Help Me Build Credit has partnered with CardRatings for our coverage of credit card products. Help Me Build Credit and CardRatings may receive a commission from card issuers. The editorial content on this page is not provided by any of the companies mentioned, and have not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are the author’s alone.

The Barclays AAdvantage Aviator World Elite Mastercard is good for those flying AA. You receive your first checked bag free for yourself and for up to 4 companions, preferred boarding on AA flight, and more great travel benefits worth checking out.

- Credit: Good credit needed

- Barclays will not approve you for their business cards if you have opened 6 or more credit cards within the past 24 months.

- Double-dipping: Barclays may not approve you for a credit card that you’ve already had in the past (and closed, for whatever reason).

Apply for three cards: If you apply for one Barclays card and get approved, it is recommended to apply for another two cards since Barclays is very good about approving for three cards, even within the same day. You might have to call the reconsideration department to push for the second and third cards to get approved.

- Use your Barclays card often: If you do not use your open Barclays cards often, then Barclays may hesitate to approve you for a new one

- Credit bureau: Barclays Bank will usually pull your Transunion credit report (if you freeze Transunion then Barclays will pull your Experian credit report)

- Combining same-day credit inquiries: Many data points suggest that credit inquiries for same-day applications will be combined

- Check application status: You can check your application status here

- Reconsideration: If declined you can call 1 866 408 4064 to be reconsidered

Quickest way to get my card: During the credit card application, you can request for your physical card to be expedited overnight via FedEx for a $15 fee. Barclays will not offer an instant credit card number for your new card

Approval Monitor (submitted by HelpMeBuildCredit users)

Credit limit range $200-$36,000

Avg. Credit limit$7,030

Disclosure: These results are based on information submitted by HelpMeBuildCredit users. Credit card approval results are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. Neither HelpMeBuildCredit nor the bank advertiser's take any responsibility on the accuracy of the information.

HelpMeBuildCredit credit ranges are a variation of FICO®️ Score 8, one of many types of credit scores lenders may use when considering your credit card application

- Balance transfer fee: 5% or $5, whichever is greater

- You cannot transfer balances from other credit cards issued by Barclays Bank

- To receive the Intro APR Offer, transfers must be completed within the first 45 days

- No penalty APR

Worldwide primary coverage on international rentals, and secondary coverage on domestic rentals. Coverage is for rentals up to 31 days.

Earn a free, annual companion certificate for a domestic economy ticket booked with American Airlines, after spending $20,000 within a cardmember year. You will need to pay $99 plus the companions taxes and fees.

First checked bag free for you and up to 4 companions on domestic American Airline flights.

Receive 25% back (statement credit) for inflight purchases of Wifi, food and drinks.

If your baggage is delayed for 4+ hours, you can claim up to $100 per day, for up to 3 days.

Get complimentary priority boarding on American Airline flights.

Get coverage if you, G-d forbid, die in an accident while traveling or lose a limb, sight, speech, or hearing (on common carriers). Receive up to $250,000 in compensation.

Coverage for canceled or interrupted travel due to an unforeseen medical emergency etc. Max $5,000 per trip, $10,000 per year for non-refundable travel expenses including flight tickets, hotels,

The points can be used at approximately 1 penny per point to book award flights with one of the following American Airlines AAdvantage airline partners:

- American Airlines

- Alaska Airlines

- British Airways

- Cathay Pacific

- Finnair

- Iberia

- Japan Airlines

- Malaysia Airlines

- Qantas

- Qatar Airways

- Royal Air Maroc

- Royal Jordanian Airlines

- S7 Airlines

- SriLankan Airlines

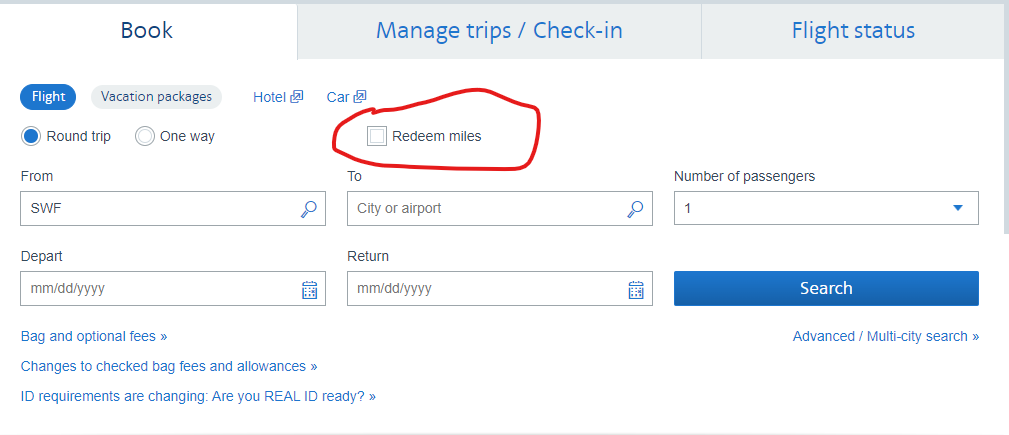

You can book award flights using your American Airline miles with American Airlines and its partners here.

To book award flights with the following American Airline partners call 1-800-433-7300:

- China Southern

- GOL

Web specials

American Airlines Web Specials can be terrific – if you’re lucky enough to get it on the days you want. These specials, unfortunately, aren’t published, so even if you’re flexible about your dates and the destination, there is no way to browse them. You have to start a search and see what happens. Here are some past examples of AA Web Specials.

- New York to LA: 5,000 in Economy

- U.S. to Australia: 10,000 miles in Economy

- U.S. to Brazil: 47,000 in Business

Web Specials are fully cancellable, however, since you can’t easily find and browse these awards, their value and appeal are limited.

American International Business Class

American doesn’t have many long-haul international routes – Turkish or Emirates it ain’t, and their premium-class cabins are not especially luxurious. However, they serve the purpose, so if (a huge if!) you can find award space at the MileSavers levels, grab your seat quickly or at least put it on hold for five days (free) while you’re contemplating whether or not to take the plunge.

Here are all or at least the vast majority of current American long-haul international destinations.

South America

- Argentina: Buenos Aires

- Brazil: São Paulo, Rio de Janeiro

- Chile: Santiago

- Uruguay: Montevideo (seasonal)

Europe

- France: Paris

- Germany: Frankfurt, Munich

- Greece: Athens (seasonal)

- Ireland: Dublin

- Italy: Milan, Rome; Venice (seasonal)

- Netherlands: Amsterdam

- Portugal: Lisbon (seasonal)

- Spain: Barcelona, Madrid

- Switzerland: Zürich

- UK: London

Middle East

- Israel: Tel Aviv

- Qatar: Doha (starts 6.4.22)

Asia

- China: Beijing, Shanghai

- India: Delhi

- Japan: Tokyo (NRT and HND)

- South Korea: Seoul

- Oceania

- Australia: Sydney

- New Zealand: Christchurch; Auckland (seasonal)

American sweet spots

“Luxury” routes to the Middle East, Asia and Australia

The miles redemptions below are per one-way travel.

| Business | First | |

| Continental U.S. to | ||

| Middle East | 70,000 per way | 115,000 per way |

| Indian Subcontinent | 70,000 per way | 115,000 per way |

| Africa | 75,000 per way | 120,000 per way |

| Asia Region 1 | 60,000 per way | 80,000 per way |

| Asia Region 2 | 70,000 per way | 110,000 per way |

| South Pacific | 80,000 per way | 110,000 per way |

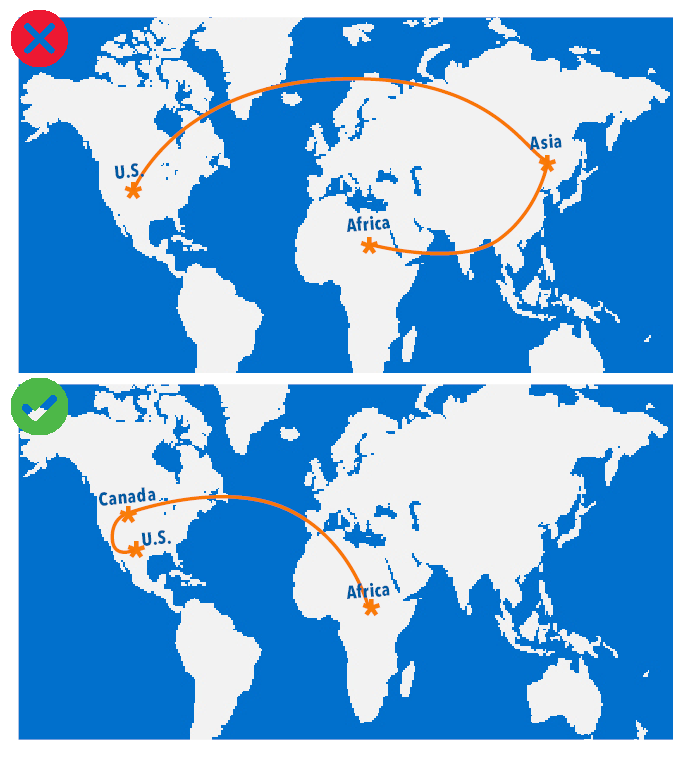

NB: AA Routing Rule

American Airlines has a very annoying routing rule: when you travel between two regions you typically can’t transit through a third one.

What it means, for example, is that you can’t travel from the U.S. to Africa via Asia or vice versa. However, AA does offer some “third region” exceptions. You can fly to:

- Asia 2 via Asia 1

- Africa via Europe, Middle East

- Indian subcontinent via Europe, Middle East

- Indian subcontinent via Hong Kong – on Cathay Pacific only!

So even though American routing rules are quite rigid, you still have some leeway.

AA miles on Cathay Pacific for ultra-long hauls to Asia 2 and India (70,000 miles in business )

Cathay Pacific has great Business and First Class seats, and redeeming AAdvantage miles on the Hong Kong carrier is usually cheaper than using Cathay Pacific miles. A flight in Business Class from anywhere in the U.S. to Hong Kong, as well as anywhere in South East Asia and India via Hong Kong runs at 70,000 miles (110,000 in Business Class).

AA miles on Qantas Airways to Australia and New Zealand (80,000 in business)

Qantas premium seats to Australia and New Zealand / Oceania (via Australia) will cost you 80,000 miles in Business and 110,000 miles in First. Finding award space is extremely hard, though.

AA miles on Qatar Airways and Etihad to the Middle East and Africa (75,000 miles in business)

Qatar has terrific Business Class Q-suites with doors between the U.S. and Doha, and is one of the few airlines that makes quite a substantial number of Business Class seats available to partners. Even better, you can fly anywhere in Africa via Doha for 75,000 miles (just 5,000 miles more than a flight to Doha).

Etihad has solid Business Class too, especially so-called Business Studios on A380. And while Etihad did ground A380, it’s just announced it’s going to bring it back, at least temporarily. If that happens, you might still have a chance to fly in First Apartment, which I believe is the best First Class seat in the world. It’s true that 110,000 miles is not a cheap experience.

AA miles for Intra-Europe flights (22,000 miles in business)

You can fly anywhere in Europe (including the western part of Russia) for 12,500 miles in Economy or 22,500 miles in Business. And while you might think that Europe is small, that’s not always the case. The distance between Reykjavik and Moscow is about 2,300 miles, while the distance between Tenerife and Istanbul is 2,700 miles. And American has four European partners: British Airways, Iberia, Finnair and S7, and you can mix the carriers to get where you need to go.