Appetizers, menus, dim lighting, table setting, waiters, gourmet food, desserts. If any of these words resonate with you or if you tend to frequent restaurants often (even if it’s just pizza!), you might want to choose a credit card from the list below. While enjoying your meal, you may as well enjoy some great rewards too!

Top 10 credit cards for restaurants

Reward amount: Earn 7 points at restaurants (approximate rewards value 1.0 cent per point)

Annual fee: $0

2. card_name

Reward amount: Earn 5% cashback on purchases in your top eligible category each billing cycle, on up to the first $500 spent per billing cycle, then 1% cashback. Eligible categories are restaurants, gas stations, grocery stores, select travel, select transit, select streaming services, drugstores, home improvement stores, fitness clubs, and live entertainment (approximate rewards value 1.0 – 1.45 cents per point)

Annual fee: $0

3. U.S. Bank Altitude Go Visa Signature Card

Reward amount: Earn 4 points on takeout, food delivery, and dining (approximate rewards value 1.0 – 1.5 cents per point)

Annual fee: $0

4. Savor Rewards from Capital One

Reward amount: Earn 4% cashback on dining

Annual fee: $95

5. card_name

Reward amount: Earn 4 points on the 2 categories where you spend the most each billing period (up to $150,000 in spending annually). The categories can be one of the following; U.S. gas stations, U.S. wireless purchases, U.S. restaurants, select media, and advertising (Including PPC Marketing), select providers of computer hardware, software, and cloud solutions, transit purchases, and electronic goods retailers. (approximate rewards value 1.0 – 1.3 cents per point)

Annual fee: $375

6. card_name

Reward amount: Earn 4 points at restaurants. (approximate rewards value 1.0 – 1.3 cents per point)

Annual fee: $250

7. card_name

Reward amount: Earn 3 points on dining (approximate rewards value 1.0 – 1.5 cents per point)

Annual fee: $95

8. card_name

Reward amount: Earn 3 points on dining. Also earn 10 points on Chase dining (approximate rewards value 1.0 – 1.5 cents per point)

Annual fee: $550

9. card_name

Reward amount: Earn 3 points on dining, including takeout and delivery (approximate rewards value 1.0 – 1.5 cents per point)

Annual fee: $0

10. card_name

Reward amount: Earn 3 points on dining (approximate rewards value 1.0 – 1.45 cents per point)

Annual fee: $95

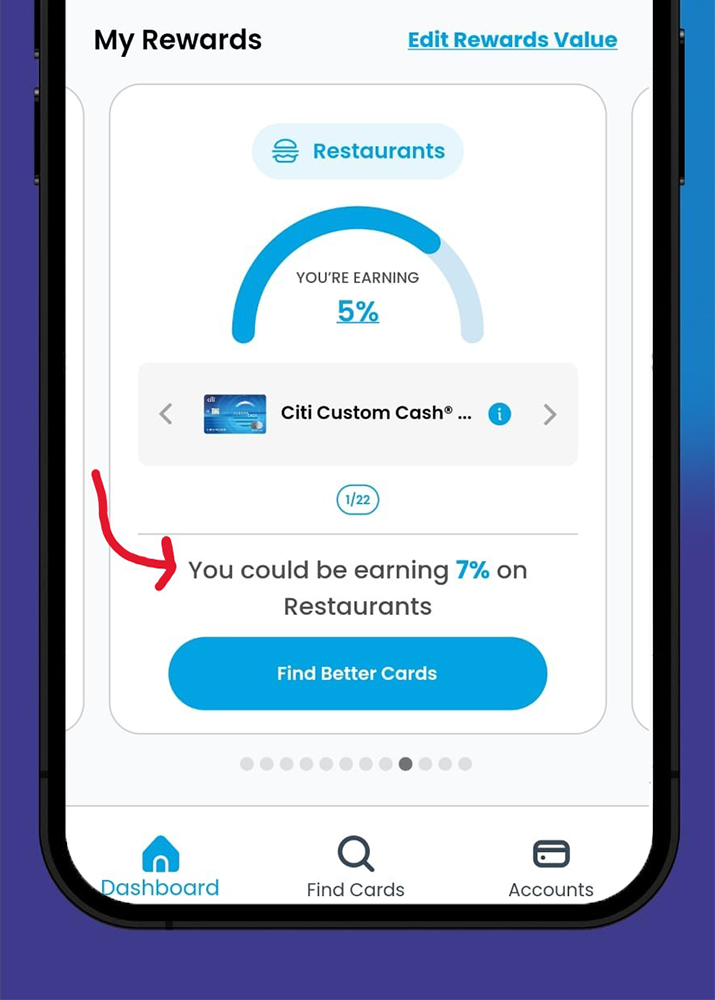

Use the CardRight app to find your best card to use

With our new CardRight app, you can see which of your cards earns the most rewards for every purchase.

If you haven’t yet downloaded the app, download it now:

Or you can use a Desktop Web version (no smartphone needed) at cardright.com.

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments