People are often hesitant to open new credit cards being that they are afraid they already have “too many cards”. How many credit cards are too many? In this post, we will answer this question.

FYI, I personally have 48 accounts on my credit report with many more business cards that don’t show on a credit report. So keep in mind that my opinion on this subject might be different than yours…

Starting to build credit

Let’s go back a few steps to discuss someone who is still a newcomer to building credit.

For a person who is starting to build credit, I recommend not stopping until they get at least 2 approved credit cards.

The best way to build your credit is by getting approved for credit cards. But, hey! How do you get approved for credit cards without having credit? That’s like saying...

Once you get approved for two credit cards, you can calm down and give it about 6 to 12 months to let those cards build a solid base for your credit.

Use all your credit cards at least once every two months. It may seem a bit overwhelming at first, but don’t worry. It will eventually become second nature.

Going further with credit cards

After the year has passed, you can apply for a new credit card every 2-3 months. This 2-3 months break in between cards will keep your credit from being affected negatively by having too many new credit cards.

So, back to our first question of how many credit cards are “too many”. As long as you do it right, you can have even 48 credit cards and still have a perfect credit score.

Player 1 and Player 2 strategy

It’s not recommended for your credit to get more than one credit card every 2-3 months. A good way to help you be more aggressive with getting welcome bonuses is using a P1 and P2 strategy. For instance, if you and your spouse are both looking to accumulate points to use for the same trip, etc. then you can rotate between each other and each month a different one of you applies for a card. With this system, each one of you does not get more than 1 card every 2-3 months.

Business cards

Because most business cards do not show on your personal credit report you can be more aggressive with business cards and apply more frequently for business cards than personal. But keep in mind that even with business cards, there will still be a credit inquiry on your credit report (just the actual new account will not show). Even with business cards, don’t be too aggressive as your score can be hit if you have too many credit inquiries.

| Reports business cards on your personal credit report? | |

| Amex | no |

| Bank Of America | no |

| no | |

| Capital One | yes, except the Spark Cash Card |

| Citi | no |

| Chase | no |

| Discover | yes |

| US Bank | no |

| TD Bank | yes |

| Wells Fargo | no |

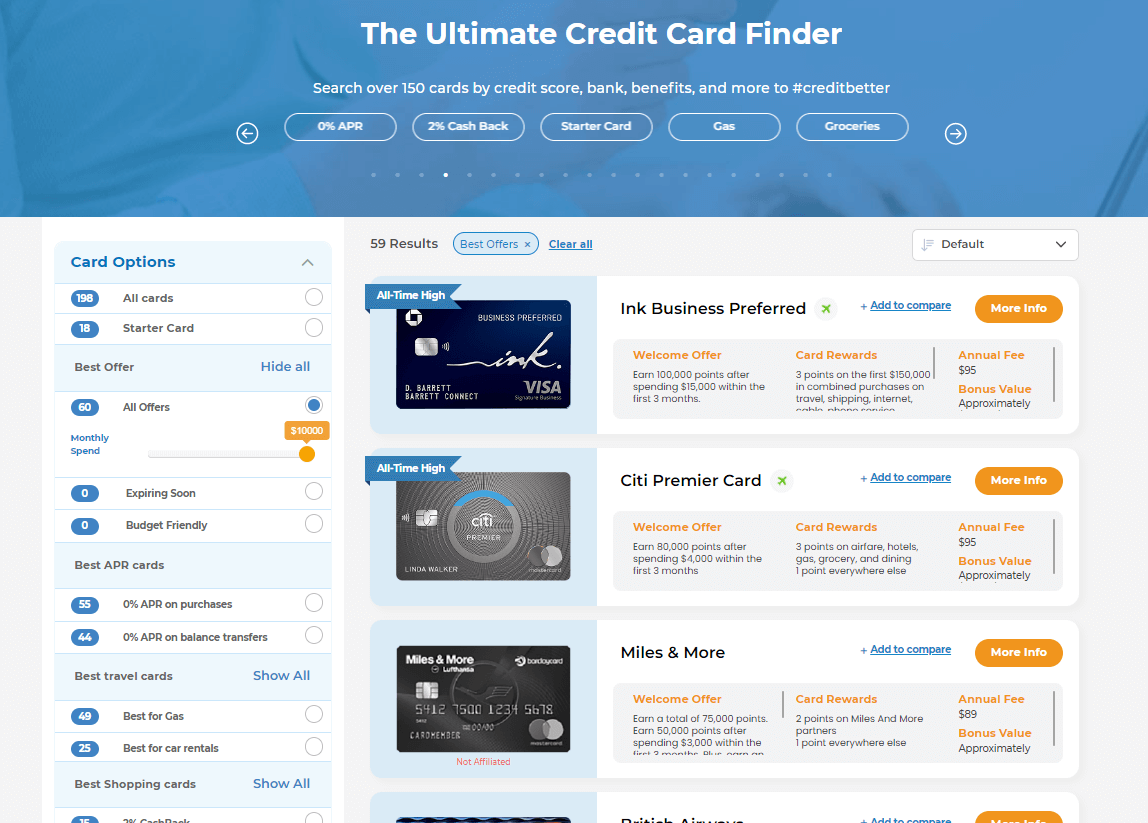

Always check out our website for the best bonuses

You don’t need to spend your days and nights looking for new welcome bonuses. You can at any time check our website for a full list of available welcome bonuses. We do the hard work of searching the internet for the good bonuses and we are happy to provide the info to you on a silver platter.

We do get paid for many of the credit cards that we promote. But even if a credit card does not pay us we will still list the card on our website (that’s why you will find many more offers on our website than other websites as they only list the cards they get paid for, but we list everything ).

With #hmbc YOU ALWAYS COME FIRST!

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

great post!!!

Thanks!