As we explained in a previous post, even if a credit card has no foreign transaction fees the card can still possibly charge a markup on the currency conversion (you can read more here).

So this takes us to the ultimate question. Which card is the cheapest to use abroad?

In order to properly answer this question we conducted a case study looking over statements from some loyal followers who recently used their cards in various countries to try to find the accurate answer to this question.

We reviewed many credit card statements to try to determine which card is cheapest, but as we were digging for the info, we realized that this is a complex matter.

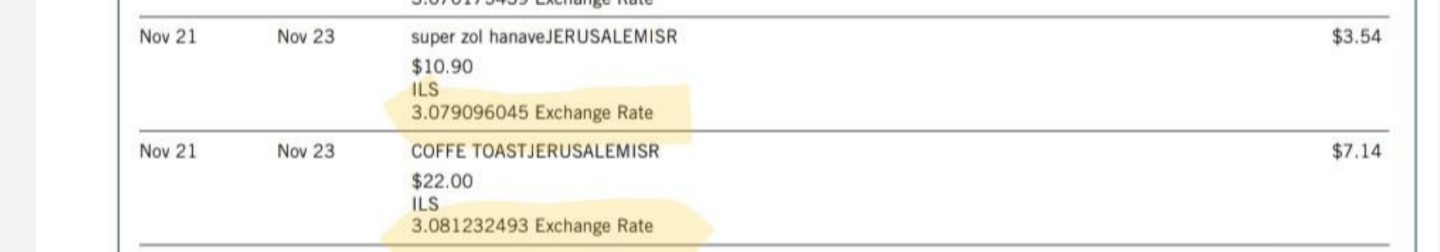

We found rates being cheaper one day but more expensive the next day. We even saw the same card having two different rates on transactions conducted on the same day, as you can see on the screenshot below.

Who decides the rates?

Based on my research, I found that the payment processor (Visa, Mastercard, Discover, Amex) is the one that ultimately decides the rate. But the banks can change the rate slightly in order to round it to the nearest penny.

In the Chase cardmember agreements it states that “If a transaction is in a foreign currency, Visa International or Mastercard International will convert the transaction into U.S.dollar using their own currency conversion procedures and then will send us the transaction amount”.

In the Amex cardmember agreements it states the following regarding converting charges made in a foreign currency.

“If you make a charge in a foreign currency, AE Exposure Management Ltd. (“AEEML”) will convert it into U.S. dollars on the date we or our agents process it, so that we bill you for the charge in U.S. dollars based upon this conversion. Unless a particular rate is required by law, AEEML will choose a conversion rate that is acceptable to us for that date. The rate AEEML uses is no more than the highest official rate published by a government agency or the highest interbank rate AEEML identifies from customary banking sources on the conversion date or the prior business day. This rate may differ from rates that are in effect on the date of your charge. We will bill charges converted by establishments (such as airlines) at the rates they use”.

In a cardmember agreement for Capital One cards, I found the following language.

“If you make a transaction in a foreign currency, the Payment Card Network will convert it into a U.S. dollar amount. The Payment Card Network will use its own currency conversion procedures. The conversion rate in effect on the processing date may differ from the rate in effect on the transaction date that appears on your statement. We do not adjust the currency exchange rate or charge any currency conversion fees.”

Which credit cards are cheapest?

As per our case study, we saw that overall, Discover and Amex usually have the cheapest rates and Visa and Mastercard a drop higher. But we did find that for certain purchases, the opposite is true as well.

So at the end of the day, which card should I use?

Either way, the difference in rates are usually not significant. When using a credit card you can feel comfortable that you’re either getting the mid market rate, or close to that. Personally, I will continue using a card that has no foreign transaction fees and the card that gives me the highest rewards, because ultimately, that is what matters most (the difference in the conversion rate is not enough to outway the rewards).

Some examples from our study

Canadian dollar – CAD

| Mid Market rate* | Visa | Discover | Mastercard | Amex | |

| 10/23/21 | 0.788 | 0.788 | .788 | 0.786 | 0.788 |

| The difference per $1,000 CAD | $0.00 | $0.00 | $0.00 | -$2.00 | $0.00 |

| 01/13/22 | 0.801 | 0.802 | 0.800 | 0.802 | 0.800 |

| The difference per $1,000 CAD | $0.00 | $1.00 | -$1.00 | $1.00 | -$1.00 |

| 01/18/22 | 0.797 | 0.801 | 0.799 | 0.800 | 0.800 |

| The difference per $1,000 CAD | $0.00 | $4.00 | $2.00 | $3.00 | $3.00 |

Israeli Shekel – ILS

| Mid Market rate* | Visa | Discover | Mastercard | Amex | |

| 10/23/21 | 0.317 | 0.319 | 0.318 | 0.324 | 0.318 |

| The difference per ₪1,000 ILS | $0.00 | $2.00 | $1.00 | $7.00 | $1.00 |

| 01/13/22 | 0.321 | 0.323 | 0.324 | 0.322 | 0.322 |

| The difference per ₪1,000 ILS | $0.00 | $2.00 | $3.00 | $1.00 | $1.00 |

| 01/18/22 | 0.319 | 0.323 | 0.323 | 0.0322 | 0.321 |

| The difference per ₪1,000 ILS | $0.00 | $4.00 | $4.00 | $3.00 | $2.00 |

British Pounds – GBP

| Mid Market rate* | Visa | Discover | Mastercard | Amex | |

| 12/01/21 | 1.330 | 1.336 | n/a | 1.336 | 1.336 |

| The difference per £1,000 GPB | $0.00 | $6.00 | n/a | $6.00 | $6.00 |

| 01/13/22 | 1.372 | 1.372 | 1.373 | 1.376 | 1.370 |

| The difference per £1,000 GPB | $0.00 | $0.00 | $1.00 | $4.00 | -$2.00 |

| 01/18/22 | 1.358 | 1.370 | 1.364 | 1.370 | 1.370 |

| The difference per £1,000 GPB | $0.00 | $12.00 | $6.00 | $12.00 | $12.00 |

Euro – EUR

| Mid Market rate* | Visa | Discover | Mastercard | Amex | |

| 01/13/22 | 1.146 | 1.146 | 1.146 | 1.148 | 1.142 |

| The difference per €1,000 EUR | $0.00 | $0.00 | $0.00 | $2.00 | -$4.00 |

| 01/18/22 | 1.133 | 1.144 | 1.139 | 1.144 | 1.144 |

| The difference per €1,000 EUR | $0.00 | $11.00 | $6.00 | $11.00 | $11.00 |

Swiss Franc – CHF

| Mid Market rate* | Visa | Discover | Mastercard | Amex | |

| 01/18/22 | 1.090 | 1.098 | 1.092 | 1.096 | 1.096 |

| The difference per 1,000 CHF | $0.00 | $8.00 | $2.00 | $6.00 | $6.00 |

If anyone would like to take part in the study so that we can expand and look into even more statements, please let me know at [email protected]

Thanks!

*Mid market rates were taken from https://www.xe.com/

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments