Citi has a very weird way of calculating eligibility for their welcome offers. With the current all-time-high offer on the Citi Premier card many people are interested to know if they are eligible for the offer in a case where they’ve already received an offer in the past.

In this post, we’ll go through the details of how exactly Citi calculates welcome offer eligibility.

The terms

On Citi’s website, you find the following terms for the welcome bonus on the Citi Premier card:

“Bonus ThankYou® Points are not available if you received a new cardmember bonus for Citi Rewards+®, Citi ThankYou® Preferred, Citi ThankYou® Premier/Citi Premier® or Citi Prestige®, or if you have closed any of these accounts, in the past 24 months.”

Here’s an explanation of the terms.

Card family

Citi will only give you a new welcome bonus on one single card from the ThankYou card family within 24 months. The ThankYou card family consists of the following cards: Citi Rewards, Citi ThankYou, Citi Preferred, Citi Premier, and Citi Prestige. So in order to be eligible for a new welcome bonus you need to make sure you did not receive a welcome offer on any of these cards within the past 24 months.

In general, I recommend not to earn a welcome bonus on one of the lower-end Citi ThankYou cards so that you don’t hinder your eligibility for a bonus on the Citi Premier card. For example, the Citi Rewards card currently offers a welcome bonus of 20,000 points while the Citi Premier card offers a bonus of 80,000 points. So make sure not to ruin your eligibility for the 80k offer by getting a welcome bonus on the Citi Rewards card (of only 20k points).

Closing an account will reset the clock

Citi terms also state that if you closed any card from the ThankYou family (Citi Rewards, Citi ThankYou, Citi Preferred, Citi Premier, or Citi Prestige) within 24 months, then you are not eligible for a welcome bonus. What that basically means is that closing any card from the ThankYou family (Citi Rewards, Citi ThankYou, Citi Preferred, Citi Premier, or Citi Prestige) will reset the clock and will make you ineligible for a bonus for the next 24 months.

Downgrading a card

If you downgrade a card within the Citi ThankYou family (Citi Rewards, Citi ThankYou, Citi Preferred, Citi Premier, or Citi Prestige) then based on Citi terms, you will still be eligible to receive a welcome bonus. In most cases, I do not see people having an issue after downgrading. In some rare cases a downgrade can be flagged in Citi’s system as a closure and cause you to be ineligible for a welcome bonus for the next 24 months (I personally only saw this happen once).

So to sum it up

So the way it works with Citi is that in order to be eligible for a welcome bonus you need to pass the following two rules:

- Not have earned a welcome bonus on any card within the Citi Thankyou family (Citi Rewards, Citi ThankYou, Citi Preferred, Citi Premier, or Citi Prestige) within 24 months

- Not have closed any credit card within the ThankYou family within 24 months

If you had never earned a welcome bonus on a credit card in the Citi ThankYou family (Citi Rewards, Citi ThankYou, Citi Preferred, Citi Premier, or Citi Prestige) or, earned the welcome bonus passed 24 months and the card is still open then you are eligible to receive a new welcome bonus

- Even for the exact same card (Citi allows you to have two of the same cards)

- Even if you opened a Citi card within the past 24 months but did not receive a welcome bonus

- Even if you downgraded the card (in most cases)

How to check if you're eligible for the welcome bonus?

Unfortunately, Citi does not have a popup like Amex does to notify you if you are yes or not eligible. You will need to do the leg work yourself. You can try to check back on your credit statements to find the month you earned the welcome bonus or chat with a Citi rep to help you with the dates.

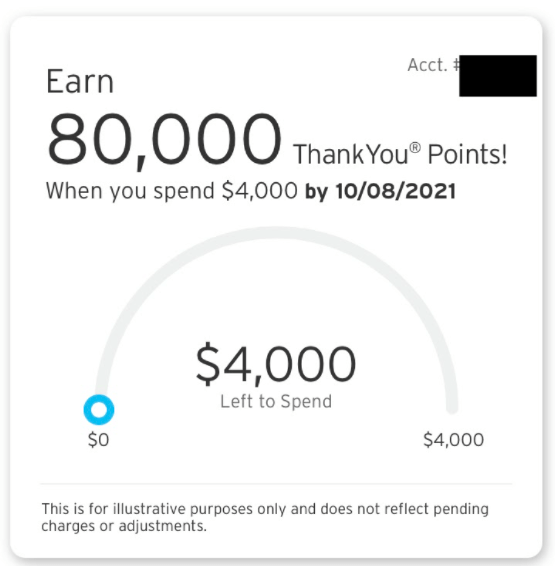

Once you’re approved for the Citi Premier card you can double-check with a rep to make sure you were eligible for the bonus or you can look for the welcome bonus tracker after you login to the Citi website or app (screenshot below). If the welcome offer tracker shows up then that will mean you’re eligible for the welcome bonus.

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments