Help Me Build Credit has partnered with CardRatings for our coverage of credit card products. Help Me Build Credit and CardRatings may receive a commission from card issuers. The editorial content on this page is not provided by any of the companies mentioned, and have not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are the author’s alone.

The card_name will definitely improve your flights with Iberia. Travel benefits include a discount on flights booked through Iberia and a mega $1,000 voucher for every year you spend $30,000 or more. The card also comes along with a great suite of travel protections including trip delay insurance, auto rental insurance, baggage delay insurance, and much more (see details below).

- Credit: Good credit needed (you will probably need at least one credit card open for more than a year)

- Chase 5/24 rule: Chase will decline an applicant that has opened 5 or more personal cards (other issuers included) in the past 24 months. Hence, 5/24 rule

- Max cards: You can get approved for up to 2 Chase credit cards in 30 days. Business cards and personal cards are counted separately

- Apply for two cards: If you apply for one Chase card and get approved, it is recommended to apply for a second card since Chase is very good about approving for two cards, even within the same day. If the first application is still pending, wait for it to be approved before you apply for a second card

- Double dipping: Chase will not approve you for this card if you currently have an Iberia Visa Signature Card, or if you have received a bonus on an Iberia Visa Signature Card within the last 24 months

- Credit bureau: Chase Bank will usually pull your Experian credit report

- Combining same-day credit inquiries: Some data points suggest that credit inquiries for all Personal Chase cards for same-day applications will be combined; also, credit inquiries for all Business Chase cards for same-day applications will be combined. Credit inquiries for Personal and Business card applications will not be combined.

- Check application status: You can check your application status at Chase.com / Customer Center / Check my app status or call 1 888 338 2586

- Reconsideration: If declined you can call 1 888 609 7805 to be reconsidered

Quickest way to get my card: You will be able to add your new card to your mobile wallet immediately after you get approved (it can sometimes take up to an hour for it to show up in your online login).

Primary coverage on rentals when renting outside of your country of residence, and secondary coverage on rentals when renting within your country of residence. Coverage is for rentals up to 31 days.

Get a $1,000 voucher after spending $30,000 in a calendar year. The voucher can be used for a $1,000 discount when you purchase two tickets on the same flight.

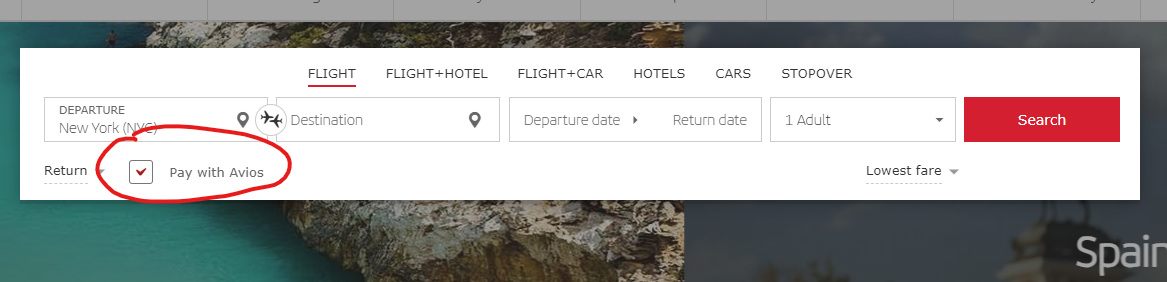

Receive 10% off on flights booked here iberia.com/Chase10Opens.

Get your original manufacturer’s warranty time matched (up to a year). (Will only cover if the original warranty is for 3 years or less). Max $10,000 per claim, $50,000 per account.

Get up to $3,000 per person for lost, stolen, or damaged luggage.

If your baggage is delayed for 6+ hours, you can claim up to $100 per day to cover expenses like toiletries & clothing, for up to 5 days.

Get refunded if your purchase is damaged, or stolen, up to 120 days from the date of purchase. Max $500 per claim, $50,000 per account.

Get coverage if you, G-d forbid, die in an accident while traveling or lose a limb, sight, speech, or hearing (on common carriers). Receive up to $500,000 in compensation.

If your flight is delayed for 12+ hours, you can claim up to $500 per trip to cover expenses like meals, lodging, toiletries, medication, and other personal use items.

The points can be used at approximately 1 – 1.25 cents per point to book award flights with one of the following Iberia airline partners:

- Alaska Airlines

- American Airlines

- British Airways

- Finnair

- Iberia

- Japan Airlines

- Malaysia Airlines

- Qantas

- Qatar Airways

- Royal Air Maroc

- Royal Jordanian Airlines

- S7 Airlines

- SriLankan Airlines

You can book award flights using your Avios miles with Iberia airline and its partners here.

To book award flights with the following Iberia airline partners call 1-800-772-4642:

- Japan Airlines

- Malaysia Airlines

- Royal Air Maroc

Iberia maintains distance-based award charts for each IAG airline (except Aer Lingus) and a separate chart for every other partner, although as far as I can see, they’re all pretty much the same.

Here are a few data points for starters.

- Iberia Plus shares the same Avios currency with other IAG airlines: British Airways, Level and Vueling.

- Iberia Plus publishes award charts for its own metal as well as every partner airline, although all Iberia partner charts appear to be the same.

- Iberia adds fuel surcharges to most partners. It also adds moderate surcharges to its own flights.

- You can transfer Avios to Iberia from British Airways and Aer Lingus and vice versa, however there are some restrictions:

- Transfers aren’t allowed from a British Airways Household Account.

- Before you can transfer, your Iberia Plus account must be open for at least three months.

- You must have some miles activity in it prior to the transfer.

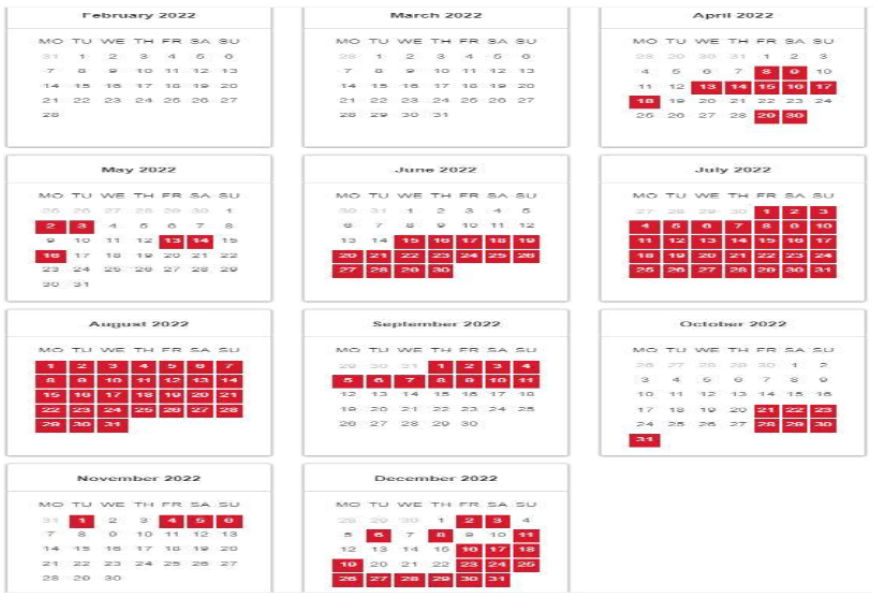

- Just like British Airways and Aer Lingus, Iberia has its own Peak / Off-Peak charts, but unlike British Airways, Iberia is fully transparent about them.

Iberia Peak / Off-Peak Calendar

Iberia award charts

Iberia is very transparent about its award levels. In this day and age when airline programs are actively unpublishing their charts, Iberia makes it very easy to find award levels.

You can go to this link –> click on any airline icon –> more information –> see redemption table. And voila!

Iberia own award chart

PIC

The table does not apply when the ticket combines Iberia Group flights with those of any other carrier (except British Airways, Air Italy and Vueling).

Iberia provides examples of the costs associated with different bands. Again: very transparent!

Example destinations from Madrid. Actually, it looks more like an exhaustive list to me than just examples, although not all of them are currently operational and some are seasonal.

Band 1: Alicante, Almeria, Asturias, Badajoz, Barcelona, Bilbao, Granada-Jaen, Ibiza, Jerez, La Coruña, Logroño, Málaga, Melilla, Menorca, Murcia, Palma de Mallorca, Pamplona, Salamanca, San Sebastián, Santander, Santiago de Compostela, Seville, Valencia, Valladolid, Vigo, Algiers, Bordeaux, Casablanca, Geneva, Lisbon, Lourdes, Lyon, Marseilles, Montpellier, Nantes, Nice, Oporto, Oran, Perpignan, Rennes, Tangier, Toulouse.

Band 2: Fuerteventura, Gran Canaria, Lanzarote, Santa Cruz de la Palma, Tenerife, Marrakech, Brussels, Amsterdam, Berlin, Birmingham, Catania, Cork, Dublin, Dubrovnik, Dusseldorf, Munich, Strasbourg, Florence, Frankfurt, Funchal, Genoa, Glasgow, Hamburg, London, Malta, Manchester, Milan, Naples, Palermo, Paris, Prague, Rome, Turin, Venice, Vienna, Zagreb, Zurich.

Band 3: Athens, Bucharest, Budapest, Krakow, Copenhagen, Corfu, Istanbul, Stockholm, Gothenburg, Heraklion, Mykonos, Moscow, Oslo, Reykjavik, St. Petersburg, Warsaw, Dakar.

Band 4: Cairo, Lagos, Malabo, Tel Aviv.

Band 5: Boston, Chicago, Luanda, New York, San Juan (Puerto Rico).

Band 6: Bogota, Caracas, Cali, San Salvador, Guatemala, Guayaquil, Johannesburg, Havana, Lima, Los Angeles, Medellin, Mexico City, Miami, Panama, Quito, Rio de Janeiro, San Jose (Costa Rica), Santo Domingo, Sao Paulo.

Band 7: Buenos Aires, Montevideo, Santiago (Chile).

Band 8: Tokyo, Shanghai.

Sweet spots: short story

- Incredibly cheap off-peak flights to Madrid in Economy, Premium Economy and Business from several U.S. cities

- Very cheap flights to Barcelona in Economy and Premium Economy on Level

- Good redemption values for short-haul travel in the Americas on American or LATAM

Sweet spots: a longer story

Fly to Madrid in Business for 34,000 miles

Look, I wouldn’t use Iberia Avios for anything else other than Business Class between the U.S. and Madrid. Well, nonstop to Barcelona in Premium Economy on Level isn’t bad either if you don’t want to bother with connecting flights.

However, in this day and age, 34,000 Avios for a trans-Atlantic Business Class flight is a true Unicorn-grade sweet spot, IMHO. Even more importantly, Iberia has pretty decent availability for two and even more people if you can book in advance.

And before you say, well, 34K Avios is only valid for off-peak travel – yes, that’s true, but Spain is wonderful off-season, especially in late spring and early fall. And if it’s the beach you’re after, you can’t go wrong in Costa del Sol in October (see the calendar above).

OFF-PEAK PRICES

| City | Economy Blue | Economy Full | Premium Economy | Business |

| NYC, Boston, Chicago | 17K | 22K | 25.5K | 34K |

| Miami, Los Angeles | 21,250 | 27,750 | 31,750* | 42.5K |

PEAK PRICES

| City | Economy Blue | Economy Full | Premium Economy | Business |

| NYC, Boston, Chicago | 20K | 28Kthe | 35K | 50K |

| Miami, LA | 25K | 35K | 43,750* | 62.5K |

NB: In addition to the above routes, Iberia is to fly to Dallas in April 2022, resume seasonal service to San Francisco in summer 2022 and finally begin the long-awaited flights between Madrid and Washington, DC (also in April), which was shelved due to the pandemic.

Use Avios beyond Madrid and Spain

If you travel to Europe, the most difficult part of the journey is getting across the Atlantic. After that, it’s a piece of cake.

Iberia and its affiliates can take you anywhere in Spain except the Canaries for mere 4,500 Avios off-peak. The most you pay for any flight in Europe from Madrid is 10,000-11,000 Iberia Avios.

Although, keep in mind that Iberia does add a small surcharge to all its flights, so you might want to use British Avios on Iberia intra-Europe routes. While it might cost you a little bit more in Avios, there won’t be any surcharges.

In fact, one of the best deals between the U.S. and Europe / North Africa / Middle East is mixing the Iberia and British Airways Avios to get to your final destination. Fly on Iberia Avios between the U.S. and Madrid and use British Airways Avios (BA doesn’t add fees or surcharges to short-haul Iberia flights) to get where you’re headed.

Here are some ideas.

- U.S. → Madrid → London Off-Peak: 34,000 Iberia Avios to Madrid PLUS 12,750 BA Avios to London for less than 47,000 Avios total in a lie-flat Business Class cabin on both segments (try to find a widebody A-330 / A-340 / A-350). Think of it as a one-way from the U.S. to UK with a free stopover in Madrid.

- U.S. → Madrid → Tel Aviv Off-Peak: 34,000 Iberia Avios to Madrid PLUS 21,250 Iberia Avios to Tel Aviv also in lie-flat Business Class cabin for slightly more than 55,000 Avios on both segments. This would be a fantastic rate for a Business Class ticket to the Middle East even without a free stopover in Spain!

N.B. You can also choose to pay for the MAD-TLV flight with BA Avios, however, this is the case where using BA Avios vs Iberia Avios is going to cost you more.

Compare what you pay in BA Avios

PIC BA

… with what you pay in Iberia Avios

PIC IB

As you can see, the BA booking would cost you10,000 Avios more and $46 less in cash outlay. So unless you value your Avios at 0.5 cents each, I would book both flights with Iberia.

NB(2). British Airways and Iberia Off-Peak calendars are not identical, although both tend to stuff July, August and the first half of September with peak dates. You need to take it into consideration when choosing which currency to use.

What’s not so sweet about Iberia sweet spots

- Nonstop flights are the best. Adding any additional segments will increase the cost.

- Onboard food and service can be hit and miss

- Glitchy website