Price protection will match a cheaper price on a product you buy and find for less on the same or even a different website within a given amount of days after you’ve made the purchase. The price protection benefit may also be limited to a maximum amount of money that would be refunded to you and/or a max amount of items protected. The details vary between banks and credit cards.

If you ever want to buy an item directly from the manufacturer but find that their price is more expensive than another website online then this is where price protection can come in handy…

Price tracking tools

You can sign up for a price tracking tool which will alert you if the price on an item you bought drops. This way you can easily keep track if the price drops and file claims accordingly.

Check out some great options here.

Following are the top 7 credit cards that offer price protection.

7 Credit Cards with Price Protection

1. Capital One Spark Cash Select Business Card

Price protection details: If you buy an item and then within 60 days find the identical item for cheaper at any US retailer, then you will be reimbursed the difference. Up to $500 per item and up to $2,500 per year.

Annual fee: $0

2. United Club Business Card

Price protection details: If you buy an item and then within 90 days find the identical item for cheaper at any US retailer, then you will be reimbursed the difference. Up to $500 per item and up to $2,500 per year.

Annual fee: $450

3. Capital One Spark Miles for Business

Price protection details: If you buy an item and then within 60 days find the identical item for cheaper at any US retailer, then you will be reimbursed the difference. Up to $500 per item and up to $2,500 per year.

Annual fee: $95 (the first year is waived)

4. Capital One Savor Cash Rewards Credit Card

Price protection details: If you buy an item and then within 120 days find the identical item for cheaper at any US retailer, then you will be reimbursed the difference. Up to $500 per item and up to 4 claims per year.

Annual fee: $95

5. card_name

Price protection details: If you buy an item and then within 120 days find the identical item for cheaper at any US retailer, then you will be reimbursed the difference. Up to $500 per item and up to 4 claims per year.

Annual fee: $0

6. Capital One Walmart Rewards Card

Price protection details: If you buy an item and then within 120 days find the identical item for cheaper at any US retailer, then you will be reimbursed the difference. Up to $500 per item and up to 4 claims per year.

Annual fee: $0

7. Capital One Spark Miles Select Business Card

Price protection details: If you buy an item and then within 60 days find the identical item for cheaper at any US retailer, then you will be reimbursed the difference. Up to $500 per item and up to $2,500 per year.

Annual fee: $0

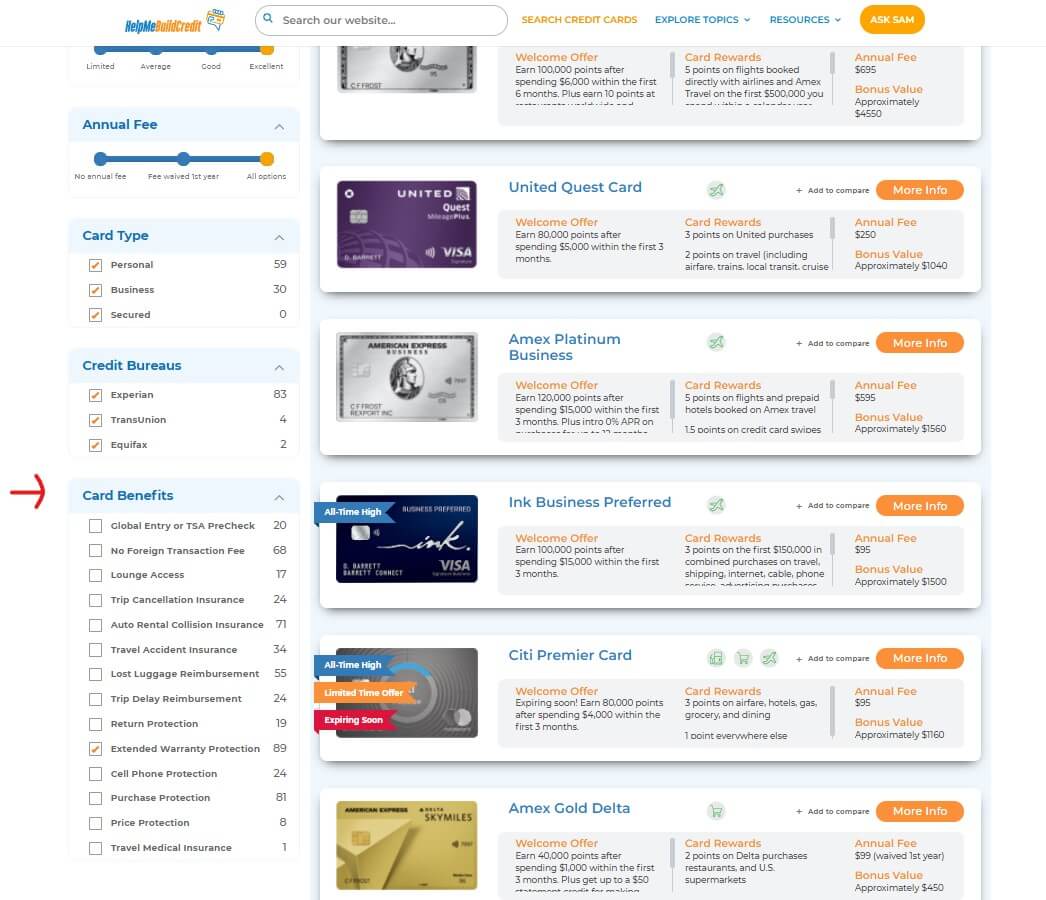

You can always choose to search for more cards with different benefits by simply visiting the Ultimate credit card finder, scrolling down to the card benefit filter and selecting the benefits you’d like. The Ultimate credit card finder will bring up all credit cards that have the benefits you’ve selected.

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments