Last week, we posted about a strategy on how to pay your balances to lift your credit score by the maximum points even by only paying a fraction of your balances.

This week, let’s discuss the consumer who does not care so much about their credit score but would rather save the most money on interest.

Every credit card has a different interest rate

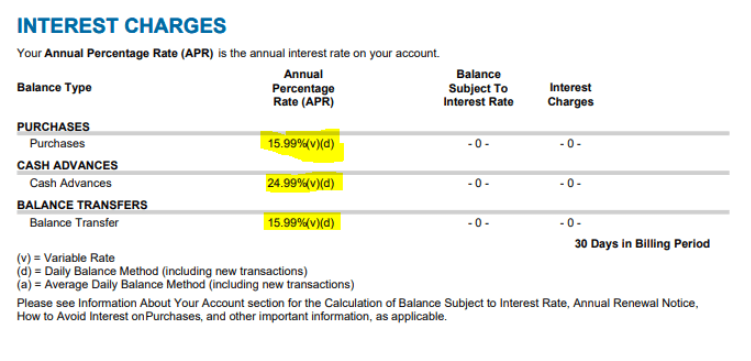

The first thing you should know is that every one of your credit cards have a different interest rate.

Interest rates can vary from 12.99% annually all the way up to 29.99% annually.

To start, go through your accounts and create a list of each one of your accounts and their interest rates. Here is a sample list you can use.

You can find the interest rate for each account on the monthly statements

The banks may negotiate interests rates

Now that you have the interest rates in front of you, you can get onto the phone and try to get those rate numbers down. Call the banks associated with your credit card accounts to negotiate better interest rates. Some banks, such as Citi and Discover, can give you a better interest rate just by asking. It’s worth the try!

If you suddenly lost your job or your income dropped and you fell into hardship and can no longer pay your credit card bill then most banks offer some type of hardship...

A second look at your interest rates

If you were successful at bringing the interest rate down, add the new rate to your list. Now is the time to go through your list again. Note the balance and interest rate for each account.

It’s the rate that counts, not the balance

Being that we want to save on interest now, here comes the last part of the strategy. Pay up the balances which have the highest interest rates.

All this may sound very simple but often people for whatever reason don’t get it. Instead of paying the balances with the highest interest rate, they pay the balance on an “eeny, meeny, miny, moe” basis, which obviously doesn’t make sense.

Good luck on knocking down your balances.

![Medical Collections Under $500 Removed From Credit Reports [Effective April 11]](https://helpmebuildcredit.com/wp-content/uploads/2023/05/post-on-medical-collection-under-500-removed-from-credit-report.png)

![How To Get Cash From A Credit Card [5 Great Ideas]](https://helpmebuildcredit.com/wp-content/uploads/2018/10/post-on-how-to-get-cash-from-credit-card-1080x675.png)

hi, i recently saw a card offer on your site that is a business’ credit card ,after giving in an application you get an offer and can decide if you want to accept it or not which card was it cant find it anymore?

Gm business

https://helpmebuildcredit.com/creditcard/gm-business-card/