Help Me Build Credit has partnered with CardRatings for our coverage of credit card products. Help Me Build Credit and CardRatings may receive a commission from card issuers. The editorial content on this page is not provided by any of the companies mentioned, and have not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are the author’s alone.

The Southwest Rapid Rewards Premier Business Credit Card gets you lots of points quickly with Southwest Airlines. You earn 6000 points every year on your cardmember anniversary. Plus, you can earn a great companion pass after earning 125,000 Southwest points in a calendar year (including the welcome bonus). The card comes along with various travel insurance, including accident insurance, baggage delay insurance, and more. With the Southwest companion pass you can fly an unlimited amount of flights with your designated companion flying along for free!

The card_name can help you earn a free companion pass after earning 125,000 Southwest points in a calendar year, with the welcome bonus points included. Another interesting point is a $500 credit to transfer points from another Southwest account. The cost to transfer points is one penny per point so this credit covers 50,000 points.

- Credit: Good credit needed

- Step by step guide on how to apply without an LLC or C-Corp

- Chase 5/24 rule: Chase will decline an applicant that has opened 5 or more personal cards (other issuers included) in the past 24 months. Hence, 5/24 rule

- Max cards: You can get approved for up to 2 Chase credit cards in 30 days. Business cards and personal cards are counted separately

- Apply for two cards: If you apply for one Chase card and get approved, it is recommended to apply for a second card since Chase is very good about approving for two cards, even within the same day. If the first application is still pending, wait for it to be approved before you apply for a second card

- Credit bureau: Chase Bank will usually pull your Experian credit report

- Combining same-day credit inquiries: Some data points suggest that credit inquiries for all Personal Chase cards for same-day applications will be combined; also, credit inquiries for all Business Chase cards for same-day applications will be combined. Credit inquiries for Personal and Business card applications will not be combined.

- Check application status: You can check your application status at Chase.com / Customer Center / Check my app status or call 1 800 453 9719

- Reconsideration: If declined you can call 1 800 453 9719 to be reconsidered

Quickest way to get my card: You can request Chase to overnight your physical card by calling Chase customer service.

Approval Monitor (submitted by HelpMeBuildCredit users)

Credit limit range $5-$5

Avg. Credit limit$5

Disclosure: These results are based on information submitted by HelpMeBuildCredit users. Credit card approval results are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. Neither HelpMeBuildCredit nor the bank advertiser's take any responsibility on the accuracy of the information.

HelpMeBuildCredit credit ranges are a variation of FICO®️ Score 8, one of many types of credit scores lenders may use when considering your credit card application

Get 6,000 bonus points each cardmember anniversary.

Worldwide primary coverage on rentals for business purposes up to 31 days, and secondary coverage on rentals for personal purposes.

Earn a free companion pass after earning 125,000 Southwest in a calendar year (welcome bonus points are included). Once earned the pass is valid for an unlimited amount of flights for the remainder of the calendar year plus for the full upcoming year. You will need to pay the companion’s taxes and fees.

New! Get a $500 credit to transfer points from another Southwest account (the cost to transfer points is a penny per point so this credit covers 50,000 points)

Get your original manufacturer’s warranty time matched (up to a year). (Will only cover if the original warranty is for 3 years or less). Max $10,000 per claim, $50,000 per account.

First and second checked bags are free on Southwest flights (this benefit is available to all Southwest customers no matter if you have their credit card or not).

New! Receive 25% back (statement credit) for inflight purchases of Wifi, and drinks.

Get up to $3,000 per person for lost or damaged luggage.

If your baggage is delayed for 6+ hours, you can claim up to $100 per day to cover expenses like toiletries & clothing, for up to 3 days.

New! Get 2 free EarlyBird check-in passes

Get refunded if your purchase is damaged or stolen, up to 120 days from the date of purchase. Max $10,000 per claim, $50,000 per account.

Receive up to $500,000 if occurred on the carrier or at the airport/station. Receive up to $100,000 if occurred from when you leave until you return.

Get 1,500 TQPs for every $10,000 you spend on the card. You need a total of 35,000 TQPS per calendar year to reach A-list status. And 75,000 TQPS per calendar year to reach A-list Preferred status.

The points can be used at approximately 1 penny per point to book award flights with Southwest airlines.

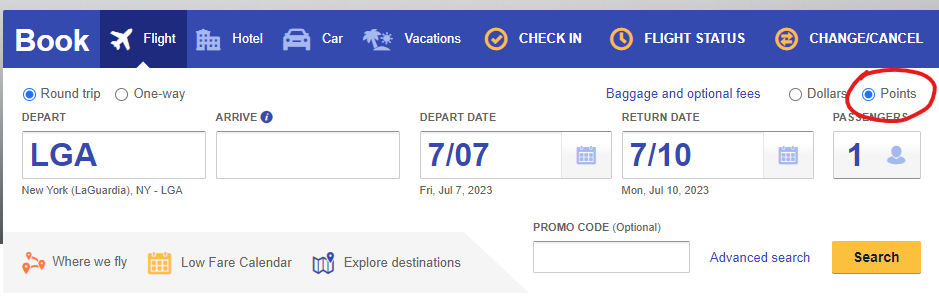

You can book award flights using your Southwest miles with Southwest airlines and its partners here.

You can use the points to Pay Yourself Back at 1.0 cent per point to pay the annual fee and 0.8 cents per point for up to $200 total in statement credits to offset purchases in the following categories:

- Dining

- Gas