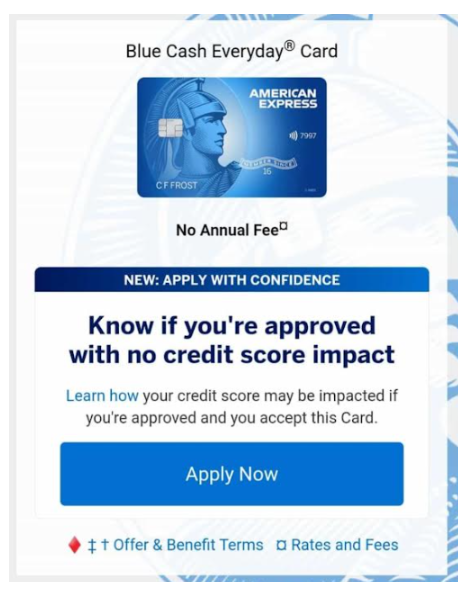

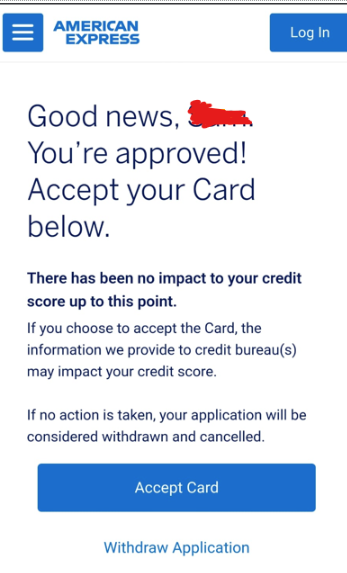

Amex released a new feature called “Apply With Confidence”. You will now get a 100% guaranteed approval for any Amex personal card with only a soft pull (a soft pull has no impact on your credit score). Only once you’re approved and agree to accept the approval will Amex pull your credit with a hard pull.

How does Apply With Confidence work?

When applying for any personal Amex credit card, Amex will not do a hard pull on your credit report until they 100% guarantee that you will be approved. Once you’re approved you can choose to accept the card. Only once you choose to proceed, will Amex do a hard pull on your credit report.

The new application experience is currently available for individuals applying for a U.S. Personal Card via HelpMeBuildCredit, at AmericanExpress.com/us/credit-cards, or by calling American Express, and is not available if you apply for a Card after you log into an existing Card Member Account.

Why this matters?

Many people are afraid to apply for credit cards as they are concerned they will get declined and it will result in a credit pull on their credit report for nothing. With Apply With Confidence, Amex is giving everyone a chance to apply for an Amex card without being concerned of damaging their credit.

Want to try to apply for an Amex card and see if you are approved with no credit score impact? Check out Amex personal credit cards here.

With Apply With Confidence, you will know if you’re approved for an American Express personal Card with no impact to your credit score. If you’re approved and choose to accept the card, your credit score may be impacted.

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

How often can I try to apply?