In today’s day and age, we hear daily of new hacks and new identity theft stories. By now everyone knows how important it is to properly monitor your credit report to make sure that no thieves are able to open any credit cards or loans in your name.

There are many companies that offer a credit monitoring service for a fee, but my advice to you is, don’t waste your money, because you can do it just as well for free. Here in this post, I will list some great websites where you can sign up to monitor and view your credit for free.

| Free Credit Score | Free Real-Time Credit Monitoring | Updated | ||

| Credit Karma | Transunion, Equifax | Vantage 3.0 | Yes | Every day for most accounts (some accounts once in 7 days) |

| Wallet Hub | Transunion | Vantage 3.0 | Yes | Every day |

| FreeCreditScore.com | Experian | Fico 8 | Yes | Every 30 days |

| Nerd Wallet | Transunion | Vantage 3.0 | Yes | Every 7 days |

| Credit Sesame | Transunion | Vantage 3.0 | Yes, with $50k identity theft protection included | Every 30 days |

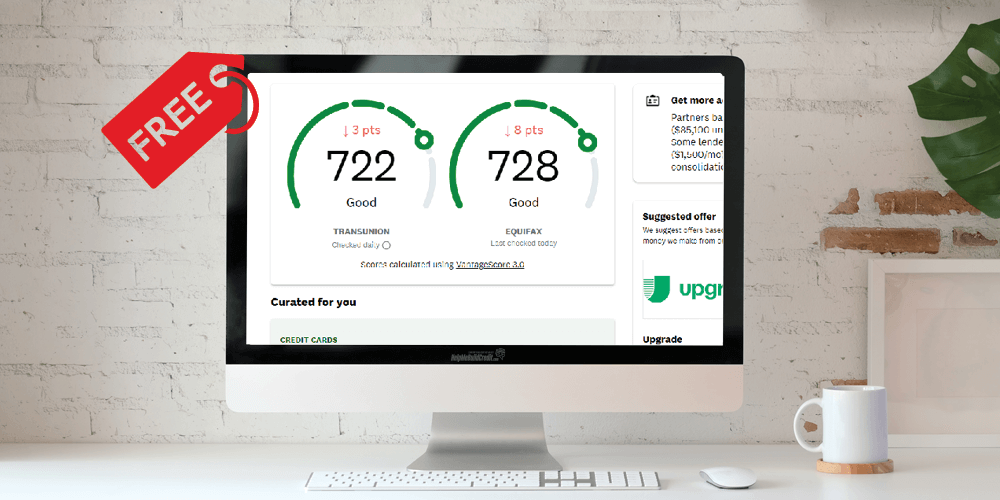

Credit Karma

With over 60 million users, Credit Karma is for sure the “Kleenex tissues” when it comes to viewing and monitoring your credit report for free. They also provide you with great personal tips and tools for how you can improve your credit.

Pros

- Free credit report from two of the three credit bureaus

- Updates every day for most accounts (some accounts once in 7 days)

- They will send you an email with real-time alerts when there are changes to your Equifax or TransUnion credit report. For example, a new credit inquiry, etc.

Cons

- The free credit score is Vantage 3.0 which is rarely used in credit decisions.

Wallet Hub

Wallet Hub provides updates on your credit report every single day. They will also give you personal tips and tools on how to improve your credit score.

Pros

- Updates every day

- They will send you an email alert and text message alerts when there are changes on your Transunion credit report.

Cons

- They only have your Transunion credit report.

- The free credit score is Vantage 3.0 which is rarely used in credit decisions.

- It’s a bit of an outdated website.

Experian

Experian offers your Experian credit report every 30 days for free. With a paid plan you can also get your TransUnion and Equifax reports ( you can usually get a free 7-day trial)

Pros

- You will get email alerts for free whenever there is a change to your Experian credit report.

- Free Fico 8 score.

Cons

- It’s only updated once in 30 days.

- You can only view your Experian credit report.

Nerd Wallet

NerdWallet is a very nice and updated website that has very good and advanced tools that will help you improve your credit score.

Pros

- Real-time credit change alerts.

- Updates every 7 days.

Cons

- They only have your Transunion credit report.

- The free credit score is Vantage 3.0 which is rarely used in credit decisions.

Credit Sesame

Credit Sesame is the only free credit monitoring service that also offers a free insurance plan which they claim will refund you up to $50k if you’re a victim of identity theft.

Pros

- They will send you an email alert on any changes to your Transunion credit report.

- Updates every 7 days

- Free $50,000 identity theft protection is included in the free plan.

Cons

- They only have your Transunion credit report.

- The free credit score is Vantage 3.0 which is rarely used in credit decisions.

- Only updates once every 30 days.

Conclusion

I usually recommend my readers to sign up for Credit Karma and Experian. Effectively, you will receive completely free real-time protection from all three credit bureaus. It is also worth it to sign up for a Credit Sesame account so that you will also be covered for up to $50k in case you are ever a victim of identity theft. So go ahead and take them all! Why not? It’s absolutely free!

Hi, I’m getting my Transunion Fico score from Discover and my Experian Fico score from Amex, monthly through my credit cards. Is there a card(or something else) that will give me my equifax fico score?

Credit Karma will let you View your Equifax report. but the credit score is not Fico. I dont know of anyplace that gives you a Equifax Fico score for free.

@Tyler: citibank uses fico bankcard score 8 model with equifax. bankcard model ranges from 250 to 900. bankcard model is used by many lenders and is mostly used for credit cards. it’s not the usual fico 8 model consumers are used to, but is the actual one lenders use when evaluating applicants for credit cards.

@Sam Billo: awesome site!

Thanks for sharing. Im happy your loving my blog. Spread the word!