Pesach is just around the corner. Bills are going up due to all the groceries, paper goods, hardware, Pesach staples, shopping, cooking, prepping, and more shopping. Your bills may be going up just thinking of the long To Buy list!

A helpful action you can take before heading into Pesach preps is to set aside a credit card to use for your Pesach expenses.

We highly recommend the Amex Blue Cash Preferred to be the credit card you use for Pesach expenses this year. It has good cashback rewards on groceries and gas, a nice and newly updated welcome offer, and also a 12 months long 0% APR period in which you can pay up your purchases.

Here are the benefits in detail.

Grocery and Gas Cashback Rewards

With the Blue Cash Preferred, you will earn 6% cashback at U.S. groceries on up to $6,000 in purchases per year.

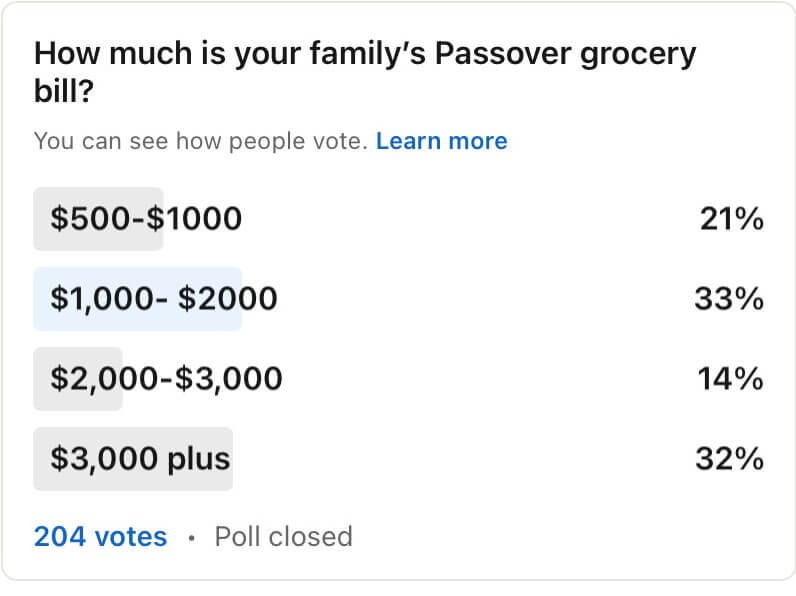

On a LinkedIn poll, I conducted asking how much people spend on their Pesach shopping, 32% of consumers said they spend more than $3,000 on Pesach grocery shopping, and 14% spend between $2,000 and $3,000.

Those who spend $3,000 or more on groceries will earn $180+ cash back with the Amex Blue Cash Preferred. And those who spend $2,000 – $3,000 on groceries will earn $120- $180 in cash back just for grocery shopping alone! I think it’s a win-win as you will anyways be spending all that money on groceries, may as well get the best possible cashback.

Running thousands of pre-Pesach errands means lots of hours in the car and using lots of gas. With the Blue Cash Preferred, earn 3% cash back on gas, parking, and tolls (that’s besides for the 3% cashback you earn on public transportation too; taxi’s, trains, buses, etc).

And better yet, when you’re kids start the “what are we doing today” chant come Chol Hamoed, you’ll happily take them on outings, knowing that you get cashback on gas you use!

$300 Welcome Offer

The welcome offer on the Blue Cash Preferred card makes you feel like Amex knew Pesach was coming up. They just raised the offer to a $300 statement credit after you spend $3,000 within the first 6 months. Also a biggie, they just waived the $95 annual fee for the first year.

I’m sure your Pesach expenses will be $3000 at least, so that’s an easy way of getting $300 in credit. All without paying the annual fee the first year (you can downgrade the card the second year to a non-annual fee card).

12 months Intro 0% APR on Purchases

The Blue Cash Preferred has an intro 0% APR for 12 months on purchases.

That means you can designate this card for all your Pesach purchases and expenses. Then, you get a year-long stretch to slowly pay up the credit card balance, all the while paying zero interest on the credit card balance. Beware that as soon as the 12 months are up from when you open the card, you will have to begin paying interest on purchases. But until then, you can spread out your credit card payments to slowly pay up your Pesach purchases, free of charge.

Some More Benefits

- Return Protection: Get a refund on a purchase you’re not happy with within 90 days of purchase. Get a refund of max $300 per claim, $1,000 per year.

- Purchase Protection: Get a refund on a purchase that’s been damaged or stolen within 90 days of purchases with purchase protection.

- Extended Warranty Protection: Get a year’s worth of protection added to the manufacturers’ warranty, that’s if the manufactures warranty covers 5 or fewer years. Max $10,000 each claim, $50,000 per year.

- Auto Rental Collision Waiver: Get secondary worldwide coverage on auto rentals damaged in a collision.

The Amex Blue Cash Preferred will give you all pluses in a credit card, and no cons. Use it for Pesach prep and earn some cashback, $300 in credit, a 12-months period of 0% APR on purchases, pay no annual fee the first year, and some more purchase benefits!

Runner up card for the more aggressive swipers! Amex Platinum Card

There is currently a welcome offer running on the Amex Platinum card offering 75,000 points after spending $5,000 within the first 6 months (you can possibly find better-targeted offers on the bottom of our Amex Platinum credit card page). In addition to that, you can earn 10 points per dollar at U.S. supermarkets or U.S. gas stations for the first $15,000 you spend (at U.S. supermarkets and U.S. gas stations combined), within the first 6 months. That gives you a total of 225,000 points for someone that can max out the full $15k spend in U.S. groceries and U.S. gas stations within the first six months.

Keep in mind that the card has a $550 annual fee which is not waived the first year. But the many credits and benefits that the card comes along with can easily justify the fee.

Here is the list

Credits

Here is the list of awesome statement credits that comes along with the card

- Earn $200 annual airline incidental fee credit

- Earn $100 in statement credits annually for purchases at Saks Fifth Avenue ($50 credits twice a year)

- Now during COVID, receive a monthly $30 statement credit for PayPal purchases 01/01/21-06/30/21

- Earn $15 monthly in Uber Cash for rides in the U.S., plus a bonus of $20 in December. This totals to $200 annually.

- Statement credit for Global Entry or TSA Pre-Check every 4 to 4.5 years- $100 value.

Card Benefits

The Amex Platinum card comes along with many awesome benefits that will enhance your travel experience. Here are the details:

- Access to 12,000+ airport lounges, with a complimentary membership to Priority Pass Select. Centurion Lounges, AirSpace Lounges, Escape Lounges, Delta Skyclub (when flying Delta)

- Complimentary Hilton Gold status, Marriott Gold status, Uber VIP, National Emerald Club Executive Status, Avis Preferred Club status (publicly available), Hertz Gold Plus Status (publicly available).

Travel protections

The card comes along with some awesome travel protections that will protect you from any mishaps that may occur during your trip.

- Trip cancelation insurance – Coverage for canceled or interrupted travel due to an unforeseen medical emergency. Max $10,000 per person per trip, with a max of $20,000 per year.

- Auto rental collision Insurance- Secondary worldwide coverage (excluding Australia, Italy, and New Zealand) on rentals up to 30 days (max $75,000). You can purchase a premium plan from Amex that will offer primary coverage up to 42 days (max $100,000).

- Lost luggage reimbursement – Up to $2,000 per person for lost or damaged luggage (max $10,000 per trip for NY residents)

- Trip delay reimbursement – If your flight is delayed for more than 6 hours, you can claim up to $500 per trip to cover expenses like meals, lodging, toiletries, medication, and other personal use items (up to two claims per year).

Purchase coverage

When you swipe the Amex Platinum card, you can feel secure with the following protections:

- Return protection – Not happy with a purchase? Get a refund on purchases that have passed the store return policy, for up to 90 days. Max $300 per claim ($1,000 per calendar year).

- Extended warranty protection – Get one additional year on top of the original manufacturer’s warranty. (Will only cover if the original warranty is for 5 years or less. Max $10,000 per claim and $50,000 per year.)

- Purchase protection – Get refunded if your purchase is damaged, lost, or stolen, for up to 90 days from the date of purchase. Max $10,000 per claim ($50,000 per year)

Welcome offer eligibility

Amex welcome offers are once per lifetime per card. So if you already received the welcome offer on the card then you cannot receive another welcome offer on the same card product. If you’re not eligible for the offer, Amex will notify you through a pop-up before you submit the application

Conclusion

The Blue Cash Preferred is your best choice if you:

- Spend $6,000 or less at U.S. Supermarkets per year

- Want 12 months to pay your bill interest-free

- Plus, now for a limited time you get a $300 welcome bonus after $3,000 spent within the first 6 months, plus the $95 annual fee is waived the first year.

The Amex Platinum card is your best choice if you:

- Can spend approximately $15,000 at U.S. groceries and U.S. gas stations within 6 months

- If you have $550 to layout on the annual fee (you can get most of it back through various credits mentioned above)

- You will earn 75,000 bonus points if you spend $5,000 within the first 3 months (you can possibly find better-targeted offers on the bottom of our Amex Platinum credit card page)

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments