Identity theft is on the rise, as ugly as it is.

It is important for every consumer to be armed with the proper information so that if you are ever, g-d forbid, a victim of identity theft, you know just what to do.

In the past, we posted about credit freezes as one solution. In this post, we’ll talk about fraud alerts as another idea. At the end of the post, I will let you know my opinion about which action I think is the best way to go.

What is a fraud alert?

When someone falls victim to identity theft or fraud, (or if someone thinks they may have fallen victim to identity theft or fraud), they can place a fraud alert on their credit reports. After you place a fraud alert, lenders will receive a message when they pull your credit which will state something like the following: ID SECURITY ALERT: Fraudulent applications may be submitted in my name or my identity may have been used without my consent to fraudulently obtain goods or services. Do not extend credit without first verifying the identity of the applicant.

Banks will take extra verification steps before extending credit or approving you for a credit card. Verification steps may include the bank calling to ask you security questions, asking for additional documents that proves your identity, etc.

How do I place a fraud alert?

You can place a fraud alert by contacting any of the three credit bureaus online or by phone.

Experian

Online: https://www.experian.com/fraud/center.html

Phone: 1888-397-3742

Transunion

Online: https://www.transunion.com/fraud-victim-resource/place-fraud-alert

Phone: 1800-680-7289

Equifax

Online: https://www.equifax.com/personal/education/identity-theft/fraud-alert-security-freeze-credit-lock/

Phone: 1800-685-1111

You only need to contact one of the three credit bureaus. The credit bureau you contact will send a message to the other two credit bureaus to place the fraud alert as well.

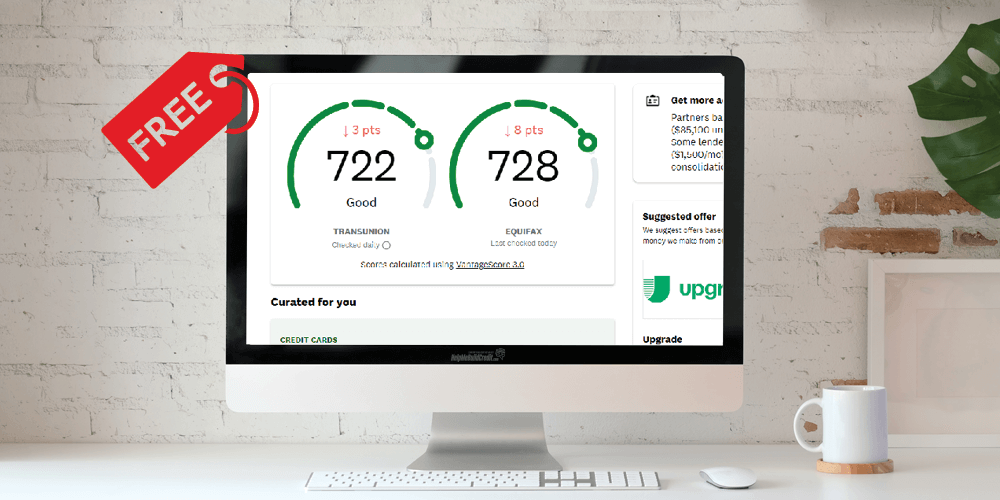

How much does a fraud alert cost?

Fraud alerts are always free.

How long does a fraud alert last for?

There are three types of fraud alerts you can place:

- Initial Alert

Since September of 2018, initial alerts expire after 12 months (not 90 days). You also receive an extra free copy of your credit report.

- Extended Fraud Alert

An extended fraud alert will last up to seven years. You may need to file a complaint with the FDC in order to place an extended fraud alert. You may also need to file a police report.

With an extended fraud alert, you will receive two extra free copies of your credit report for the first 12 months after placing the alert.

- Active Duty Military Alert

This alert is for US servicemen and women and expires after 12 months. Once it expires, you can renew it as necessary.

How do I remove a fraud alert?

If you feel that the fraud alert is no longer needed or if you placed it by mistake, you can have it removed by mailing a request of removal to all three credit bureaus. Make sure to include identifying documents and follow the steps found on the credit bureaus website.

Conclusion

Even though a fraud alert sounds easier to place, you only need to contact one credit bureau, I still wouldn’t recommend it over a credit freeze. The reason being that it’s much harder to remove than a credit freeze. There are many reports on the internet of people getting declined on credit cards just because they had a fraud alert. Credit card issuers like to have their systems run smoothly and they don’t want to deal with extra headaches. With a fraud alert, you’re locking thieves out, but at the same time, you’re also locking yourself out. On the other hand, with a credit freeze, you have more control of when you want it locked and when you want it open.

The Equifax phone number is wrong. The fake Equifax people will try to charge you. The customer care number is 1 (888) 548-7878.

The number i provided is for the Equifax fraud department. I believe it is a correct number. Thanks

I would like to add that when you do not now have an insurance policy or else you do not remain in any group insurance, you could possibly well really benefit from seeking assistance from a health insurance agent. Self-employed or individuals with medical conditions typically seek the help of an health insurance dealer. Thanks for your text.