Many people are now getting 0% APR cards either for themselves or for their business, in order to prepare available cash flow in case a recession hits. When choosing a 0% APR card, people always want to choose a card that will approve for a high credit limit so they gain enough swiping power on 0% APR.

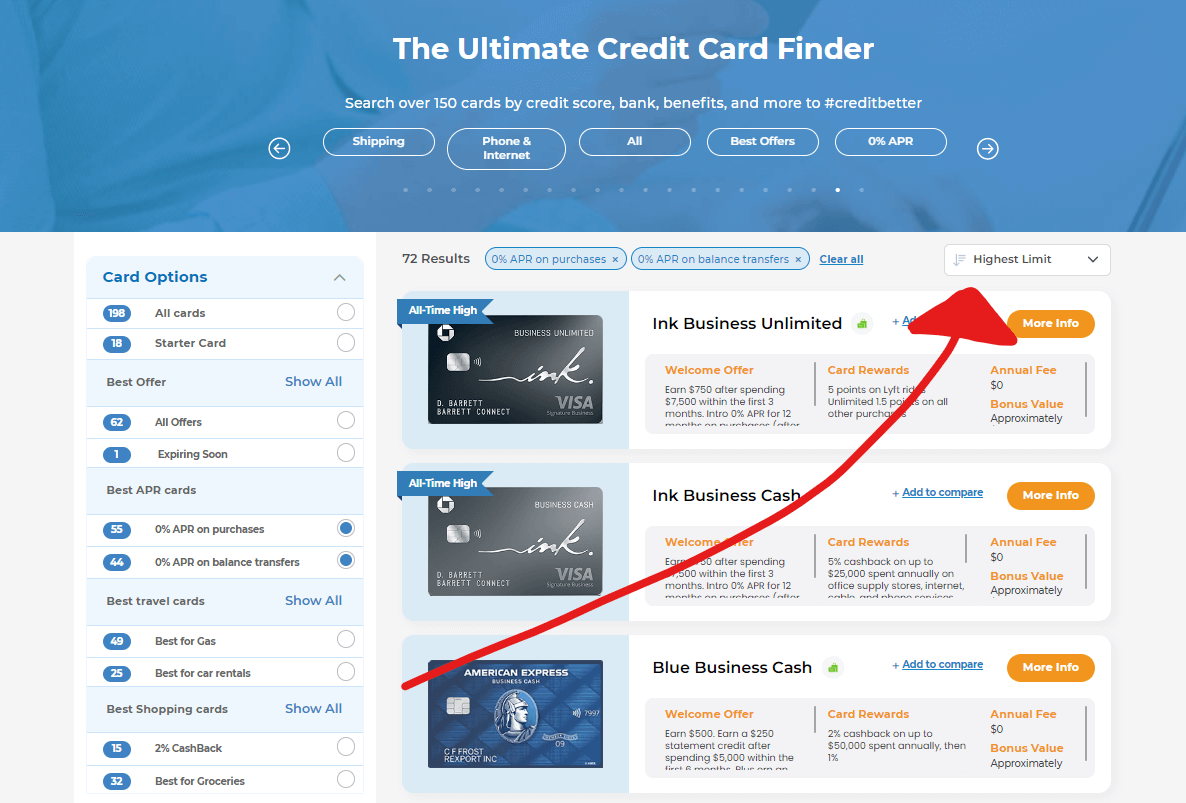

A few months ago, we improved our Ultimate Credit Card Finder so you can sort cards based on “Highest limits” approved. With just a click of a button, our advanced website will crunch thousands of real time data points and spit back the cards that are currently approving the highest credit limits.

Let’s discuss a few of the top choices.

Ink Business Cash ($0)

Currently, the top card on the list is the Ink Business Cash Credit Card which has 0% APR for 12 months on purchases, plus you get 75,000 points after spending $7,500 within the first 3 months.

Average credit limit approved: Within the last 30 days (based on the data from users who reported their approvals in our database) the average approved credit limit for the Ink Business Cash was $28,200 with limits ranging from $3,000-$42,000.

Ink Business Unlimited ($0)

Next up is the Chase Ink Business Unlimited® Credit Card. The Chase Ink Business Unlimited has 0% APR for 12 months on purchases, plus you get 75,000 points after spending $7,500 within the first 3 months. On top of all this, the card earns an unlimited 1.5 points on all purchases!

Average credit limit approved: Within the last 30 days (based on the data from users who reported their approvals in our database) the average approved credit limit for the Ink Business Unlimited was $26,714 with limits ranging from $4,000–$42,000.

Chase has been very good at approving both cards for similar limits. I would recommend, if you get approved for the Chase Ink Cash to go for the as well Chase Ink Unlimited (wait till you get approved and do not apply while the first application is pending).

Amex Blue Business Cash ($0)

The American Express Blue Business Cash Card is next up on the list and has 0% APR for 12 months on purchases, plus you get $500 after spending a total of $15,000 within the first year. Plus, you can earn 2% cashback on up to $50,000 spent annually, then 1%.

Average credit limit approved: Within the last 30 days (based on the data from users who reported their approvals in our database) the average approved credit limit for the Amex Blue Business Cash was $18,400 with limits ranging from $2,000-$30,000.

Bank Of America Customized Cash Rewards ($0)

The Bank Of America Customized Cash Rewards Credit Card has a 0% APR for 15 months on purchases and balance transfers, plus you get $200 after spending $1,000 within the 3 months.

Average credit limit approved: Within the last 30 days (based on the data from users who reported their approvals in our database) the average approved credit limit for the Customized Cash Rewards Credit Card was $10,400 with limits ranging from $10,400-$10,400.

Amex Blue Business Plus ($0)

The Blue Business Plus Credit Card from American Express has 0% APR for 12 months on purchases, plus you get 15,000 points after spending $3,000 within the first 3 months.

Plus, you can earn 2 points on up to $50,000 spent annually, then 1 point.

Average credit limit approved: Within the last 30 days (based on the data from users who reported their approvals in our database) the average approved credit limit for the Blue Business Plus was $10,000 with limits ranging from $10,000-$10,000.

Choose both Chase Inks Business and both Amex Blue Business cards

As we pointed out previously, both Chase and Amex are currently approving nice limits and they are approving both cards at the same time with pretty similar limits on each. It would be recommended for you to go for both Chase Inks and both Amex Blue Business cards in order to gain the most credit limits all on 0% APR.

Here is the order in which you should apply for the cards

- Chase Ink Cash – Wait till you are approved (if it’s pending then do not apply for a new card until its approved)

- Chase Ink Unlimited

- Amex Blue Business Plus

- Amex Blue Business Cash

As long as you have good credit and a minimum of one year credit history, you should not have an issue getting approved for all 4 cards at the same time, all with great credit limits.

Reallocating your existing credit limits to also become 0% APR

If you currently have existing great credit limits with a bank, then in many cases, you can reallocate (aka transfer) your credit limits from your old card to the new card and gain an even higher credit limit all on 0% APR.

Here is a list of bank rules regarding reallocating credit limits.

| Reallocating credit limits | |

| Amex | You can reallocate credit limits from personal to personal, business to business, and from personal to business cards. You cannot transfer from business to personal. You cannot reallocate your credit limits more than once in 30 days. |

| Bank Of America | You can reallocate credit limits between credit cards at Bank of America even from a personal card to a business card but not from business to personal |

| Barclays | You can reallocate Barclays credit limits from personal to business, and from business to personal, but you will need to speak to the Credit Analyst Department |

| Capital One | It’s no longer possible to reallocate credit limits with Capital One |

| Chase | You can reallocate Chase credit limits only from personal to personal or from business to business. Chase will do a hard credit pull If the new credit limit will exceed $35,000. |

| Citi | Most report not being successful with reallocating a credit limit with Citi bank |

| Discover | Discover mostly does not allow reallocating credit limits, but it can be done through first requesting a credit limit increase. And after approved ask to talk to the Credit Operation Department to reallocate the credit limits. For whatever reason, once you are approved for a credit line increase, reallocating credit lines becomes possible. |

| US Bank | Most report not being successful with reallocating a credit limit with US Bank; some suggest talking to a supervisor. |

| Wells Fargo | Wells Fargo allows reallocating credit limits |

Getting approved for multiple cards

If you are looking to get approved for multiple 0% APR credit cards at the same time then make sure you strategize the applications properly. You can read our comprehensive post on how to strategize the applications properly here.

You can search many 0% APR cards available now here.

Did you get approved for any of the credit cards mentioned? Let us know your results here. Together we will #Creditbetter

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments