We find ourselves in a pandemic which seems to be sticking around for the foreseeable future.

Fatal tragedies aside, Covid-19 has taken our credit lines on a roll.

Credit card companies appear to be tightening their belts as about 50 million Americans have seen their credit card limits cut, or accounts closed altogether, over the last month.

A new study conducted by Lending Tree found that one in four credit cardholders have had their credit limits cut or their accounts closed within the last 30 days. According to the study, lenders have decided on this a month ago in order to protect against losses. The unemployment rate has skyrocketed and cardholders are unable to make their payments. Over 30 million Americans have filed unemployment claims over the last six weeks. Lenders foresighted this and have therefore reduced credit limits to avoid cardholders from biting off more than they can chew, which would cause debt.

Speaking of which, consumer debt is now over $14 trillion. The New York Federal Reserve says the $14.3 trillion figure through March has made a new high record. It is also a jump of just over one percent from the last quarter.

Will A Credit Limit Cut Effect Credit?

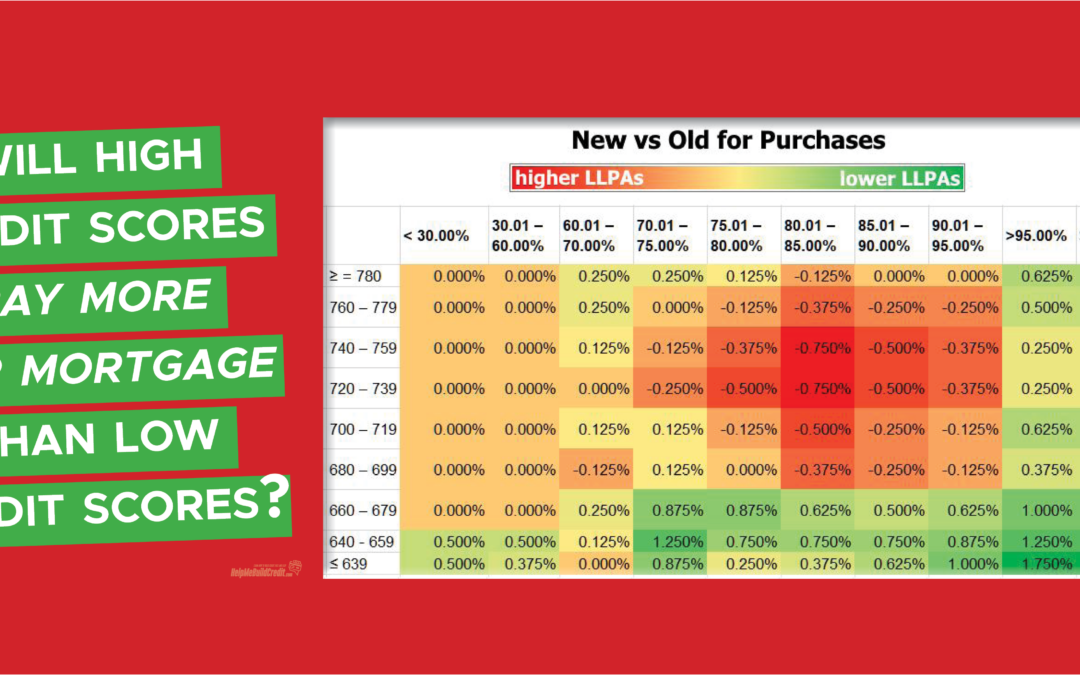

High credit limits do not help your credit score in anyway. And low credit limits do not effect credit scores in anyway. But, what you do want to keep in mind is “credit utilization”.

Credit utilization accounts for 30% of the FICO scoring model. We recommend keeping your credit utilization below 9% of your credit limit. So if you had your credit limit cut then make sure to lower your balances as well. But sometimes it can be a catch 20-20, and as you will lower your balances the bank will lower your credit limit (even more). But in the long run keeping your balances low will help you re-establish good credit scores which will ultimately help you gain back your credit limits.

If your credit cards were shutdown, it can possibly effect your credit score. Read more details here.

Stay safe!

![Finally Going Into Effect! Bank Can’t Take Away Your Points When Closing Your Credit Card [In New York]](https://helpmebuildcredit.com/wp-content/uploads/2023/11/post-on-new-law-that-can-redeem-points-90-days-affter-closure-1080x675.png)

![[Update] Great News! Most Medical Collections Will Be Removed From Credit Reports](https://helpmebuildcredit.com/wp-content/uploads/2022/03/post-on-medical-collections-news.png)

A Credit Limit Cut WILL Effect Credit because it WILL raise the credit utilization as it happened to me…