Being a parent in 2020 means you work and overwork, constantly trying to make life work for you. Your phone rings and you pick up. It’s your bank calling about a transaction that needs to be verified. They ask you for your name, social security number, date of birth, address, and then just put the phone down on you. What? Your mind starts racing…. Was I just scammed?!? Oh my! Was that not my bank? What will happen next? I can’t believe it! A thief just walked off with all my personal information… Will he now drain my bank accounts? Take out a mortgage in my name? What can I do now? How can I protect myself?

What Is identity theft?

The story above is one of many, which take place every year to millions of people.

In a world where everybody likes to work remotely, thieves like to do work remotely as well (they were already doing this before the coronavirus hit us). In 2020, a thief can rob you of thousands of dollars plus cause you months of headache, all without ever stepping over your doorstep or even visiting your country. In 2018 the out-of-pocket loss due to identity theft reached over $14.7 billion. That’s a staggering number!

How to protect yourself

Your first reaction may be, “Let me call the social security administration office to change my social security number.” Unfortunately, it’s not possible to change a social security number, unless you’re a victim of domestic violence. There isn’t even a way of checking a report of all activity conducted on your SSN. That is very frustrating, as you feel like you’re groping in the dark but that shouldn’t stop you from being proactive.

In this post, we will discuss the next steps you should take to bulletproof your finances and personal information after being the victim of an identity scam. We will go through a list of the most common ways your identity might be used by thieves and how to lock it so that your identity becomes zero value to them.

Do the paperwork

If your identity was compromised, the first thing you should do is file a police report or fraud affidavit. This is a piece of paper that you can use as proof that you were a victim of identity theft. This will make your job of disputing false accounts on your credit report or get transactions refunded by your bank, etc., much easier. You can file a fraud affidavit online on the FTC website found here (choose “get started”). Just be careful to fill out all information as accurately as possible.

Protecting your credit score

The most famous thing that thieves might want to do with your identity is steal your credit. A thief who gets a hold of your personal information will apply for credit cards or other loans in your name, steal the money and leave you with hefty balances and damaged credit.

The loss

Under most state laws, you are not responsible for any debt incurred on fraudulent new accounts opened in your name without your permission. The Fair Credit Report Act (FCRA) instructs the credit bureaus to remove any accounts which were opened in your name without your permission. Therefore, there’s no monetary loss if your identity was compromised and used to open fraudulent accounts; but, you will still want to protect yourself so as not to have to go through months of aggravation until everything is resolved.

How to Protect yourself

There are three ways you can protect your credit reports from thieves:

- Credit freeze

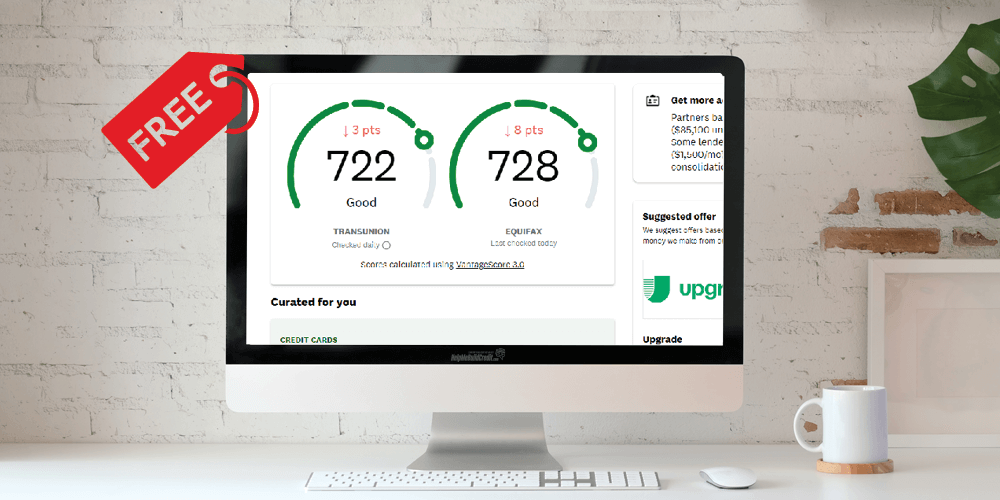

In order for hackers or thieves to open credit cards or any other tradeline under your name, the lender will need to be able to pull one or all of your credit reports. When your credit report is frozen then no one can pull your credit. Freezing your credit report basically locks any thief out from applying for any trade lines under your name. The FCRA gives you the right to freeze your credit report at any time for free. Read more details on how to freeze your credit report here. - Credit monitoring

A credit monitoring service will send you an alert every time there’s a change to your credit report or credit score. Having a credit motoring service will help you be in the know if anyone misused your credit report and would give you a heads up to allow you to take action before the damage is done. For example, if you see a new inquiry coming from Chase that you don’t recognize, you can contact Chase right away and notify them not to extend credit as you never submitted the application. Chase will immediately withdraw the application and cancel the credit card even before it gets into the wrong hands.

There is no need to pay for a credit motoring service. There are many companies (for example Credit Karma) that offer credit monitoring for free and work just as well or even better than the paid service. Here is a list of how to get free credit monitoring by all three credit bureaus. - Fraud alert

A fraud alert puts a warning sign on your credit reports telling lenders to take extra steps to verify your identity before approving a loan. I usually do not recommend placing a fraud alert as this may give you major complications when you yourself try to apply for a loan. Placing a fraud alert on your credit report may lock you out from using your own credit when needed. But if you suspect that a credit freeze plus credit monitoring is not sufficient, then place a fraud alert as well. Read all the details about fraud alerts and how to place it here.

Tax identity theft

Another very common way thieves or hackers steal money through identity theft is through tax fraud. The thief will file a false tax return in your name and later steal your tax refund or tax credit.

The loss

The IRS swallows the monetary loss of tax fraud, but you may be left with more paperwork, headaches, and a delayed refund.

How to protect yourself

If you’re a victim of identity theft then you can get an IP PIN from the IRS which is a six-digit pin that only you will know. This pin is used in order to file a tax return in your name. You can check out more details on how to receive one here.

It may also be recommendable to file taxes early so that your tax return reaches the IRS before any fraudulent one does. First come first serve…..

Employment related identity theft (or unemployment)

When it comes to employment identity theft it can go one of two ways. Either the thief might want to earn wages in your name so they get rid of their tax bill (leaving you to fend for yourself). Or they can file unemployment in your name and collect unemployment insurance checks.

The loss

The IRS swallows the monetary loss of tax fraud, but you may be left with more paperwork, headaches, and a delayed refund.

How to protect yourself

If you suspect that you’re a victim of employment-related identity theft then ask you’re accountant to request a wage transcript from the IRS to review wages reported in your name and help you dispute them with the IRS and the employers involved. For unemployment identity theft then immediately do the following steps:

- Report the unemployment to the U.S. Department Of Labor here

- Report the fraud to your employer. Keep a copy of any confirmation you get.

- Report the fraud to the U.S. Department of Justice’s National Center for Disaster Fraud (NCDF) here, or by calling 866-720-5721.

Initiate false transactions in your bank account

As scary as this may sound, if a thief got a hold of your checking number, debit card number, or online login, then they can initiate false transactions or transfer funds to their accounts, in effect draining your accounts from your hard-earned money!

The loss

Federal banking regulations provide protection to victims of identity theft. But the level of protection largely depends on how fast you report the fraudulent transactions. If you report the fraudulent transactions within two days of receiving your statements, then you will be protected with your liability capped at $50, if you wait a third day before you report the theft then your liability jumps all the way up to $500. And if you neglect to report the suspicious transactions past 60 days, you will not receive any refund. (You won’t receive a refund for transactions that happen after 60 days. The transactions that occurred within the first 60 days are still covered with a liability of $500).

How to protect yourself

Most banks allow you to set up alerts to monitor fraudulent activity. You can set it up to be alerted if transactions exceed a preset amount, your address is changed, money is transferred, etc. Sign up to these alerts to help you get an early warning if your bank account is being misused. Always make sure to use strong passwords and if available, opt for two-step verification to make it harder for thieves to hack your online account. Always review your bank statements for transactions you don’t recognize.

If you review your statement and find any suspicious activity, make sure to contact the bank right away. Never delay, as this may result in your liability to increase significantly.

Investment account identity fraud

The accounts which you should be most concerned about are your investment accounts. If a thief is able to hack your investment account, then they can possibly walk away with your funds.

The loss

Unlike bank accounts, there are no laws in place which protect your investment accounts from identity theft. There are many brokerages that do offer limited protections in a case that a thief manages to drain your investments without your authorization.

How to protect yourself

With so many data breaches happening every year I would advise any savvy consumer to make sure to only keep money with an investment brokerage who offers protection against identity theft. Upon my limited research, I found that Fidelity and Charles Schwab offer great coverage as long as you keep your login information private and notify them immediately of any suspicious activity.

You can review some of the major brokerage firms policy’s here

False bank accounts opened in your name

Criminals might try to open bank accounts in your name which they can later use for criminal activity. Or they might want to write out checks in your name which will later bounce or be overdrawn.

The loss

Under federal regulation, you are protected against this type of activity. You will not have to pay the overdraft funds, fees or for the bounced checks. The loss in result to criminal activity is discussed later in the post.

How to protect yourself

There are companies that collect information about your open and closed checking accounts and activity. Most banks report to them. Under federal law, you have the right to view your credit report for free once a year or order your report at any time for a reasonable fee. If you suspect being a victim of identity theft I would recommend you to order your report at least twice a year (once a year is free the second time will cost you a minimum amount) and check for any activity you don’t recognize.

Here is where you can order copies of your bank screening reports

Many banks will also do a soft pull on your consumer credit report before opening a bank account. To view your recent soft credit inquiries you will need to order a copy of your credit reports. You can order a free copy of your credit report once every 12 months from all three credit bureaus at annualcreditreport.com

Medical identity fraud

Medical insurance identity fraud is when a thief uses your information in order to get medical coverage in your name.

The loss

You may have someone else’s medical treatments recorded in your name which may confuse doctors about your medical history. You may also find on your credit report, medical collections not belonging to you which may affect your credit score. And even worse, you may get denied for medical insurance due to the fraudulent medical conditions showing on your medical records

How to protect yourself

There is nothing really you can do to prevent this from happening. But if you know you’re a victim of identity theft, always notify doctors about your concern so they know to double check facts about your medical history before making any medical decisions. If you find any medical collections on your credit report which you believe are not yours, under the FCRA you have the right to dispute it and have them removed. Contact any medical provider that is reporting false medical history about you and ask them to remove these errors from your medical records. You can learn more on how to correct medical record errors here.

Criminal identity fraud

If a thief commits various fraudulent activities while including your information, or provides your information to an arresting officer during an arrest, then you can mistakenly be linked to criminal investigations and may even be picked up by authorities.

The loss

Anguish and maybe some high legal fees to clean up the mess. You may also suffer being denied for a job due to a false criminal record.

How to protect yourself

Criminal Identity theft is the least common use of stolen identities, but it’s also the hardest one to protect yourself from. If you suspect that you may be a victim of criminal identity theft or if you’re denied a job due to criminal records not belonging to you, then obtain legal counsel from an attorney immediately. You can sign up to companies like Identity Force who offer dark web monitoring services so you get alerts about activity found on the dark web attached to your personal information. They also include a $1,000,000 identity theft insurance that will cover your legal fees or other losses if god forbid it’s needed.

Recap

Being the victim of identity theft can add a lot of stress to your life. But you do have options you can do to still stay in control and significantly minimize the damage. Act fast. Follow the steps explained in this post. Always stay alert. Protect your credit and protect your finances.

We will not allow the thief to profit a single penny by stealing your information. You may be fooled once, but not twice!

I do believe all the ideas you have introduced on your post. They are very convincing and can definitely work. Still, the posts are very brief for novices. May you please extend them a bit from next time? Thanks for the post.

We included some links to posts that we expand more on each individual subject. Thanks for your feedback and we will keep this in mind for future posts