I’m always getting questions of this sort, whether through the free help desk or directly. What credit score do I need to get approved for such and such card? Or, what credit limit can I get approved for with such and such card? Or, do I have any chance of getting approved for such and such card?

People don’t want to apply for credit cards without prior research. They want to know what their chances are of getting approved for the card before having an issuer pull their credit report for nothing.

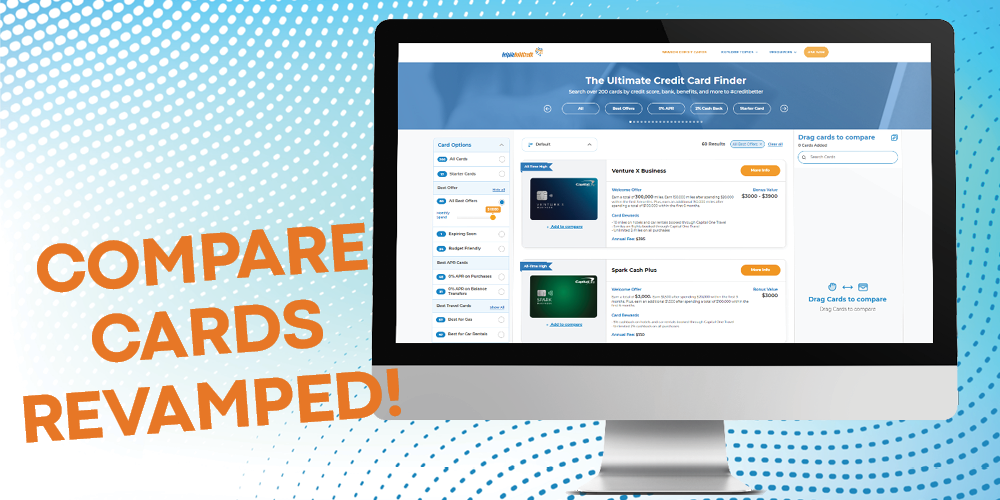

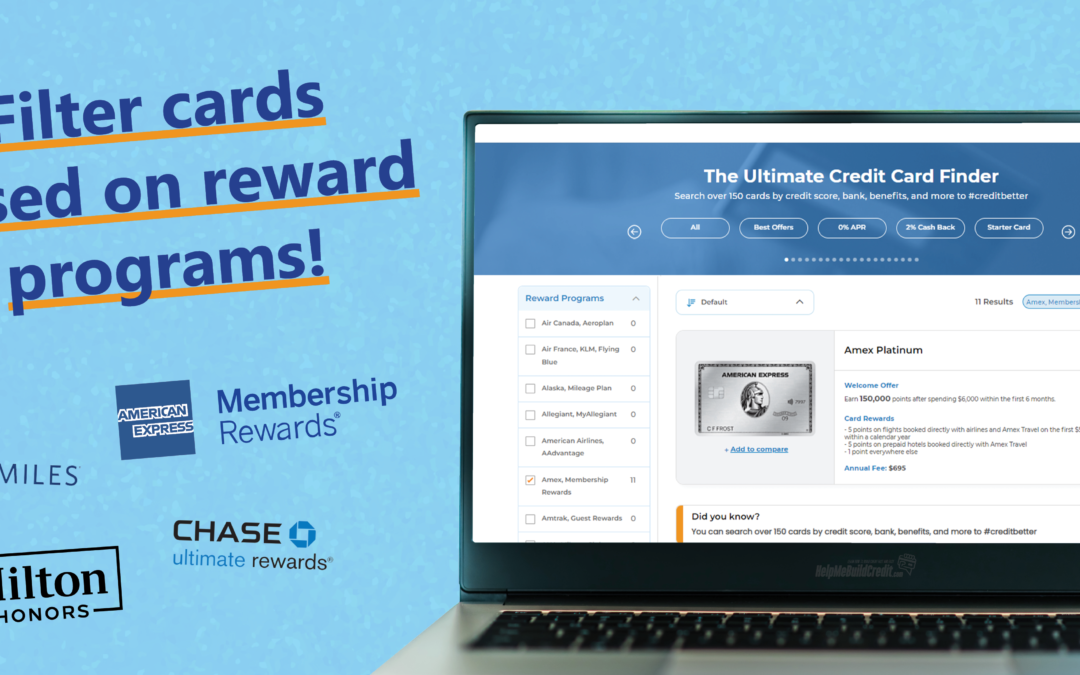

Credit card database

To target these concerns, we created our Credit Card Database a few months back.

It’s been a hit and took off really well. Consumers from all over the United States submit their credit card approvals and denials. Submissions include the credit score of the consumer when applying for the card, the credit limit approved for, if the application was denied, and more.

Then other consumers benefit by reviewing the information before they try applying for whatever card they’re set on. It’s a great feeling to see our users helping each other #creditbetter.

We currently have close to 1,200 credit card submissions in the database!

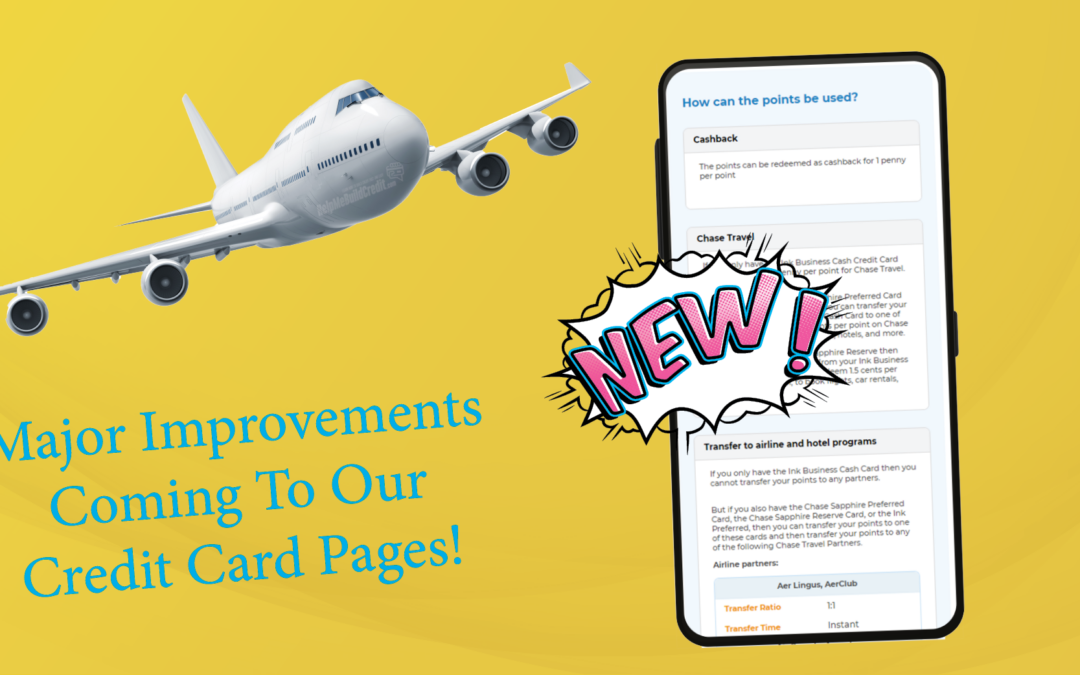

New section! Recent approvals and denials

So we have our Credit Card Database doing great, but we wanted to make things even easier for you.

We now have a new section on every single credit card page. The new section holds the compiled results of all submissions sent in for the credit card whose page you’re on. You don’t even have to go looking at the database to get the information you want. Right there, while you’re checking out a credit card, you get all the information you’d want on what your chances are of getting approved for the card. Based on credit scores, credit limits, and credit bureaus.

Find it by scrolling down on any of our dedicated credit card pages.

All information is taken from the Credit Card Database, which is submitted by Help Me Build Credit users.

Crunching the numbers

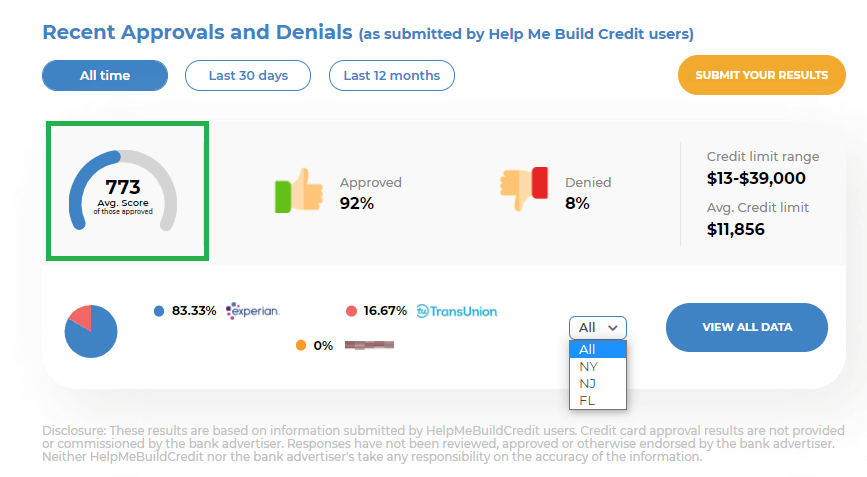

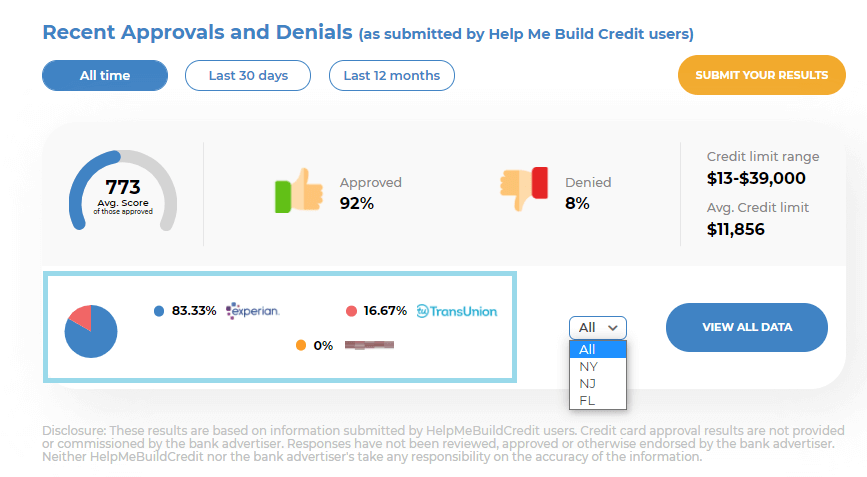

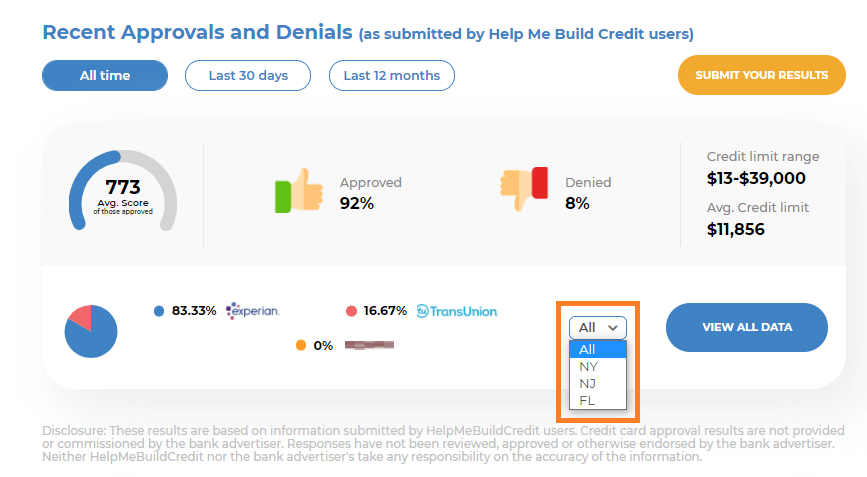

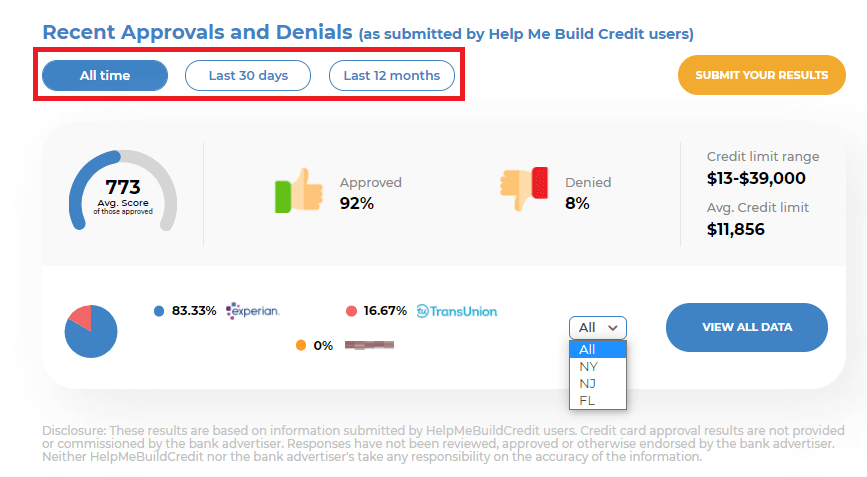

In the nicely designed box, you will see the average credit score of those consumers that were previously approved for the card.

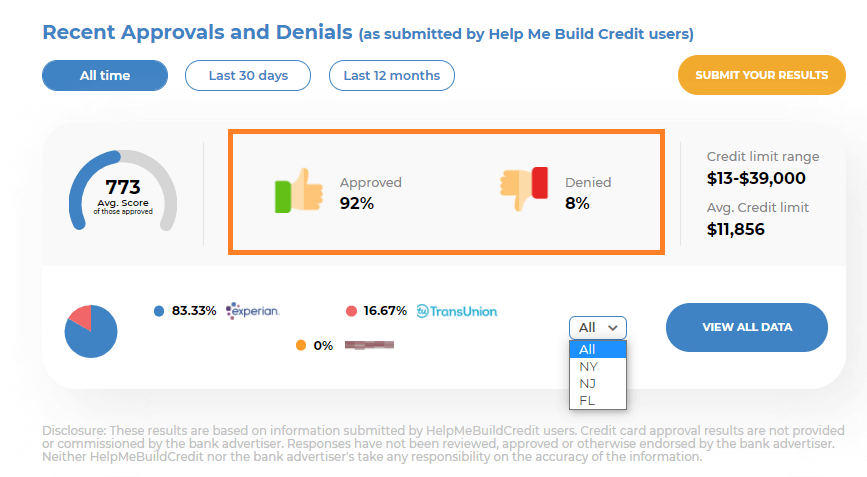

Next, you get to see how many applications for this card were approved and how many were denied.

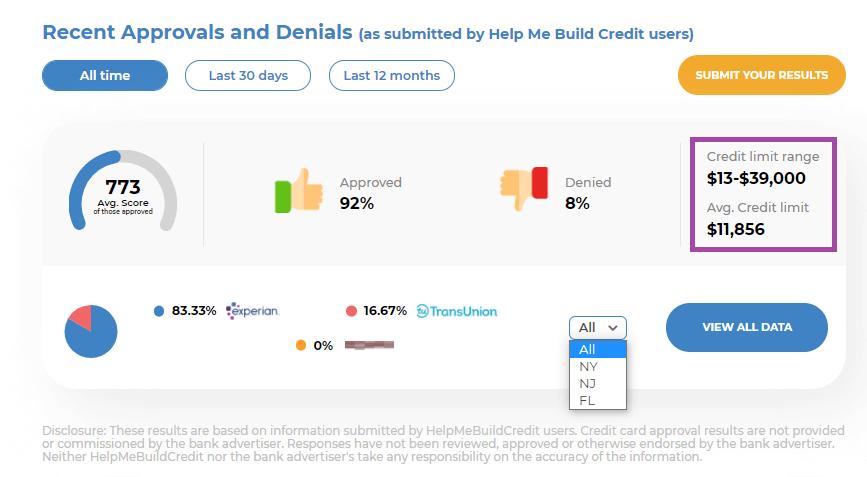

Then, you get to see what the credit limit range other people got approved for. Plus the average credit limit people got so you can know exactly what to expect.

Next up, are the credit bureaus. In a beautiful pie chart with the color coded credit bureaus on its side, you get to see which credit bureau was pulled by the bank when applying for this card. The numbers are given in percentages; how many of the applicants had Experian, how many had Transunion, and so on for Equifax.

You can even sort the results to show only results from specific states, or choose all results for this card.

On top of everything, you can drill down the results to only see results from the last 30 days (giving you the real time picture), past 12 months, or all time.

I hope this new feature greatly eases your credit card search so that you can do it mindfully and with success.

If you have any suggestion on how to improve the recent approvals and denials section, feel free to shoot me an email at [email protected]. We are always looking for new ways to make finding your next best credit card as easy as can be.

0 Comments