The Fed recently raised its benchmark interest rate. In this post we will discuss what that means in regards to the interest rate you pay on your credit card debt.

How is the interest rate decided on a credit card?

When you apply for a credit card, part of the approval is the interest rate you will get. The same way your credit limit is decided, so is your interest rate. If you have a higher credit score you can expect a better interest rate.

Fixed and variable

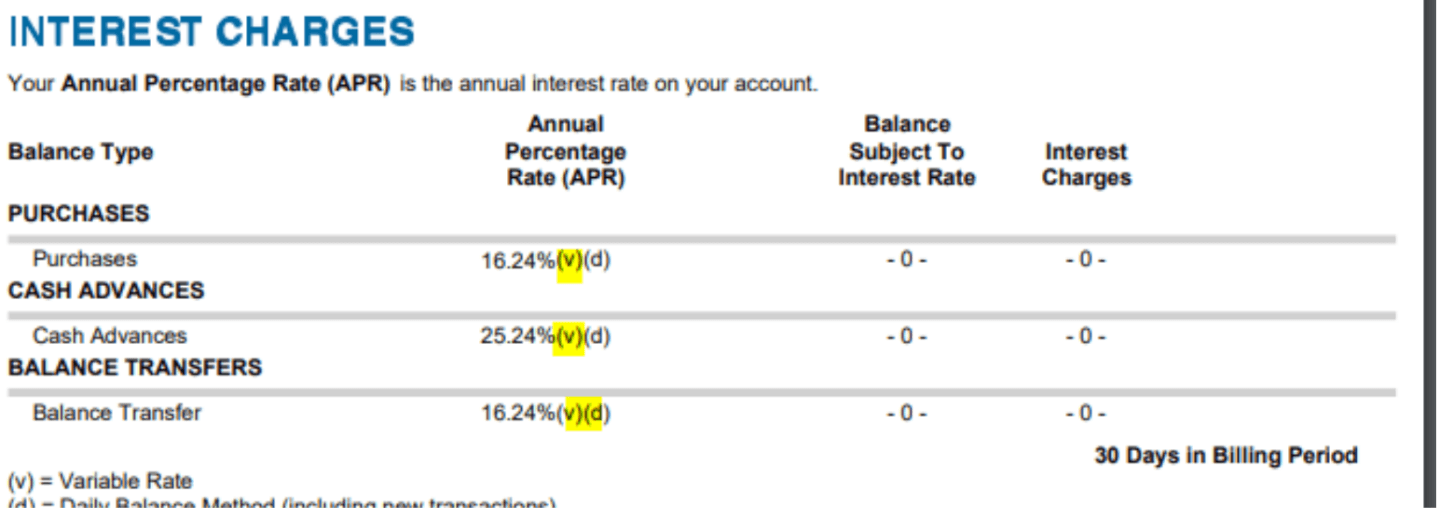

There are two types of interest rates credit cards could possibly have. One is fixed (f) and one is variable (v). If a credit card has a fixed interest rate then your interest rate will be fixed to a specific number which stays the same until the credit card issuer decides to raise it (which will be discussed later in the post). But some credit cards will not include a fixed rate. Rather, they will have a variable rate which can fluctuate along with the interest rate market.

Will interest rates on my existing credit card balance increase?

Fixed rate credit card

For existing cardholders who have a fixed interest rate, it’s not so simple for a credit card issuer to raise the interest rate. Here is when a bank can or cannot raise your interest rate.

- A bank generally cannot raise your interest rate within the first year

- A bank cannot raise the rate on an existing balance unless it’s one of the following:

- A promo rate or intro 0% APR promo has expired

- You were 60 days late or more on a payment (the old rate must be reinstated after 6 months of on time payments)

- The credit card issuer must give you 45 days notice before they raise your interest rate

Variable credit cards

With a variable rate, the bank can increase your APR even on existing balances. Credit cards that include a variable rate are most likely already paying more interest on credit card debt due to the interest rate increase by the Fed.

How do I know if my credit card interest rate is variable or fixed?

You can call the number on the back of your card and ask customer service. Or, you can check any of your statements to see if you see a (v) next to the interest rate. If you see that (v) then it means the rate is variable.

If I have 0% APR on my card does anything change?

No. You will still be left with 0% APR until the promo expires and then the fixed or variable rate will kick in.

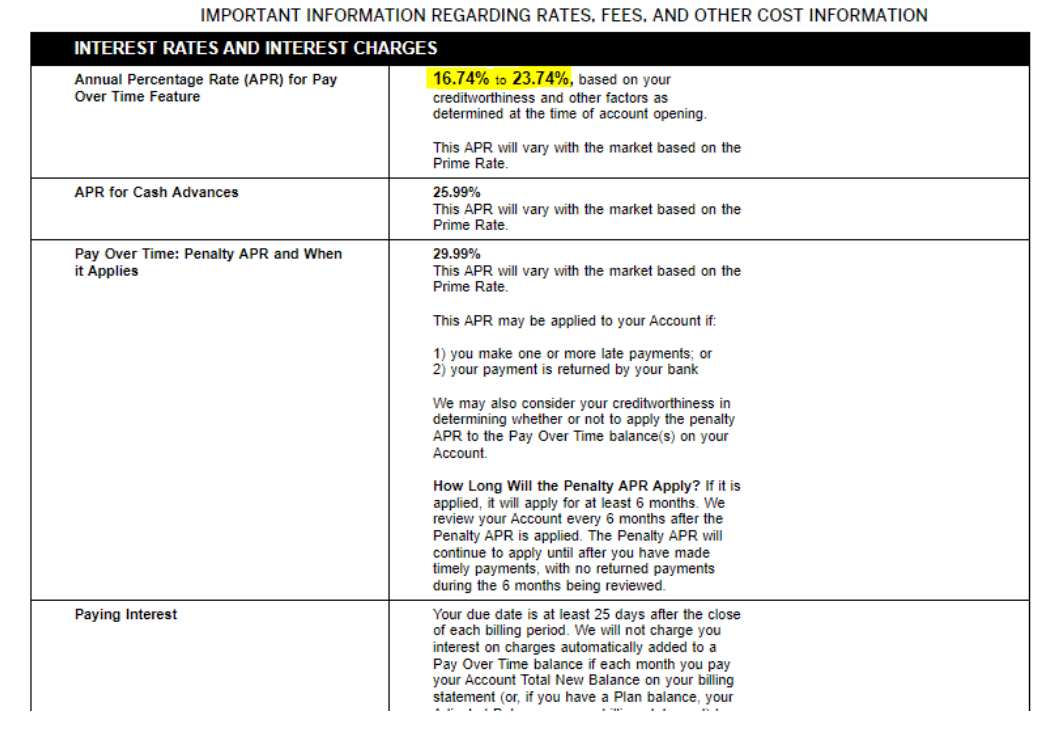

Will the interest rate be higher for new applicants?

If you decide to apply for a credit card today you will see a higher interest rate approved than before the rate hiked. Almost all credit cards updated the variable rate table for new applications and now reflect higher interest rates.

Conclusion

So make sure to check your statement to see if your credit card interest rate is fixed or variable (as described above). If it’s fixed then you may not see a change but if the rate is variable then it’s most likely that you’re already paying more interest on credit card debt due to the rate increase by the Fed.

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments