There are multiple reasons why you may want to get approved for several credit card applications at once. Reasons may include getting multiple welcome bonuses at the same time, getting more money on 0% APR, and more. When a credit card issuer sees too many recent credit inquiries on your credit report, they may decline your credit card application due to too many recent inquiries.

If you’re planning to apply for several credit cards at the same time you need to do it smartly so you don’t get declined due to the new credit inquiries.

In this post, we will teach you how to properly strategize your applications so that you can up your chances of getting approved for several credit cards within a short period of time.

Two browser method (2BM)

First things first, let’s get 2BM out of the way. Years ago, it was possible to apply for multiple credit cards by submitting the applications within the same second using different browsers for each application. This was done to help avoid the banks from seeing each other’s credit inquiries. This trick is now dead. The credit bureaus currently update files within a microsecond and it is impossible for you to act faster and submit a second application before the first credit inquiry shows up.

Splitting up the applications between different credit bureaus

In the USA, there are three credit bureaus which each independently collect your credit information. Each one of them creates their own credit report.

The three credit bureaus are:

- Experian

- Transunion

- Equifax

Most banks will only pull one of your three credit reports, and thankfully, not all banks pull from the same credit bureau. This is the key to how you hide the credit inquiries from each bank seeing the other guys, by applying for credit cards that pull from different credit bureaus.

The first step to take in order to be successful in getting approved for several credit cards is to know which bank will pull from which credit bureau.

Here is the list of which credit bureau each bank pulls (You can track live and updated data in our credit card database).

| Credit Bureau | Notes | |

| Amex | Experian | For existing Amex cardholders, Amex does not pull your credit for new credit card applications. |

| Avianca | TransUnion | |

| Apple card | TransUnion | They will first only do a soft pull to check if you qualify. And if you qualify and accept the offer, only then will they do a hard pull. Some have had success of avoiding the hard pull by freezing Transunion after the preapproval but before the final decision). |

| Barclays | Transunion | |

| Bank Of America | Experian | If you freeze your Experian report then they will pull your TransUnion credit report. |

| Capital One | Experian, Transunion, and Equifax | If you freeze one credit bureau you can still get approved (the credit bureau you freeze cannot be Transunion). |

| Chase | Experian | |

| Citi | Citi will usually pull your Experian credit report, sometimes Equifax, and sometimes Experian and Equifax | If you freeze your Experian credit report you can sometimes request the reconsideration department to pull your Equifax credit report. |

| Citizens | Equifax | |

| Discover | Discover will usually pull your Experian credit report, sometimes Equifax. | If you freeze your Experian credit report then Discover will be glad to pull from either TransUnion or Equifax. Chat with a rep after submitting the application |

| Elan Financial | Experian | |

| HSBC | Equifax | |

| Key bank | Equifax | |

| Synchrony | Transunion | |

| TD Bank | Experian | |

| US Bank | Experian | If you frequently apply for credit cards, first freeze your IDA/ARS bureaus before applying for a US Bank credit card. |

| Wells Fargo | Experian, (in some states they pull Experian and Equifax). |

Strategize the applications in the right order

Now that you understand which credit bureau each bank will pull your credit report from, it’s time for step two.

You need to know how sensitive each bank is to recent inquiries so that you can set up the proper order of which credit card you will apply for first and which one second. The banks that are more sensitive to recent inquiries should go first. Then apply for other cards from banks that are less sensitive.

Based on my experience these are the banks that are very sensitive to recent inquiries:

And these are the banks that are less sensitive to recent inquiries:

- Amex

- Bank Of America (if you only have one recent inquiry)

- Citizen (if you only have one or two recent inquiry)

- Barclays (if you only have one or two recent inquiry)

Make sure to first apply for the credit cards that are more sensitive. Do the other credit cards second so that you do not get hit with a denial when applying for multiple cards due to the recent inquiries.

Don't waste credit inquiries - know the bank rules before applying

You can’t ever know for sure if you will get approved for a credit card or not. But there is a certain level of what you can know before. Do not try a bank where you don’t have any chance of getting approved for their cards.

Here are some things to keep in mind.

Are you eligible under the bank's rules?

Many banks have rules in place on who they will approve and who they won’t. Some of the most famous bank rules are:

- Chase will decline an applicant that has opened 5 or more cards (other issuers included) in the past 24 months. Hence, 5/24 rule.

- In a time span of 90 days, you can only get approved for 2 Amex cards. (AKA- 2/90. Spoof of Chase 5/24 rule ; )

- Officially, you can only get approved for up to – and including- 5 Amex credit cards (including personal and business), but this rule isn’t always enforced (please note the total of 5 credit cards excludes some Amex cards that are No Preset Spending Limit* cards like the Amex Platinum, Amex Gold, etc)

- You can only get approved for up to-and including- 10 Amex No Preset Spending Limit* cards. (This rule is not always enforced)

*No Preset Spending Limit means the spending limit is flexible. [In fact,] unlike a traditional [credit] card with a set limit, the amount you can spend adapts based on factors such as your purchase, payment, and credit history

- Citi will only approve you for one personal card every 8 days, and only 2 Citi personal cards within 65 days.

You can learn many more bank rules all listed in this post on Credit Card Application Rules.

Are you blacklisted by any bank?

If you know you’re blacklisted by any bank then take out their cards from your list. You do not want to waste a credit inquiry for nothing.

Did you recently have a returned check or something that might cause the bank to decline you?

If you recently had a returned check, for example on your Amex credit card, then Amex will hesitate to approve you for a new Amex credit card within the next 6 months. Keep this in mind when choosing your list of cards to make sure that your relationship with each bank you choose is perfecto. It’s important to note that if you have a bank account with the same bank you’re planning on applying for cards with, make sure your checking account is clean of any past overdraft fees etc.

Decide which cards you want to apply for and the order to so in

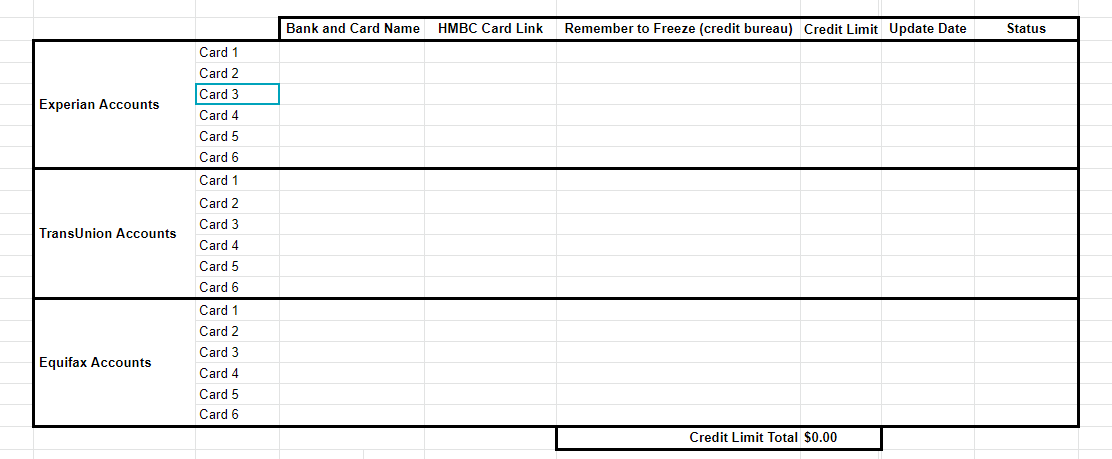

Keeping all this in mind, prepare a spreadsheet with the exact cards you’re looking to apply for. List the cards in an order of which card goes first and split up the cards between the different credit bureaus

The list should look like this.

Feel free to use this chart to help you strategize your cards (see the instructions on the sheet on how to copy the sheet so that you can use it for yourself)!

Remember to apply for all credit cards within the same day.

Go for a second round - Same day applications

Once you have submitted all the applications, take a moment to analyze the battlefield. Write down whether each application was approved or not. Also include the credit limit you were approved for.

Based on the results, consider applying for a second card within the same day from the same bank. In many cases you can get approved for a second card within the same day on the same credit inquiry.

Amex credit inquiries will be combined for same-day applications, as long as they are both approved for on the same day.

Please note, for some existing Amex credit cardholders, Amex will not do a hard credit pull when applying for a new credit card at any time.

I recommend applying for a second Amex credit card the same day you’re approved for a first one. I usually find that Amex approves a second card with the same credit limit as the first card was approved for.

Applications for all Personal BOA cards within 30 days will be combined.

Many data points suggest that Barclay’s inquiries which are done on the same day will be combined.

Please note, if you apply for one Barclays card and get approved, it is recommended to apply for a second card since Barclays is very good about approving for two cards, even within the same day. You might have to call the reconsideration department to push for the second card to get approved.

The data points are mixed. Some data points suggest that applications for all personal Chase cards within the same day will result in only one credit inquiry. Also, applications for all Chase business cards within the same day will result in only one credit inquiry. But, applications for personal and business cards will not be combined.

There are data points that suggest that Chase credit inquiries are not being combined for even two personal or two business cards done on the same day.

Applications for all personal Citi credit cards will be combined; also, applications for all Citi business cards will be combined. Personal and business cards will not be combined.

But, you cannot get approved for more than one Citi personal card within eight days (Combining credit inquiries will only make a difference when declined for your first try and you want to try a new one…)

Capital One credit inquiries will be combined. But, Capital One will only approve you for one credit card application within every six months. (Combining credit inquiries will only make a difference when declined for your first try and you want to try a new one…..)

Two Discover card applications in one day will result in only one credit inquiry. Be aware though, that Discover will not approve you for more than one credit card within every 12 months. (Combining credit inquiries will only make a difference when declined for your first try and you want to try a new one…)

Inquiries will not be combined at all.

There are some data points that suggest that Wells Fargo applications combine credit inquiries, but some suggest that they don’t.

How HelpMeBuildCredit can make applying easy

You mastered the skill of organizing your credit card applications. Let’s backtrack a bit to how HelpMeBuildCredit plays a part when you still are busy choosing the right credit cards for yourself.

At HelpMeBuildCredit, you can set up your game plan with just a few clicks.

Hundreds of cards

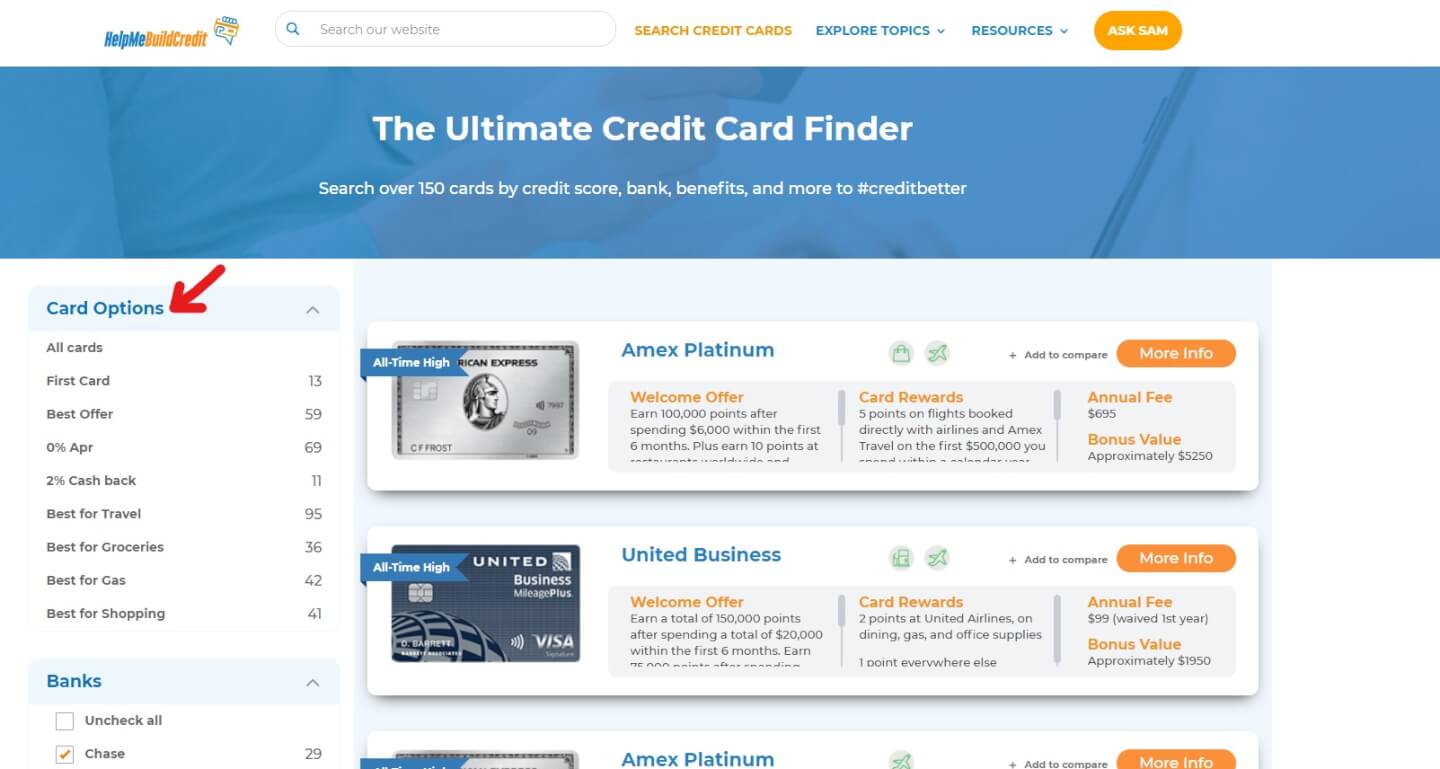

Here, you will find over two hundred cards to choose from. We present to you all the credit cards you can benefit from, even those we get zero commission on. HelpMeBuildCredit is here to serve you and we’d never deprive you of a good credit card offer out there. Pick from over 200 cards.

Loads of filtering options

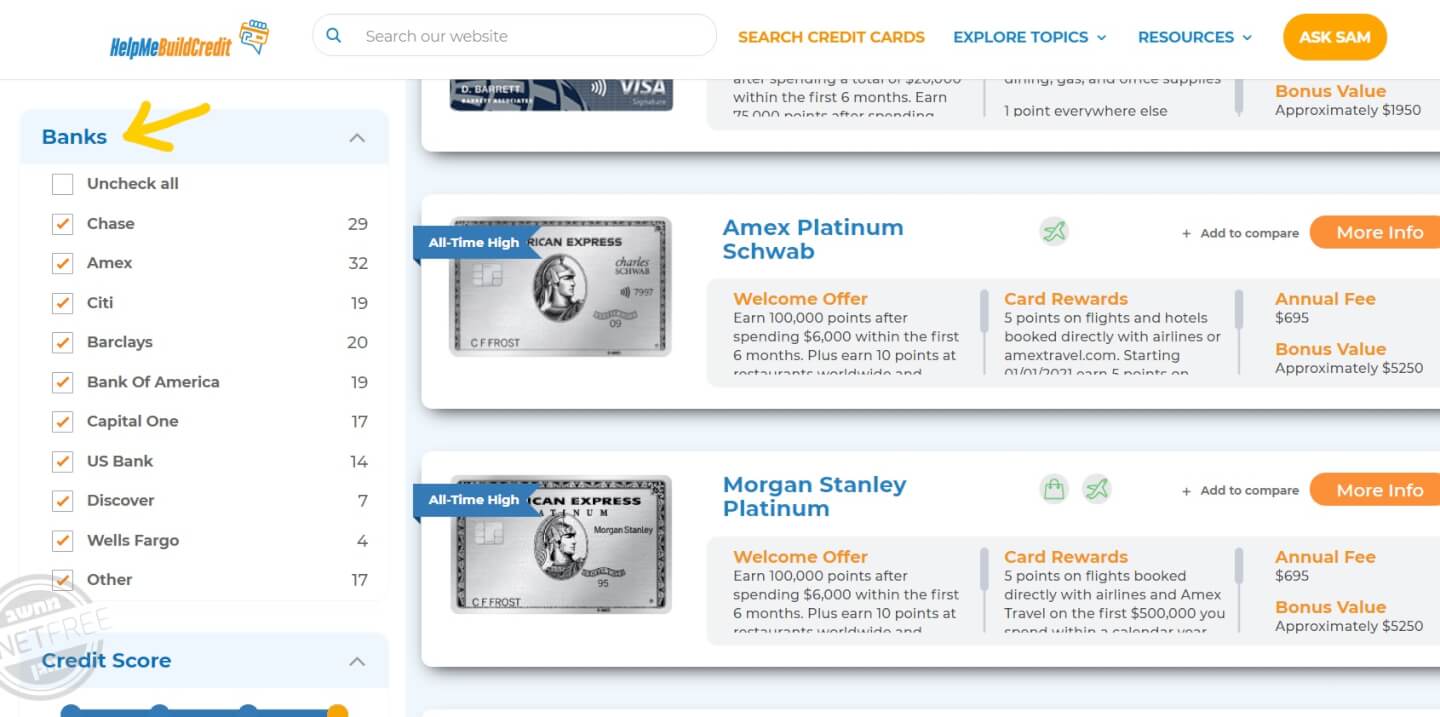

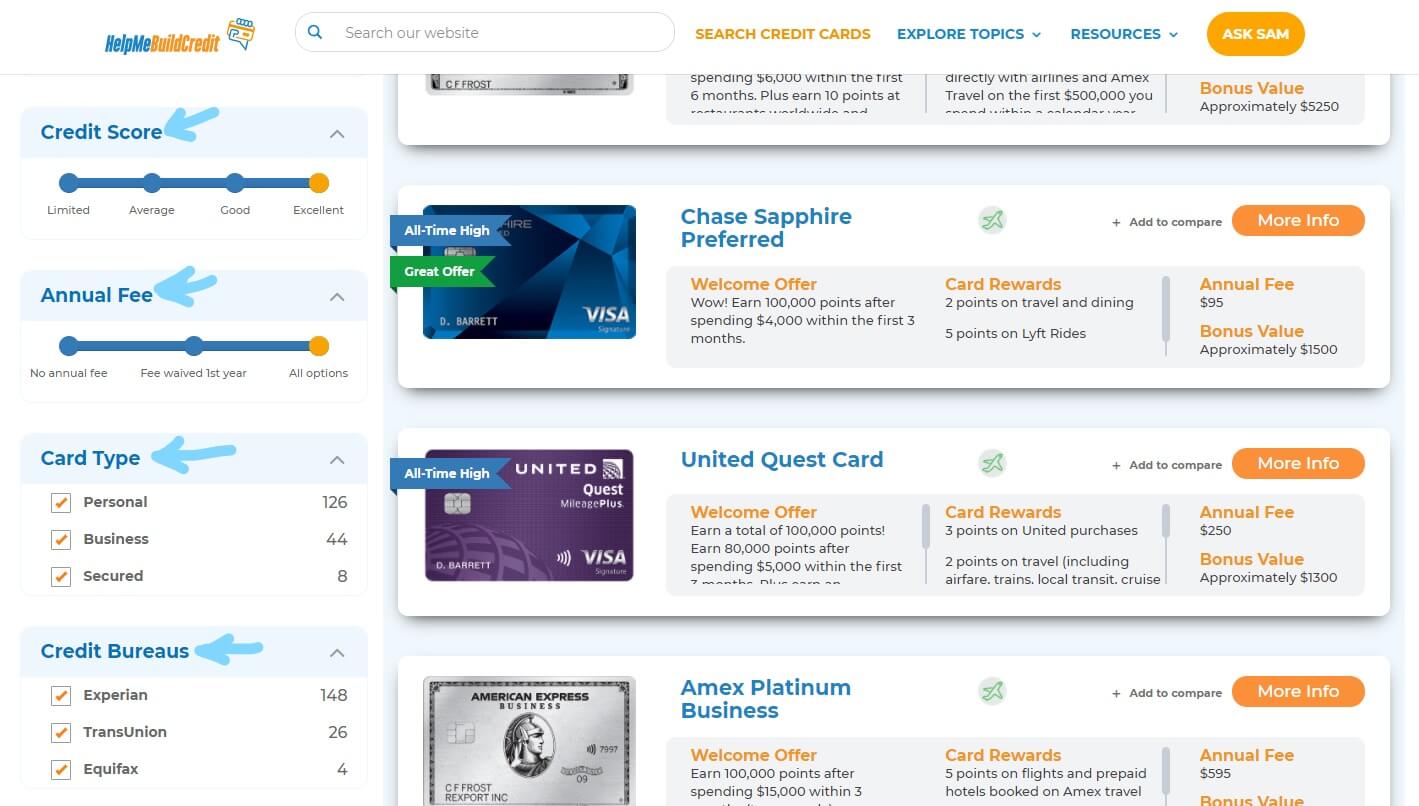

Now, we don’t just give you a list of credit cards and let you go figure out the options on your own. At HelpMeBuildCredit, you’ll find an extensive filtering feature.

Filter the credit cards by bank,

filter the cards by category,

and more options such as filtering the cards according to your credit score, their annual fees, type of cards, and according to credit bureaus.

So, you can nail down your card options to give you only the ones you are interested in. Your card choices can vary for multiple reasons. As mentioned in this post, you may be eligible for cards from certain banks and not others due to bank rules, you may need to apply for cards that pull credit from one specific credit bureau, you may want certain benefits to come along with your cards, you may need a card that works with the credit score you have, and so many other reasons.

HelpMeBuildCredit presents a platform that will customize your needs when it comes to choosing and applying for credit cards.

Find them all under one tab. Apply for as many as you can at once. You read the post, you now know how to.

I hope you did not find this post too complicated. Congratulations on mastering the skill of applying for multiple cards at the same time!

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

I applied for 2 Amex cards, in the same day and got approved for both but the second was 10k less than the fist 1

Love knowledge