Did you ever lose your credit card and needed to order a new one but felt frustrated about needing to contact all merchants on monthly subscriptions to update them with your new credit card info? Or did you think of a great idea on how to block a merchant from charging your card? Just cancel the card and order a new one?

Welcome to automatic credit card update services. What is it? Let’s discuss it in detail.

What is a credit card update service ?

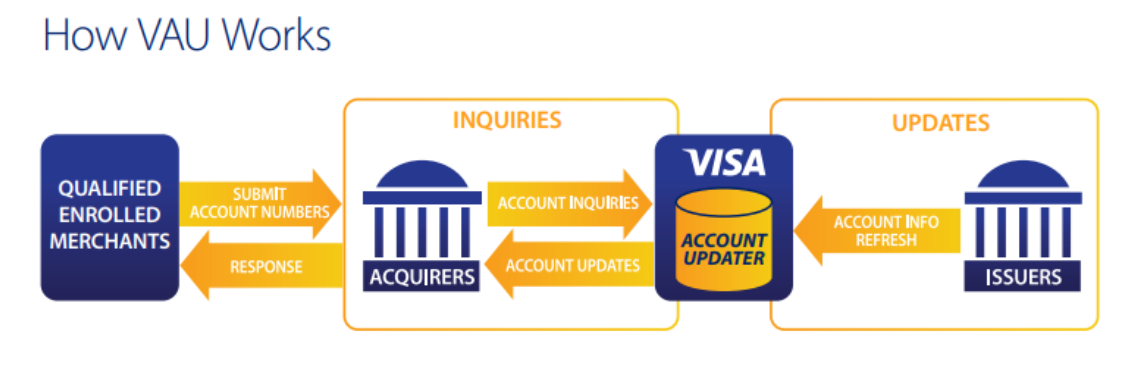

Credit card issuers offer merchants what’s called a credit card update service. Merchants who enroll in this service get access to updated credit cards that they’ve previously billed. If the account holder changes their credit card number, expiration date, etc., then the merchant can get the updated credit card info directly from the credit card issuer through the update credit card service and continue to charge the card.

(Screenshot taken from Visa website)

Which cards have them?

Visa, Mastercard, Amex, and Discover all have a program that allows enrolled merchants to receive updated information about cards that they previously charged. If a merchant submits an account number they can get a response within 24-48 hours with the new updated information.

The good and the bad

The good thing about a credit card update service is that if you lose your card or your card expires and you need a new card then you do not need to be busy contacting all the merchants to update them. They can get the updated info form the issuer directly. But the bad news is that if you want to try to block a merchant from charging your card then just reporting your card lost and ordering a new one will not always be sufficient. If the merchant is enrolled in an update service then they will be able to get your updated account info and still charge your card.

Rather block the merchant

In the case that you want to stop a merchant from charging your card, a better approach would be to contact the bank and request to block the merchant from charging your card. This is not possible to do with all banks but many banks do offer such a service.

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

Hello, I am currently fighting a scam charge and I am wondering if Bank of America will let me block them from charging me. If so, how do I go about requesting that?