There is no way to avoid the grocery, unless you decide to go hungry…

But you can at least choose a credit card to use at the grocery so that you can earn rewards on your purchases.

Here are the best ones.

Best credit cards to use for groceries

1. card_name

Annual fee: $95 (waived 1st year)

Grocery rewards: Earn 6% cashback at U.S. supermarkets on up to $6,000 per year

2. card_name

Annual fee: $0

Grocery rewards: Earn 5% cashback on purchases in your top eligible category each billing cycle, on up to the first $500 spent per billing cycle, then 1% cashback. Eligible categories are restaurants, gas stations, grocery stores, select travel, select transit, select streaming services, drugstores, home improvement stores, fitness clubs, and live entertainment.

3. card_name

Annual fee: $250

Grocery rewards: Earn 4 points at U.S. supermarkets on up to $25,000 per year (approximate rewards value 1.0-1.3 cents per point)

4. card_name

Annual fee: $95

Grocery rewards: Earn 3 points on groceries (approximate rewards value 1.0-1.45 cents per point)

Annual fee: $0

Grocery rewards: Earn 4 points on groceries (approximate rewards value 1.0 cents per point)

6. Amex Everyday Preferred Card

Annual fee: $95

Grocery rewards: Earn 3 points on supermarkets on up to $6,000 per year (approximate rewards value 1.0-1.3 cents per point)

7. card_name

Annual fee: $95

Grocery rewards: Earn 3 points on groceries (approximate rewards value 1.0-1.3 cents per point)

8. card_name

Annual fee: $0

Grocery rewards: Earn 3% cashback at US groceries on up to $6,000 per year

9. Savor Rewards from Capital One

Annual fee: $95

Grocery rewards: Earn 3% cashback at groceries

10. card_name

Annual fee: $0

Grocery rewards: Earn 3% and 2% cashback on the categories you choose each quarter. Eligible categories are dining, gas, groceries, entertainment, and travel.

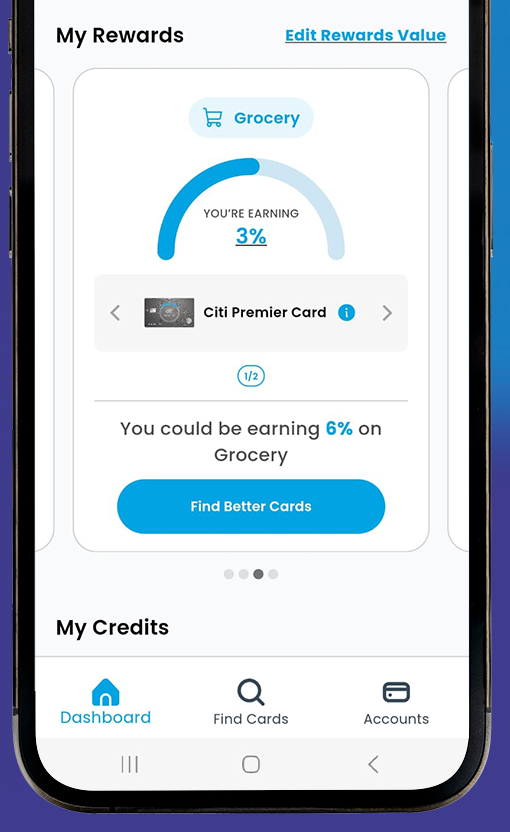

Good to know: In our CardRight app, you can check out the My Rewards section. There you can see which of your credit cards earns the most rewards for grocery purchases.

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments