So, you’re applying for a credit card. Or, better put, credit cards. There’s so many awesome welcome bonuses and 0% APR introductory rates plus plus plus. You might want to quit the guessing game of “Will I get approved for a card or not?”

What are credit card applications?

Credit card applications are a form that you fill out when you apply for a new card.

Credit card applications are free, but applying “just because”- without knowing if you stand a chance- is not worth it, because it leads to credit inquiries, which affects your credit score. (More on credit inquiries here)

Most credit card issuers have set rules when it comes to credit card approvals.

If you do not meet these standards, then you will automatically get declined- even if you have perfect credit!

What are the credit card application rules?

The most famous rule is the Chase 5/24 rule, but do you know the approval rules for the other credit card issuers?

Let’s discuss the approval rules for all the major credit card issuers.

Chase Application Rules

- Chase will decline an applicant that has opened 5 or more cards (other issuers included) in the past 24 months. Hence, 5/24 rule.

- You can get approved for up to 2 Chase credit cards in 30 days. Business cards and personal cards are counted separately.

- If you have any Sapphire card currently open (Reserve or Preferred), Chase will not approve you for a new Sapphire card (regardless of which Sapphire card you apply for). You can close or product change the card and apply for a new one after approx 48 hours (As long as you did not receive a welcome offer on any Sapphire card within the past 48 months).

- If you have any Chase Freedom card currently open (Freedom, Freedom Flex, or Freedom Unlimited), Chase may not approve you for a new Freedom card (regardless of which Freedom card you apply for). This rule is not set in stone, though.

5/24

How can I calculate my 5/24 score?

Before you apply for a Chase credit card, you may want to see where you stand with the Chase 5/24 rule. To calculate it, review your credit report and calculate the number of accounts you opened in the last 24 months.

Being that Chase only pulls your report from Experian, be sure to request your credit report from Experian, as you want to see what they’ll see.

You can request your report on Experian’s site.

You can read more details about the Chase 5/24 rule here.

American Express Application Rules

- In a time span of 90 days, you can only get approved for 2 Amex cards. (AKA- 2/90. Spoof of Chase 5/24 rule ; ). No Preset Spending Limit* cards are not included in this rule and do not get counted.

- Officially, you can only get approved for up to – and including- 5 Amex credit cards (including personal and business), but this rule isn’t always enforced (please note the total of 5 credit cards excludes some Amex cards that are No Preset Spending Limit* cards like the Amex Platinum, Amex Gold, etc)

- You can only get approved for up to-and including- 10 Amex No Preset Spending Limit* cards. (This rule is not always enforced)

- Amex has three personal Platinum cards 1) The Amex Platinum 2) The Morgan Stanley Platinum, 3) The Schwab Platinum. You can only get one of the three Platinums in a 90 day period.

*No Preset Spending Limit means the spending limit is flexible. [In fact,] unlike a traditional [credit] card with a set limit, the amount you can spend adapts based on factors such as your purchase, payment, and credit history

Citi Application Rules

- Citi will only approve you for one personal card every 8 days, and only 2 Citi personal cards within 65 days.

- Citi will only approve you for one business card every 95 days.

Barclays Application Rules

- Barclays will not approve you for their business cards if you have opened 6 or more credit cards within the past 24 months.

- Barclays may not approve you for a credit card that you’ve already had in the past (and closed, for whatever reason).

- If you do not use your open Barclays cards often, then Barclays may hesitate to approve you for a new one

Bank of America Application Rules

- Bank of America will only approve you for 2 Bank of America personal cards within 2 months, 3 Bank of America personal cards within 12 months, and 4 Bank of America personal cards within 24 months (bank of America business cards do not have this rule).

- You cannot get approved for a Bank of America personal card if you have more than 5 Bank of America personal credit cards open (bank of America business cards do not have this rule).

- Bank of America will not approve you for their credit card if you opened more than 2 cards in the past 12 months, even if it’s from other issuers. Unless you’re a BOA bank account holder, then you can get approved even if you opened up to 6 cards in 12 months.

Capital One Application Rules

- Capital One will only let you have a maximum of 2 personal Capital One branded credit cards. (This excludes co-branded credit cards like the Capital One Walmart Rewards card.)

- You can only get approved for 1 personal Capital One card every 6 months (not always enforced)

Discover Application Rules

- Discover will only approve you for one card every 12 months, and they only allow a total of 2 open Discover credit cards.

Wells Fargo Application Rules

- You might need a Wells Fargo bank account in order to get approved for some of their credit cards.

- You might not qualify for a 2nd Wells Fargo credit card if you have opened a Wells Fargo card in the last 6 months.

US Bank Application Rules

- There are no known rules for applying for US bank cards.

So, before you apply for credit cards, be sure to refer back to these rules, so you don’t “waste” a credit inquiry.

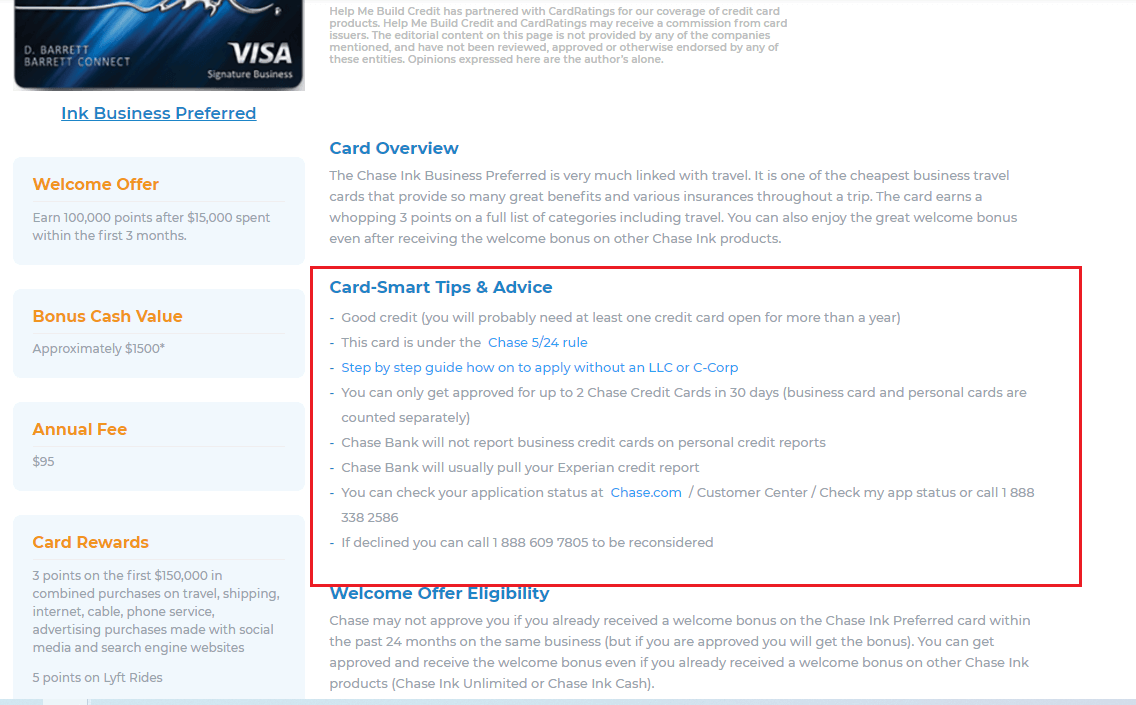

You can always find these rules listed on each of our dedicated credit card pages, under “Card-Smart Tips & Advice”.

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

What’s the chase rule?if you have freedom you cant get unlimited or cant get another freedom?

Pls explain

Thank you

You cannot get approved for another freedom card if you already have one open. For example if you have already the Freedom Unlimted then you cannot get approved for the regular Freedom.

Hi like to know how often the report an inquiry

I want to open a lot of cards in one day and they should not see the inquiry?

Nowadays it is reported by the microsecond. Impossible to catch it before. You can maybe try several cards that pull different credit bureas. Our credit card search lets you filter cards based on which credit bureaus they usually pull. Check it out