Congratulations! You turned 18 and you decided you’re gonna do this. You’re going to start building credit like a boss! One teeny problem- you know you’re still young (c’mon, admit it!) so you wonder why the bank should trust you. How can you prove yourself trustworthy to the banks, at the age of 18?

You start asking. You turn to every one of your friends, uncles, and your neighbor (the one that’s a self-proclaimed credit guru). Everyone gives you different answers on what the best way to build credit at 18 is. You google “How to Build Credit at 18” but only get ads for credit repair companies. Sounds familiar?

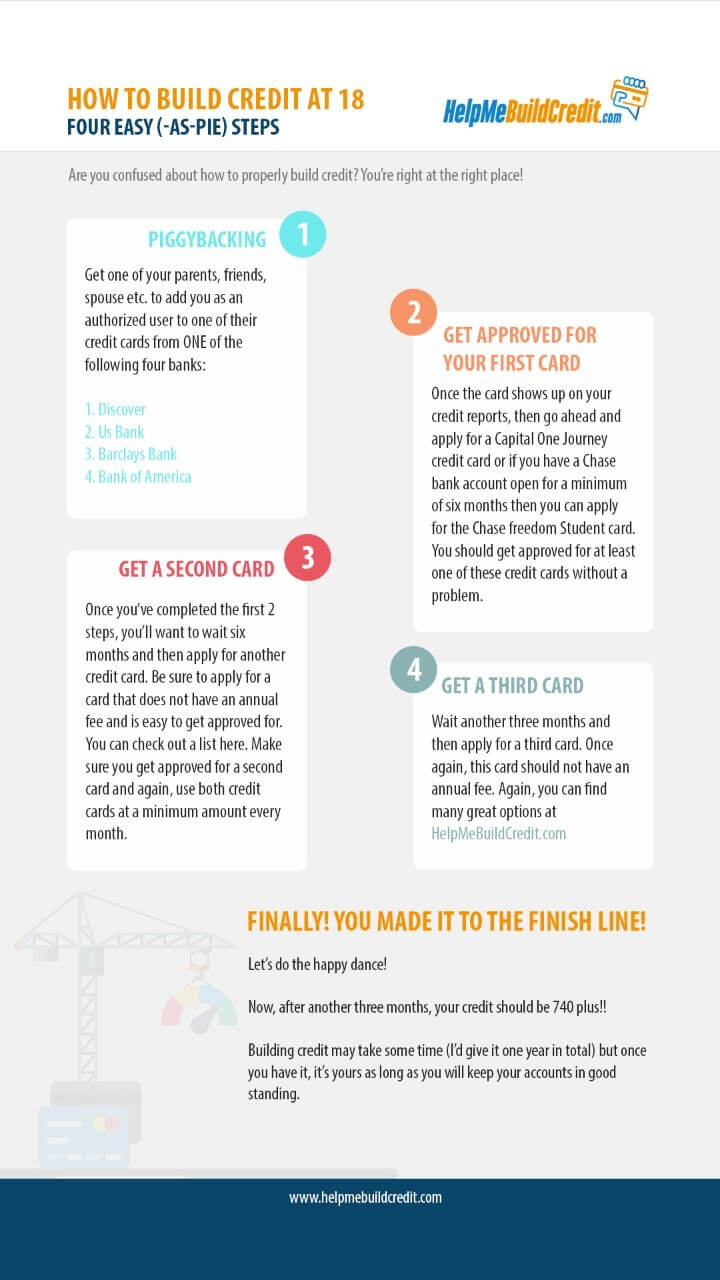

Are you confused about how to properly build credit? You’re right at the right place!

Yup, that’s what we do at HelpMeBuildCredit. We help people like you do just that – build credit.

Here, in this post, I will teach you how to build your credit quickly, in four easy but essential steps. This is the method I use to help many young adults build credit. I used it many times and it always worked. Just make sure to be motivated and follow the steps exactly as written.

Step 1- PiggyBacking (Authorized User)

Get one of your parents, friends, spouse etc. to add you as an authorized user to one of their credit cards from ONE of the following four banks:

(Citi and Capital One may also work, but not as well as the others).

Very important: Make sure the card that you get added to has all of the following requirements:

- The card is at least two years old

- The card does not have a high balance

- The card was used within the last three months

- The card never ever had any late payments

This is known as “piggybacking” cuz’ that’s exactly what you’re doing! You’re getting the cardholder’s credit information to be counted as yours. That’s, quite obviously, why you want to be sure to make they fall into all of the above categories because if they’re history is perfecto, it’ll be easier for you to apply for your first card.

When being added as an authorized user, instruct the cardholder that they should try to use your address when providing your details, not the primary cardholder’s address, as the address used will be the address that will show up on your credit report.

Wait ‘till the authorized user shows up on your credit reports (this usually happens after about 30 days) You can track that very easily on Credit Karma or Wallethub)

Step 2 - Get Approved for your first card

Once the card shows up on your credit reports, then go ahead and apply for a Capital One Journey credit card or if you have a Chase bank account open for a minimum of six months then you can apply for the Chase freedom Student card. You should get approved for at least one of these credit cards without a problem. (If you get declined for both cards, feel free to reach out to me for further advice at [email protected]).

Once you get approved, use the card at a minimum amount each month.

(Once you get approved for your first card, I recommend removing yourself from being an AU on someone else’s credit card, as any late payment or high balance may have a significant impact on your credit report. Read this post on how to properly remove yourself from being an AU.)

Step 3- get a second card

Once you’ve completed the first 2 steps, you’ll want to wait six months and then apply for another credit card. Be sure to apply for a card that does not have an annual fee and is easy to get approved for. You can check out a list here. Make sure you get approved for a second card and again, use both credit cards at a minimum amount every month.

The reason why I recommend choosing a card that does not have an annual fee is that you’ll want to always keep these cards open, since the longer you have them open, the better your credit will be. It’s easy to keep the card open when you don’t have to pay an annual fee.

Step 4 - Get a third card

Wait another three months and then apply for a third card. Once again, this card should not have an annual fee. Again, you can find many great options here.

Finally! You made it to the finish line!

Let’s do the happy dance!

Now, after another three months, your credit should be 740 plus!!

Building credit may take some time (I’d give it one year in total) but once you have it, it’s yours as long as you will keep your accounts in good standing.

How do I maintain good credit?

Don’t be like Silly Sally Saucer that invested thousands of dollars and hours to create a stunning landscape in front of his house, only to neglect it and let it become overgrown.

In order to make sure your credit score keeps on going higher and higher, make sure to maintain it properly.

Keep note of the following:

- On-time payments: Always be extremely on top of making all payments on time

- Credit utilization: Be careful not to spend a lot on your cards. Never spend more than 9% of your credit limit. If your credit limit is $1,000, then do not spend more than $90. This can significantly hurt your credit.

- Use cards monthly: Your accounts need to stay active. Every card should be used at least once every six months.

- Never close your three oldest credit cards: Be careful to never close the first three credit cards you get approved for, as this can affect your credit history and affect your credit score

Congratulations on finally joining us adults here on this planet! (the ones with good credit, that is 🙂

Keep those scores popping! C’mon make us proud here at HelpMeBuildCredit:)

Download this infographic to save or share with friends!

Hi, thanks for making this info available to the public. I never went ahead and built my credit b/c it sounded quite complicated. Now with your step by step guide, it seems quite clear and simple! Thank you so much!

Thanks CF, that is great to hear!

As I site possessor I believe the content material here is rattling wonderful , appreciate it for your efforts. You should keep it up forever! Good Luck.

thanks, Food!

Hey I have done these steps around a year ago and have 3 cards (TD-cash,Apple Card and the Chase freedom unlimited) and I never made a late payment or went over 10% utilization. My score is 750 how long will it take to go up from there. Thx

750 is a perfect score. Congratulations! Continue doing what you are doing and you should see your score keep on rising and you should be able to reach 800+ within the next year or two.

U mentioned not to use more than 9% of the credit limit.

Did you actually mean not using, or did you mean that a day or two before the statement date, the bance should be under 9%, but actually using more throughout the the statement cycle is okay?

If you pay down the balance to 9% before the statement prints then your good. You can find more info on credit utilization here