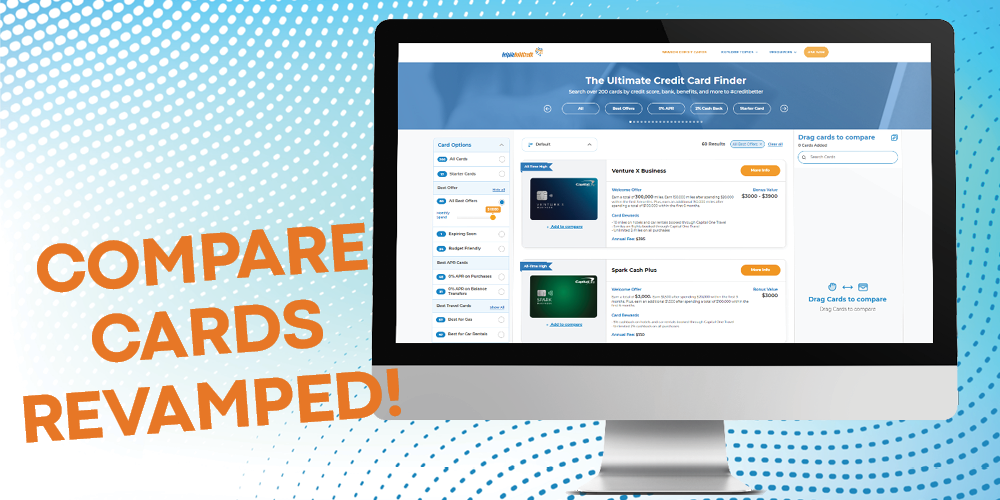

Ok, This. Is. So. Exciting! After so many hours and months of hard work, I am thrilled to present the Ultimate Credit Card Finder which is bound to revamp your search for a credit card most suited for you. The Ultimate Credit Card Finder features clear-cut filtering options to make it ever so simple to search for those cards. Let’s get going and explore.

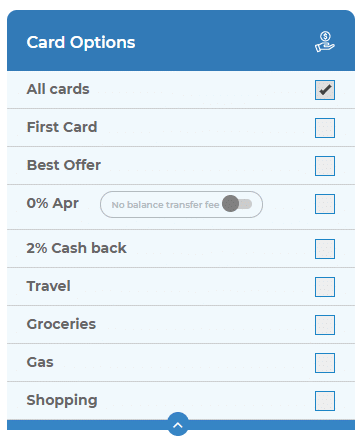

Card Options

Credit cards get sorted into categories. We’ve got those that work great as a first card, meaning fair credit will suffice. There are cards that are wonderful for cashing in on rewards for gas or groceries. All you’ve gotta do is check off the card category you need and the credit card finder will filter out all those cards which fall under the category you have selected.

What Are The Options?

Visit the Credit Card Finder and choose one of the following categories,

First Card, Best Offer, 0% APR, 2% cashback, Travel, Groceries, Gas, Shopping.

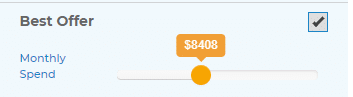

Are you looking for a great credit card offer and you only want to see offers that the minimum spend fits within your budget? No problem, just slide the slider to only show the offers within your budget. It is fun and easy!

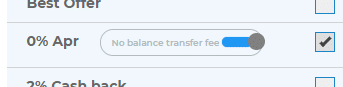

Regarding the 0% APR category, you can slide that glider to the right to specifically select 0% APR cards which do not have a balance transfer fee.

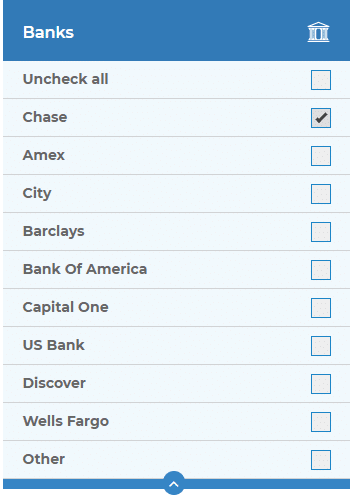

Banks

We all have specifications when it comes to signing up as a cardmember with a bank. Banks each pull reports from different credit bureaus when weighing approval for a card. Banks have limits to the number of personal and business credit cards allowed per client. All that will make you require one bank over the other. Well, take your pick by checking off the banks you are interested in.

What are the options?

Chase, Amex, City, Barclays, Bank Of America, Capital One, US Bank, Discover, Wells Fargo, Others.

You can always choose to Uncheck All to start your selection from scratch.

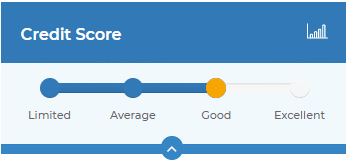

Credit Score

A credit score is crucial in order to get approved for a credit card. Each card has it’s own level of credit needed in order to get approved. With the credit score bar, you can now adjust the search to get you cards that require the credit score range you own.

What are the options?

Limited, Average, Good, Excellent.

Annual Fee

Are you a student tight on paying fees? Want to try a card for a bit of time yet don’t want to pay extras and commit? Are you open to any amount of fee and just want the best for your money? This is where the Annual Fee bar steps in. You get to choose and filter the cards based on the annual fee.

What are the options?

No annual fee, Fee Waived First Year, All Options.

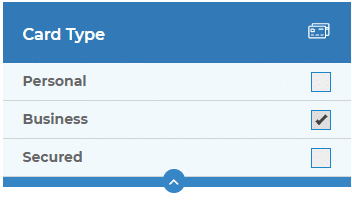

Card Type

Card rewards, fees, and benefits will vary depending on if it is a personal credit card or business credit card. The fact that you are applying for a card for your business should not make you go hunting elsewhere. Keep your personal and business life apart, yet let the Ultimate Credit Card Finder rule! Choose if you’d like a secured credit card which will keep a deposit secured in a savings account and make sure you pay your bills. Different strokes for different folks.

What are the options?

Personal, Business, Secured.

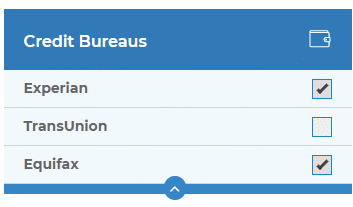

Credit Bureaus

If your planning to apply for several credit cards at the same time you need to do it smartly so you don’t get declined due to the new credit inquiries. Thankfully most credit card issuers only pull one of your three credit reports. So you can apply for multiple credit cards by making sure you split up the credit inquiries between the three credit bureau by choosing the right banks. But hey, how do you know who pulls who? This is where this filter setting comes in. Just click and choose and the Credit Card Finder will only display the results of banks that pull the credit bureau you chose.

What are the options?

Experian, TransUnion, Equifax

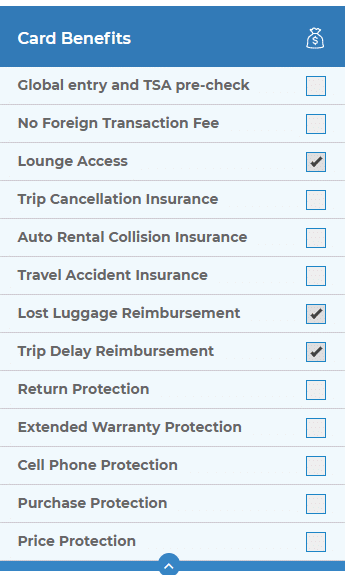

Card Benefits

For the fun part, where you get to reap the benefits of owning a credit card! Using a credit card is a tool. Getting benefits out of that is a bonus. But that awesome bonus should not stop you from picking the very benefits you would like to see yourself receiving. A frequent traveler can check off travel benefits, while a spender can check off purchase protections and warranties. Pick as many as you’d like.

What are the options?

Global Entry and TSA Pre-Check, No Foreign Transaction Fee, Lounge Access, Trip Cancellation Insurance, Auto Rental Collision Insurance, Travel Accident Insurance, Lost Luggage Insurance, Trip Delay Reimbursement, Return Protection, Extended Warranty Protection, Cell Phone Protection, Purchase Protection, Price Protection.

Mix And Match

No, this is not one of my filters, yet this applies to all of the above. You are not limited to one checkbox per category. Pick as many as you need and I will bring up your options. If there are no cards pertaining to all you’ve selected, I’ll point that out to you.

Mix and match between categories too. Take Mr. Student for example. He wants a first credit card, has limited credit score as he is new to credit, and wants no foreign transaction fees as he studies overseas. Mr. Student will check off all of those so that the filter can select cards falling under all categories essential to Mr. Student.

So specific. So simple. So beneficial.

Drum roll please as we give The Ultimate Credit Card Finder it’s place to credit shine!

Here you go! Check it out!

The Ultimate Credit Card Finder

P.S. Your feedback will be greatly appreciated. Let me know your what your thoughts and suggestions are in the comments below (or email me at [email protected]). Thanks!

![Finally Going Into Effect! Bank Can’t Take Away Your Points When Closing Your Credit Card [In New York]](https://helpmebuildcredit.com/wp-content/uploads/2023/11/post-on-new-law-that-can-redeem-points-90-days-affter-closure-1080x675.png)

This is super duper! So easy to find exactly what I’m looking for in seconds!