For some people, it’s more practical to have one credit card with a high credit limit as opposed to having a few credit cards from the same issuer, with all of them having smaller credit limits.

Sometimes reallocating credit limits can be a great tool. It can help with getting more available credit on a card that has an intro 0% APR offer, giving you much more money available to borrow interest-free.

Here in this post, we will go through the list of major credit card issuers and their policies on reallocating / transferring credit limits.

Please note: I put a strong emphasis that all information found in this post should be as accurate and up-to-date as possible. But, even after spending hours on research and interviewing other credit card experts, I will be honest and say that I still do not have a full clear picture. It seems that results strongly vary even within the same credit card issuers between different cardholders. If your result is different than that which is stated in this post, then please kindly leave a comment and we will update the post accordingly.

Amex

- You can reallocate credit limits from personal to personal, business to business, and from personal to business cards. You cannot transfer from business to personal.

- Reallocating can be done on the phone or online. Here is a step-by-step guide for how to reallocate your credit limits online:

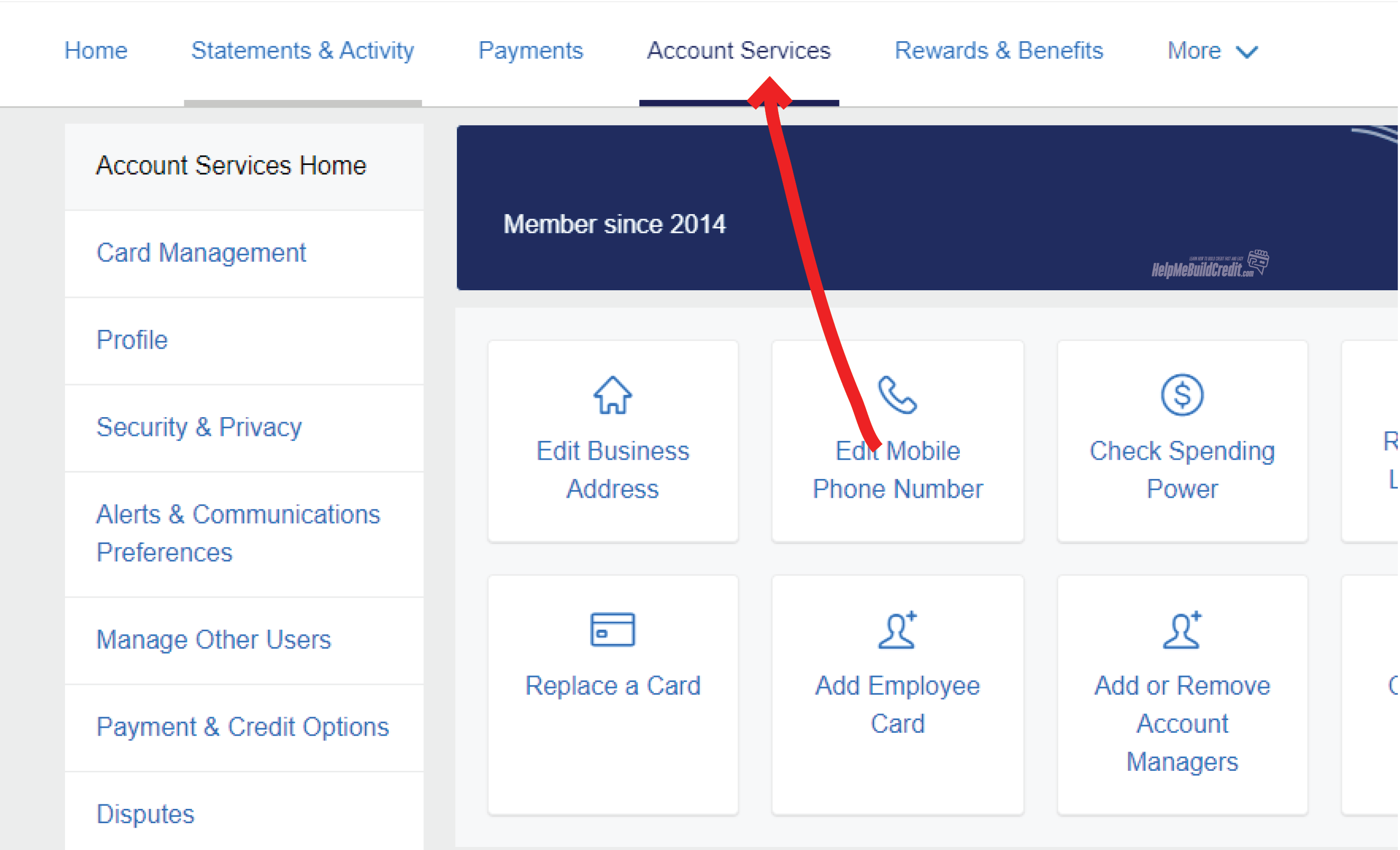

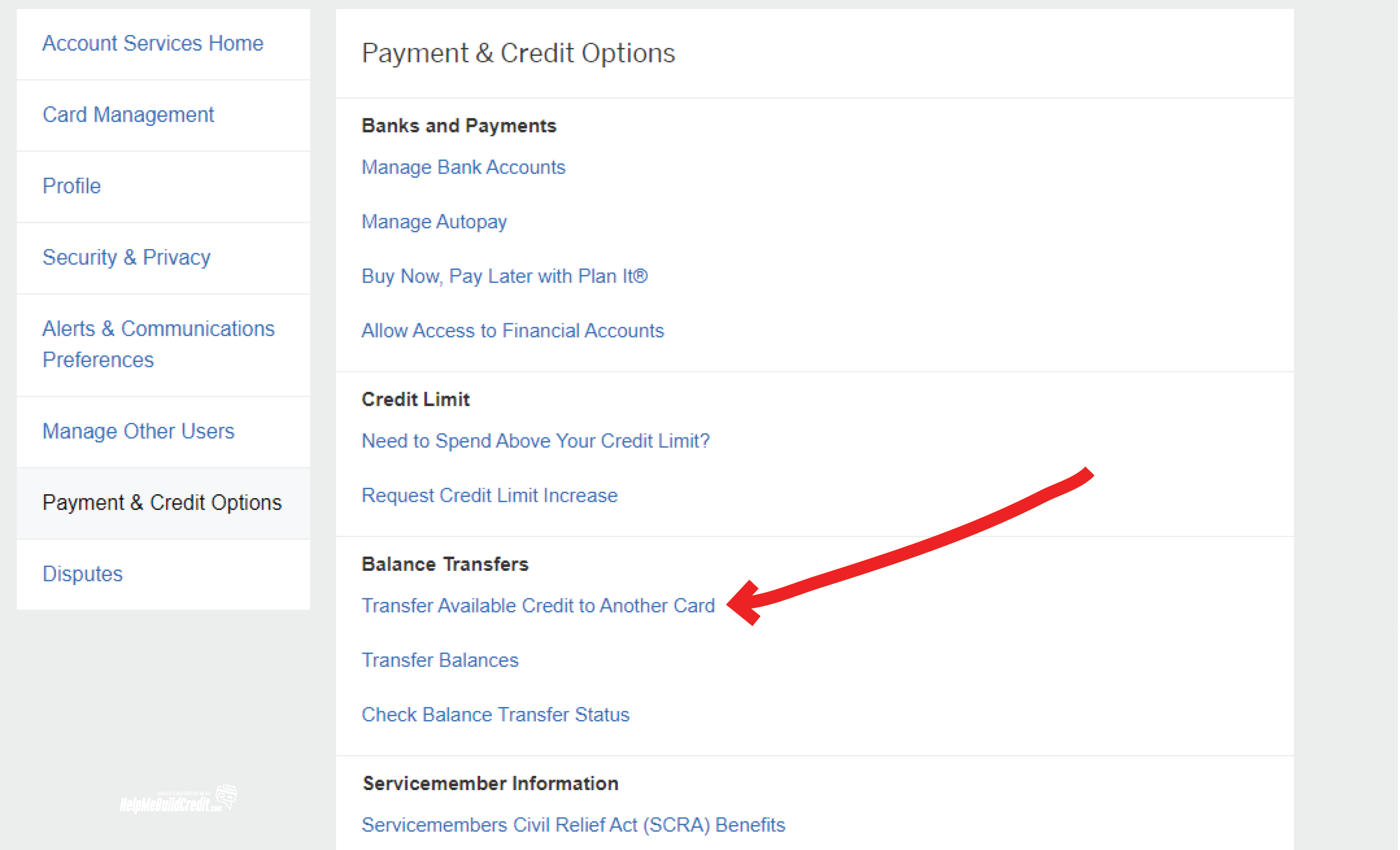

1. Click on Account Services

2. Click on Payments & Credit Options

3. Click on Transfer Available Credit To Another Card

- You cannot reallocate your credit limits more than once in 30 days.

- Reallocating credit limits with Amex will only result in a soft credit pull.

- If you want to leave the old card open (the one that you are transferring the credit limit from) then you need to leave over a min of $1,000 credit limit on that card.

Bank of America

- You can reallocate credit limits between credit cards at Bank of America from to personal card to personal or from business card to business card.

- Reallocating credit limits will only result in a soft credit pull

Barclays

- You can reallocate Barclay’s credit limits from personal to personal, business to business, and personal to business. More recent data points suggest that you can’t transfer from business to personal.

- To reallocate balances with Barclays, you need to speak to the Credit Analyst Department.

- Reallocating credit limits at Barclays will only result in a soft credit pull.

Capital One

Data points suggest that its not anymore possible to reallocate credit limits with Capitol One

You can reallocate Capital One credit limits by phone or online (login/services/ request account combination).Both accounts must be at least six months old.One of the two accounts needs to have a zero balance.Capital One will only do a soft credit pull.

Chase

- You can reallocate Chase credit limits only from personal to personal of from business to business.

- Reallocating credit limits by Chase will result in a soft pull,

except if the new credit limit will exceed $35,000, which in that case, a hard credit pull will be done.

Citi

- Most report not being successful with reallocating a credit limit with Citi bank; some suggest talking to a supervisor or asking to be transferred to the credit analyst department and only then being successful.

- Both cards will need to be open for six months.

- Citi will make a hard inquiry when reallocating credit limits

Discover

- Discover mostly does not allow reallocating credit limits, but it can be done through first requesting a credit limit increase. And after approved ask to talk to the Credit Operation Department to reallocate the credit limits. For whatever reason, once you approved for a credit line increase reallocating credit lines become possible.

US Bank

- Most report not being successful with reallocating a credit limit with Us Bank; some suggest talking to a supervisor.

Wells Fargo

- Wells Fargo allows reallocating credit limits.

- Wells Fargo will only do a soft pull.

I hope you enjoyed reading this post, and again as previously stated, if you had a different experience then what was described here in this post, please leave a comment below.

Thanks

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

I personally transferred big chunk of Barclay JB Personel to Barclay JB Business less then a year ago

Thanks. Will update post

Great article

Thanks!

chase sometimes have a limit on who much you could reallocate

I tried to transfer credit from my personal to business but they wouldn’t allow.

Which bank?

American Express

Can I transfer from a american express old business card to a new business card that I just opened?

Generally yes. but recently some people reported issues

Thank you

So is it better to wait 30 days from opening new Card or doesn’t make a difference?

I I just tried to relocate my credit limit on my Amex cards. But interestingly enough the website did not give me that option why is that? Is there anything I can do about that?