What’s usually one of the happiest days for Jews around the world has unfortunately ended in deep sadness due to the horrific acts of terror by Hamas terrorists in Israel. Our mind and soul are fully focused on our brothers and sisters in Israel. We pray that everyone should stay safe during these difficult times. Our heart goes out for those killed and their families and we continue to pray for those injured for a speedy recovery.

We have two HelpMeBuildCredit team members living in Israel. We pray for their safety and we made sure they get the time off they need in order to care for themselves and their family.

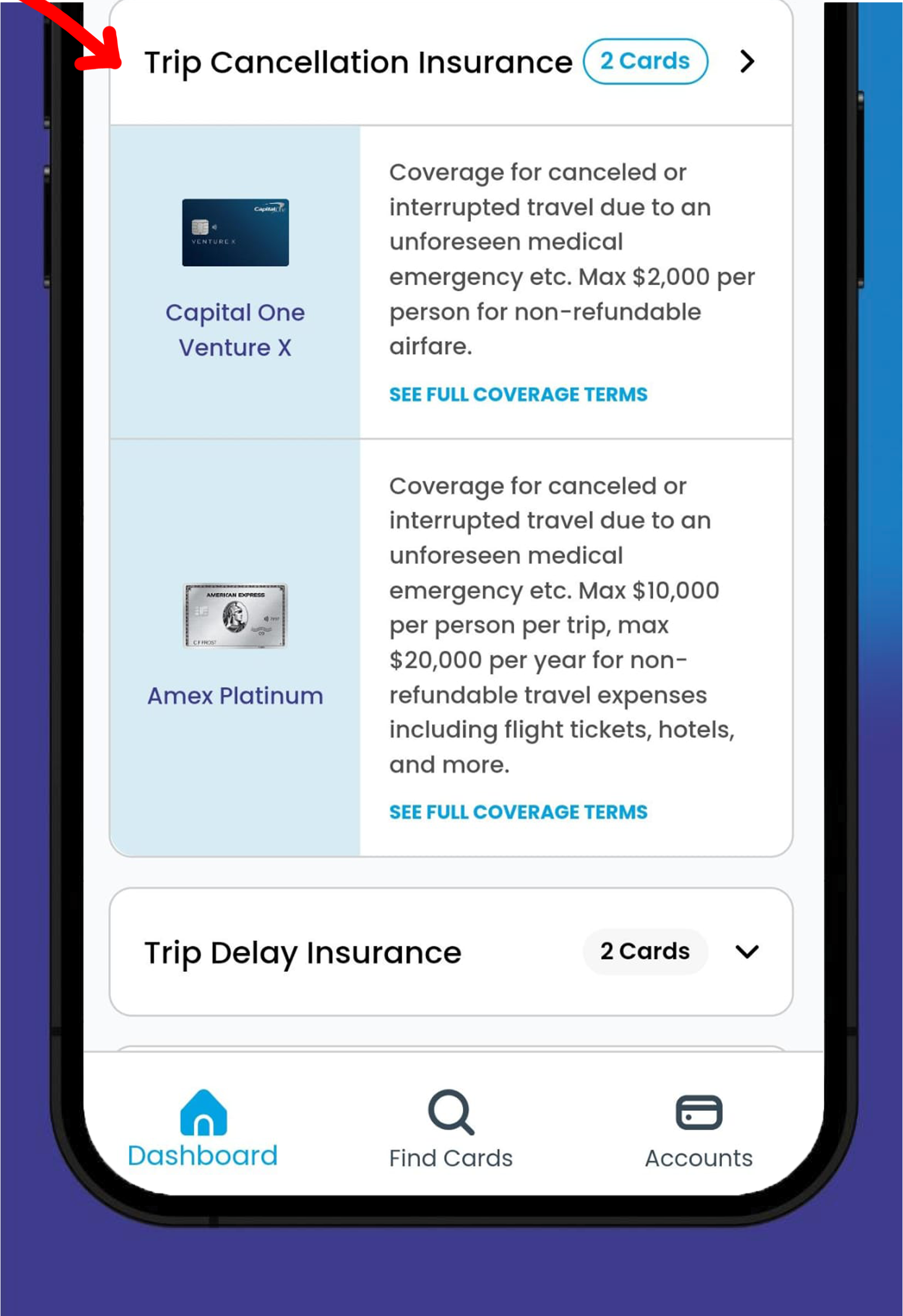

Due to the war currently raging in Israel, we are getting a lot of questions regarding trip cancellation insurance and trip delay insurance offered by credit cards from people either stuck in Israel or from people who have upcoming trips planned to Israel.

Let’s answer them one by one.

What does trip cancellation insurance cover?

The benefits of trip cancellation and trip interruption insurance are offered by many credit cards. In most cases, they’ll refund you for the prepaid, non-refundable travel expenses.

Some will only cover the airfare expenses, while some will cover all the travel expenses- including the hotel, car rental and more.

Is an act of terror related cancellation eligible for coverage?

With most cards, if you need to cancel your trip due to “act of terror” in either your country or the country you are planning to visit then you’re eligible for coverage.

Do I need to pay the travel expenses using the eligible card?

In order for the insurance to cover the expenses, you need to pay for them with the eligible card. While some cards allow you to pay only part of the expenses on the eligible card, some cards will require you to pay for all of the expenses on said card.

Amex: To be eligible for coverage the full amount will need to be charged to your Amex card

Barclays: Barclays will cover whatever percentage of the trip was purchased using your Barclays card or Barclays points. To get full coverage, you will need to charge the full amount to your Barclays credit cards or Barclays points.

Chase: To be eligible for coverage at least a portion of the travel expenses will need to be charged to your Chase card or Chase Ultimate Rewards.

Citi: No Citi credit card currently offers trip cancellation insurance.

Capital One: To be eligible for coverage the full amount will need to be charged to your Capital One card or Capital One points

Discover: No Discover credit card currently offers trip cancellation insurance

US Bank: To be eligible for coverage the full amount will need to be charged to your U.S. Bank card

Wells Fargo: To be eligible for coverage the full amount will need to be charged to your Wells Fargo card.

If I booked a ticket for a friend or family member using my card, do they get coverage?

Immediate family members are covered as well even if they are not an authorized user on your card. For friends, they will need to be an authorized user on the card to receive coverage.

If I had my ticket booked on a flight out of Israel in a few days but decided to take an earlier flight, can I get a refund for the unused ticket?

Yes. That should be eligible for coverage.

If I needed to book a more expensive ticket would I get coverage for the difference in price?

No. Coverage is only to get refunded for the ticket paid, not the cost of rebooking a new ticket.

If the airline canceled my flight am I eligible for coverage?

In such a case the airline usually needs to refund you or rebook a flight for you so coverage is usually not applicable. If the airline refuses to refund you then dispute the charge as a regular credit card dispute.

If I have a flight planned for Israel soon but decided not to go am I eligible for coverage?

Yes. That should be eligible for coverage.

If my flight got delayed, am I eligible for coverage?

You’re not eligible for coverage under trip cancellation insurance but you might be eligible for coverage if your card also has trip delay insurance.

What is trip delay insurance?

If your flight is delayed, you can get refunded for items like meals, lodging, toiletries, medication, and other personal use items you needed to buy during the delay.

The exact coverage amount and how many hours your flight needed to be delayed varies by card.

Check out CardRight to see if your card offers coverage

Check our app to see if your card offers coverage and for the exact coverage terms.

Download it here:

Or you can use a Desktop Web version (no smartphone needed) at cardright.com.

![Primary CDW Insurance: Which Credit Cards Still Offer Them? [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/04/post-on-cards-that-have-primary-cdw-insurance.png)

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments