Update: Offers expired.

Chase released the end date for the card_name and card_name offers. The offers will be ending soon!

You definitely don’t want to miss these offers! You can earn a total of 180,000 points! You earn 90k points after spending $6,000 within three months on each card. And even better. Chase is approving for both cards easily.

- Both cards don’t have an annual fee!

- Both cards have 0% APR for 12 months!

And last but not least, both cards earn you 90k bonus points!

So don’t miss this incredible opportunity to earn a total of 180,000 points.

Passover shopping is coming up. You will be spending a ton on credit cards anyway. You might as well earn a great bonus, plus 0% APR for 12 months!

Don’t delay, apply today!

Approval tips

- Apply first for the card_name

- Once approved, apply for the card_name

- If you apply for both cards the same day it will only result in one credit inquiry

- If one application is pending then its best to wait till its approved before you submit the second application.

- If you got declined you can call the Chase underwriting team at 1-888-609-7805 to have your application reconsidered. Here are some tips.

How to apply for both Ink business cards without a business tax ID (using your social security number as your tax ID)

The card_name and card_name cards are both business cards. So yes, you technically need to have a business in order to apply for a business card. But did you know how many jobs qualify as owning a business?

For starters; tutoring a school kid, a side-bookkeeping job, selling winter coats out of your house, freelancing, doing deliveries, etc. can all be considered a business or sole proprietorship.

According to all that info, you are most likely eligible to apply for the Ink business cards. Here’s how.

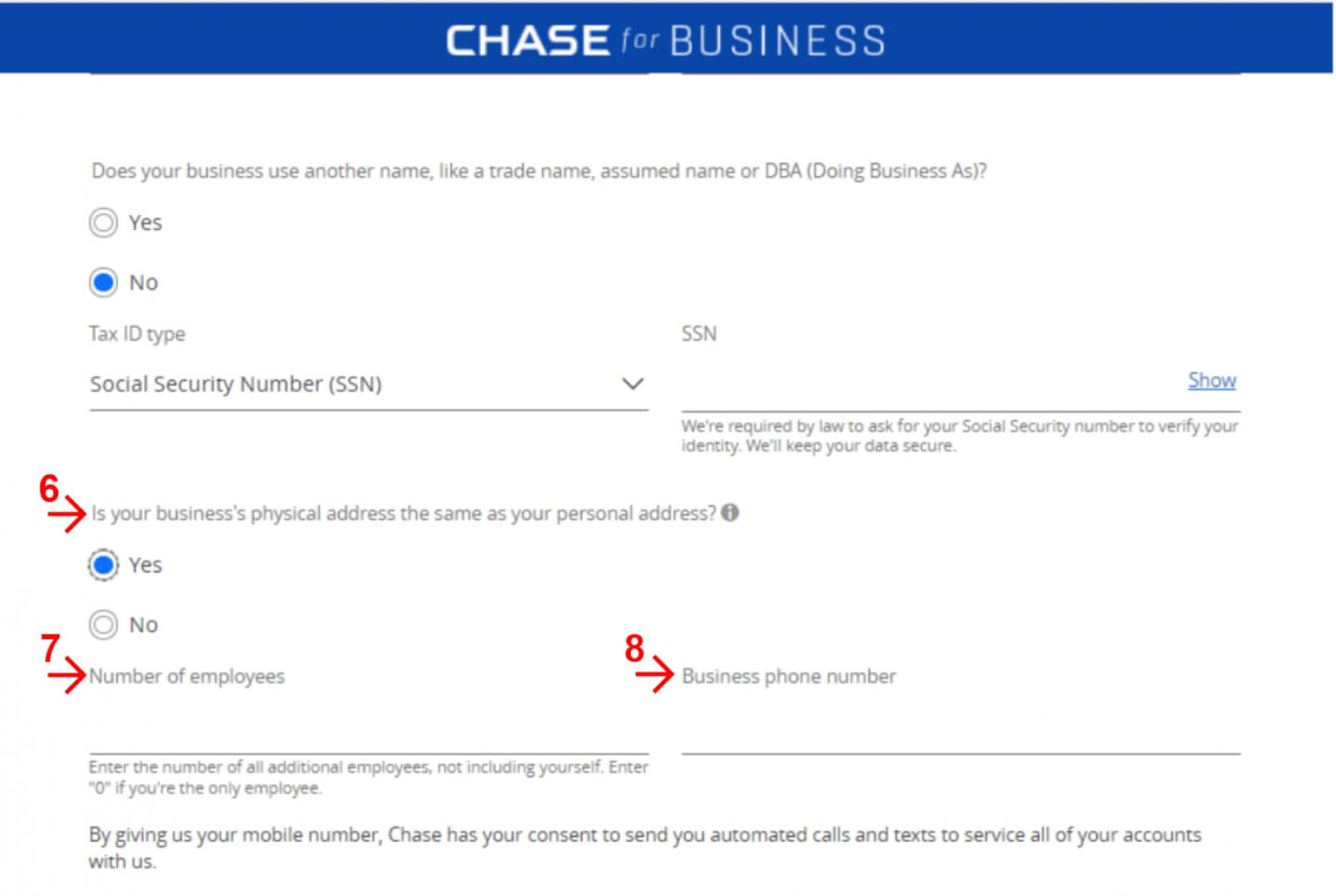

How to fill out a business application without a business Tax ID

Once you make the clever decision to click on the Apply Now button and are about to start applying for the card_name or card_name card, you would treat it as an application for a personal card.

Meaning, in place of the business name you’d put your personal name, and your personal contact information would take the place of the business contact information, such as the address and phone numbers.

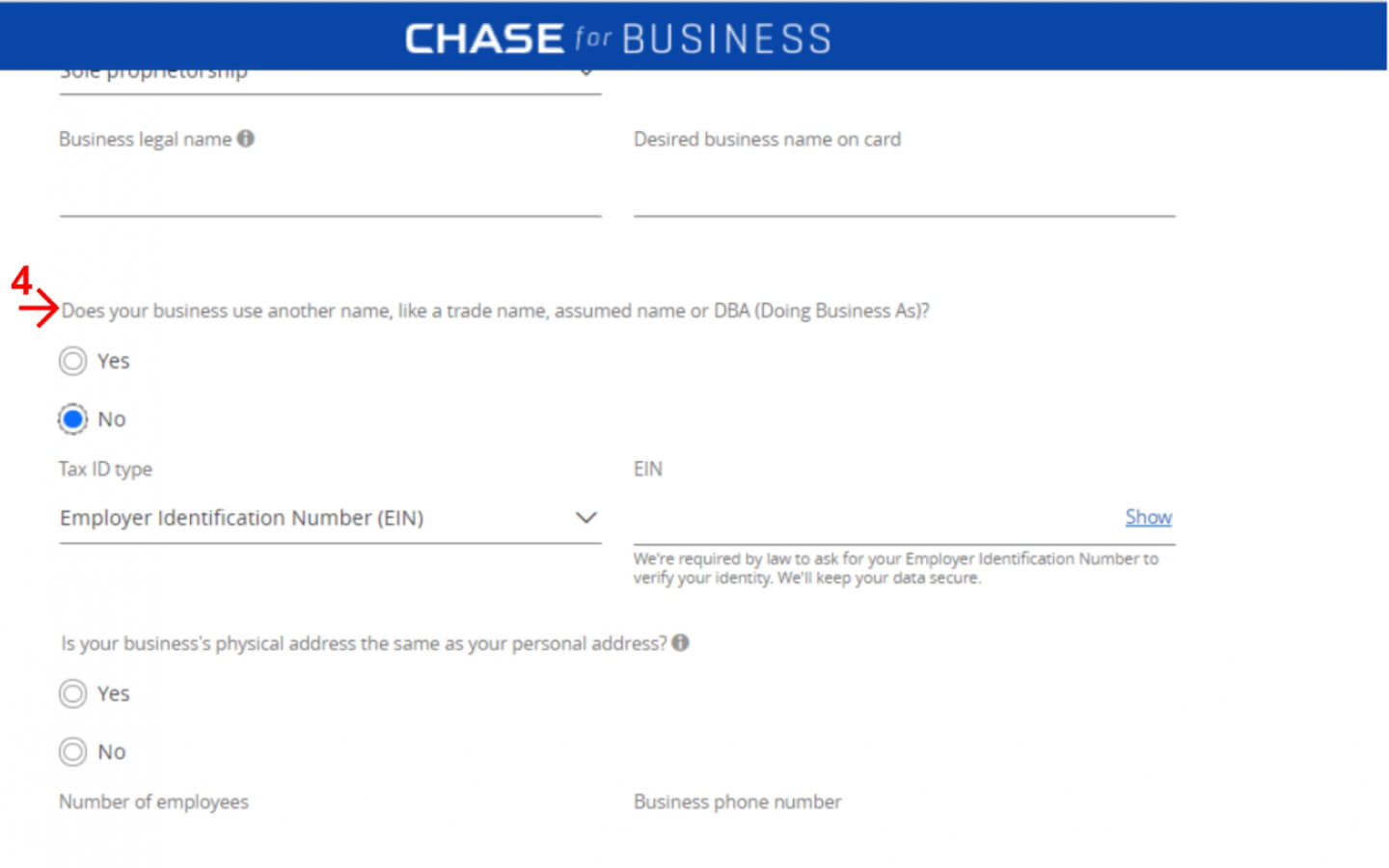

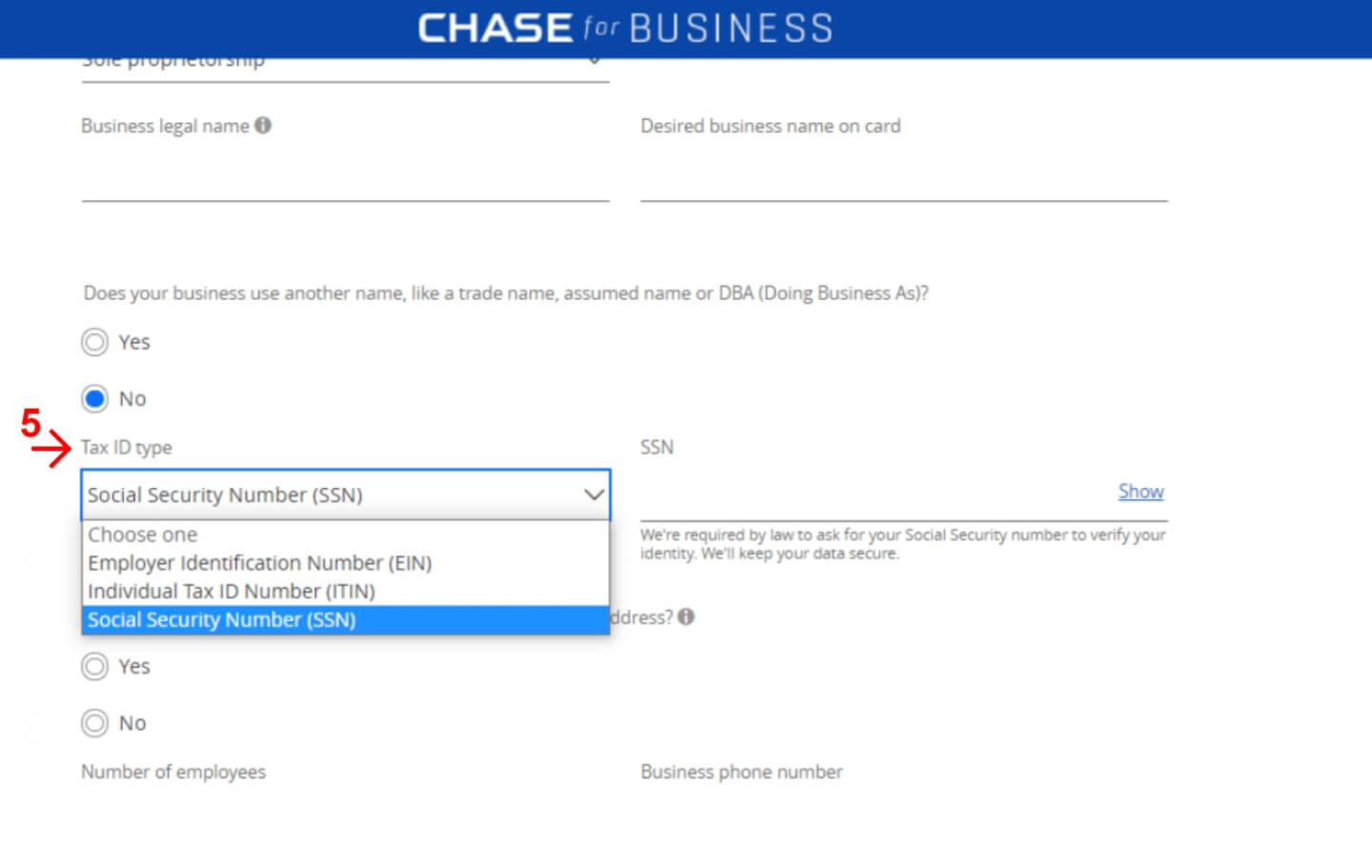

It may get confusing once you hit the business part of the application. Here’s a step-by-step guide on how to fill it out without owning a business or LLC. But the general idea is that you can use your SIN in place of a business tax ID or EIN (unless you choose to get yourself a free EIN here), and so on.

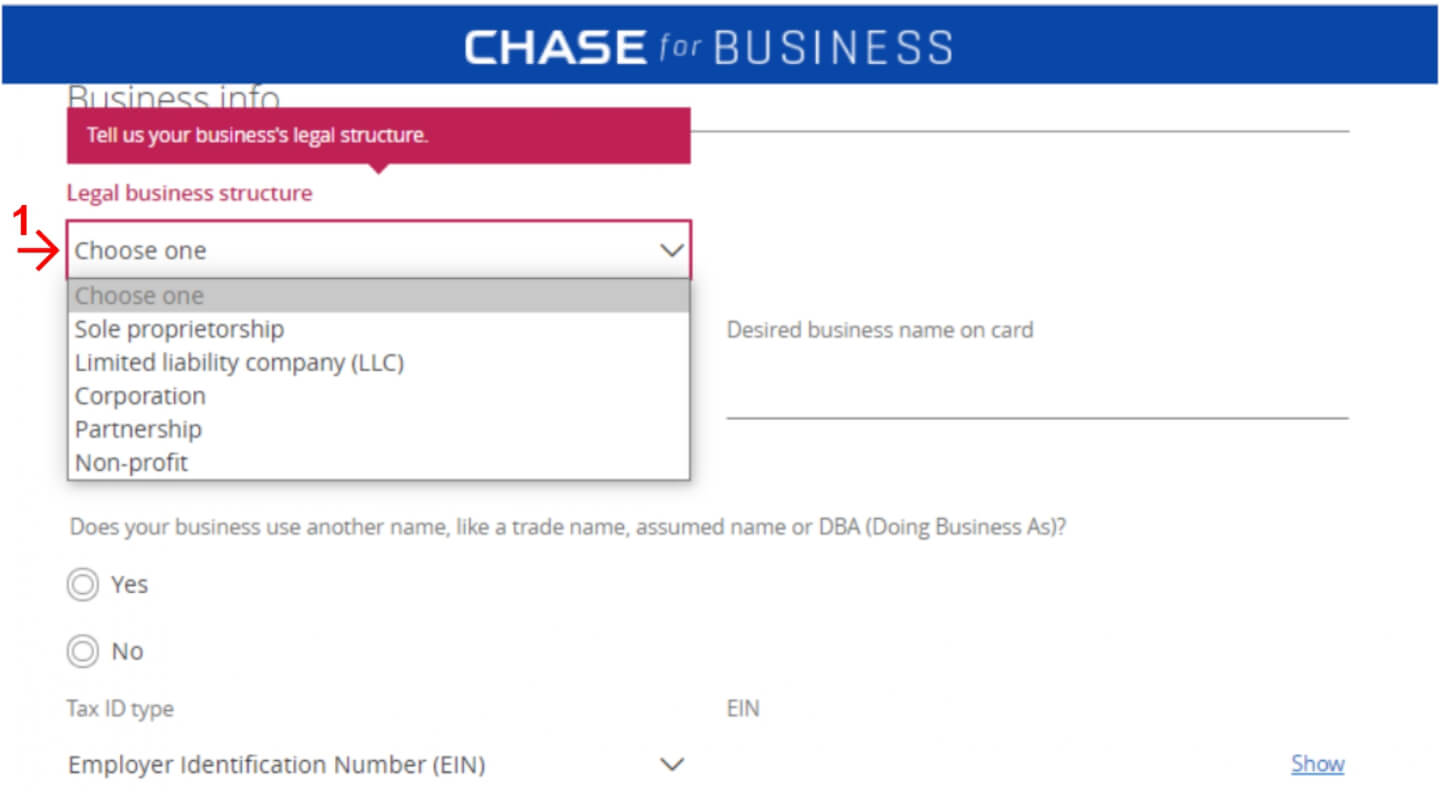

- Legal business structure: Choose “sole proprietorship”.

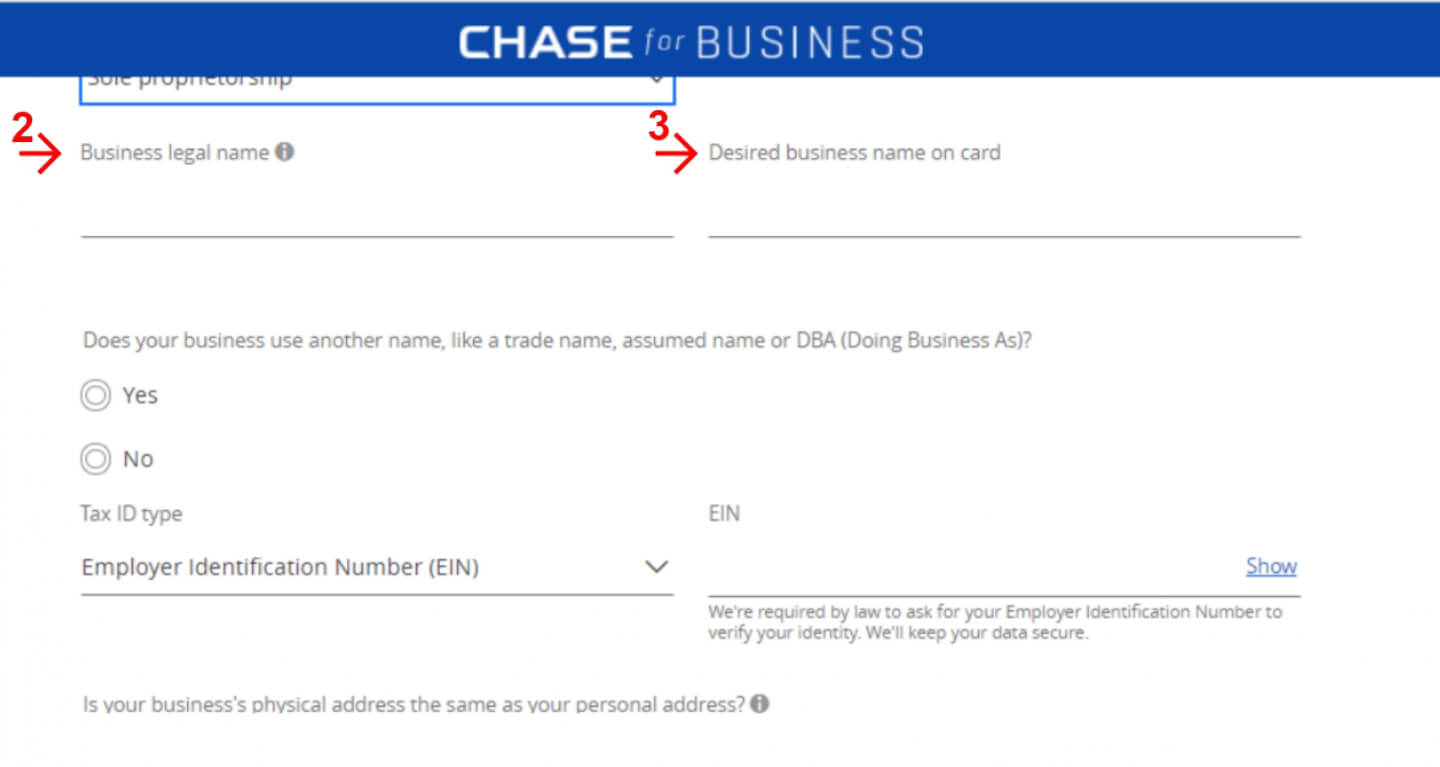

- Legal business name: Write the business name. If the business does not have a name then write your own name, which is actually better as it will help you out later with providing proof of the business name, if requested (you can then send any utility bill that has your name on it).

- Desired business name on card: Write any name you prefer to be displayed on the card.

- Number of employees: Put in as applicable, if it’s 0 write 0.

- Business phone number: You can put your own phone number.

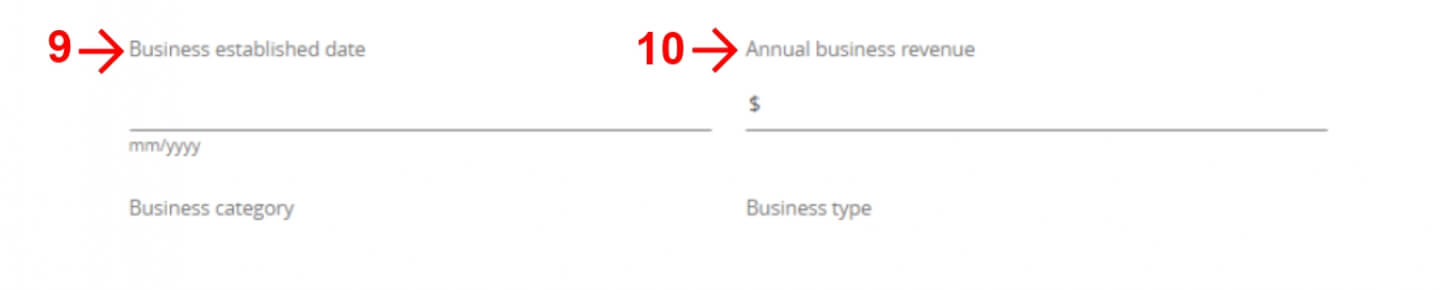

- Business established date: Put the date you opened the business (it’s recommended to have a business open for a minimum of one year in order to get approved).

- Annual business revenue: Put in the net sales of the business (How much money your business has in sales before deducting your expenses).

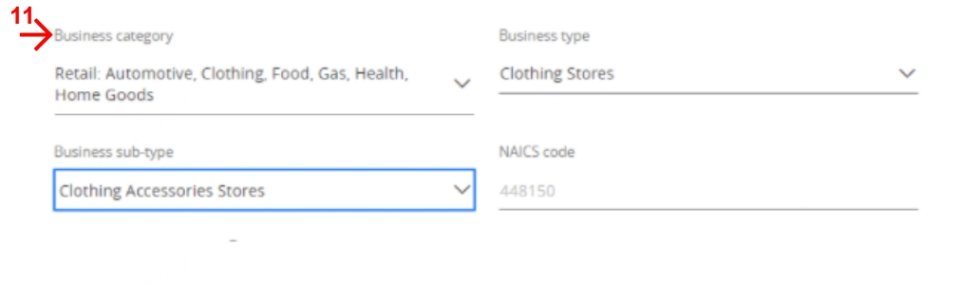

- Business category: Fill out whatever type of business you have (for example, if you sell your own knitted hats then your type of business is retail) Do the same in the field where it says “business type” and “subtype”.

- Business established date: Put the date you opened the business (it’s recommended to have a business open for a minimum of one year in order to get approved)

- Annual business revenue: Put in the net sales of the business (How much money your business has in sales before deducting your expenses).

- Business category: Fill out whatever type of business you have (for example, if you sell your own knitted hats then your type of business is retail) Do the same in the field where it says “business type” and “subtype”.

Answers to many more questions can be found here.

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments