Promoting!

I’ve always promoted the Amex Blue Cash Preferred card, the current welcome offer for the card is; earn $250 after $1,000 spent within the first 3 months! Plus, get 0% APR on purchases for up to 12 months! This card is absolute no brainer for someone spending a lot on groceries.

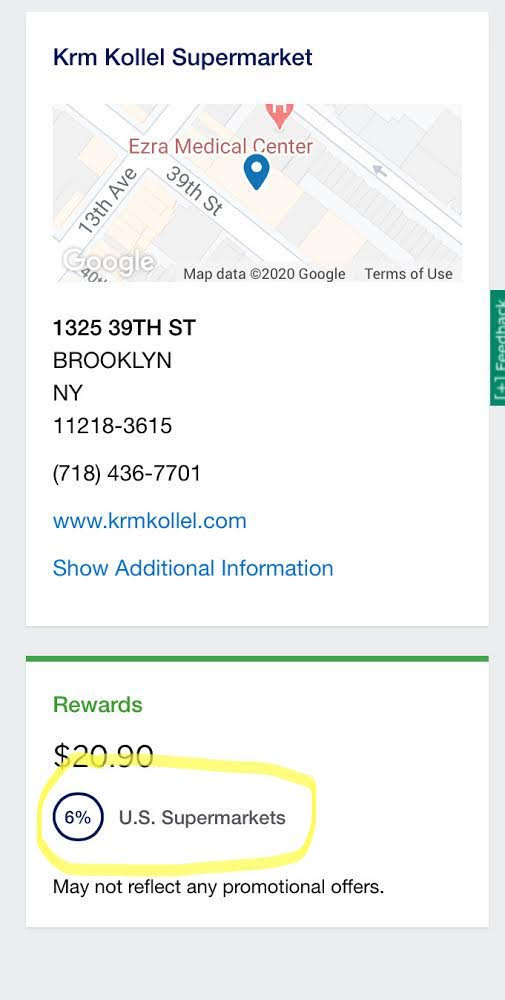

Here Is Why - 6% Cashback On Groceries

As a cardmember of the Amex Blue Cash Preferred card, you’ll get 6% cash back at US supemakets on purchases of up to $6,000 annually.

Even after you deduct the $95 annual fee (which you’ll start paying only the second year of your card membership as the fee is waived the first year), you will still earn a whopping number of cashback at a bit over 4%, more accurately 4.41%, on groceries.

Comparing The Blue And The Gold

The Amex Gold card offers 4 points on groceries on up to $25,000 spent annually, to see how the Amex Blue Cash Preferred still beats it. Let’s assume the average American, the child-rearing family spends $12,000 annually on groceries.

- $12,000 spent = 48,000 points

- Now let’s deduct the $250 annual fee $720 – $250 = $470

- $12,000 spent = $720

- Now let’s deduct the $95 x 2 annual fee (remember we got two Blue Cash Preferred cards) $720 – $190 = $530

But please note the following three points

- The Amex Gold will work better for someone spending an amount more than $12,000 but less than $18,000 or $24,000 because as long as you cant maximize the full $6,000 cap on each Blue Cash Preferred Card you need to still deduct the $95 fee which will change these numbers significantly.

- With the Amex Blue Cash Preferred card, you earn cashback but with the Amex Gold card, you earn Membership Reward points. We value Amex Membership Reward points at 1.5 cents per point but your personal value for MR points might be either higher or lower depending on how mile savvy you are. So you will need to recalculate the results based on your own value

- We deducted the full annual fees assuming that you sign up for the credit card just to earn bonus points on grocery spend. The Amex Gold and Blue Cash Preferred both have a lot of other side benefits that might justify the annual fee. You can check out the list of benefits on the detailed credit card page Amex Blue Cash Preferred – Amex Gold Card

Return Protection

Some More Benefits

The joys of the Amex Blue Cash Preferred don’t end with the grocery cashback and return protection. Here are some more:

- Get a refund on a purchase that’s been damaged or stolen within 90 days of purchases with purchase protection.

- Get a year’s worth of protection added to the manufacturers’ warranty, that’s if the manufactures warranty covers 5 or fewer years. Max $10,000 each claim, $50,000 per year.

- Get secondary worldwide coverage on auto rentals damaged in a collision.

If your a grocery shopper, the Amex Blue Cash Preferred is for sure a card worth a look at, but get it today to take advantage of the all-time high offer!

List Of Kosher Groceries And How They Code

Borough Park and Flatbush

- Appels – Groceries

- Bingo – Wholesale Stores (does not earn as a grocery)

- Center Fresh – Groceries

- Einhorns – Groceries

- Gourmet Glatt – Groceries

- Goldbergs – Groceries

- KRM – Groceries

- Kosher Discounts – Groceries

- Mountain Fruits Of Brooklyn – Groceries

- Mittelmans – Groceries

- South Side Food Plaza – Groceries

- Moshes Discounts – Groceries

- Yidels – Groceries

Williamsburg

- Arons Kissena Farm – Groceries

- Bondos 24 – Groceries

- Bedford Gardens – Groceries

- Chesnut – Groceries

- Lefkowitz Grocery – Groceries

- Satmar Fleish – Groceries

- S Kahan Grocery – Groceries

- W Fresh – Groceries

Monsey

- Brand New Day – Groceries

- Evergreen Kosher- Groceries

- Hatzlacha – Groceries

- Madanim Supermarket – Groceries

- Rockland Kosher- Groceries

- Redelicious Supermarket- Groceries

Monroe

- Refresh – Groceries

- Grand Food Market – Groceries

- Landau’s – Groceries

Lakewood

- Bingo – Wholesale Stores (does not earn as a grocery)

- Evergreen – Groceries

- Gourmet Glatt South – Groceries

- Gourmet Glatt North – Groceries

- Kosher Village – Groceries

- Kosher West – Groceries

- NPGS – Groceries

- Seasons – Groceries

If you have any additional information about grocery stores not listed please submit them in the comments below. You can always check how a store is categorized after you log-in to your account and you click on the transaction.

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments