Many people who are homeowners today would not have been able to do it without a co-signer. Co-signing on a mortgage loan is one of the biggest favors you can do for your child, relative, or friend who is looking to buy a home. But co-signing on a mortgage puts a lot of risk on the table as well. Co-signers are responsible for making payments in a case where the primary fails to make payments. In many states, banks are legally allowed to collect from co-signers, even before they try to collect payment from the primary.

By co-signing on a loan, you are risking your money, you are risking your credit, and you are risking your relationship.

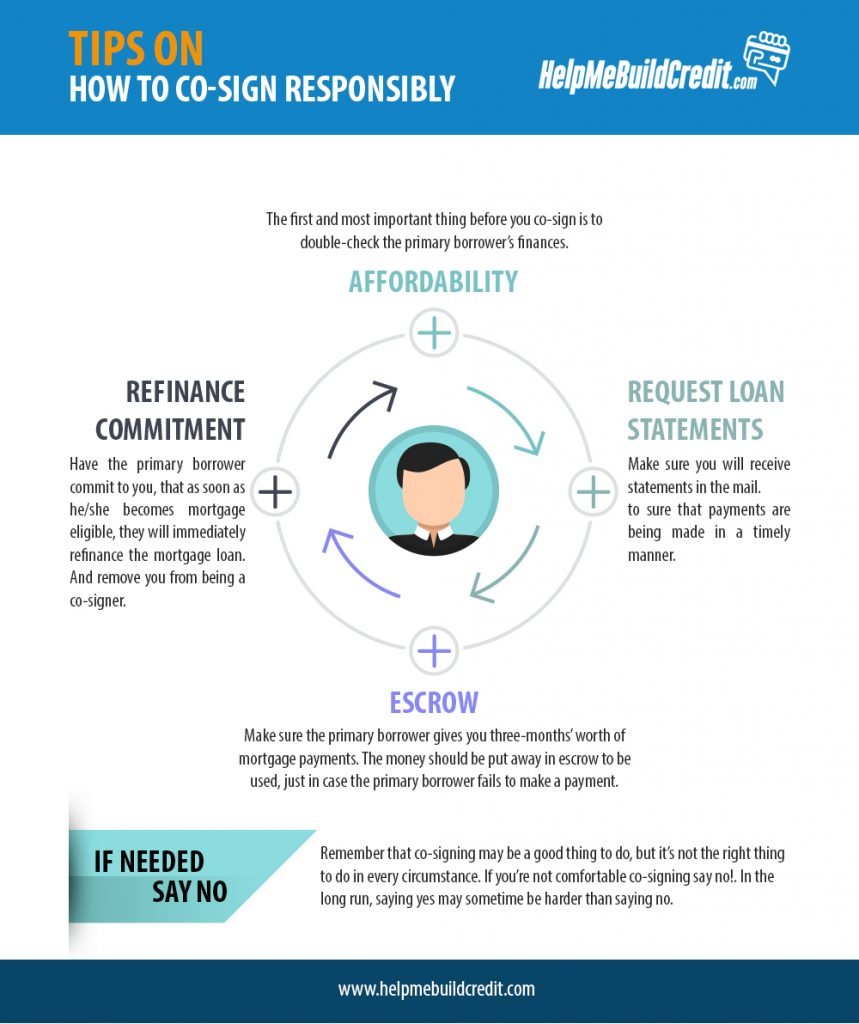

Here in this post, we will discuss some tips on how you can co-sign responsibly so that you do not end up biting yourself in the leg.

Affordability

The first and most important thing before you co-sign is to double-check the primary borrower’s finances. Sit down and go through the plan on how he/she is planning to afford the mortgage payments. Make sure there is also some breathing space financially, just in case an emergency comes up. Banks check finances before approving a loan, so should you.

Request loan statements

Make sure you will receive statements in the mail. Banks do not send statements to the co-signer unless it’s requested. Make sure to ask to receive statements, so you can be properly on top of the loan, to make sure that payments are being made in a timely manner.

Escrow

Make sure the primary borrow gives you three-months’ worth of mortgage payments. The money should be put away in escrow to be used, just in case the primary borrower fails to make a payment.

Refinance Commitment

Have the primary borrower commit to you, that as soon as he/she becomes mortgage eligible, they will immediately refinance the mortgage loan. And remove you from being a co-signer.

If needed, say no

Remember that co-signing may be a good thing to do, but it’s not the right thing to do in every circumstance. If you’re not comfortable co-signing say no!. In the long run, saying yes may sometime be harder than saying no.

0 Comments