Tax season is here. Were you hit with a huge, unexpected tax bill? Don’t freak out.

In this post, I’ll teach you how you can easily pay your tax bill slowly over the next 21 months – interest free!

It’s actually very simple. Pay your tax with a 0% APR card!

Spill the beans- what does 0% APR mean?

0% means 0%, which I believe you know. The term “APR” stands for Annual Percentage Rate, and it means the interest rate that you pay on your credit card.

If a person pays 24.99% interest on their credit card, then their credit card APR is 24.99%.

If a credit card has 0% APR then you pay 0% interest.

Hold it. How is that possible?

You’d think these credit card companies are smarter than that. Why would they offer 0% APR? What’s the catch?

The answer is that there is no catch. When a person gets an introductory 0% APR promo, they really don’t pay interest until the promo expires.

Why do the banks offer it?

The answer is a simple one. The way banks make money (lots and lots of it) is by charging interest. A great way to catch a fish (i.e. a customer) is by offering a 0% APR promo.

The idea is to get the people to spend freely and to rack up a bill.

While you’re spending all that money (knowing you have no interest rate) the bank is murmuring prayers. They hope that you won’t be able to pay up the balance when the offer expires and at that point, they’ll start raking it in (from the interest rates applied to your extremely high bill).

But you can outsmart the bank by being a savvy consumer and making sure to pay up the bill before the promo is up and you just walked away with a free loan for the past while.

Where can I find these great intro 0% APR cards?

We did the work for you! On our website you can find a list of 55 cards that currently have 0% APR all the way up to 21 months!

Check out the full list here. We will also list some of the best offers available now in the bottom of this post.

How to pay taxes with a credit card

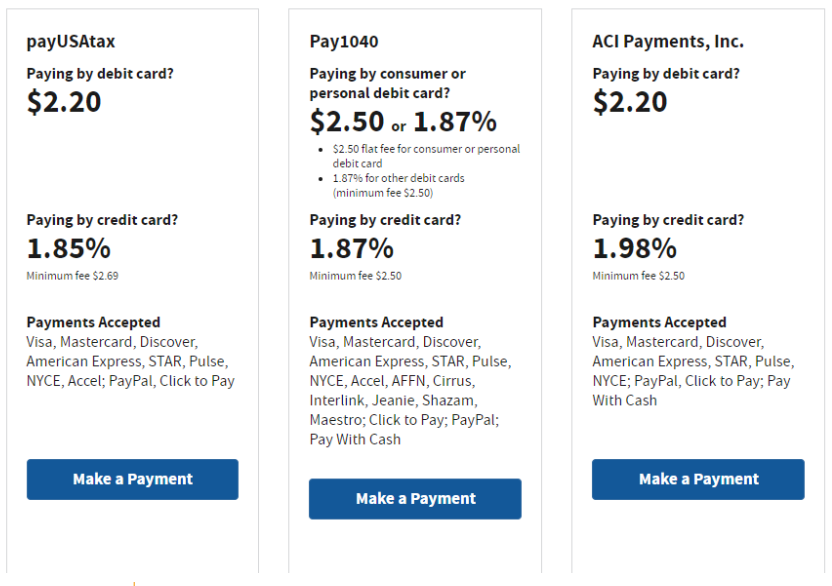

The IRS lists on their website the three third-party companies that you can pay your taxes to, using a credit card.

- Fee to pay with a credit card: 1.85%

- Accepts: Visa, MasterCard, Discover, Amex, Star, Pulse, Accel, PayPal

- Fee to pay with a credit card: 1.87%

- Accepts: Visa, MasterCard, Discover, Amex, Star, Pulse, NYCE

- Fee to pay with a credit card: 1.98%

- Accepts: Visa, MasterCard, Discover, Amex, Star, Pulse, NYCE, (digital wallets for Visa, MasterCard, and Amex) Paywithcash, Paynearme

- Note: ACI Payments doesn’t accept the Point debit card

Here are some additional options, not listed on the IRS website, to pay taxes with credit cards or debit cards.

Melio

- Fee to pay with a credit card: 2.9% (only business credit cards are accepted)

- Accepts: Visa, MasterCard, Discover, Amex (only business credit or debit cards, not personal)

Plastiq

- Fee to pay with a credit card: 2.85%

- Accepts: Visa, MasterCard, Discover, Amex

Are the payment processing fees tax deductible?

Payment processing fees are tax-deductible as a business expense for your business tax returns, but they are not deductible on your personal tax returns.

Top 11 credit cards for 0% APR

Let’s dive in and get you the top 11 cards with the longest 0% APR period. At the end you will also find a list of business credit cards that currently have Intro 0% APR.

21 months of 0% APR

1. Bank AmeriCard

Intro 0% APR offer: Intro 0% APR for 21 months on purchases and balance transfers (after that 16.24% to 26.24% variable).

Annual fee: $0

Credits limits approved for on this card as reported in our credit card database: $1,200-$16,000, with an average of $8,137

2. Wells Fargo Reflect Card

Intro 0% APR offer: Intro 0% APR for 21 months on purchases and balance transfers (after that 17.99% to 29.99% variable). The balance transfer fee is 5% or $5, whichever is greater.

Annual fee: $0

Credits limits approved for on this card as reported in our credit card database: $1,500-$50,000 with an average of $11,733

3. Citizens Bank Clear Value

Intro 0% APR offer: Intro 0% APR for 21 months on purchases and balance transfers (after that 18.24%, 22.24% or 26.24% variable).

Annual fee: $0

Credits limits approved for on this card as reported in our credit card database: $6,000-$25,000 with an average of $12,905

18 months of 0% APR

4. Bank Of America Customized Cash Rewards Credit Card

Intro 0% APR offer: Intro 0% APR for 18 months on purchases and balance transfers (after that 18.24% to 28.24% variable).

Annual fee: $0

Credits limits approved for on this card as reported in our credit card database: $400-$45,000, with an average of $10,665

5. Bank of America Travel Rewards Card

Intro 0% APR offer: Intro 0% APR for 18 months on purchases and balance transfers (after that 18.24% to 28.24% variable).

Annual fee: $0

Credits limits approved for on this card as reported in our credit card database: $500-$27,500 with an average of $12,335

6. Chase Slate Edge

Intro 0% APR offer: Intro 0% APR for 18 months on purchases and balance transfers (after that 19.24% to 27.99% variable).

Annual fee: $0

Credits limits approved for on this card as reported in our credit card database: $1,500-$12,000 with an average of $7,664

0% APR business cards

7. Ink Business Cash Credit Card

Intro 0% APR offer: Intro 0% APR for 12 months on purchases (after that 17.49% to 23.49% variable), plus you get 90,000 points after spending $6,000 within the first 3 months.

Annual fee: $0

Credits limits approved for on this card as reported in our credit card database: $3,000-$65,000 with an average of $17,620

8. Ink Business Unlimited® Credit Card

Intro 0% APR offer: Intro 0% APR for 12 months on purchases (after that 17.49% to 23.49% variable), plus you get 90,000 points after spending $6,000 within the first 3 months. On top of all this, the card earns an unlimited 1.5 points on all purchases!

Annual fee: $0

Credits limits approved for on this card as reported in our credit card database: $3,000-$100,000 with an average of $19,265

9. Blue Business Plus Credit Card from American Express

Intro 0% APR offer: Intro 0% APR for 12 months on purchases (after that 17.49% to 25.49% variable), plus you get 15,000 points after spending $3,000 within the first 3 months. Plus, you can earn 2 points on up to $50,000 spent annually, then 1 point.

Annual fee: $0

Credits limits approved for on this card as reported in our credit card database: $200-$35,000 with an average of $11,604

10. American Express Blue Business Cash Card

Intro 0% APR offer: Intro 0% APR for 12 months on purchases (after that 17.49% to 25.49% variable), plus you get $500 after spending a total of $15,000 within the first year. Plus, you can earn 2% cashback on up to $50,000 spent annually, then 1%.

Annual fee: $0

Credits limits approved for on this card as reported in our credit card database: $1,000-$35,000 with an average of $13,225

11. GM Business Card

Intro 0% APR offer: Intro 0% APR for 12 months on purchases (after that 18.24% to 28.24% variable).

Annual fee: $0

Credits limits approved for on this card as reported in our credit card database: $5,000-$40,000 with an average of $23,462

Some tips for applying

- If you get approved for one Bank of America card then do another one. Bank of America will only pull your credit once per 30 days and they will usually approve the second application.

- You can freeze Experian in order for Bank of America to pull Transunion.

- If you get approved for one Chase card then do a second one. Chase usually only pulls once per day and it’s very likely you will get approved for the second card.

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments