The US government started handing out the 3rd stimulus check of $1400 per eligible person. Many people have already received their checks via direct deposit to their checking accounts. A very smart way to use the money would be to pay up high-interest credit card bills. In this post, we will teach you how to be over-smart while using the stimulus check to pay your credit card bills to give you the biggest bang for your money. Here are two strategies to use.

Strategy #1: Saving the Most On Interest. Which Credit Card Balance Goes First?

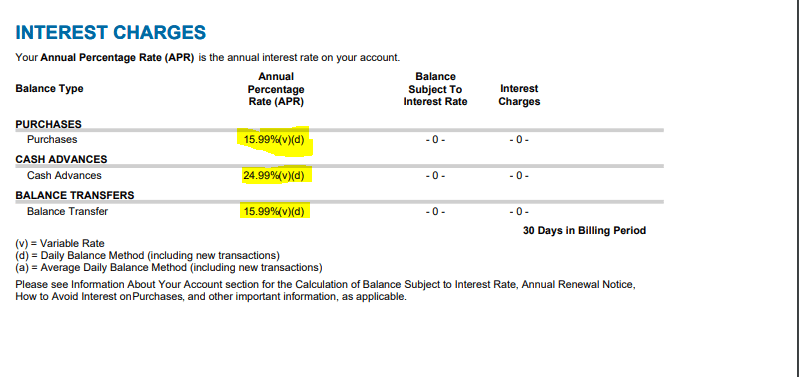

The first thing you should know is that every one of your accounts has a different interest rate. Interest rates can vary from 12.99% annually all the way up to 29.99% annually. To start, go through your accounts and create a list of each one of your accounts and their interest rates.

You can find the interest rate for each account on the monthly statements

The Banks May Negotiate Interests Rates

Now that you have the interest rates in front of you, you can get onto the phone and try to get those rate numbers down. Call the banks associated with your credit accounts to negotiate better interest rates. Some banks, such as Citi and Discover, can give you a better interest rate just by asking. It’s worth the try!

If you were successful at bringing the interest rate down, add it to your list. Now is the time to go through your list again. Note the balance and interest rate for each account.

It’s The Rate That Counts, Not The Balance

Being that we are want to save on interest now, here comes the last part of the strategy. Pay up the balances which have the highest interest rates.

All this may sound very simple but often people for whatever reason don’t get it. Instead of paying the balances with the highest interest rate, they pay the balance on an “eenee meenee minee moe” strategy which obviously doesn’t make sense.

Strategy #2: Increase Your Score By The Most Points While Only Paying a Fraction Of Your Balances

Fico categories credit utilization based on brackets which are believed to be the following (please note the real Fico brackets is confidential info which is not publicly available. The brackets shown below are just an educated guess).

Bracket #1 [0%-9%]

Bracket #2 [9.1%-29%]

Bracket #3 [29.1%-49%]

Bracket #4 [49.1%-79%]

Bracket #5 [79.1%-100%]

Bracket #6 [100% plus]

0% shows no money has been used on the card. Balance is at zero.

100% shows the full credit limit amount has been used on the card. Balance is the same amount as the credit limit. 100% plus would be a card that the balance is higher than the credit limit.

Please make sure you understand the brackets as you will need to remember this information going further in the post.

Pro Tip: Credit utilization only affects personal credit cards – most business credit cards do not get reported on your personal credit report. So, don’t worry about them affecting your credit. (Exceptions would be Capital One business cards, Discover business cards, and some other smaller credit card issuers, which report business cards on personal credit reports).

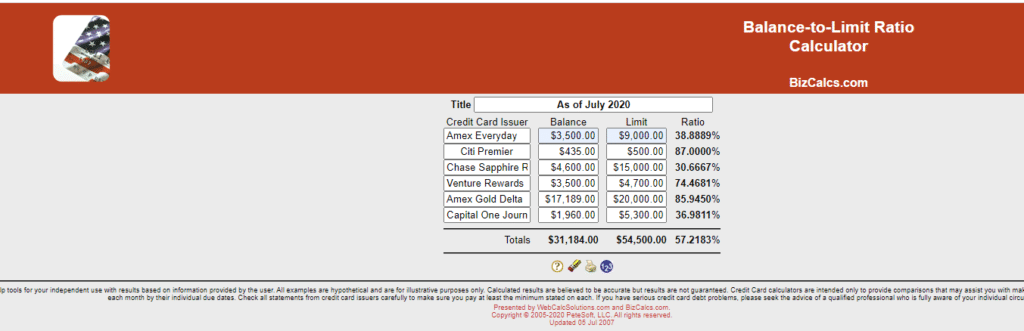

Calculate Your Credit Utilization To Later Decide Which Card Goes First

Knowing the credit utilization percentage on each card will help you pay up your balances efficiently. Credit utilization is what percent of your credit limit you actually used. Every one of your credit cards has a credit limit which is the maximum amount of money you are allowed to spend with that card. Then there is the balance which is the amount of money you spent on your card.

See the sample chart below with the credit card name, credit limit, and balance listed. Make your own chart by filling in the credit cards, credit limits, and balances, along with how much money you have available to make some payments.

| Credit Limit | Balance | Utilization | |

| Amex Everyday | $9,000 | $3,500 | 38.89% |

| Citi Premier | $500 | $435 | 87.00% |

| Chase Sapphire Reserve | $15,000 | $4,600 | 30.67% |

| Venture Rewards | $4,700 | $3,500 | 74.47% |

| Amex Gold Delta | $20,000 | $17,189 | 85.95% |

| Capital One Journey | $5,300 | $1,960 | 36.98% |

| Wells Fargo Propel | $1,200 | $200 | 16.67% |

| Amazon Card | $4,000 | $1,300 | 32.50% |

| Costco Anywhere | $2,250 | $776 | 34.49% |

| Available Money | $3500 |

To calculate credit utilization, divide the balance by the credit limit then multiply the result by 100. You now end up with a percentage which is your credit utilization.

Try out this calculator to plug in your numbers and get your results.

Balance-to-Limit Ratio Calculator

Learn The Goal Of Paying Off Your Balances

Surprisingly enough, the goal of paying off your credit card balances is to get as many as possible into the 2nd credit utilization bracket, a max of 29%. That is considered rational credit utilization. 29.1% is already considered part of the next bracket which is one step less. Scoring models do not look at the amount of the balance, rather they look at the credit utilization number. They like to see you keep a lot below your credit limit. Turns out, you don’t even have to pay up the full amount. You could pay up the card with as much money it takes to get it to 29%.

Let’s break up this concept using our sample chart.

Example 1:

Amex Gold Delta has a high balance of $17,189.

| Credit Limit | Balance | Utilization | |

| Amex Gold Delta | $20,000 | $17,189 | 85.95% |

The instinct reaction would be to knock off that balance first. But hold it. Whatever money you have on hand might not cover the full balance. Even if it does, you still would need money left over for the rest of the balances.

To take this a step further. The credit utilization on the Amex Gold Delta is 85.95%. I mentioned above that we want to get as many credit utilization numbers down to 29%. You would need lots of money to get the balance to 29% credit utilization.

Example 2:

On the other hand, the Wells Fargo Propel has a relatively low balance of $200.

| Credit Limit | Balance | Utilization | |

| Wells Fargo Propel | $1,200 | $200 | 16.67% |

Pay that off, easy, and done with? No, doing that will not improve your score much. It is already in a good credit utilization bracket, with a number of 16.67%. You would leave that balance for now.

Example 3:

The Chase Sapphire Reserve has a balance of $4,600. That might be out of your budget right now. Credit utilization is 30.67% which is so close to 29%, our goal number. Meaning, to get this card to have a good credit utilization number, all you would pay is 1.67% of the balance. That comes to just $76.82. Fair enough?

| Credit Limit | Balance | Utilization | |

| Chase Sapphire Reserve | $15,000 | $4,600 | 30.67% |

Calculate How Much Of The Credit Card Balance To Pay

Here is how to calculate how much of the balance you need to pay to get it to 29%.

First figure out the amount in dollars your balance should be to have a credit utilization below 29%. Take the credit limit and divide it by 100. Multiply the result by 29. The result in dollars is what your balance should be after paying. To figure out how much of your balance to pay to get to that amount, subtract the amount from your balance. That is how much you should pay so that your balance results in a credit utilization of 29%

Now you can refer back to your chart and make a list of how much you would need to pay for each card to get to 29% credit utilization.

Tackle the Balances

According to your budget, start with the cards which are closest to 29%. You will pay off the difference needed to get the balance to the below 29% bracket. Do so until you use up the available money you have to pay up the balances.

Distribute The Extra Money Over Larger Balances

If you can’t get all cards below 29%.1, or if you find yourself with extra money, aim to get the rest of the cards within the 29.1%-49% bracket. Still left over with balances, not in that range, aim next for the 49.1%-79% bracket, and so forth.

Let’s see how we would work that out with our sample chart.

| Credit Limit | Balance | Utilization | Difference (%) Needed To Pay To Get To 29% | Difference ($) Needed To Pay To Get To 29% | |

| Amex Everyday | $9,000 | $3,500 | 38.89% | 9.89% | $890 |

| Citi Premier | $500 | $435 | 87.00% | 58% | $290 |

| Chase Sapphire Reserve | $15,000 | $4,600 | 30.67% | 1.67% | $250 |

| Venture Rewards | $4,700 | $3,500 | 74.47% | 45.47% | $2,137 |

| Amex Gold Delta | $20,000 | $17,189 | 85.95% | 56.95% | $11,389 |

| Capital One Journey | $5,300 | $1,960 | 36.98% | 7.98% | $423 |

| Wells Fargo Propel | $1,200 | $200 | 16.67% | – | – |

| Amazon Card | $4,000 | $1,300 | 32.50% | 3.50% | $140 |

| Costco Anywhere | $2,250 | $776 | 34.49% | 5.49% | $123.50 |

| Available Money | $3500 |

- I would start with the following cards: Amex Everyday, Citi Premier, Chase Sapphire Reserve, Capital One Journey, Amazon Card, Costco Anywhere. Those all have the smallest amount to pay (according to the % difference) to get to a credit utilization of 29%.

- That totals $2,116.50 out of $3500 available. I have 2 credit card balances left after that, Venture Rewards and Amex Gold Delta. I want to get those into the 49% bracket at least and I have $1,383.50 to work with.

- The Venture Rewards card needs $1197 paid to get to 49%. I will pay that much up.

- The Amex Delta Gold card needs $7389 paid to reach 49%. Too much for now. It needs $4200 to reach 79%. I can’t pay that either. Maybe soon when I have more money.

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments