Fraudsters are sly and cruel and wreak millions of dollars in damage to thousands of creditors. Now that credit cards are so much more secure against fraud, the fraudsters have gone on to create greater schemes. One of the newer schemes is called Synthetic Identity Fraud.

This may sound like a fancy hard-to-pronounce-name but it can also be the reason your credit card applications are always being flagged by the bank’s fraud department.

Synthetic identity fraud

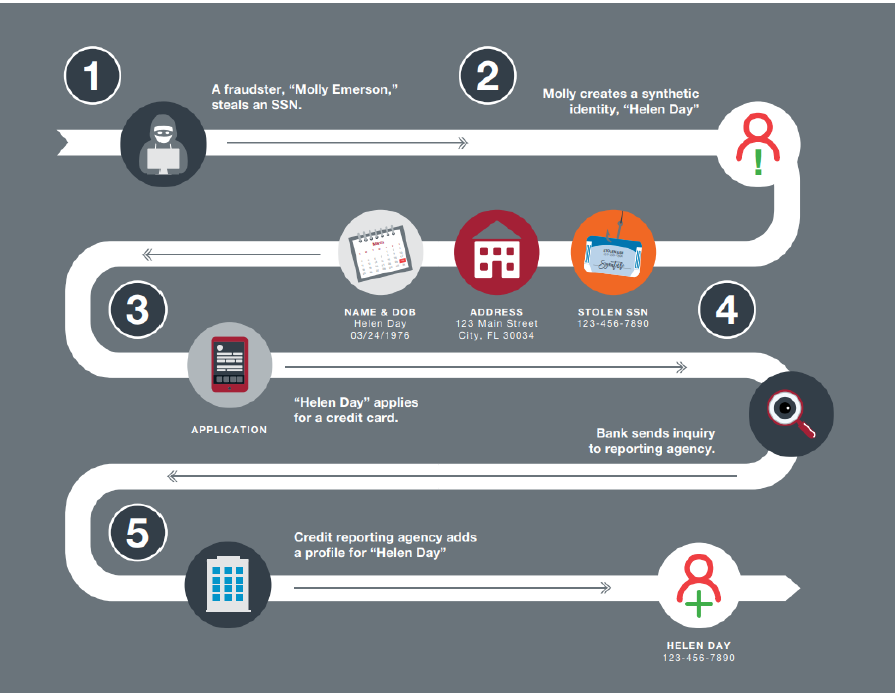

Equifax has revealed that it is possible for fraudsters to create synthetic credit reports by creating a synthetic identity. All the fraudster needs is a social security number as a starter. They can then create a bluff address, date of birth, and name. How is that done?

Authorized user abuse

First, to bring this identity into the credit world, the fraudster applies for a credit card under the synthetic identity. The bank declines the application since the identity information provided does not truly exist.

But the credit inquiry that happens during the application results in a credit profile being created. The synthetic identity person is now an official name on record.

Now, the fraudster adds the synthetic person as an authorized user to an existing, proper account holder. The fraudster can then go ahead and get approved for a first credit card. The fraudster will keep the account in good standing. And slowly get approved for many more credit cards.

Image Source: Equifax

Many months later, it can be even 2 years later, the fraudster will “burst out”. He will now go wild and spend huge amounts of money on all of the accounts he created under bluff names.

The damage to the creditor

The fraudster maxes out all the accounts, stealing thousands of dollars. When the creditors suddenly jump in at this madness, they have no one to blame because the charges and accounts are all under synthetic identities, bluff, fake people. The creditors are left with millions of dollars in losses with no one to take responsibility.

There are thousands of fraudsters out there and they each create multiple accounts. This results in huge amounts of money in losses. The numbers are increasing too, as time goes by. Aite Group estimated that U.S. losses from bust-out fraud would soar from $1.8 billion in 2020 to $2.42 billion in 2023.

The red flags

To try and prevent all this from happening, creditors keep their eyes wide open. The fraud departments look out for some of these red flags to identify fraud.

- Little SSN verification evidence

- No proof of life evidence shared SSN

- No utility or phone bills

- No relatives

- Too many changes of address (an average good consumer changes their address only once in 70 months while a bad guy changes their address once in 10 months)

- No documentary

- No employment history

- Too many authorized users being added within a short amount of time

- Too many mismatches in identity

- Interesting behavior patterns

- Email or phone number not matching to email or phone number on file

- Address not matching address on file

- Multiple credit cards applied for at once

When too many of the pointers above are existent or non-existent, fraud departments realize something fishy is going on. Who is this person? Why can’t he verify his identity properly? Has he never paid any bills? Why so many authorized users (which is the tactic fraudsters use to get their synthetic people out on the credit market)? Banks, issuers, or whoever it may be, will at this point investigate very deeply to find out if identity fraud or synthetic identity fraud is the case here.

How to avoid being flagged by the fraud department

You may be a good and honest consumer but still show red flags like a fraudster. No one wants that to happen to them.

The trick is to keep away from as many of the red flags as possible pointed out above. This way you don’t look suspicious to creditors and fraud departments don’t have to check in on you to make sure things are authentic.

Sometimes you will be flagged randomly

Even when you try your best to avoid the red flags you can still be flagged randomly. Banks have algorithms that choose people randomly to go through extra steps of verification (I guess they hope that they will be lucky and flag the fraudster randomly). It can also sometimes be that more people are being flagged than usual based on a trend that banks see more fraud happening etc.

If you do get flagged by the fraud department, don’t panic

Getting flagged by the fraud department can sound scarier than it really is. Usually, they will just ask you some basic questions and ask you to provide basic documents to prove your identity (such as a copy of your photo ID or social security card). Just comply promptly with what they ask for and it will be smooth sailing from there on.

0 Comments