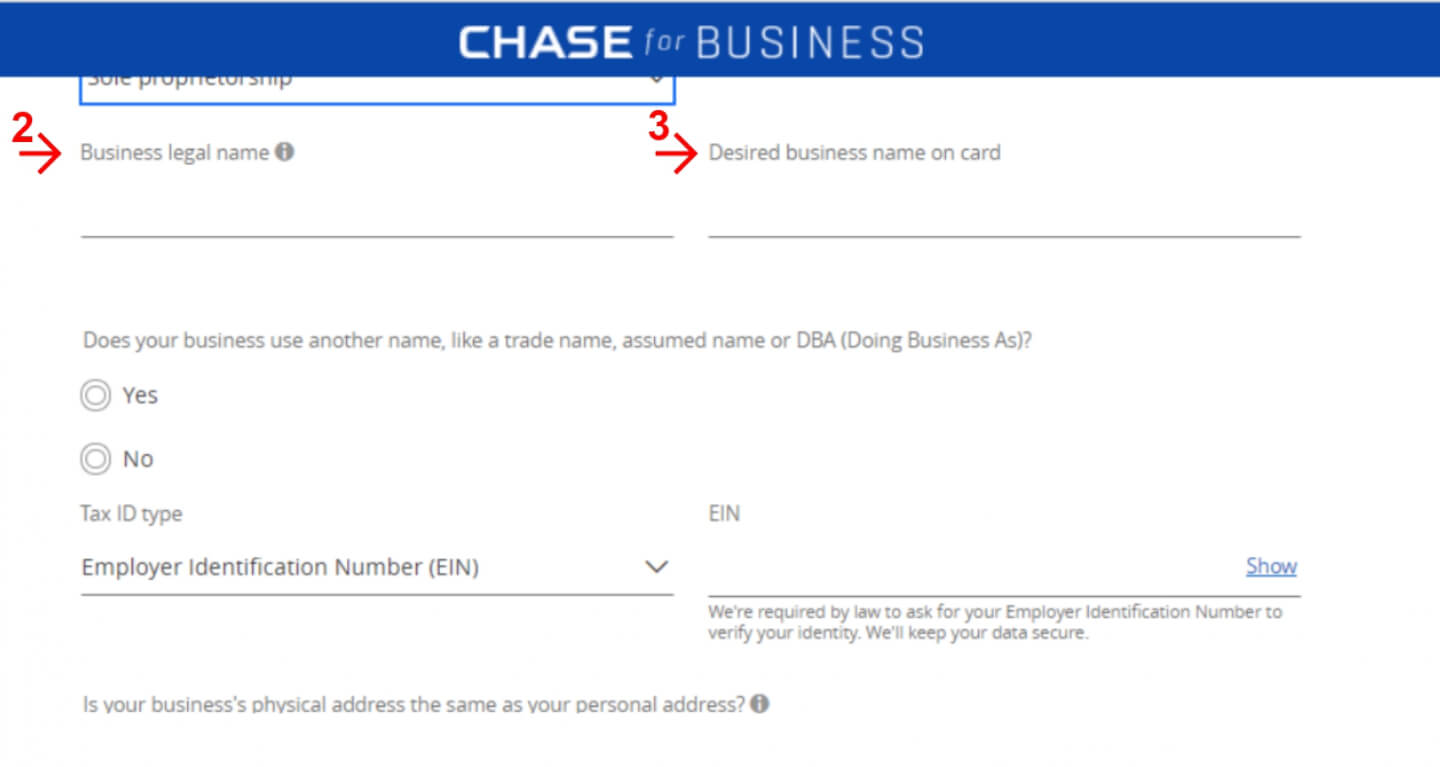

2. Legal business name: Write the business name. If the business does not have a name then write your own name, which is actually better as it will help you out later with providing proof of the business name, if requested (you can then send any utility bill that has your name on it).

3. Desired business name on card: Write any name you prefer to be displayed on the card. 4. Does your business use another name, like a trade name, assumed name or DBA (Doing Business As)? In most cases the answer is “no”.

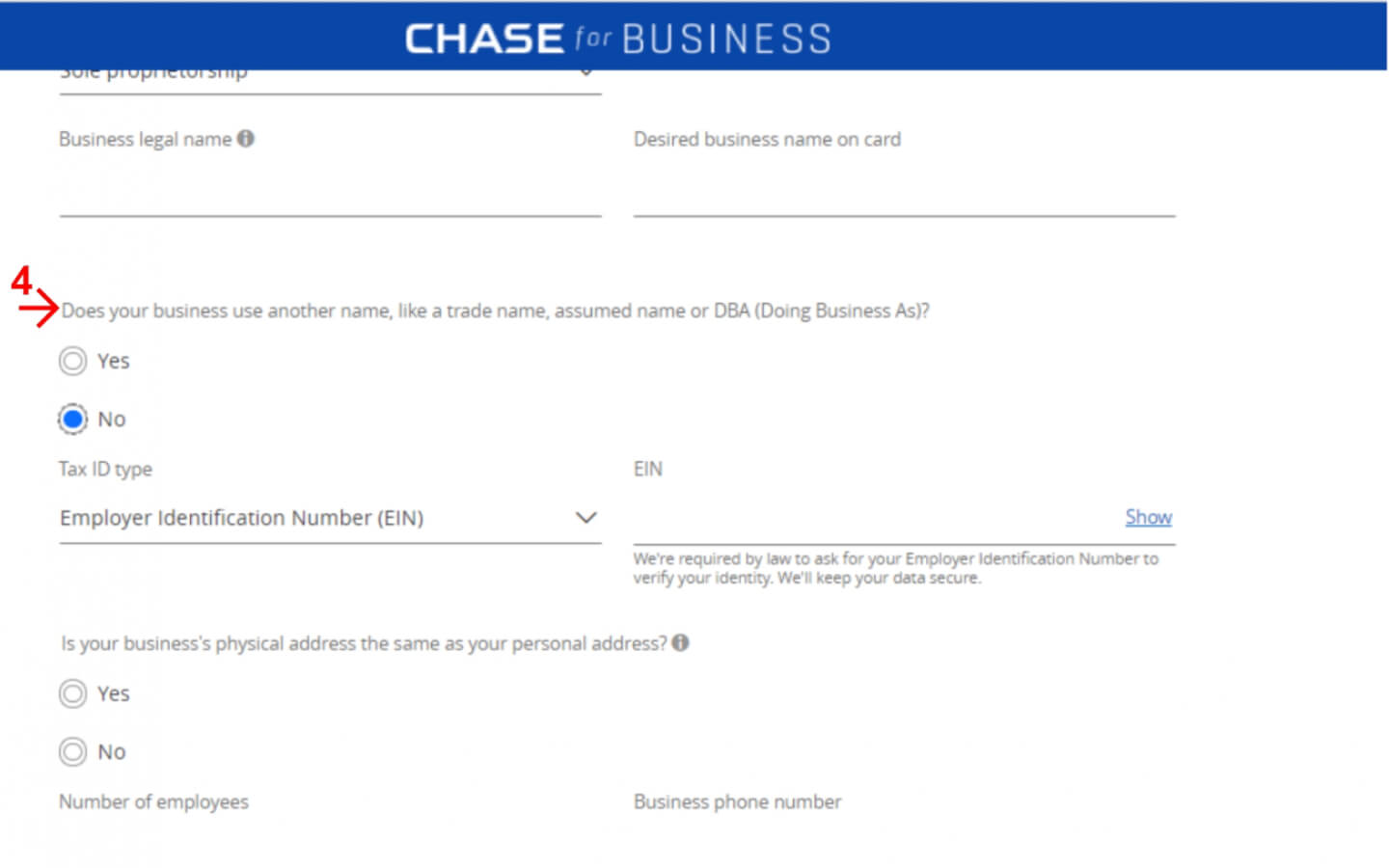

4. Does your business use another name, like a trade name, assumed name or DBA (Doing Business As)? In most cases the answer is “no”.  5. Tax ID type: Choose “Social security number” and fill out your social security number.

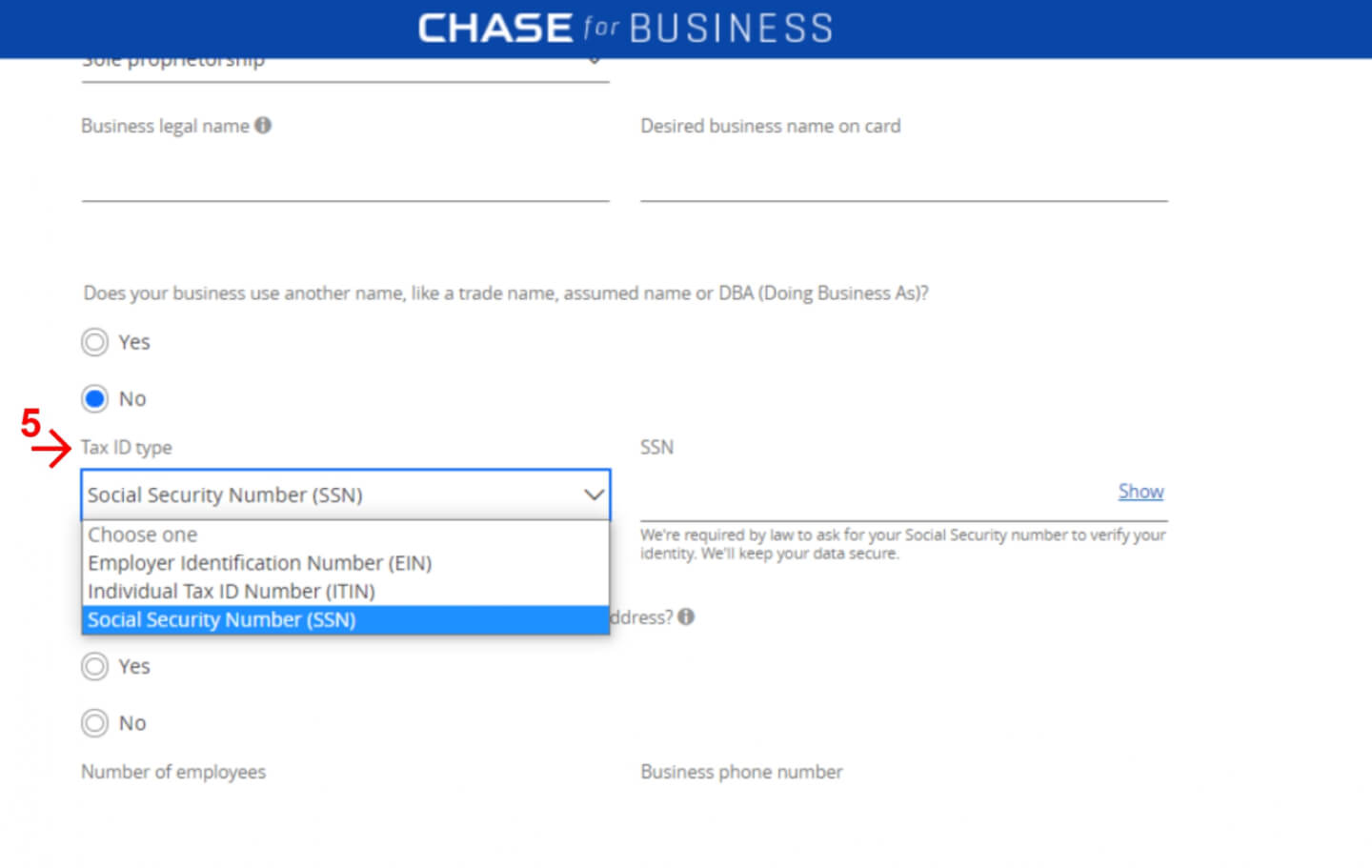

5. Tax ID type: Choose “Social security number” and fill out your social security number. 6. Is your business’s physical address the same as your personal address? You can answer “yes”

6. Is your business’s physical address the same as your personal address? You can answer “yes”

7. Number of employees: Put in as applicable, if it’s 0 write 0.

8. Business phone number: You can put your own phone number.

9. Business established date: Put the date you opened the business (it’s recommended to have a business open for a minimum of one year in order to get approved).

10. Annual business revenue: Put in the net sales of the business (How much money your business has in sales before deducting your expenses).

- Business category: Fill out whatever type of business you have (for example, if you sell your own knitted hats then your type of business is retail) Do the same in the field where it says “business type” and “subtype”.

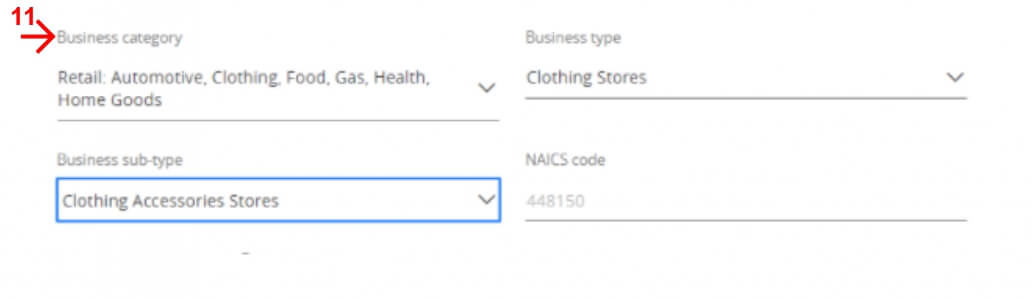

Amex business card applications

Amex business card applications should be filled out similarly to Chase. But to make it easier for you, we took some screenshots from the Amex website to give you a step-by-step guide on how to do it.

- Legal business name: Write the business name. If the business does not have a name then write your own name, which is actually better as it will help you out later with providing proof of the business name, if requested (you can then send any utility bill that has your name on it).

- Business name on card: Write any name you prefer to be displayed on the card.

- Does the Company have a DBA (Doing Business As) name? In most cases, the answer is “no”.

- Business address: Enter your business address. If you run your business out of your house then write your home address.

- Business phone number: You can put your own phone number.

- Industry type: Fill out whatever type of business you have (For example, if you sell your own knitted hats then your type of business is “retail trade”).

- Company structure: Choose “sole proprietorship”.

- Years in business: Enter the amount of years you’re in business (it’s recommended to have a business open for a minimum of one year in order to get approved).

- The number of employees: Enter the number of employees the business has, including yourself (so the minimum amount of employees needs to be at least one).

- Annual business revenue: Put in the net sales of the business (How much money your business has in sales before deducting your expenses).

- Estimated monthly spend: It’s optional so leave it blank.

- Federal tax ID: Enter your own social security number.

- Role in company: Choose as applicable.

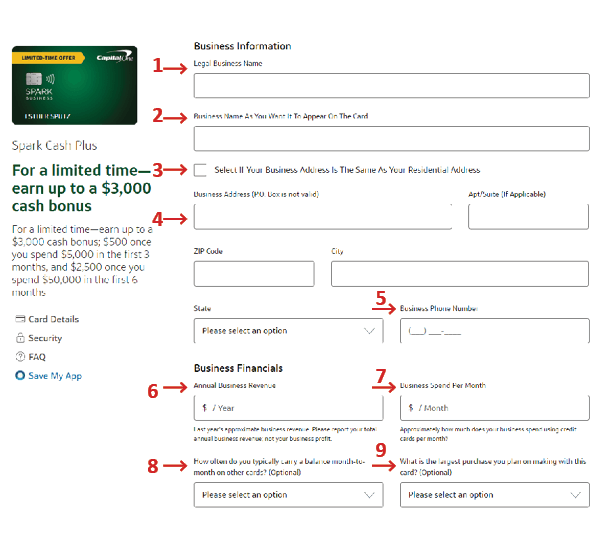

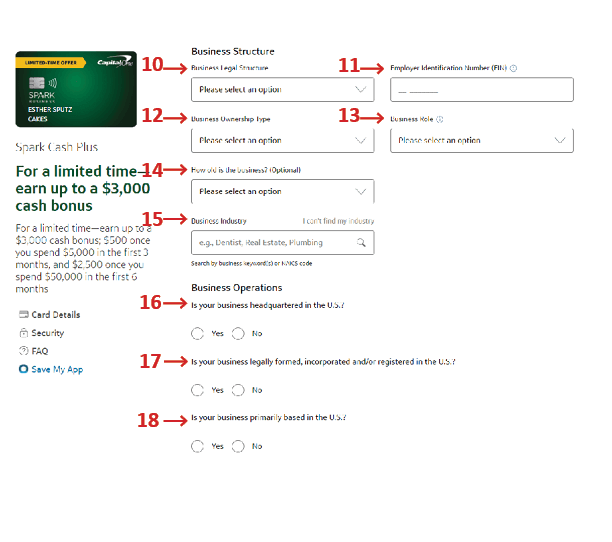

Capital One business card applications

Following, similar to Chase and Amex, is a screenshot from the Capital One website to give you a step-by-step guide on how to apply for a business credit card without an LLC C-Corp.

- Legal business name: Write the business name. If the business does not have a name then write your own name, which is actually better as it will help you out later with providing proof of the business name, if requested (you can then send any utility bill that has your name on it).

- Business name on card: Write any name you prefer to be displayed on the card.

- Select if your business address is the same as your residential address: You can check off the box If you run your business out of your house then write your home address, or leave it and move on to 4.

- Business address: Enter your business address. If you run your business out of your house then write your home address.

- Business phone number: You can put your own phone number.

- Annual business revenue: Put in the net sales of the business (How much money your business has in sales before deducting your expenses).

- Estimated business monthly spend: Put in the expenses of the business

- How often do you typically carry a balance month to month on other cards: It’s optional so leave it blank.

- What is the largest purchase yo plan on making on this card: It’s optional so leave it blank.

10. Business Legal Structure: Choose “sole proprietorship”.

11. Employee Identification Number (EIN): Enter your own social security number.

12. Business Ownership Type: Choose “privately owned”.

13. Business Role: Choose as applicable.

14. How old is the business: It’s optional so leave it blank.

15. Business Industry : Fill out whatever type of business you have (For example, if you sell your own knitted hats then your type of business is “retail trade”).

16. Is your business headquartered in the U.S.? You can answer “yes”

17. Is your business legally formed, incorporated and/or registered in the U.S.? You can answer “yes”

18. Is your business primarily based in the U.S.? You can answer “yes”

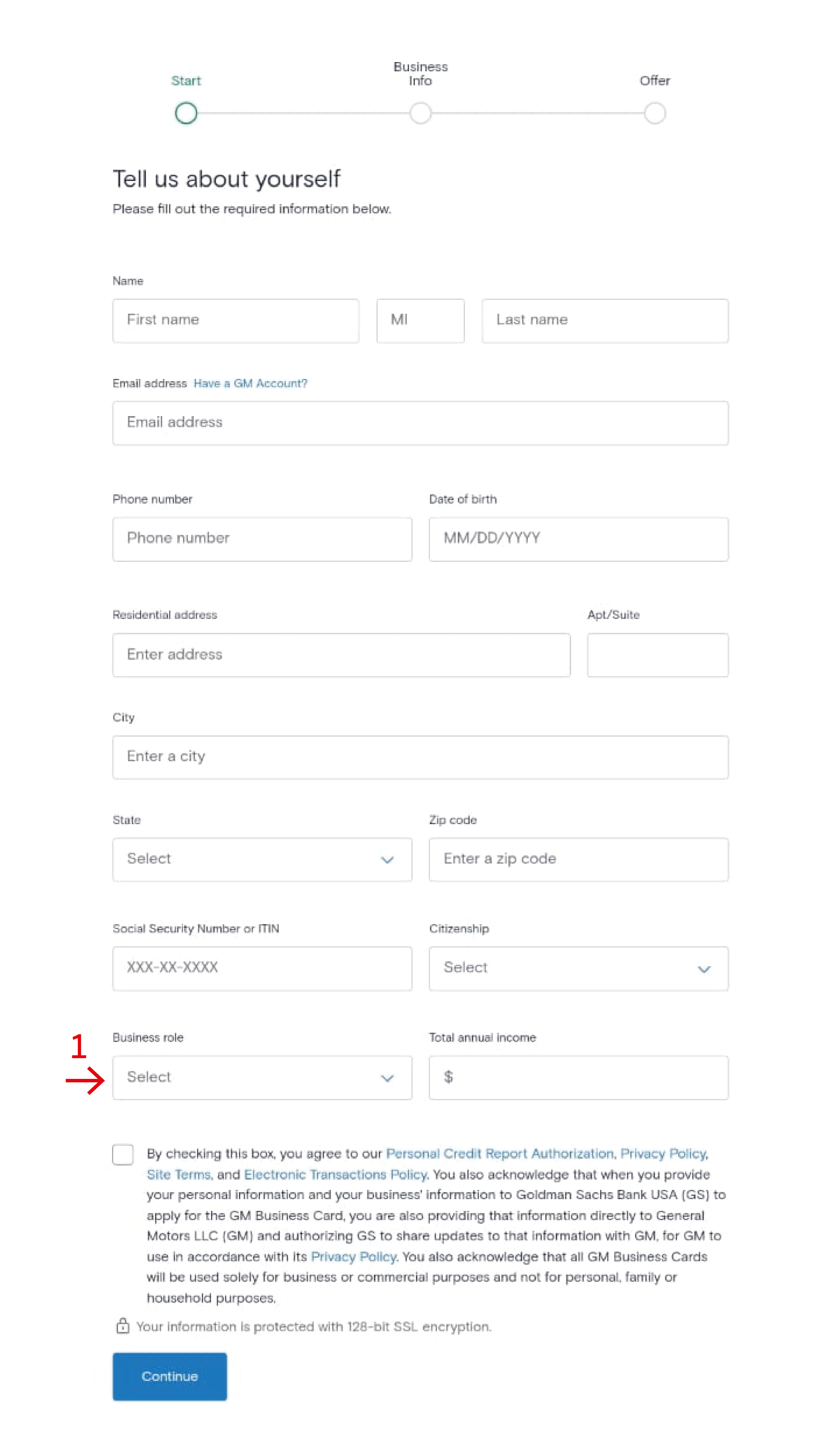

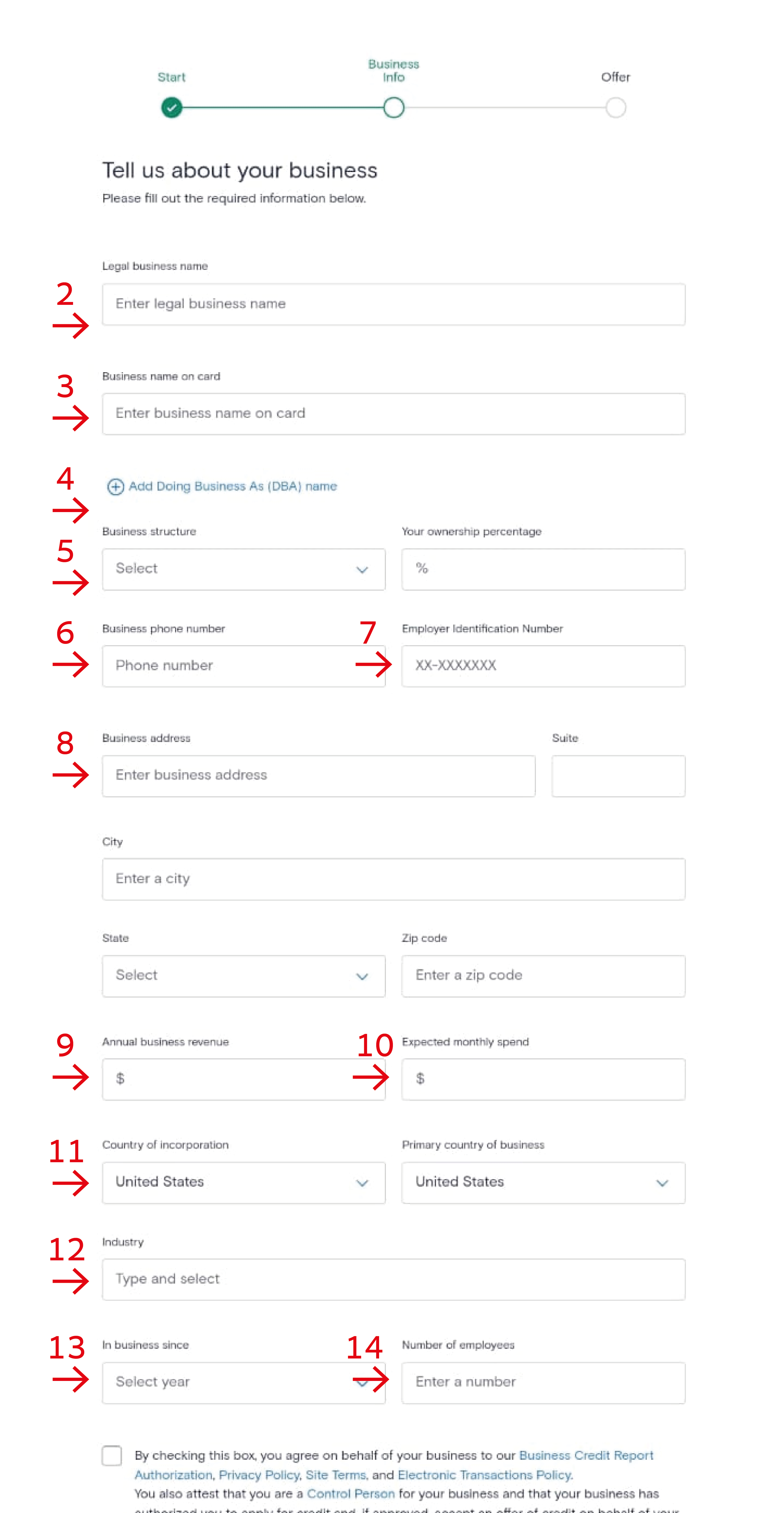

GM business card application

1. Business Role: Choose as applicable.

2. Legal business name: Write the business name. If the business does not have a name then write your own name, which is actually better as it will help you out later with providing proof of the business name, if requested (you can then send any utility bill that has your name on it)

3. Business name on card: Write any name you prefer to be displayed on the card

4. Add DBA (Doing Business As) name? It’s optional so leave it blank. In most cases it is anyways “no”

5. Business structure: Choose “sole proprietorship”

6. Business phone number: You can put your own phone number

7. Employee Identification Number: If you are a sole proprietor and don’t have an EIN then leave this blank

8. Business address: Enter your business address. If you run your business out of your house then write your home address.

9. Annual business revenue: Put in the net sales of the business (How much money your business has in sales before deducting your expenses).

10. Expected monthly spend: Put in how much you spend per month

11. Country of incorporation and Primary country of business: You can put United States

12. Industry: Fill out whatever type of business you have (For example, if you sell your own knitted hats then your type of business is “retail trade”).

13. In business since: Enter the year your business opened (it’s recommended to have a business open for a minimum of one year in order to get approved).

14. Number of employees: Enter the number of employees the business has, including yourself (so the minimum amount of employees needs to be at least one).

Other credit card issuers

We listed four business credit card issuers, but you can mix and match these instructions for all other credit card issuers as well.

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

Is this business trick still in affect ?

Yup you can still do a SP

Could I do a pre approval check before applying?

It will depend on the bank. some have this future and some do not. You can also check out Cardmatch to search for preapproval.

it also work on a business credit card what you need to have good business credit ?

Business credit cards mostly base approvals on your personal credit report

Can I apply for a business card without a business at all?

Business credit cards are designed for business. But any side hustle is considered a business. Almost everyone has something they can call a business