Travel is restricted, work gets busy, income is tight. These, and other factors, may make you regret opening the credit card (the one with the high annual fee) that you have in your wallet. It may not seem worth it for you to hold onto the credit card and keep paying the high annual fee, without racking in travel rewards to make up for this expense.

However, you despise closing the card for fear of hurting your credit.

Downgrading your credit card

Luckily, most credit card issuers offer an alternative option (other than closing the account) that helps get rid of a high annual fee that you don’t want to keep paying.

By downgrading your credit card to a credit card that has a lower annual fee or no annual fee, you save yourself that headache. Once you downgrade, you no longer have to pay the high annual fee on your credit card. You will only have to pay the annual fee of your new card, if there’s any at all.

Saving your credit fall

Even more so, in contrast to your score going a bit bad by closing an account, your credit will not be impacted negatively by downgrading to a lower annual fee card.

When you downgrade a card, nothing will change on your credit report. Your account will show on your credit report with the exact same credit history and the exact same credit limit as it did until now. Downgrading a credit card is just an internal product change that is done on the credit card issuer’s level. The credit bureaus will never know about it.

Additionally, no credit check is done when you product change or downgrade a card.

Con- impact on your rewards

Downgrading is mostly a great step to go for. What may be a downside is the way your rewards transfer to the new card. You will not lose your rewards by downgrading, but the value of the points and the point rules will adjust to match the value and the point rules of the card you’re downgrading to. For example, with the Chase Sapphire Preferred card, you have the option to transfer your points to an airline or hotel partner . But if you downgrade the card to the Freedom Unlimited then you will lose the option to transfer your points to an airline or hotel partner etc.

Welcome bonus while upgrading or downgrading

Welcome bonuses are usually only available for new cardholders. If you upgrade or downgrade a credit card, you will not receive a welcome offer (unless you are targeted for a special upgrade offer).

How long after downgrading will I get the annual fee back?

This depends bank by bank. Here are the details:

Amex: You will receive a prorated annual fee refund which will be divided by the days left within the cardmember year. But please note, you need to ask the representative to put in a prorated annual fee refund request, and, results can sometimes vary between each individual account.

Bank Of America: Officially, Bank of America annual fee refunds are on account by account bases, depending on your relationship with the bank. In real life, Bank of America will usually refund you the annual fee if you downgrade or close the card within 30-45 days.

Barclays: Downgrades are NOT guaranteed. They are only available upon eligibility – it’s recommended to ask for a supervisor as they may be able to do downgrades in some cases even if the front rep is not able to. If you downgrade or close a Barclays card within 60 days of when your annual fee was charged then Barclays will refund you the full annual fee amount.

Capital One: Capital One acts very strangely in regards to annual fee refunds. You can get an annual fee refund only if you close the card within 30 days of when the annual fee was charged. If you choose to downgrade the card then Capital One will not give you a refund for the annual fee even within the 30 days. Why they want you to close the card rather than downgrade it, I don’t know. But it’s important to note that Capital One very often offers an annual fee waiver if you agree to keep the card open as-is, and you have a perfect payment history. So it’s definitely worth asking for the waiver first.

It’s also important to note that with Capital One downgrades are not always available. They can be targeted for each account. Some cardholders are not able to downgrade their Capital One credit card.

Chase: You have 41 days to downgrade the card from when the annual fee has been billed for a full refund. If you downgrade after 41 days, you will usually (not always) get a prorated annual fee refund.

Citi: You have 60 days after the annual fee posted to your account to get a full refund. If you downgrade or close your Citi card after 60 days, you will get a prorated annual fee refund (in the past, the time frame was 30 days – some cardholders still report not getting a full refund past 30 days).

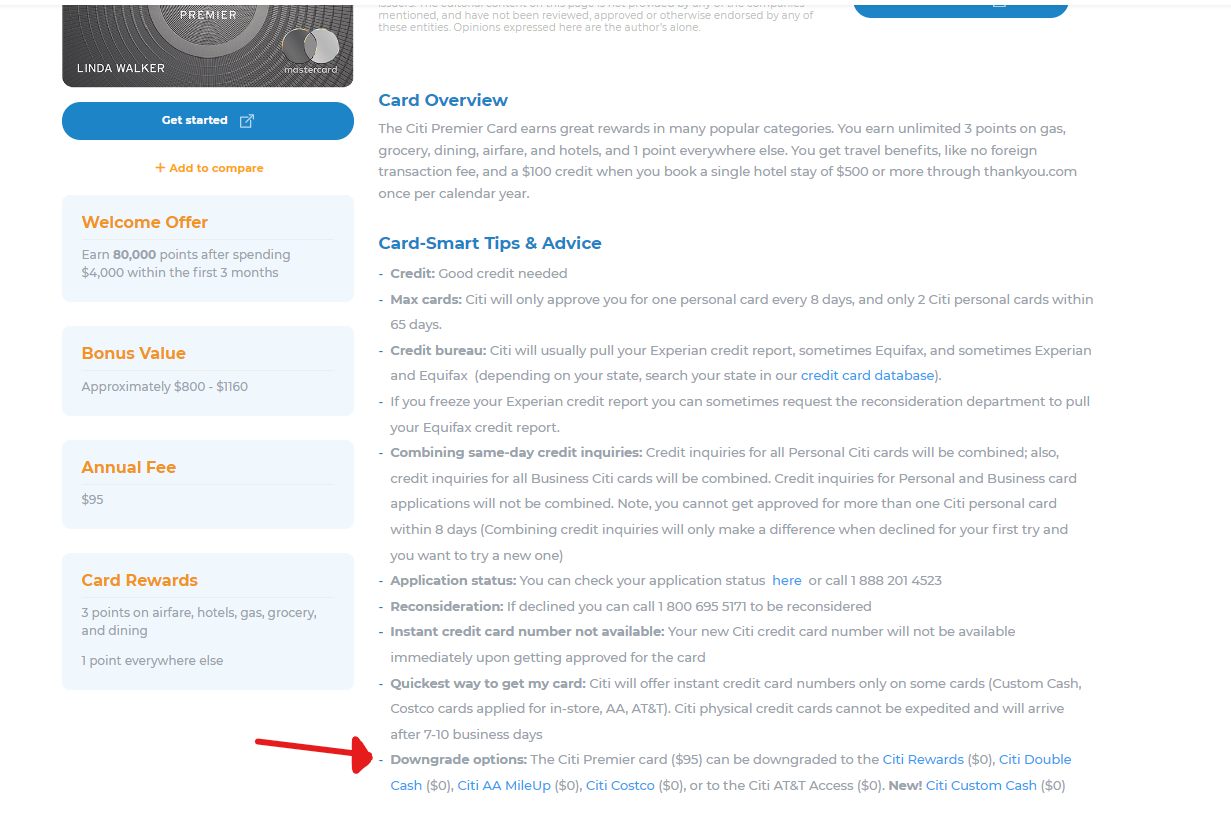

Which cards can I downgrade to?

On each of our credit card pages, we list the downgrade options under “Card Smart Tips And Advice”. If you’re looking to downgrade a card then hop over to that card page and check out your downgrade options.

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments