Tax season is here. What’s the connection between tax and credit cards? A lot! In this post, we’ll discuss paying taxes with credit cards and debit cards. Why? To make paying taxes rewarding (as rewarding as paying tax can be)!

When is it worth it to pay my taxes with my credit card?

When you pay taxes with a credit card, there will be a fee ranging from 1.85% to 1.98%.

In order for it to be worthwhile for you to pay with a credit card, your total rewards will need to equal MORE than that 1.85% fee.

Let’s illustrate this with an example: Let’s say you need to pay $10,000 in taxes.

$10,000 x 1.85% = $185.

You’ll be paying an additional fee of $185. That means that the total will be $10,185

So your rewards need to be worth more than $185. This is doable with a card like the Amex Blue Business Plus card that allows you to earn 2 membership reward points for every dollar you spend. If you value the membership rewards points at 1.5 cents per dollar, then you end up with a 3% value which totals $300 with the example we used ($10,000 tax payment).

The Chase Ink Premier card earns 2.5% cashback on transactions of $5k or more. Plus you earn a $1,000 bonus after spending $10,000 within the first 3 months! This card is pure profit for your tax bill!

Discover also has a card, Discover It Miles, that earns 3% cashback for the first year.

When else is it worth it to pay my taxes with my credit card?

There are many other pros to paying your taxes with your credit card. Here are some of them:

- To reach your “minimum spend” in order to access the welcome offer.

For example, you can earn 90,000 points after spending $6,000 within the first 3 months on the Chase Ink Unlimited and Chase Ink Cash cards. With these cards you can also get 0% APR for 12 months on purchases.

- To get your taxes interest fee for 0% APR for up to 21 months, on a 0% APR card.

- To reach your “minimum spend” in order to qualify for a free night in a hotel, or for elite status.

For example, with the Hilton Honors Surpass card, you can earn a free night after you spend $15,000 within a calendar year. You can also get a complimentary upgrade to Hilton Diamond Status after spending $40,000 on the card, within a year. With the American Express Delta Reserve card, you can earn Silver Medallion Status with $60,000 in spend, and Gold Medallion Status after $120,000 in spend.

Some have reported last year that credit card payments did not count toward minimum spend on their Amex cards. In most cases, people did not have an issue but proceed with caution.

Paying taxes with a debit card

Another way and reason it might be worth it to pay your taxes and earn rewards is paying your taxes with a debit card. There are some debit cards that earn 1% -2.2% cashback. The fee for paying taxes with a debit card can be as low as $2.20 – which is a flat fee (no matter how much you pay in taxes).

Debit cards that earn rewards

Discover Debit card

With the Discover Debit card you earn 1% cashback on the first $3,000 you spend per month.

Upgrade Debit card

The Upgrade Debit card earns unlimited 1% cashback on all purchases.

PayPal Business Debit card

The Paypal Business Debit card earns unlimited 1% cashback on all purchases.

How to pay taxes with a credit card or debit card

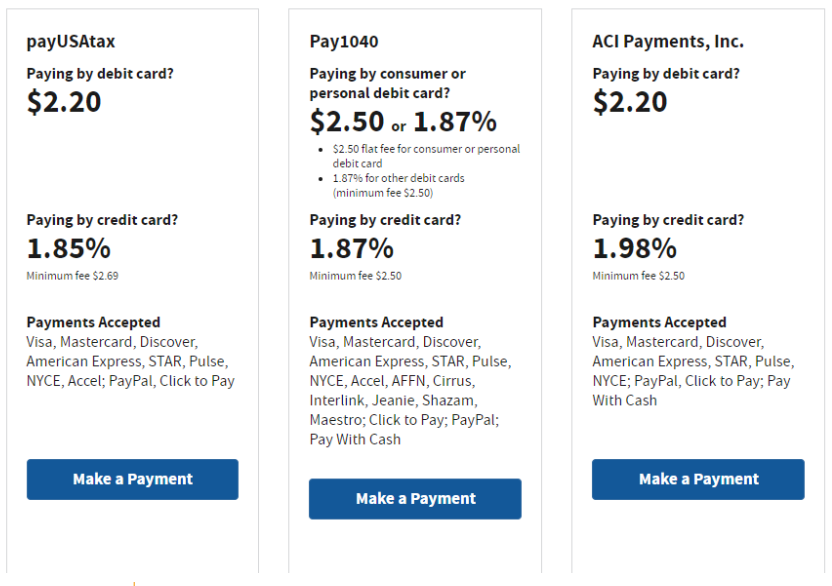

The IRS lists on their website the three third-party companies that you can pay your taxes to, using a credit card.

- Fee to pay with a credit card: 1.85%

- Fee to pay with a debit card: $2.20 (flat fee)

- Accepts: Visa, MasterCard, Discover, Amex, Star, Pulse, Accel, PayPal

- Fee to pay with a credit card: 1.87%

- Fee to pay with a debit card: $2.55 (flat fee)

- Accepts: Visa, MasterCard, Discover, Amex, Star, Pulse, NYCE

- Fee to pay with a credit card: 1.98%

- Fee to pay with a debit card: $2.20- flat fee for transactions up to $1,000, and $3.95- flat fee for transactions above $1,000.

- Accepts: Visa, MasterCard, Discover, Amex, Star, Pulse, NYCE, (digital wallets for Visa, MasterCard, and Amex) Paywithcash, Paynearme

- Note: ACI Payments doesn’t accept the Point debit card

Here are some additional options, not listed on the IRS website, to pay taxes with credit cards or debit cards.

Melio

- Fee to pay with a credit card: 2.9% (only business credit cards are accepted)

- Fee to pay with a debit card: $0 (only business debit cards are accepted)

- Accepts: Visa, MasterCard, Discover, Amex (only business credit or debit cards, not personal)

Plastiq

- Fee to pay with a credit card: 2.85%

- Fee to pay with a debit card: 1%

- Accepts: Visa, MasterCard, Discover, Amex

Are the payment processing fees tax deductible?

Payment processing fees are tax-deductible as a business expense for your business tax returns, but they are not deductible on your personal tax returns.

Overpaying your tax bill to spend more on your card

If you overpay the IRS, then the IRS will issue a refund to you for the amount you overpaid. That means that you can max out- charge even more than you owe for taxes- to be able to achieve spending more on your credit card. But, as with everything in life, it’s never good to overdo it, and since 2020 the time to process and receive some overpayment refunds has soared to 6 months or longer.

Only two direct credit card payments per person

If you want to split your tax bill with multiple credit cards, you can do so. In general, you can only pay the IRS twice, using a credit card for each tax type. This limit is only enforced per tax period so if you pay taxes each quarter, then you can make two payments by credit card each quarter. You can check out a chart with more details on the IRS website found here.

As per the Frequent Miler, these limits are only enforced per credit card processor so if you have already paid two payments with, lets say, Pay1040, you can do another two with PayUSATax, and another two with ACI Payments etc.

Because Plastiq sends paper checks to the IRS, the two card payment rule doesn’t apply to payments sent with that service.

If you’re looking for a great signup bonus to make paying taxes a little more rewarding, then check out our comprehensive list of all great credit card sign-up bonuses available now, here. You can also check out a comprehensive list of 0% APR offers available here.

Paying property tax with a credit card

It’s possible to pay your property tax or other types of taxes using a credit card through third party companies, and it may be possible to pay your county directly. Fees vary though, so check to see whether paying direct is cheaper than using one of the following options.

Here are some options:

- Fee to pay with a credit card: 2.85%

- Fee to pay with a debit card: 1% (excludes online-only bank debit cards)

- Accepts: Visa, Mastercard, Amex, and Discover

- Fee to pay with a credit card: 2.9% (only business credit cards are accepted)

- Fee to pay with a debit card: $0 (only business debit cards are accepted)

- Accepts: Visa, Mastercard, Amex, and Discover

What are some cons for paying taxes with a credit card?

- Processing fees- if your processing fee (the percentage or the flat fee) is more than your rewards, then it may not be worth it to pay with your card.

- Interest charges- if you don’t have a 0% APR card, then it’s only worthwhile to pay your taxes with your credit card if you pay the full balance amount. Otherwise you risk incurring high-interest charges.

- High credit utilization- paying taxes with your card can lead to a temporary credit drop if you use too much of your utilization rate.

You can calculate your utilization rate by dividing your credit card balance by your total available credit.

For example: $4,000 = balance. $10,000 = available credit.

Utilization rate = 40%. Adding a $2,000 (fill in with your amount) tax payment will lead to a 60% utilization rate. That is way too high! Your utilization rate shouldn’t be more than 9%.

Keeping all that in mind, make sure to make the decision based on if it’s best for YOU!

Happy tax season!

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments