Help Me Build Credit has partnered with CardRatings for our coverage of credit card products. Help Me Build Credit and CardRatings may receive a commission from card issuers. The editorial content on this page is not provided by any of the companies mentioned, and have not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are the author’s alone.

The JetBlue Business card is fantastic for saving up on those JetBlue points. You can earn 6(!) points on JetBlue purchases. As well, earn 2 points on all office supplies and restaurant purchases. You will earn a $100 statement credit after you purchase a vacation package, potential to reach Mosaic status, priority boarding, and more! This card will work well for a business traveling on JetBlue Airlines.

- Double-dipping: If you had this credit card in the past, you may be declined

- Barclays will not approve you for their business cards if you have opened 6 or more credit cards within the past 24 months.

- Double-dipping: Barclays may not approve you for a credit card that you’ve already had in the past (and closed, for whatever reason).

Apply for three cards: If you apply for one Barclays card and get approved, it is recommended to apply for another two cards since Barclays is very good about approving for three cards, even within the same day. You might have to call the reconsideration department to push for the second and third cards to get approved.

- Use your Barclays card often: If you do not use your open Barclays cards often, then Barclays may hesitate to approve you for a new one

- Not reported on personal credit reports: Barclays Bank will not report business credit cards on personal credit reports

- Credit bureau: Barclays Bank will usually pull your Transunion credit report (if you freeze Transunion then Barclays will pull your Experian credit report)

- Combining same-day credit inquiries: Many data points suggest that credit inquiries for same-day applications will be combined

- Check application status: You can check your application status here

- Reconsideration: If declined you can call 1 866 408 4064 to be reconsidered

Quickest way to get my card: During the credit card application, you can request for your physical card to be expedited overnight via FedEx for a $15 fee. Barclays will not offer an instant credit card number for your new card

Approval Monitor (submitted by HelpMeBuildCredit users)

Credit limit range $1,000-$12,000

Avg. Credit limit$5,267

Disclosure: These results are based on information submitted by HelpMeBuildCredit users. Credit card approval results are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. Neither HelpMeBuildCredit nor the bank advertiser's take any responsibility on the accuracy of the information.

HelpMeBuildCredit credit ranges are a variation of FICO®️ Score 8, one of many types of credit scores lenders may use when considering your credit card application

Receive 5,000 bonus points every year after your account anniversary.

Worldwide secondary coverage for rentals up to 31 days. Covers vehicle with MSRP up to $50,000.

Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone breaks or gets stolen. To activate coverage, you need to pay your monthly cell phone bill with your JetBlue Business credit card. Max $1,200 per year.

Get a $100 credit for using your card for a JetBlue vacation package each calendar year.

Get 10% of your points back when redeemed for travel on JetBlue operated Awards Flight.

First checked bag free for you and up to 3 companions. To qualify, make sure to include your TrueBlue number on your reservation

Receive 50% back (statement credit) for inflight purchases of food and drinks.

Earn TrueBlue Mosaic benefits for 1 year after spending $50,000 annually.

The points can be used at approximately 1 penny per point to book award flights with one of the following JetBlue airline partners:

- Hawaiian Airlines

- Icelandair

- JSX

- Qatar Airways

- Silver Airways

- Singapore Airlines

- South African Airways

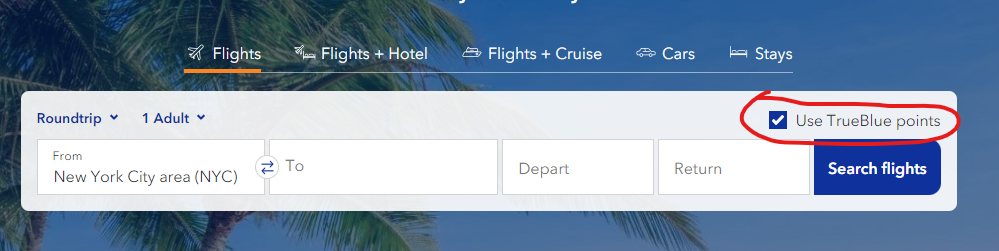

You can book award flights using your JetBlue miles with JetBlue airline and its partners here.