Credit card welcome offers are constantly changing, whether for the better or for the worse. We call it the card dance. Today it’s high, tomorrow even higher, then low. Kinda like the stock market.

But, if you got bad luck with stocks you might still be able to play lucky with welcome offers AKA sign-up bonuses.

If you sign up for a card and the bonus is suddenly increased a few days later, or even as much as 90 days later, some banks will as courtesy match you to the higher bonus upon request.

Credit Card Issuers Policy Regarding Matching Higher Sign-Up Bonuses

Here is the list of the popular credit card issuers’ policies.

American Express

Amex will usually not match increased welcome sign up bonus offers.

Amex welcome offers are once-in-a-lifetime meaning once the offer expires, it will never be offered again. So I would recommend you to always wait for an all-time high credit card offer.

Bank Of America

Bank Of America will sometimes match increased welcome sign up offers. What it depends on is which customer service rep you get on the other line, and on your relationship with Bank Of America.

Barclay

Barclay will usually match increased welcome offers if it’s requested within 30 days of when you were approved for your credit card. So you can monitor the card offer for the first 30 days after you get approved to watch for a new increased offer and request for a match if it does happen in that period of time. (Some reported success even past 30 days 1,2)

Capital One

Capital One will not match increased welcome offers.

Chase

Chase will usually match increased public welcome offers if it’s requested within 90 days of when you were approved for your credit card. They will match public offers only, not target ones.

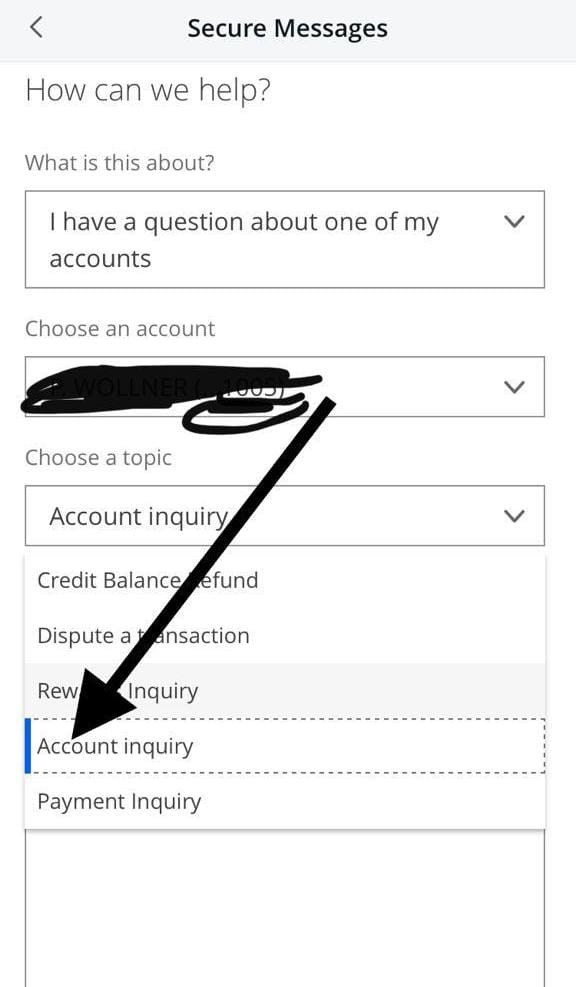

In order to request Chase to match an offer, call the number on the back of your card. You can alternatively send them a secured message (recommended)

It’s better to request the match after you have already completed the spend requirement

Update 10/28/22: Many people are reporting that Chase matched the increased Sapphire Reserve 80k offer and Ink Unlimited and Ink Cash 90k offer. For the Ink offers some people got matched even more than 90 days.

With the most recent Chase Sapphire Preferred 80,000 offer Chase has refused to match applicants that applied for the card even within 30 days. Is this a change in policy? Time will tell.

06/05/2021 update: Chase is currently not matching the Chase Sapphire Preferred 100k offer for applicants who applied with the 80k offer. As per a rep if enough people request the match then Chase corporate may change the policy.

11/10/20 Update: As per DOC, Chase is currently matching the 75k offer on the Chase Ink Cash and Chase Ink Unlimited for applicants that got approved for the card within the last 90 days.

11/11/20 Update: Chase is currently matching the 70k offer on the United Explorer for an applicant who applied within the last 90 days.

Citi

Citi will usually match increased welcome offers if it’s requested within 90 days of when you were approved for your credit card. Call the number on the back of your card to request a match. If you don’t get approved for the match, hang up call again (HUCA).

Discover

Discover might match increased welcome offers. It all depends on which representative you speak to. Try your luck with a supervisor

Wells Fargo

Wells Fargo will not match increased welcome offers.

It does seem worth it to keep checking welcome offers after getting approved for a card to see if the offer gets increased within a month or so, as more issuers than not will possibly offer some points as a match. Good luck!

Follow us on WhatsApp or subscribe to our email list to get updates on new welcome offers as soon as they are released!

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

I would like to know if chase will match the offer

Chase is not matching the CSP 100k offer

Citi does not match. I chatted, called, tweeted, and escalated to the executive resolutions team about the Aadvantage card (got 50k, three days later it was 75k), and they all said they do not match signup bonuses. Some of them were quite rude as well.

Thanks for sharing the data point.