Covid -19 has put the world on pause. It’s, unfortunately, making many sick, but it is also taking many businesses on a major roller coaster ride! The financial disaster that Covid -19 is causing is unfortunately tremendous! Many people are now out of a job; they have lost their income, and have no financial security.

Everyone is working together to fight the virus, even the big banks. Many banks announced great relief and hardship programs to help consumers that were affected.

Some are offering to wave minimum payments for one or two months. Many banks are even offering to waive the interest as well!

Be Aware

1. Please be aware that these programs are only available for consumers who contact the bank before being late on the payments. If you do not contact the bank and you end up being late on the payments then your payments will be reported late just like any other month.

2. Its recommended to get these agreements in writing and it should clearly state that joining the program will not have any impact on your credit whatsoever.

3. Please keep in mind that joining a hardship program can possibly affect your relationship with the bank. Meaning, when, or if, you later apply for a new credit card at the same bank, the bank might decline you due to your negative relationship. Or the bank may freeze your credit line for future purchases.

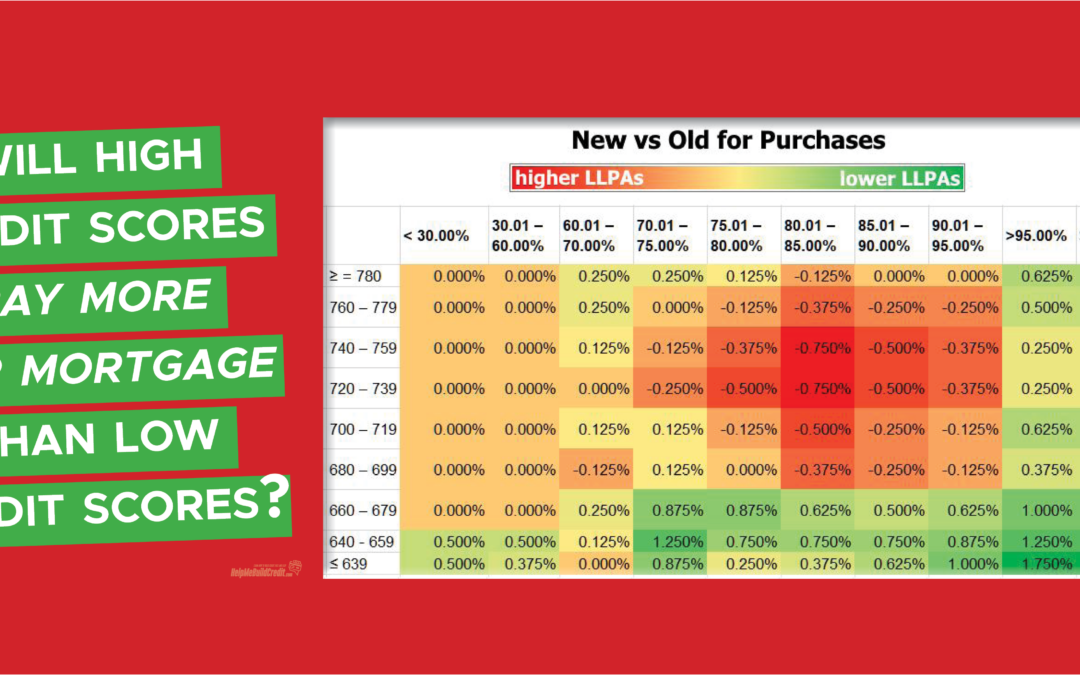

4. Mortgage Loans: Do not confuse the forbearance program with a loan modification. The forbearance program will not affect your credit score but a loan modification will damage your credit. Say no to any loan modification! And as mentioned above its recommended to get these agreements in writing. Forbearance programs may have mortgage consequences. Consult with your mortgage broker first.

Here is a list of data points we got about different programs available by each creditor.

Credit Cards

Amex:

Amex is offering to waive minimum payments, late fees and interest for up to two months on personal and business cards.

There are some data points that once you join the hardship program your credit card and rewards points will be frozen until you exit the program.

Amex has also announced a great Financial Relief Program, read all the details here

Apple Card:

Apple is offering to waive minimum payments, late fees, and interest for up to two months.

Bank Of America:

Bank Of America is offering to waive minimum payments, late fees and interest for up to two months.

Barclays:

Barclays is offering to waive minimum payments and late fees for up the three months. Barclays is not waiving interest.

Chase:

Chase is offering to waive your minimum payment, late fees, for three months on personal and business cards, auto loans, mortgage, and home equity loans. Chase is not waiving the interest. You can request the delay with the dedicated Chase automated phone line 1-888-356-0023

Capital One:

Capital One is offering to waive minimum payments, late fees and interest for up to two months on personal and business cards.

Discover:

Discover is offering to waive your minimum payment and late fees for one month. Discover is not waiving the interest.

Auto Loans

Toyota TFC:

TFC is offering to waive up to two lease payments and even extend your lease for two months!

Honda HFS

HFS is offering to waive up to two lease payments and even extend your lease for two months free!

Lincoln

Lincoln is offering to waive up to two lease payments for free!

Chase Auto Loans

Chase is offering to waive payments on auto loans for 90 days. You can request the delay with the dedicated Chase automated phone line 1-888-356-0023

Ally Bank:

Ally Bank is offering to defer payments for up to 120 days on auto loans!

Audi Financial Services

Audi Financial Services is offering to defer payments for up to 3 months.

BMW Financial Services

BMW is offering to defer payments for up to three months

Banks

M&T Bank:

M&T Bank is offering its clients a personal loan for up to $5,000 for 2.99% interest.

Mortgage Loans (Forbearance Programs)

Pros of forbearance,

Pro #1 In a situation where you can’t afford to make your monthly mortgage payments forbearance will save you from foreclosure and give you a break on you payments till your back on your feet.

Banks are offering the forbearance programs without proof of hardship just by asking for it.

The terms can be from 3-6-12 months and with protection under the Cares Act banks cannot report any adverse marks on your credit report unlike in the past with forbearance programs.

Pro # 2 In the past, at the end of the forbearance program, banks would be able to ask for a lump sum repayment of the full past due amount. The government announced that if your loan is owned by any of the government agencies like Fannie Mae, Freddie Mac, FHA Etc. (a majority of loans are Fannie or Freddie owned, you can lookup your mortgage here) then there will not be a lump sum payment at the end of the program.

Cons of forbearance,

Con #1 After you join a forbearance program you may have issues with getting financing in the future. Some mortgage banks will not lend without a 12-month on-time payment history. This is regardless of what your credit score is. If you joined a forbearance program you will not have a 12 month on-time payment history and will not be able to lend with these banks for up to 12 months.

Con #2 Joining a forbearance program will show on your credit report “Affected By Natural Disaster” and this might result in a home equity shutdown or other lenders lowering your credit limits, etc.

Con #3 The certainty of the unknown, the government directed the banks to approve anyone for forbearance without any proof but didn’t say much on what will happen when exiting the forbearance program. It’s possible that at the end of a forbearance the bank will evaluate your financial ability to pay and determine if they will modify your loan or add the balance to the end of your loan term or divide the past due in monthly payments for all this they might ask for paperwork income documents living expense and if you can’t provide proof of your ability to pay the bank can proceed with a foreclosure, time will tell.

You may also want to read our great post on how 0% APR credit card may help you manage your cash flow

Stay Safe!

![Finally Going Into Effect! Bank Can’t Take Away Your Points When Closing Your Credit Card [In New York]](https://helpmebuildcredit.com/wp-content/uploads/2023/11/post-on-new-law-that-can-redeem-points-90-days-affter-closure-1080x675.png)

![[Update] Great News! Most Medical Collections Will Be Removed From Credit Reports](https://helpmebuildcredit.com/wp-content/uploads/2022/03/post-on-medical-collections-news.png)

“3. Please keep in mind that joining a hardship program can possibly affect your relationship with the bank. Meaning, when, or if, you later apply for a new credit card at the same bank, the bank might decline you due to your negative relationship.”

Would you know if this is true with leasing companies as well? Toyota to be specific.

I believe it will not effect.

Do you know what/if Kia is offering anything?

And if ye where I can apply for it?

Thanks!

Not sure. if you get any data please report back. Thanks!