For the sake of the consumers, we are introducing the all-new, easy to use, credit card forum, and credit pull database! It is a fantastic tool when considering applying for a credit card. This tool will give you an exact picture of how to go about it. You can share right here if you were approved or not, and exactly how and why. It also includes a great credit pull database where you will be able to research which bank pulls which credit bureau in real-time and state by state.

What To Do And When To Use

If you recently applied for a new credit card, please join us here. It’s fabulous! Follow the instructions below to fill out a report of what was involved in the acceptance or denial of the card you applied for. The details will show up on the same web page, alongside the card you applied for other users to see. This way, when you or your fellow users want to apply for additional cards, you can have this as a guide. You’ll see just why it’s so handy! Once you fill out your details, you can submit them, then scroll down to see the other submissions.

Let’s explore the features:

Where To Find Us

In the upper right corner of the HelpMeBuildCredit home page, on the left of the Ask Sam button. The tool is in the Resources selection, under User CC Results

The Forum And Credit Pull Database

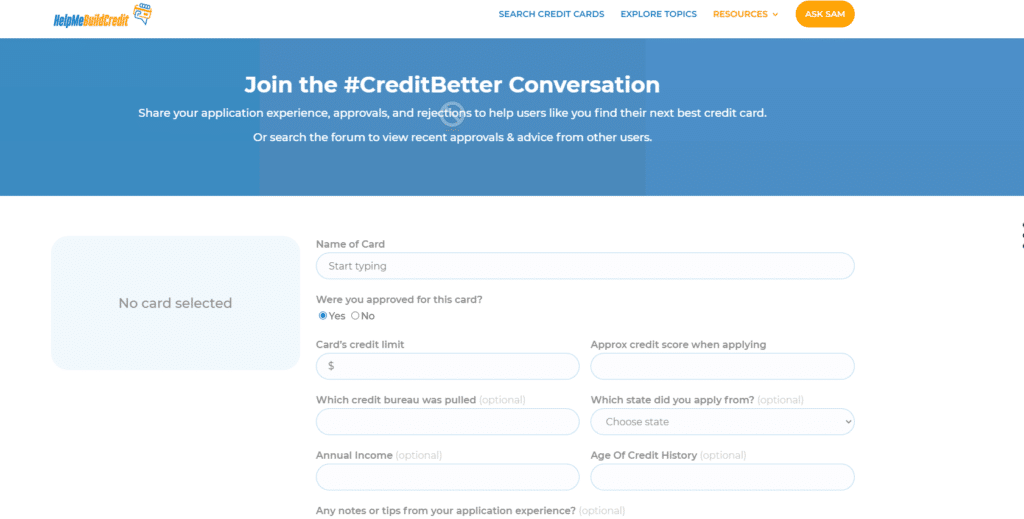

As titled, Join the #CreditBetter Conversation, you’ve arrived at the home page of the new credit card submission tool. This is what it looks like before you get started. Let’s get started.

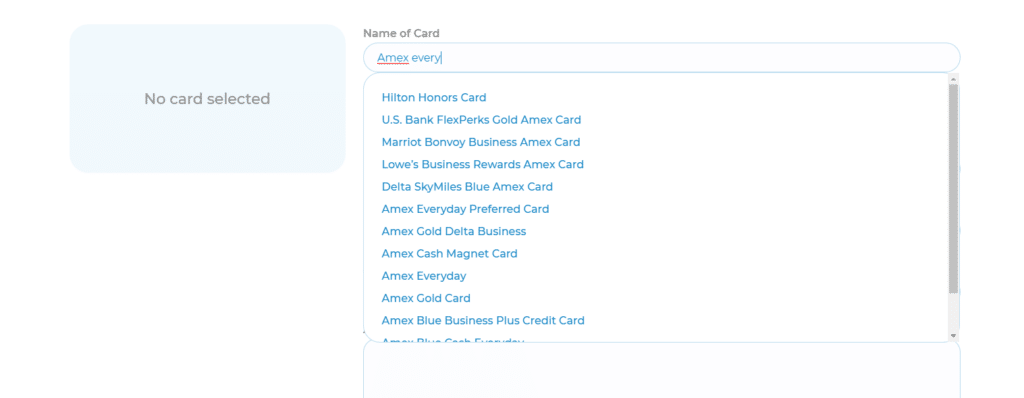

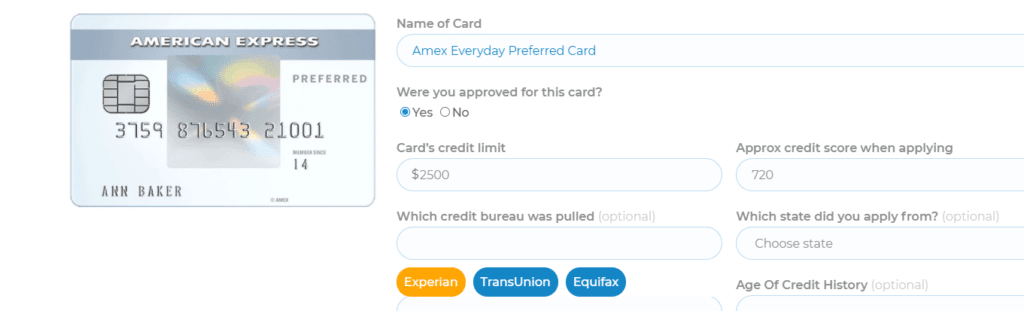

Name Of Credit Card Card

As indicated in this field, start typing the name of the card you applied for. As you type, suggestions similar to what you’re typing will pop up. You can select the name of the card if you find it or fully type the name of the card. I’m reporting the Amex Everyday Preferred card today.

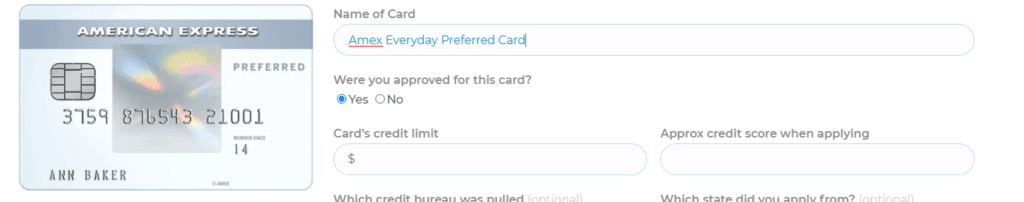

Approved Or Not

See how the image of the card showed up so nicely? If you report a card already in the system you will have the image pop up. Now select Yes or No, according to if you were approved for the card or declined. Don’t be ashamed, that’s why we’re here. To share our trials and errors and perfect our attempts for the future (we will not collect or share your personal information). I’ll go with Yes today. I was approved for the card.

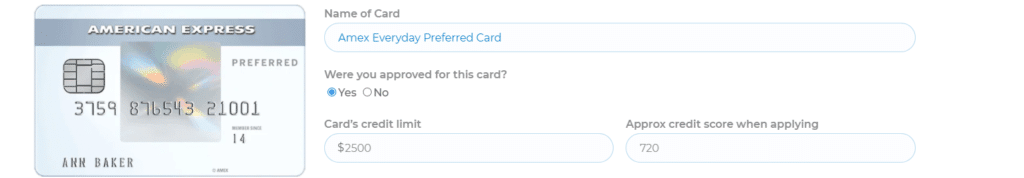

Credit Limit And Credit Score

When you get approved for a credit card, make sure the bank tells you what your credit limit on the card is. Here’s where will type in the number. You can use the up and down arrows too. Then type the credit score you had at the time of applying. This’ll allow others to base their choices according to the credit scores they have.

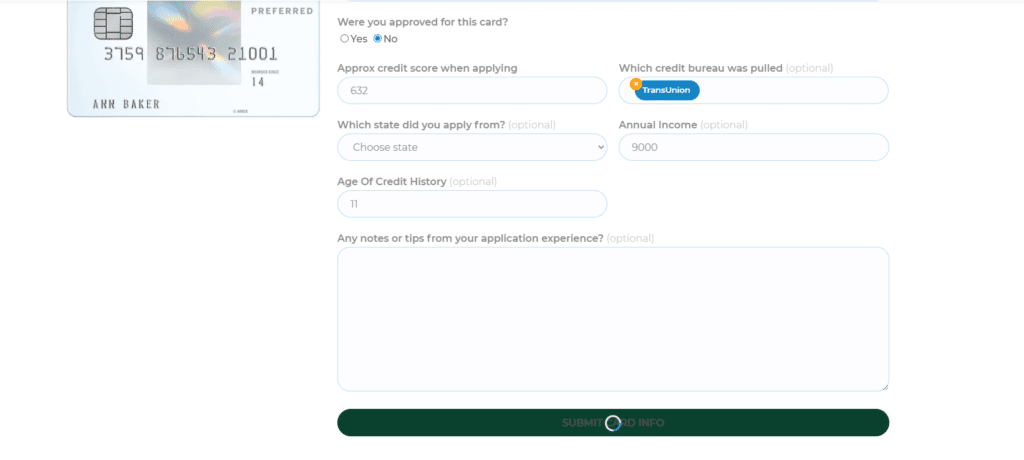

Credit Pull Database

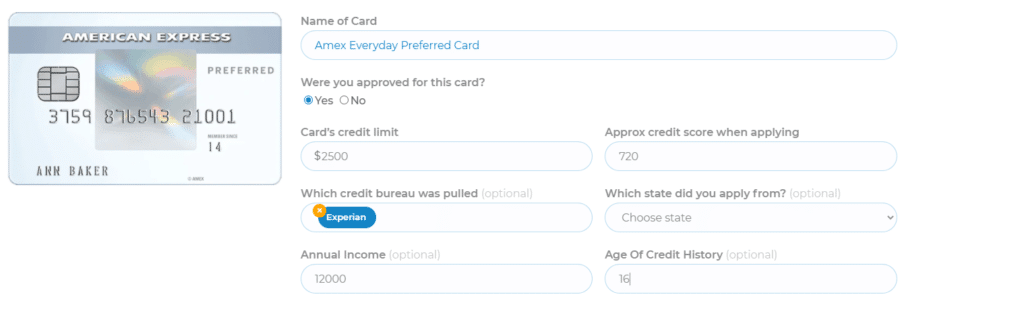

Once you are in the credit bureau field, the three bureaus’ names will pop up. You can select the credit bureau from where the bank pulled your report to consider your application. You can select one or multiple. It is an optional field but when possible please submit the information so we can update the credit pull database with real-time information.

Some More Personal Details

The following fields are all optional too. Choose the state you applied by selecting a state. Then type in your annual income. The age of credit history is the amount of time since your first account was opened.

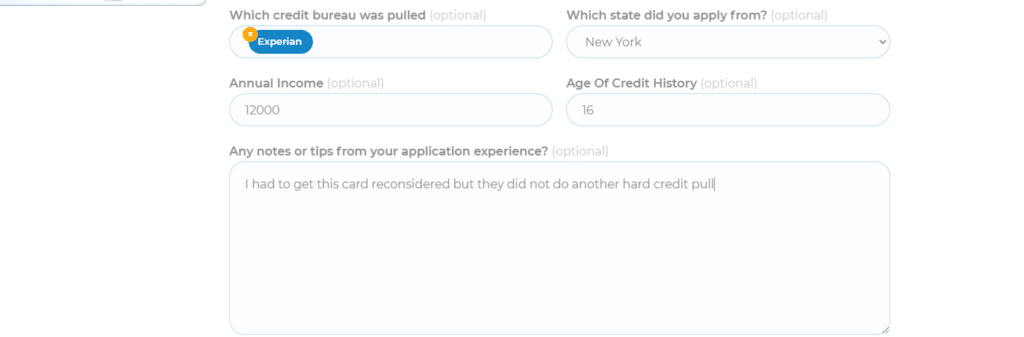

Any Notes

This is the box where you can choose to write some more information. I wanted to let everyone know that I had to ask Amex to reconsider the card as it wasn’t approved the first time around, but good thing is, they didn’t do another hard pull. Feel free to leave this box blank or share something you think others can benefit from. A certain situation you think might have affected the outcome, a trick you discovered in getting them to approve you, an additional contact number to a bank rep, etc.

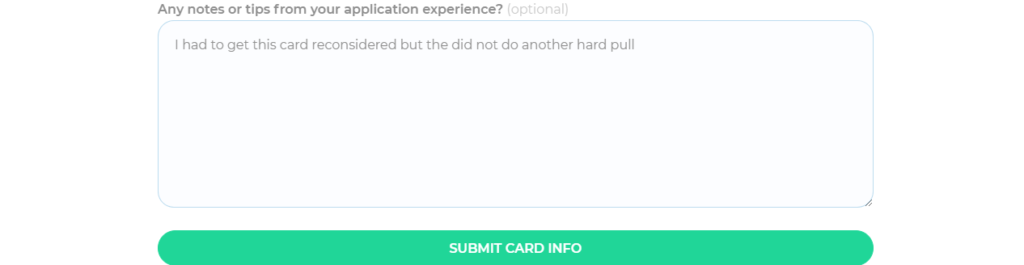

Submit Button

Once you’re done, click on the green Submit Card Info bar. But, I want to backtrack now and go through the process of what would be if you were declined for a card.

Not Approved

If you were declined for a card, select No back on top, where it says Were you approved for this card? Then type the credit score you had when applying for the card. The rest of the fields are optional, but again, recommended: select a credit bureau or more than one from where the bank pulled your credit report, select a state you applied from. Then type your annual income and type your age of credit history which is the time since your first account was opened. If you’d like, write a note or tip from your experience. Now, let’s submit card info.

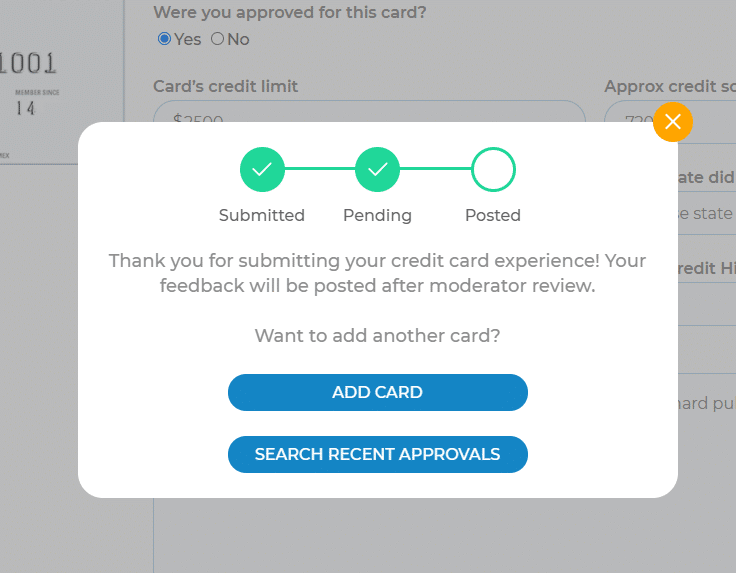

Dialogue Box

Once you hit on submit, a dialogue box will open. You can choose to directly add another card. If you choose not to, you can select to search for recent approvals to find all user’s experiences!

User CC Results And Credit Pull Database

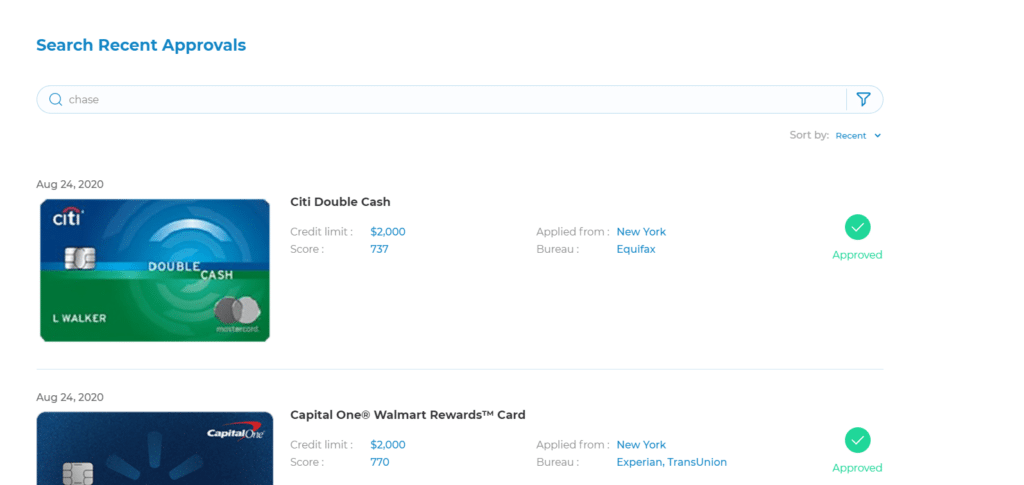

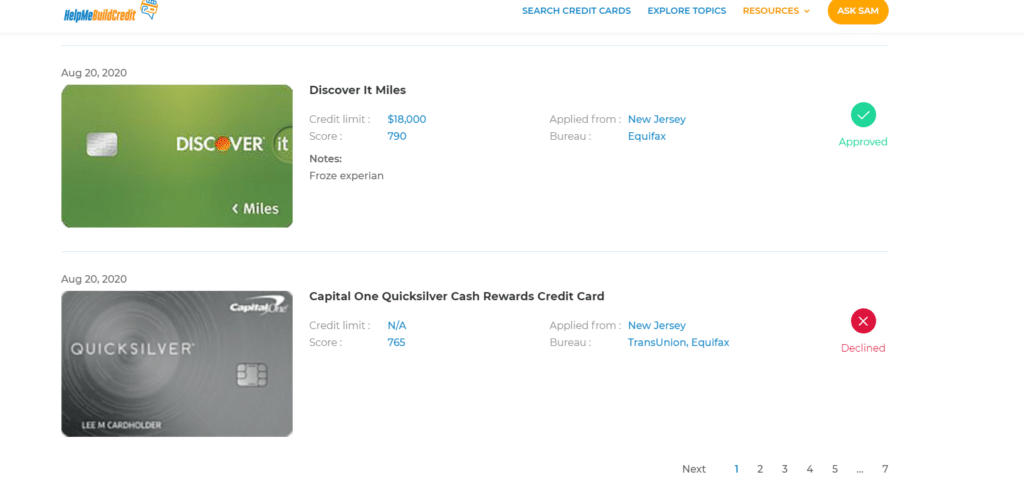

Cards will be listed right here in neat squares. Whatever information you filled out for your card is displayed right here for every card applied for. See the date, names, credit pull, notes, and more.

Notice how each card is marked on the right with a bright green check-mark for approved and cards that were denied are marked with a bright red X.

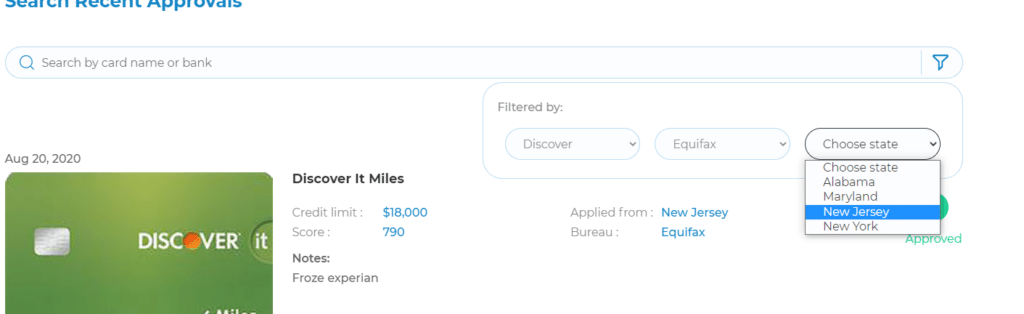

Search CC Results Database

![]()

Right on top at the recent approvals, you can use the search engine to sift through the cards listed. Type the bank or card you want to check out. This is beneficial if you want to inquire about a certain bank.

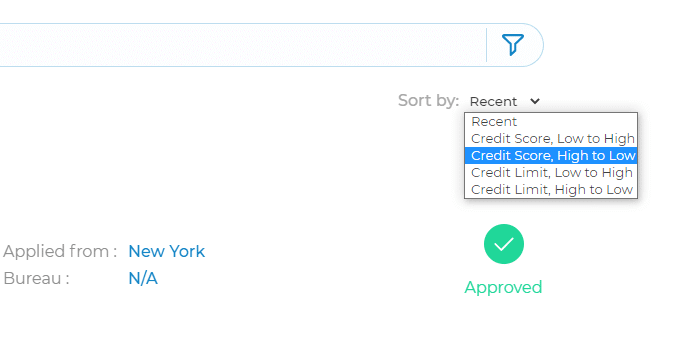

Sort By

To organize your search even more when you are sifting through others experiences, you can sort by. Below the search bar, select the way in which you want the cards to be sorted; Most recent, credit score from high to low or from low to high, or credit limit from high to low or from low to high.

Filter By

On the right side of the search engine, there’s a key shape. When you click on that you get three options by which to further filter the search. You can select a bank, a credit bureau, and/or a state applied from. Again, super convenient for when you are looking into something specific when applying for a card.

Thanks For Joining!

I hope you have it all down pat! It’ll be great if you join the #CreditBetter conversation so that we can all gain from your experiences. The cc submission tool is really simple to use and so beneficial too. It’ll be fun so why not join the convo?

0 Comments