An Apple a day keeps the doctors away. But, how about the Apple Card? Apple wants you to use their credit card for all your everyday purchases. But is the Apple Card the right choice? So, to answer our questions, we have with us today my good friend Pinchas Genger who was invited by Apple to be one of the first ones to try out the new Apple card. In this post, he will discuss his experience with the Apple card.

Apple Card

Author: Pinchas Genger

This post is going to be a bit of a different type of post. When talking about most credit cards the focus is on benefits, point rewards, etc. The Apple Card is an entirely different concept.

Apple Card brings to the table something that no card ever did. Until now, credit cards were just a boring piece of plastic that just got the job done.

The Apple Card is changing that.

The benefits of the Apple card can be broken down into six parts.

One: User Experience

Like everything Apple, they re-thought cards from bottom up. Apple’s motto is, “Do things differently”; that’s why they re-created the card the way it’s meant to be.

Ever wondered why there are numbers on credit cards? Why risk the card being stolen and then deal with canceling the card and re-entering the new number in every place you have saved it? The Apple card is a beautiful white card with nothing on it besides for branding from Apple, Goldman Sachs, and MasterCard.

No, you don’t have to have a $450 annual fee membership card. I have that beautiful metal Apple Card, and it’s free!

Two: Ease Of Sign-Up and Activation

The ease of signing up is remarkable. The requested info is standard on all cards. The fantastic part is that you can use the card the instant you are approved. All the fields are pre-filled for you. And the only additional info you need to provide is the last 4 digits of your social and your annual income. The verification process takes seconds, and once you are approved the Apple Pay card (the virtual card in your phone), and the card number is available to use instantly.

After the card arrives, all you have to do is place your phone near the packaging and walla! Your card is active! This is what I call seamless!

Three: Ease of Approval

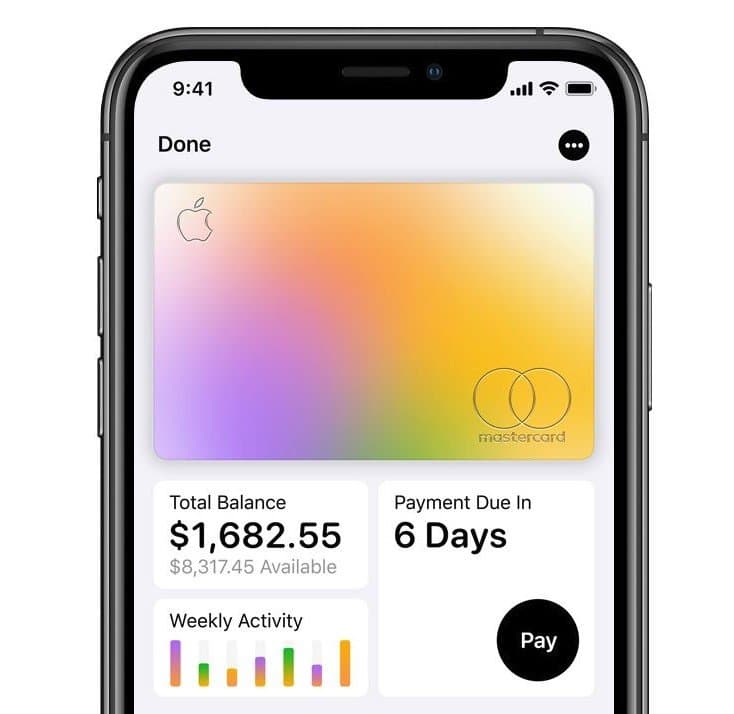

With a score of 800, I got a $7,500 credit limit, with an APR of 17%. The Verge reported that some people got approved with a score of, as little as, 600 and even less.

Four: Categorized Spending

For me, the deal-breaker is categorized as spending and reporting. Yes, there are a lot of financial reporting tools out there, and many of them are perfect. But there is something here that only Apple can do. And for me, it struck out as the most valuable part. The predefined categories which CAN’T be changed. The accuracy of the location from where you swiped the card comes from Apple Maps. In your Apple wallet, you will see the colors of your card change according to your spending. After using it for a week or so, you will be able to figure out your spending habits in an instant.

Five: 2% Daily Cashback

The rewards are nothing mind-blowing, but the simplicity is well worth it: It’s a two percent Cashback on any Apple Pay transactions, and one percent on purchases made with the card or card number. That cash accumulates in your Apple Pay Cash account every day, and you can use it to pay off your balance, send it to friends, or transfer it to your bank account.

It falls short in other premium card perks; like access to airline lounges, concierge services, and so on. But Apple believes the simplicity and speed of just getting cashback will entice premium card customers who are frustrated with complicated point schemes to switch to Apple. They assume the payment and financial health features will appeal to everyone else. (Basically: people with less money.)

Number Six: No Fees

Apple Card has zero fees, again zero, 0, nada, null. Apple states, “No fees. Not even the hidden ones.” There are no: late fees, international transaction fees, no annual fee, cash advance fee, and over-the-limit fee.

It’s worth mentioning that this is the only credit card on the market that encourages you to pay less interest. When you’re ready to make a payment, Apple Card estimates the interest you’ll wind up paying, based on any payment amount you choose.

The benefit network is from MasterCard.

The Apple card is from now on, definitely, going to be the card I will use on everything I buy!

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

Like the fact that you don’t have to call to activate the card.

Yup thats something new! #onlyapple

Nice!!

Thanks!

Great article with a easy understanding of how this card works!!

Thanks!

Thanks Dave for writing a compelling piece on the Apple Card.

MKBHD (Tech YouTuber) did his own video on this card and highlighted the bells & whistles of easy application process, sleek metal card design, and the awesome phone app with the nifty, too-cool color scheme that adjusts in real time to your spending. Apple is making a push (beyond tech devices) for users to abandon their ecosystem to other Tech Manufacturers even more difficult now that they’ve literally entered consumers’ wallets with this card.

I doubt I’ll ever get this card myself, but the Verge article you linked to may suggest this will be OK for people with little credit or rebuilding credit?

I’ll definitely be giving this card another review in light of your informative article, Dave (& Sam of course)!

Shalom

Will check that out. Thanks Cap