Help Me Build Credit has partnered with CardRatings for our coverage of credit card products. Help Me Build Credit and CardRatings may receive a commission from card issuers. The editorial content on this page is not provided by any of the companies mentioned, and have not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are the author’s alone.

The card_name is great for those traveling United as you earn 2 miles for purchases with United Airlines. More United benefits offered include a first free checked bag for both you and a companion and 2 annual free United Club passes which allow you to enjoy the United lounge. Card members also receive better availability when booking reward flights on United Airlines. Stay protected with a great package of travel benefits and various insurance (see details below).

The card_name is a great business credit card if you plan to fly United. One of the best parts of this card is that you get expanded Savor Award availability on United flights which is a super benefit. You will get access to a certain amount of Savor Award seats available only to United cardholders. It’s hard enough to find award availability so anything to expand the award availability is super valuable. Along with the card comes 2 United Club lounge passes per cardmember year. By being a cardholder you will also get a bit of a priority to get upgraded to first or business class upon availability (this is only for United MileagePlus Premier members).

- Credit: Good credit needed

- Step by step guide how on to apply without an LLC or C-Corp

- Chase 5/24 rule: Chase will decline an applicant that has opened 5 or more personal cards (other issuers included) in the past 24 months. Hence, 5/24 rule

- Max cards: You can get approved for up to 2 Chase credit cards in 30 days. Business cards and personal cards are counted separately

- Apply for two cards: If you apply for one Chase card and get approved, it is recommended to apply for a second card since Chase is very good about approving for two cards, even within the same day. If the first application is still pending, wait for it to be approved before you apply for a second card.

- Not reported on personal credit reports: Chase Bank will not report business credit cards on personal credit reports

- Credit bureau: Chase Bank will usually pull your Experian credit report

- Combining same-day credit inquiries: Some data points suggest that credit inquiries for all Personal Chase cards for same-day applications will be combined; also, credit inquiries for all Business Chase cards for same-day applications will be combined. Credit inquiries for Personal and Business card applications will not be combined.

- Check application status: You can check your application status at Chase.com / Customer Center / Check my app status or call 1 800 453 9719

- Reconsideration: If declined you can call 1 888 609 7805 to be reconsidered

- Quickest way to get my card: You can request Chase to overnight your physical card by calling Chase customer service.

Approval Monitor (submitted by HelpMeBuildCredit users)

Credit limit range $5,000-$40,000

Avg. Credit limit$12,295

Disclosure: These results are based on information submitted by HelpMeBuildCredit users. Credit card approval results are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. Neither HelpMeBuildCredit nor the bank advertiser's take any responsibility on the accuracy of the information.

HelpMeBuildCredit credit ranges are a variation of FICO®️ Score 8, one of many types of credit scores lenders may use when considering your credit card application

Get 5,000 bonus points each cardmember anniversary, if you have both the United Business card and a United Personal credit card.

Worldwide primary coverage on rentals for business purposes. Coverage is for rentals up to 31 days.

Get a $100 United travel credit after using your card for 7 United purchases of $100 or more within a cardmember year.

Get your original manufacturer’s warranty time matched (up to a year). (Will only cover if the original warranty is for 3 years or less). Max $10,000 per claim, $50,000 per account.

Expanded award availability on United Flights when booking award flights

First checked bag free for you and one companion on United flights. Plus receive a free carry-on bag even with a basic economy ticket. The ticket must be purchased with your United credit card and your MileagePlus number must be added to the reservation.

Receive 25% back (statement credit) on United for inflight purchases of Wifi, food and drinks.

Get up to $3,000 per person for lost or damaged luggage.

Access to United Club lounges, with 2 free complimentary passes annually.

If your baggage is delayed for 6+ hours, you can claim up to $100 per day to cover expenses like toiletries & clothing, for up to 3 days.

Get complimentary priority boarding on United flights.

Get refunded if your purchase is damaged or stolen, up to 120 days from the date of purchase. Max $10,000 per claim, $50,000 per year.

Get coverage if you, G-d forbid, die in an accident while traveling or lose a limb, sight, speech, or hearing (on common carriers). Receive up to $500,000 in compensation.

Coverage for canceled or interrupted travel due to an unforeseen medical emergency etc. Max $1,500 per passenger and $6,000 per trip for non-refundable flight tickets.

If your flight is delayed for 12+ hours, you can claim up to $500 per trip to cover expenses like meals, lodging, toiletries, medication, and other personal use items.

Premier upgrades on United flights (only for Mileage Plus Premier members)

Get boosted to a higher status faster! Earn up to 1,000 bonus Premier Qualifying Points. Earn 25 PQPs for every $500 you spend with your card (up to 1,000 PQPs per calendar year).

The points can be used at approximately 1 penny per point to book award flights with one of the following United airline partners:

- United Airlines

- Aegean Airlines

- Air Canada

- Air China

- Air India

- Air New Zealand

- All Nippon Airways (ANA)

- Austrian Airlines

- Avianca

- Brussels Airlines

- Copa Airlines

- Croatia Airlines

- EgyptAir

- Ethiopian Airlines

- EVA Air

- LOT Polish Airlines

- Lufthansa

- Scandinavian Airlines (SAS)

- Shenzhen Airlines

- Singapore Airlines

- South African Airways

- Swiss Airlines

- TAP Portugal

- Thai Airways

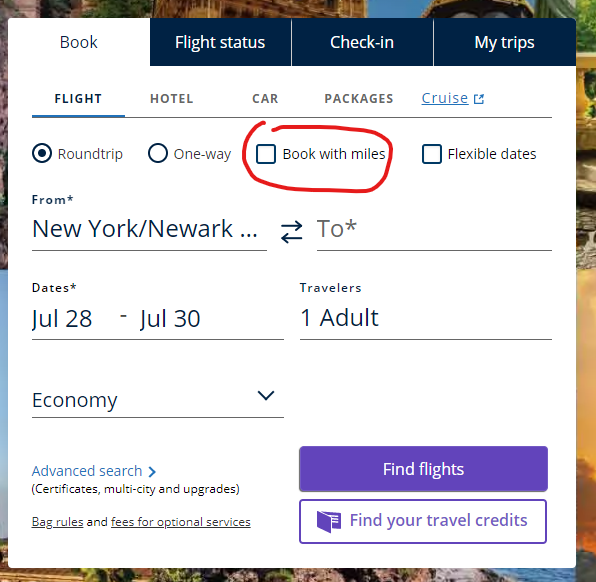

You can book award flights using your United miles with United Airlines and its partners here.

You can also PayYourselfBack by paying for the annual fee on your card and offsetting the fee with points. You can get 1.5 cents per point.

United has switched to dynamic pricing almost entirely, but this “almost” thingy means there are still some remnants of normal values United once maintained in its award chart. You can still find some saver awards (which are very mediocre, at best), but the only way to find these awards is to look for your dates and destination. Fortunately, you can still see monthly calendars if you’re flexible with your dates.

Here’s why United MileagePlus is still relevant:

- You most probably have some United miles in your coffers

- United miles don’t expire

- United elite members and credit card holders have access to better Saver award space

- The United award search engine interface is easy to use

- United has a huge number of partners, which makes it easier to find Saver availability

- There are no fuel surcharges ever

- United offers a free stopover on a round-trip award ticket (Excursionist Perk)