Tax season is coming up. What’s the connection between tax and credit cards? A lot! In this post, we’ll discuss paying taxes with credit cards and debit cards. Why? To make paying taxes rewarding (as rewarding as paying tax can be)!

When is it worth it to pay my taxes with my credit card?

When you pay taxes with a credit card, there will be a fee ranging from 1.82% to 1.98%.

In order for it to be worthwhile for you to pay with a credit card, your total rewards will need to equal MORE than that 1.82% fee.

Let’s illustrate this with an example: Let’s say you need to pay $10,000 in taxes.

$10,000 x 1.82% = $182.

You’ll be paying an additional fee of $182. That means that the total will be $10,182.

So your rewards need to be worth more than $182. This is doable with a card like the card_name that allows you to earn 2 membership reward points for every dollar you spend. If you value the membership rewards points at 1.5 cents per dollar, then you end up with a 3% value, which totals $300 with the example we used ($10,000 tax payment).

Or you can sign up for the card_name and earn as a welcome bonus 3% cashback the first year. That will add up to a lot of pure profit on your tax bill (and you will also get 0% APR for 15 months!)

When else is it worth it to pay my taxes with my credit card?

There are many other pros to paying your taxes with your credit card. Here are some of them:

- To reach your “minimum spend” in order to access the welcome offer.

For example, you can earn 100,000 points after spending $8,000 on the card_name. - To get your taxes interest fee for 0% APR for up to 21 months, on a 0% APR card.

- To reach your “minimum spend” in order to qualify for a free night in a hotel, or for elite status.

For example, with the Amex Hilton Surpass Card, you can earn a free night after you spend $15,000 within a calendar year. You can also get a complimentary upgrade to Hilton Diamond Status after spending $40,000 on the card, within a year.

Paying taxes with a debit card

Another way and reason it might be worth it to pay your taxes and earn rewards is paying your taxes with a debit card. There are some debit cards that earn 1% cashback. The fee for paying taxes with a debit card can be as low as $2.14 (which is a flat fee, no matter how much you pay in taxes).

Debit cards that earn rewards

Discover Debit card

With the Discover Debit card you earn 1% cashback on the first $3,000 you spend per month.

Upgrade Debit Card

The Upgrade Debit card earns unlimited 0.50% cashback on all purchases.

PayPal Business Debit card

The Paypal Business Debit card earns unlimited 1% cashback on all purchases.

How to pay taxes with a debit or credit card

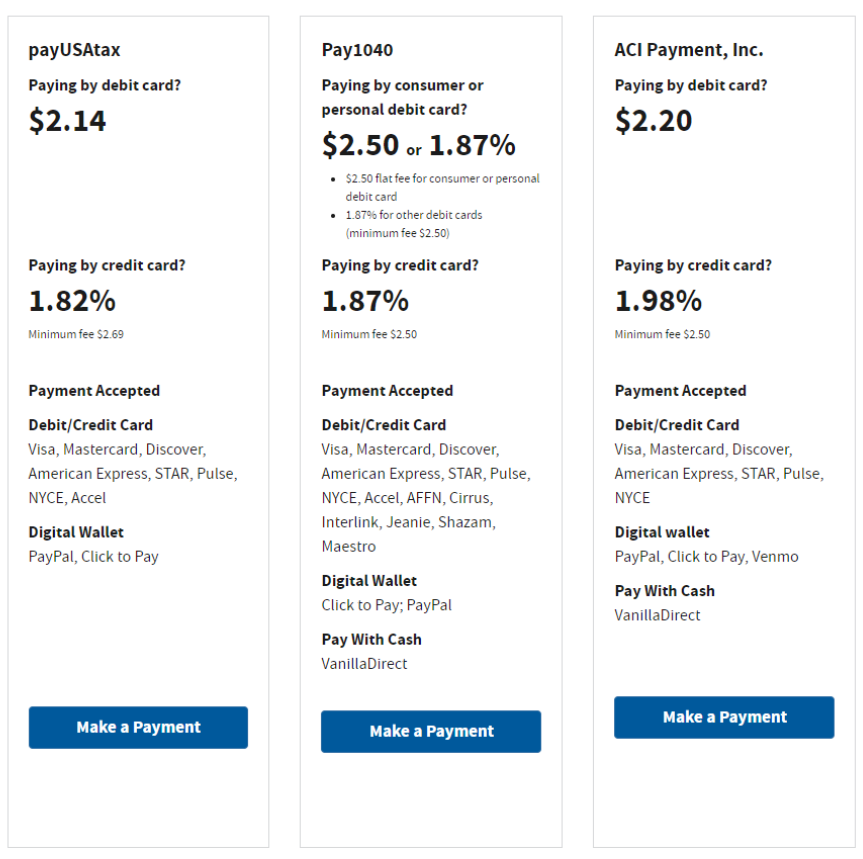

The IRS lists on their website the three third-party companies that you can pay your taxes to, using a credit card.

- Fee to pay with a credit card: 1.82%

- Fee to pay with a debit card: $2.14 (flat fee)

- Accepts: Visa, MasterCard, Discover, Amex, Star, Pulse, Accel, PayPal

- Fee to pay with a credit card: 1.87%

- Fee to pay with a debit card: $2.55 (flat fee)

- Accepts: Visa, MasterCard, Discover, Amex, Star, Pulse, NYCE

- Fee to pay with a credit card: 1.98%

- Fee to pay with a debit card: $2.20- flat fee

- Accepts: Visa, MasterCard, Discover, Amex, Star, Pulse, NYCE, (digital wallets for Visa, MasterCard, and Amex) Paywithcash, Paynearme

Here are some additional options to pay taxes with credit card or debit card not listed on the IRS website.

Melio

- Fee to pay with a credit card: 2.9% (only business credit cards are accepted)

- Fee to pay with a debit card: $0 (only business debit cards are accepted)

- Accepts: Visa, MasterCard, Discover, Amex (only business credit or debit cards, not personal)

Plastiq

- Fee to pay with a credit card: 2.85%

- Fee to pay with a debit card: 1%

- Accepts: Visa, MasterCard, Discover, Amex

Are the payment processing fees tax deductible?

Payment processing fees are tax-deductible as a business expense for your business tax returns, but they are not deductible on your personal tax returns.

Overpaying your tax bill to spend more on your card

If you overpay the IRS, then the IRS will issue a refund to you for the amount you overpaid. That means that you can max out- charge even more than you owe for taxes- to be able to achieve spending more on your credit card. But, as with everything in life, it’s never good to overdo it, and since 2020 the time to process and receive some overpayment refunds has soared to 6 months or longer.

Only two direct credit card payments per person

If you want to split your tax bill with multiple credit cards, you can do so. In general, you can only pay the IRS twice, using a credit card for each tax type.

This limit is only enforced per tax period so if you pay taxes each quarter, then you can make two payments by credit card each quarter. You can check out a chart with more details on the IRS website found here.

These limits are only enforced per credit card processor so if you have already paid two payments with, lets say, Pay1040, you can do another two with PayUSATax, and another two with ACI Payments etc.

Because Plastiq sends paper checks to the IRS, the two card payment rule doesn’t apply to payments sent with that service.

If you’re looking for a great signup bonus to make paying taxes a little more rewarding, then check out our comprehensive list of all great credit card sign-up bonuses available now, here. You can also check out a comprehensive list of 0% APR offers available here.

Paying property tax with a credit card

It’s possible to pay your property tax or other types of taxes using a credit card through third party companies, and it may be possible to pay your county directly. Fees vary though, so check to see whether paying direct is cheaper than using one of the following options.

Here are some options:

- Fee to pay with a credit card: 2.85%

- Fee to pay with a debit card: 1% (excludes online-only bank debit cards)

- Accepts: Visa, Mastercard, Amex, and Discover

- Fee to pay with a credit card: 2.9% (only business credit cards are accepted)

- Fee to pay with a debit card: $0 (only business debit cards are accepted)

- Accepts: Visa, Mastercard, Amex, and Discover

What are some cons for paying taxes with a credit card?

- Processing fees- if your processing fee (the percentage or the flat fee) is more than your rewards, then it may not be worth it to pay with your card.

- Interest charges- if you don’t have a 0% APR card, then it’s only worthwhile to pay your taxes with your credit card if you pay the full balance amount. Otherwise you risk incurring high-interest charges.

- High credit utilization- paying taxes with your card can lead to a temporary credit drop if you use too much of your utilization rate.

You can calculate your utilization rate by dividing your credit card balance by your total available credit.

For example: $4,000 = balance. $10,000 = available credit.

Utilization rate = 40%. Adding a $2,000 (fill in with your amount) tax payment will lead to a 60% utilization rate. That is way too high! Your utilization rate shouldn’t be more than 9%.

Keeping all that in mind, make sure to make the decision based on if it’s best for YOU!

Codes to understand when paying tax with a credit card

Make sure to select the proper tax type you are paying because you do not want your payments to be applied incorrectly (it can be a big headache to fix later on). Here is an explanation of the different code types to choose.

- 1040 – Current Tax Return 2023: This should be chosen when paying your tax bill that you owe for 2023 upon filing tax.

- 1040 – Prior Year Tax Return: This should be chosen when paying any tax that you owe from previous years besides 2023.

- 1040 – Installment Agreement: This should be chosen when paying tax for any installment agreement you made with the IRS.

- 1040 ES – Estimated Tax: This should be chosen when paying estimated tax for the year 2024 (or for 2023 payments if you haven’t filed tax yet for 2023).

- 4868 – Tax Extension: This should be chosen when paying tax you owe for the year 2023 upon filing an extension

- Other types: Should be chosen when paying any other tax type not mentioned above.

How to keep track of the payments submitted?

You can check your payment history with the IRS here.

Happy tax season!

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments