I recently published a post about credit card auto rental insurance and a reader asked me in the comments if the Chase Sapphire Preferred is the only card offering primary auto rental insurance? At a first glance, I wanted to reply that there are many cards that offer it. But then it hit me. Hey, are there really that many cards that still offer primary auto rental insurance? After reviewing the list I found that there are actually a total of 10 cards left that are still offering primary CDW insurance.

The following card have worldwide primary auto rental CDW insurance

1) Chase Sapphire Prefered ($95 annual fee)

2) Chase Sapphire Reserve ($550 annual fee)

3) United Explorer ($95 waived 1st year)

4) United Quest ($250 annual fee)

5) United Club Infinite ($525 annual fee)

6) Us Bank Altitude Reserve* ($400 annual fee)

7) Chase Ink Cash on rentals for business purposes – ($0 annual fee)

8) Chase Ink Unlimited on rentals for business purposes – ($0 annual fee)

9) Chase Ink Preferred on rentals for business purposes – ($95 annual fee)

10) United Business on rentals for business purposes ($99, first-year waived)

*excluding rentals in Israel, Jamaica, the Republic of Ireland, or Northern Ireland

What's the difference between primary auto rental coverage and secondary?

Primary auto rental insurance will cover you no matter if you have other insurance or not. Whereas secondary coverage will only cover you only in a case where you do not have any other coverage.

What difference does this make? Well, the only real difference this makes is if you have your own car, then most probably your insurance policy covers you in a case where you rent a vehicle on vacation, etc. With secondary coverage, the credit card issuer will refuse to pay for damages, forcing you to bill your primary auto insurance provider, which may cause your premiums to go up. But with primary coverage, you will be covered by the credit card issuer regardless if you have other insurances or not.

Amex premium car rental insurance

All Amex cardholders have standard secondary auto rental insurance but cardholders can purchase Premium Car Rental Protection for $12.25 – $24.95 per rental. Premium Car Rental Protection offers primary coverage up to 42 days. And covers vehicles up to $100,000 value. It also includes secondary medical coverage and accidental death or dismemberment coverage for drivers and passengers.

Want to learn more about auto rental insurance offered by each credit card?

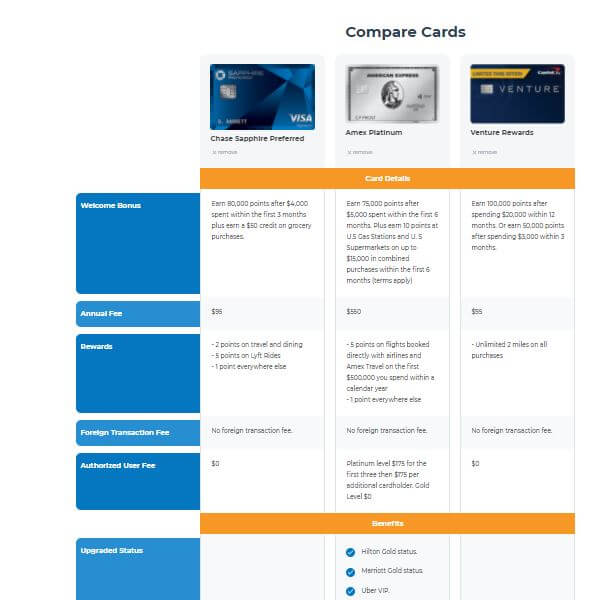

Check out our detailed benefits description of coverage on each of our credit card pages or compare the benefits between multiple cards on our brand new compare cards feature found here. You can add as many cards as you want to compare them side by side.

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments