There used to be no restrictions for getting the bonus on the same Capital One cards multiple times.

The official terms used to state that “The bonus may not be available for existing or previous account holders”. But in real life it was not enforced. They easily approved the same card again and gave the welcome bonus as long as you currently did not have the same card open.

New 48-month rule

This has unfortunately changed. New terms on Capital One cards state that if you received the bonus within 48 months you are not eligible to receive the bonus again.

The only bright side here is that these rules are per card, not per family of cards. So for example, the Venture and Venture X are still considered two separate products and you are eligible to receive the bonus on each.

Which cards have the new rules?

The following cards have the new 48 month rules

Savor Rewards from Capital One

Surprisingly, the business cards do not have the new rule (yet)

Capital One did not add the new 48-month rule to any of their business cards. You can still get the signup bonus on a business card even if you received the bonus in the past

Here are the welcome bonuses available on Capital One business cards:

Earn $1,200 after spending $30,000 within the first 3 months.

Earn $500 after spending $4,500 within the first 3 months.

Earn 50,000 bonus miles after spending $4,500 within the first 3 months.

Capital One Spark Miles Select Business Card

Earn 50,000 miles after spending $4,500 within the first 3 months.

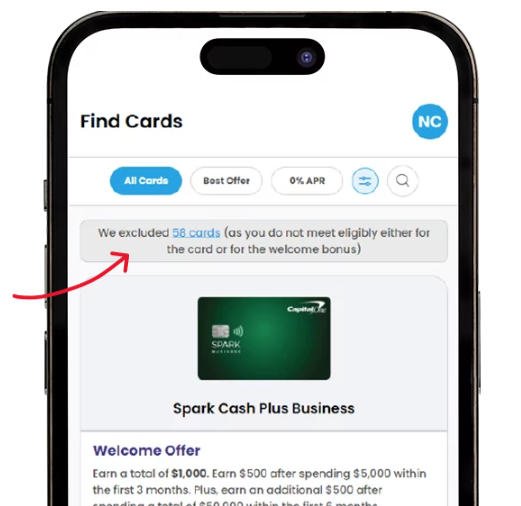

Let CardRight keep track of these rules for you

Do these rules confuse you? Luckily, our new app can keep track of these rules for you.

One of the features of our new app is that it keeps track of all the different rules set by banks regarding card eligibility or welcome offer eligibility. We already updated our app with the new Capital One 48-month rule. So if you received a welcome bonus on the Capital One cards affected by the new rule then the card will be excluded from your search results for the next 48 months.

Did you already download our app?

Download it here:

- Android

- Apple

- Or use our web version online at cardright.com (no smart phone needed)

![Primary CDW Insurance: Which Credit Cards Still Offer Them? [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/04/post-on-cards-that-have-primary-cdw-insurance.png)

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments