People are always asking me: Does closing a credit card hurt your credit?

Closing a credit card does not hurt your credit directly. But closing a credit card may hurt your credit indirectly.

Confused? Let’s explain…

How is your FICO score calculated?

First, let’s go back a step and explain how a Fico score is calculated.

A fico is score is calculated by the following:

- 35% Timely payments – paying all of your bills on time

- 30% Credit utilization – how much of your credit limit you spend (less than 9% preferred)

- 15% Credit history- for how long you have credit

- 10% Credit mix- the type of accounts you own

- 10% New credit- how many credit inquiries or new accounts you have

(For more on this, see: The 5 Most Important Factors In A FICO Score.)

A slight effect to your credit utilization

After understanding how a Fico score is calculated, you’ll realize that by closing a credit card you may be hurting your overall credit utilization (even if the fact that you closed a credit card is not a red flag on its own).

For example, let’s say you have four credit cards, each having a $5,000 credit limit (totaling $20,000.) You spend a total of $10,000 on your credit cards. Your overall credit utilization would be at 50% ($20,000 limit with $10,000 spent.) Now, by closing one credit card, your overall utilization would become 75% even without spending an additional dime ($15,000 limit with $10,000 spent). Credit utilization is calculated per card not overall. So your overall utilization should not have a major impact on your credit score. But, it might affect your credit score slightly as you are losing some of your overall available credit.

TIP: If you have a second card with the same bank, they may allow you to transfer the credit line to the other card, so this will save you this headache.

Losing credit history

If you’re closing your oldest credit card, then this may affect your credit history. How? You will be losing your oldest tradeline.

Though closed accounts still stay on your credit report for up to 10 years, Fico does not count positive credit history from closed cards into their scoring models after they are closed for 6 months or more (they might count it slightly but not the same as an open and active card).

For this reason, I always recommend that the first two or three credit cards that you open should be credit cards with no annual fees. As a result, you are able to keep them open for as long as you live.

Messing up your credit mix

It is beneficial to have five open trade lines with a mix of revolving loans (credit cards etc.) and installment loans (car loans, mortgages, etc.) By closing a credit card, you will be losing one of your active trade lines. This can hurt your credit.

Don't close a card within six months of applying for a mortgage

Please note, if you know that you will be applying for a mortgage in the next six months, I would never recommend closing a credit card as even the slightest effect in your credit score can end up costing you a lot of money in interest. I would recommend you rather wait till after the closing and only at that time you can consider closing the credit card.

Avoid paying an annual fee by downgrading

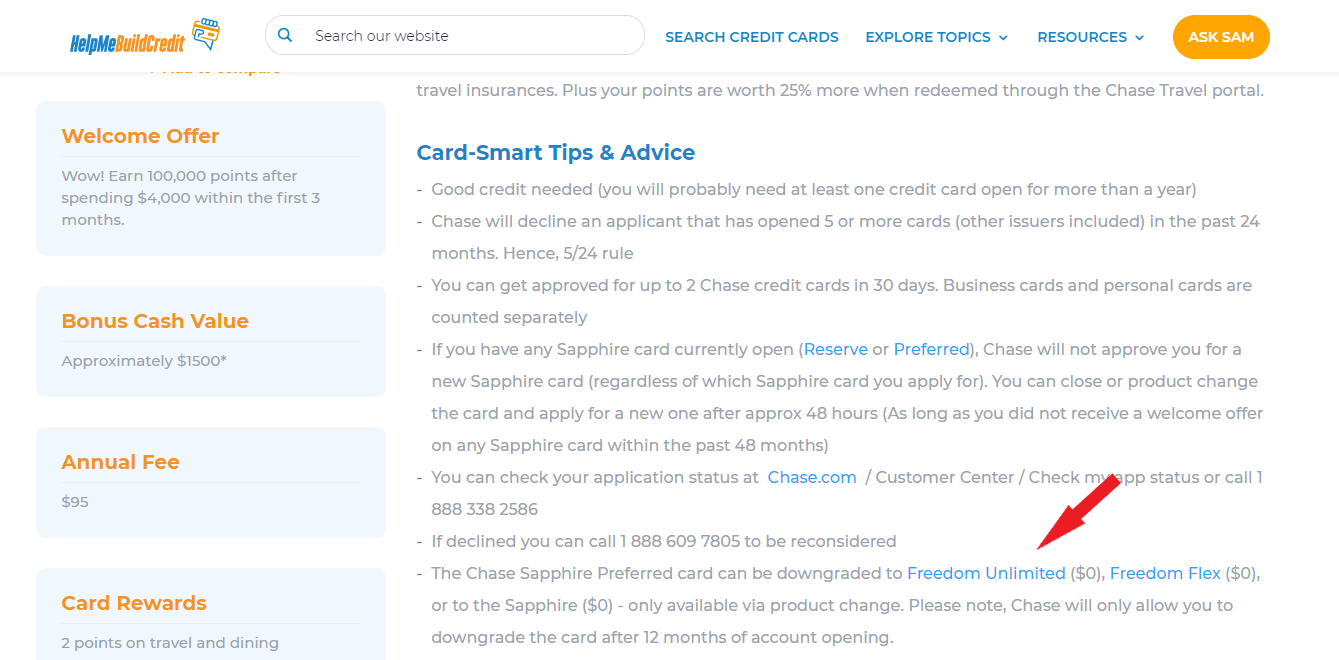

Is important to note that you do not necessarily have to close a card in order to avoid the annual fee. Most credit cards have the option to downgrade the card to a sister card that doesn’t come along with a high annual fee which will result in the credit card staying open but you will be able to avoid paying the annual fee.

You can check out credit card downgrade options on all of a credit card pages under “Card Smart Tips And Advice“

Conclusion

If you want to close a credit card, make sure to transfer the limit to another open credit card. Also, ensure that it is not one of your first three credit cards. Be careful to have five open trade lines at all times. If all of the above conditions are met, then closing a credit card won’t hurt your credit enough to make you poor.

If you’re closing a credit card, it is a great time to rethink the reason you opened the card in the first place. (Maybe it wasn’t the best credit card for you.) Need help choosing the right credit card? Hop over to our credit card page found here and let us help you choose the perfect credit card!

If you have any questions about anything discussed in this post please leave a comment and I will respond.

I’m an additional to someone on a card. At this point I don’t use the card but it is affecting my score, because the balance of the main user reflects on my score. Would you reccomend I close the card? Would it affect the main users credit?

I would recommend you getting off that card. It will not affect the primary in any way. Just please make sure to follow these steps

I have a credit card that I opened recently and it has a very low credit limit, could closing it actually help my score by improving my average age of accounts?

No. That’s not how it works