There are always many great welcome offers available on credit cards. However, not always is it the right time for you to apply. Even more, the offer may sometimes sound better than it is. Here are some pointers to consider when choosing a welcome offer to make sure it is the right choice for you and that you will end up gaining, not losing.

1. Make sure the offer is an all time high

Just like the stock market, welcome offers are constantly increasing and decreasing. Sometimes an offer can have an over 50,000 point difference between an offer all-time high and the low!!

Because most welcome offers have restrictions on how often you can get them, I would only choose cards when the offer is at an all-time-high. Because if you get them at a lower point you might lose out if the offer later increases.

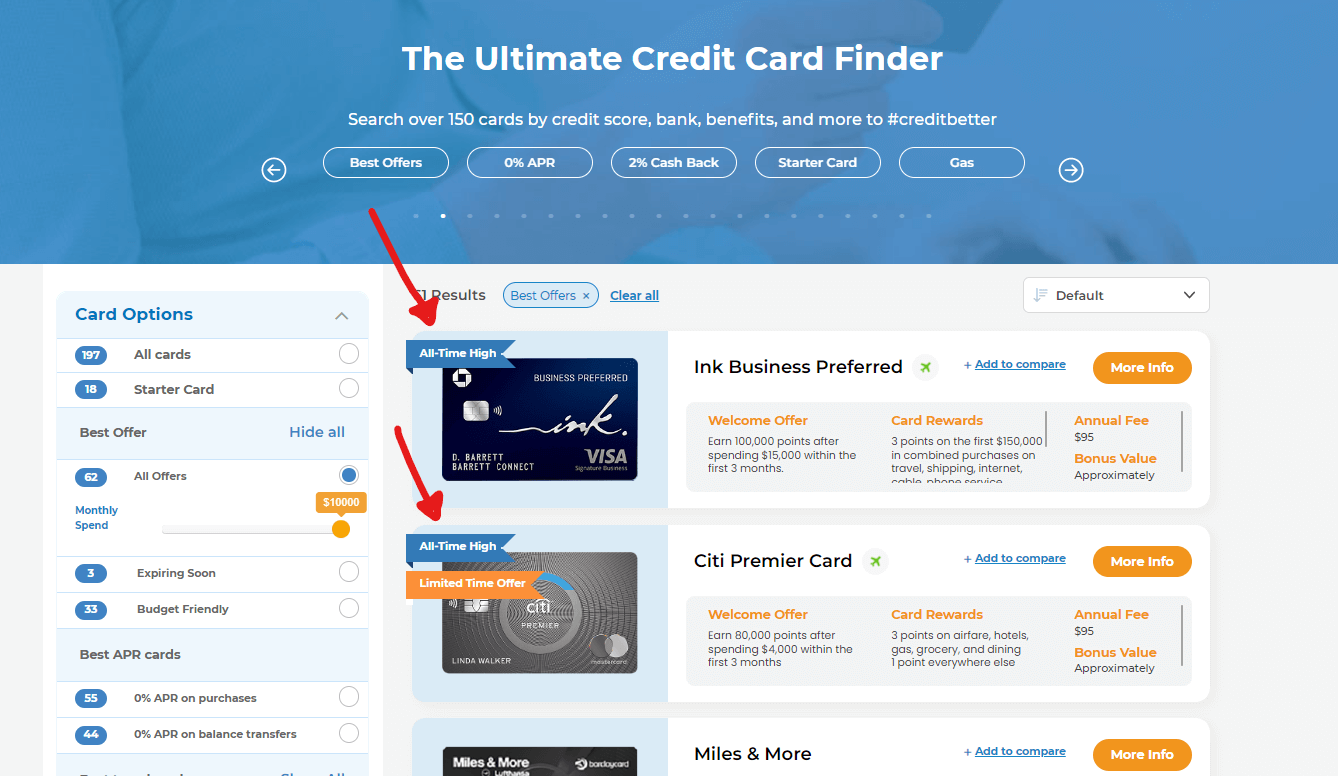

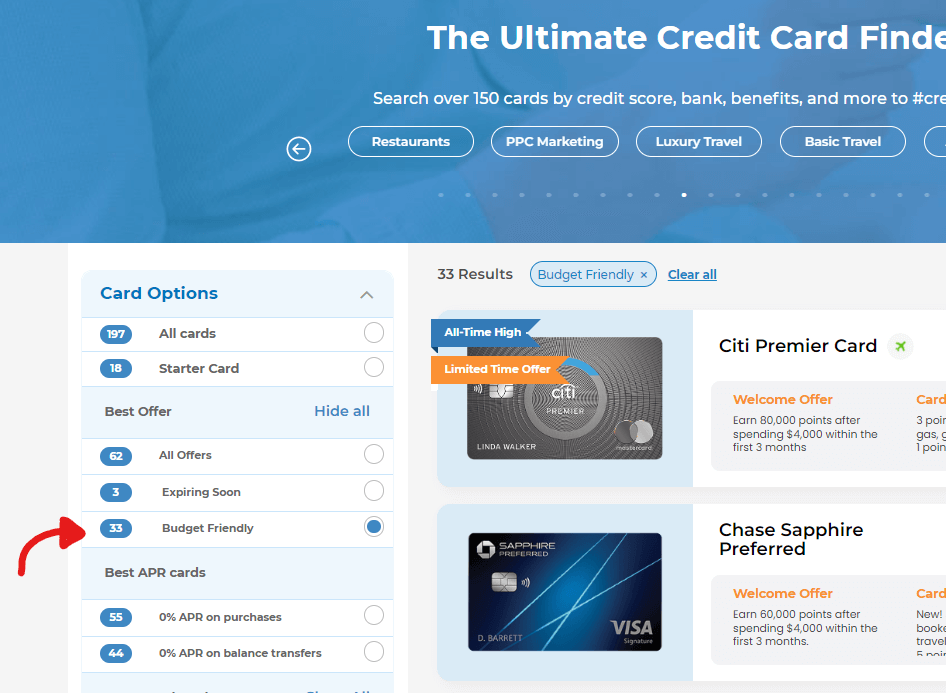

To make it easier for you when searching offers on our website, you can look out for offers with the “all-time high” label on them

As you can see, right now, the Ink Preferred and the Citi Premier Card both have an all-time-high offer.

2. Make sure you're eligible for the offer

Most cards have restrictions on how often you can get the welcome bonus on the same card. For example, Amex has their once in a lifetime rule so you can only get a bonus on each Amex card once per lifetime. And you can only get a card in the Chase Sapphire family once within 48 months.

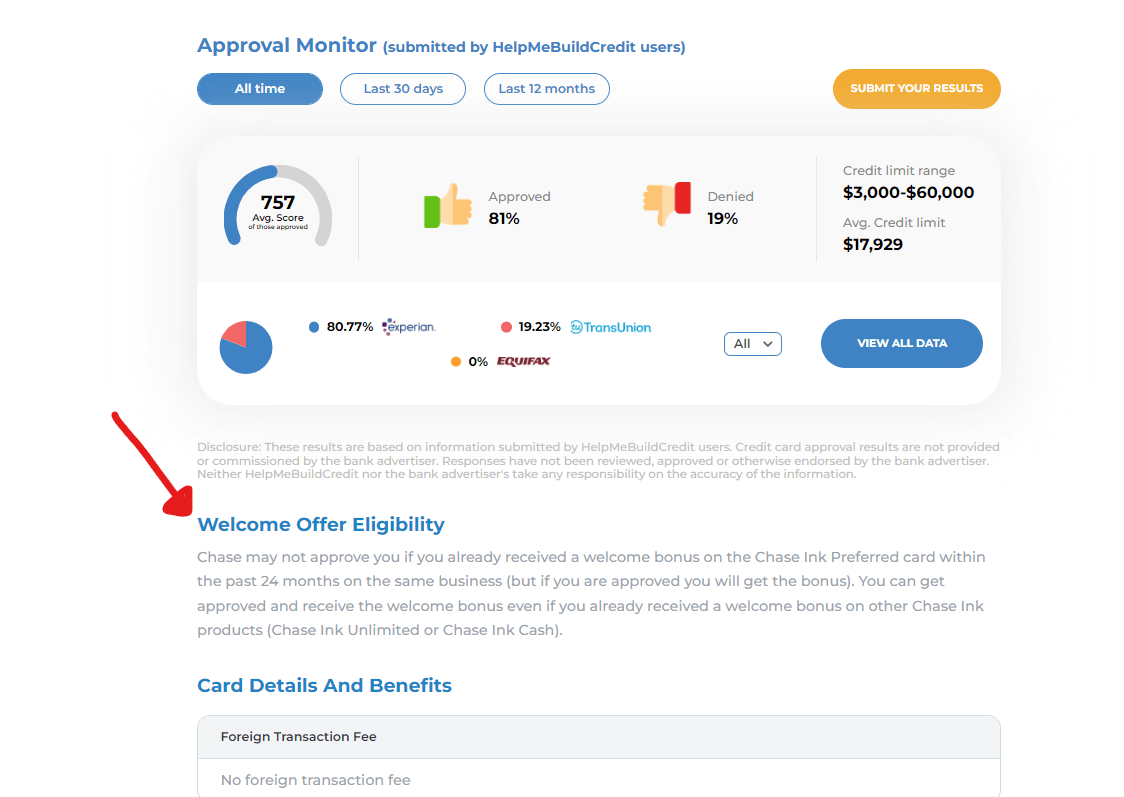

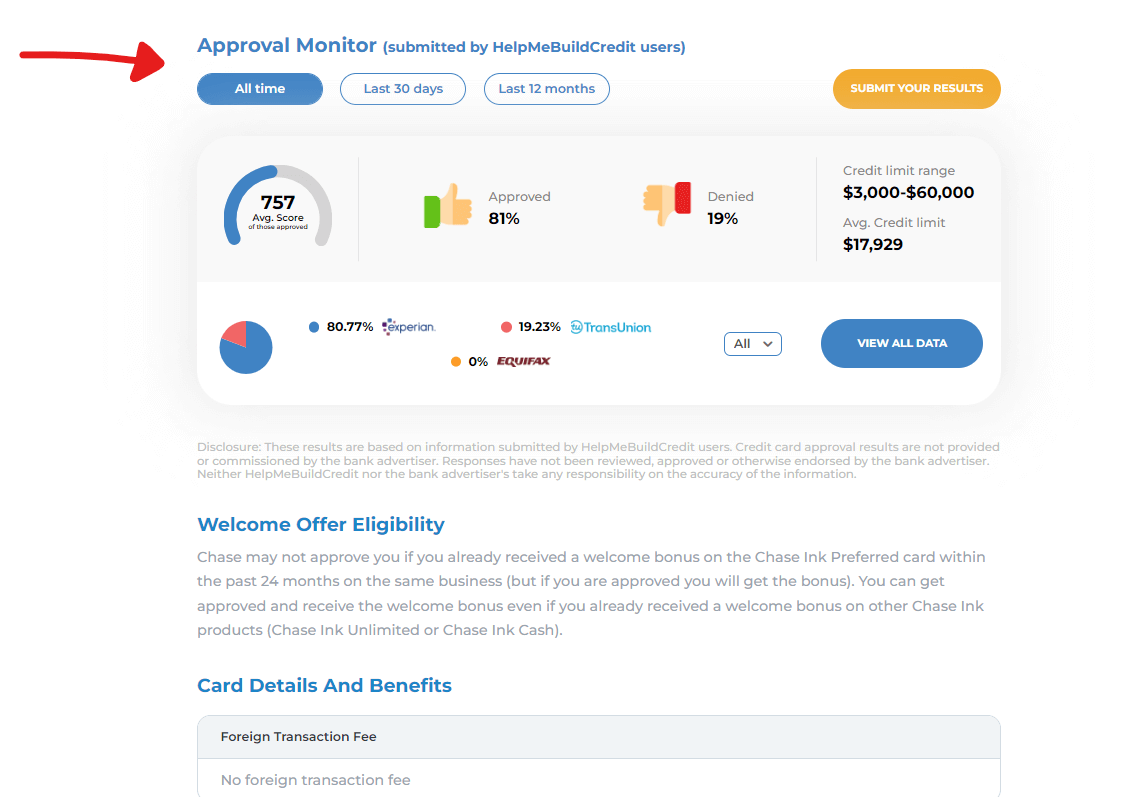

So in order to make sure you are eligible for the offer, remember to always check our credit card pages for the welcome offer eligibility section on our website.

3. Make sure your credit is sufficient

There are cards that will approve beginners, but for some cards you need good, or even excellent, credit.

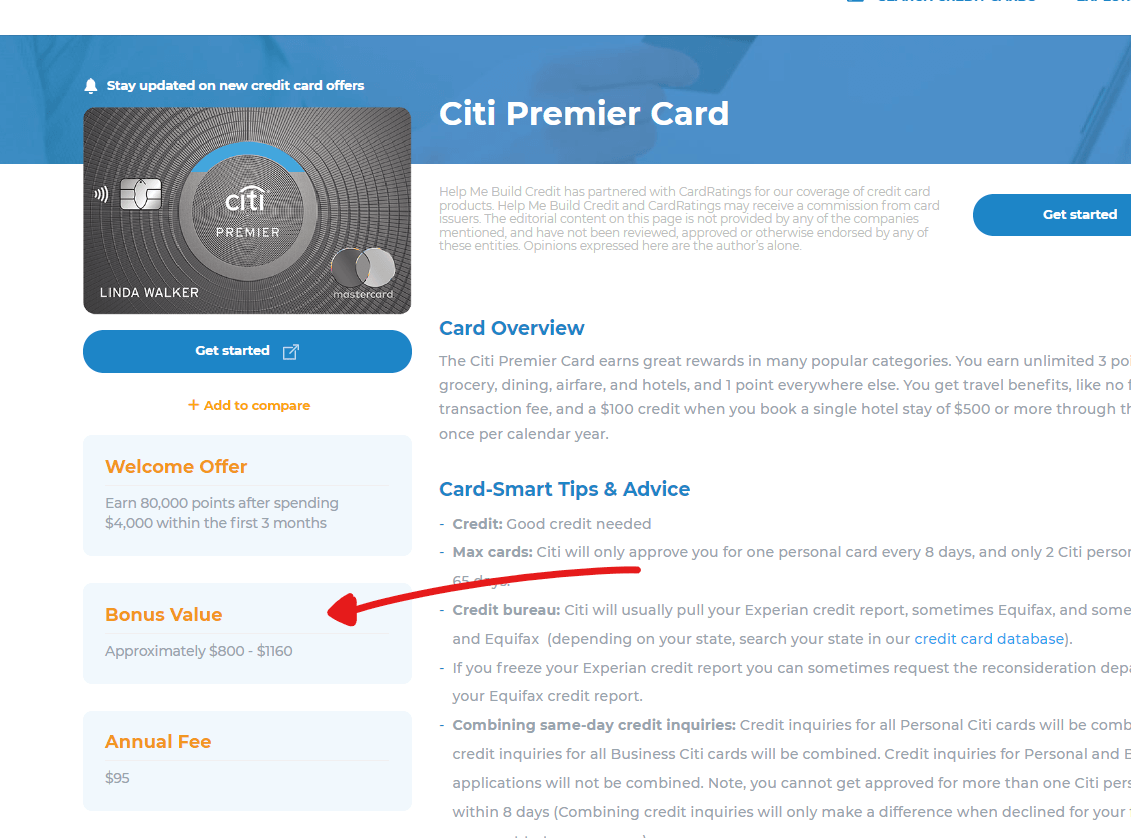

As an example, to get approved for the Capital One Venture X Rewards Credit Card, you need 2+ years of credit history, while for the Capital One Venture Rewards Credit Card, one year of credit history is enough. The Citi Premier Card is now approving applicants with credit scores as low as 680. So knowing if your credit score and credit history is sufficient or not, is key.

You can find statistics of approvals for each credit card on every one of our credit card pages. You can sift through data and see who got approved and how much credit history they had. Check out the data points in our Credit Card Database.

4. Follow the bank rules

If you don’t comply with the bank rules, the banks won’t approve you for their cards.

The banks have rules and you will only be eligible for cards based on these bank rules. It is worth your while to check through the list of rules before you choose an offer, to avoid disappointment!

Some of the most famous bank rules are as follows:

- Chase will decline an applicant that has opened 5 or more cards (other issuers included) in the past 24 months. Hence, 5/24 rule.

- In a time span of 90 days, you can only get approved for 2 Amex cards.

- Officially, you can only get approved for up to – and including- 5 Amex credit cards (including personal and business), but this rule isn’t always enforced (please note the total of 5 credit cards excludes some Amex cards that are No Preset Spending Limit* cards like the Amex Platinum, Amex Gold, etc)

- You can only get approved for up to-and including- 10 Amex No Preset Spending Limit* cards. (This rule is not always enforced)

- Citi will only approve you for one personal card every 8 days, and only 2 Citi personal cards within 65 days.

You can check out many more bank rules on our post about Credit Card Application Rules.

5. Make sure you can complete the spend

Before you choose an offer you need to make sure you can afford to spend the minimum amount that needs to be spent in order to reach the bonus. Some offers have a higher spend amount needed and some have lower.

Depending on your budget, make sure you can complete the spend in order to get the offer.

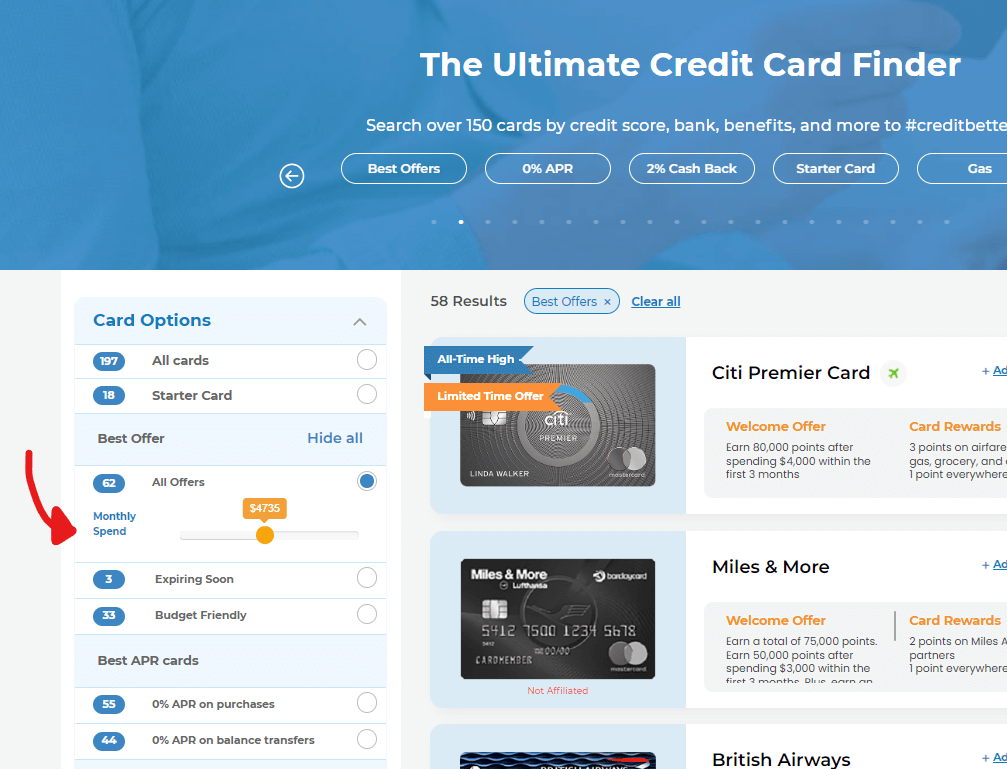

In the Ultimate Credit Card Finder, you can filter the best offers based on your monthly spend amounts.

We even have a filter for budget friendly offers, which will filter the best offers that have a spend amount of less than $5,000.

6. Make sure the annual fee makes sense

You may have found an awesome offer, but if the card has a high annual fee as well, then the welcome offer may not be worth much after having to pay the fee.

For example, the Chase Sapphire Preferred and Chase Sapphire Reserve have the same offer of 60,000 points after spending $4,000 within the first 3 months. But the Preferred has an annual fee of $95, while the Reserve has a way higher fee of $550. That’s where the difference lies.

So remember to always deduct the annual fee to make sure the offer is still worth it.

7. Check the point value

Some offers sound huge because they promote a huge point amount but in real life, the points are worth peanuts compared to other cards that offer less points, but the points are valued more.

That’s where the “bonus value” section on our website comes into play. Always double check the bonus value to see if the amount of points offered are valued enough compared to other available offers.

*No Preset Spending Limit means the spending limit is flexible. [In fact,] unlike a traditional [credit] card with a set limit, the amount you can spend adapts based on factors such as your purchase, payment, and credit history

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments