In 2017 Chase released a free, credit monitoring service called Chase Credit Journey. A credit monitoring service is a platform that allows you to review and keep tabs on your credit report and score.

Why would you want to keep tabs on your credit report and score, you ask? It’s because your credit report and score are what affects the way banks look at you when you apply for a credit card, mortgage, or loan, and these are things you keep bumping into, whether you like it or not.

So yes, it’s important to often check in on your credit report.

Knowing that, is Chase Credit Journey an accurate enough platform to help you do so?

What is Chase Credit Journey?

Chase Credit Journey is a tool Chase offers that lets you view and monitor your credit report and credit score.

They get all your credit information from Experian, one of the 3 well-known credit bureaus.

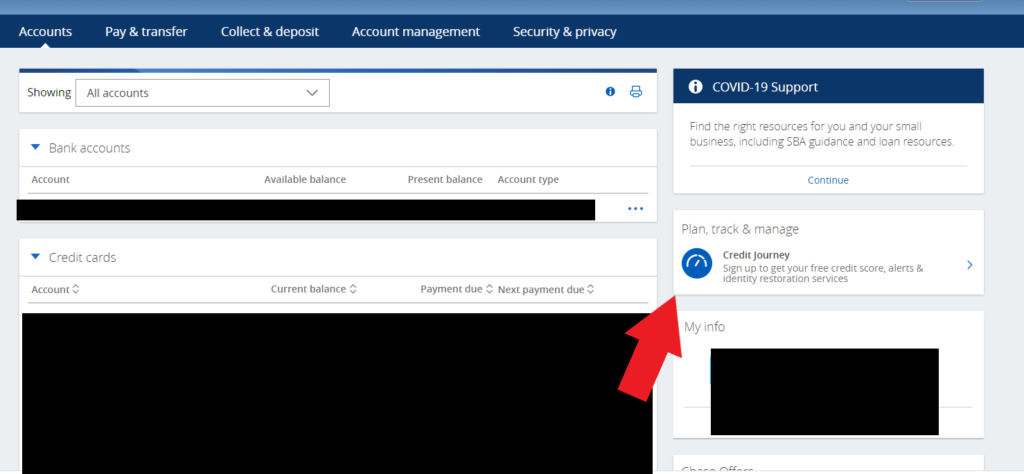

Chase Credit Journey is set up as an online account which you can find by either visiting the link at Chase Credit Journey or, if you already have a Chase online account, by accessing the tool from there, or by getting onto your Chase banking mobile app.

You get to create your own account by setting up a username and password.

You can keep logging in to view and review your credit report and score, which will update on a weekly basis.

Chase Credit Journey Benefits

Besides for your credit report and score, Chase Credit Journey has additional features, listed below.

- You get to see your Vantage 3.0 credit score and the factors that make up your credit score. More on your Vantage score soon.

- You get to see your credit information, such as open accounts, closed accounts, inquiries, collections, delinquencies, and more; the type of information you’d typically find on a credit report. These are all factors that are part of your credit report which affect your score. Keep in mind, your credit details will not be displayed in a formal credit report on Chase Credit Journey.

- You are alerted by an email or notification any time there’s a change to your report, to keep identity theft away. Such as if an account is added to your report, your name is changed on the report, your address is changed on your report, a hard inquiry is made, a new collection or late payment, etc. These alerts may be helpful in terms of your credit safety to insure no stranger gets their hands on your credit and that no error is made. You can turn alerts off or personalize them to only alert you for activities you choose to be notified of.

- There is a score simulator tool that you can play around with to see what would happen to your score “if” and “when” you’d do any specific credit activity, such as apply for a new credit card, pay off a balance, increase a credit limit, miss a payment, etc. The way it works is you pick a credit action, for example, apply for a new card. The simulator will then calculate how much of an effect that would have on your score and throw back your predicted credit score. Based on that, you can decide if to go ahead with the action or not. It’s a tool we’d love to have in all aspects of our life:) Users have reported that the simulator is not set in stone and the system can stall or be way off with the scores, and Chase has a disclaimer that the tool is not to be relied on. However, it’s a nice tool to have to get a general idea of how your credit score will turn out if…

- Chase offers a vast array of credit resources to help all consumers, from the credit beginner to the credit pro. You can find credit-related topics such as how to build credit, how to apply for credit cards, and other financial articles. Users report this being very helpful.

- Last but not least, credit card suggestions are offered to you. Credit cards that would work for you based on your credit report are suggested to you by the system. Keep in mind, all credit card suggestions will be issued from Chase so if you need unbiased credit card proposals, check out our credit card finder to help you pick from the hundreds of cards available from other issuers.

These are good features but beware. Chase Credit Journey is not always smooth sailing and may stall, provide random scores, and not update properly. Disclaimer so you know what you’re in for.

Do I have to be a Chase customer to use Chase Credit Journey?

Now that we’ve explored the features, I may have wet your appetite.

That’s good because there’s nothing standing in your way. Chase Credit Journey is open to everyone. Come one call all!

You do not have to be a previous Chase customer to create a Chase Credit Journey account, and you don’t have to become one either. This is a major advantage to Chase Credit Journey.

To sign up if you are not a Chase customer, you can visit https://www.chase.com/personal/credit-cards/chase-credit-journey to create your account. If you are a pre-existing Chase customer, you can log on to your online Chase account or to the Chase mobile banking app, and head over to Check Credit Score/Chase Credit Journey to get into the platform. If you’re a Chase business customer only though, you can log on to your Chase Credit Journey account through the desktop version only.

Is Chase Credit Journey free?

More than being available to one and all, by opening an account with Chase Credit Journey you stand no loss because it is completely free! Free to sign up for and free to use. It’s even free if you choose to stop using it.

Looks like Chase, the big bank and huge financial institution, has its many other ways to earn revenue and doesn’t rely on earning back from this nice, little credit monitoring platform.

Are the scores on Chase Credit Journey accurate?

As a society, when a product or item is offered free, some of us tend to either stay away from it, or, others take it but stay on high alert. Our suspiciousness in a windfall is just too big. Too good to be true?

Chase Credit Journey seems all nice and dandy, but are the credit scores it provides accurate? Can you rely on it as you do on your car speedometer?

To get an answer to that, I’ll start by saying that the scoring model Chase Credit Journey uses to produce your score is Vantage 3.0.

There are two well-known scoring models used; Fico and Vantage. Scoring models are companies that take your credit information; think personal info, accounts, credit history, balances, payments, etc., and they use it to calculate and create your credit score.

Fico and Vantage are similar scoring models, yet not the same. The information they use to calculate your credit score differs.

Of the two, Fico is used way more and gained way more popularity amongst lenders. When you apply for a card or loan, most of the time, the lender will be using your Fico score to check you out before making an approval decision. As a matter of fact, Fico reports that 90% of top lenders use them over Vantage.

The fact that Chase Credit Journey uses your Vantage score, lessens the accuracy of the credit score you get there. It is somewhat true, but it is not the credit score that’ll get used to approve or decline you for new credit lines, mortgages, or loans.

However, everything besides for your actual score; your credit history, account details, derogatories, etc, is true, because it originates from Experian.

The credit bureaus; Experian, Transunion, and Equifax, are the ones that collect credit information from every consumer and hand it over to the scoring models.

Chase Credit Journey gets the credit scores from Vantage, but the actual information on your credit report they get directly from Experian. Experian is trusted since it’s one of the credit bureaus, so we can safely know that the credit report displayed on your Chase Credit Journey portal is all accurate.

Subscribe for more great credit content.

Which credit report is Chase Credit Journey based on?

Chase Credit Journey recently transitioned from using Transunion as the credit bureau and is now using Experian.

For most users, this already changed. If you use Chase Credit Journey and notice they’re still basing it on Transunion for your stuff, it should be updating properly soon.

How often does Chase Credit Journey update?

Because our credit reports and scores are so crucial to our financial part of our lives, just like coffee is, we need to have it as up-to-date as possible! Your credit report will update in real-time, meaning if you apply for a credit card, a hard inquiry shows up on your report. But you will only see these updates reflect on Chase Credit Journey once every 7 days. You got that, on a weekly basis. Hmm, is that often enough…?

Is Chase Credit Journey good or bad, recommended or not?

Good question.

As a credit monitoring tool, it’s good. It’s free, it gives you access to your credit report, and gives you an about-credit score.

It offers some great, and fun features such as the score simulator, credit resources, recommendations, and alerts. So on that front, it is recommended.

But, there is some bad to it. Ok, it’s not bad, but has some disadvantages. For one, we mentioned the credit score is inaccurate, being produced by Vantage. And second, the features are good but not all are oiled well; The simulator can often freeze or decide not to calculate a predicted score or throw back a random score, and card recommendations will only propose Chase credit cards.

In addition, Chase Credit Journey is based on only 1 out of the 3 credit bureaus. That gets you some place, but since each credit bureau reports a bit more or a bit less than its partner, you’re not getting The Full picture from one credit bureau.

Also, Chase Credit Journey updates once a week. We’ve got other credit monitoring services that update daily! You can literally clock in every morning with those. So why go for the weekly??

However, if those disadvantages don’t stand in your way, go for it! After all, the good of it is still really good.

Chase Credit Journey Alternatives

If not all is hunky-dory back with Chase Credit Journey, are there any other, free, credit monitoring options out there for someone who’d like another option?

There sure are other free options, let’s check it out.

Credit Karma

With over 60 million users, Credit Karma is for sure the “Kleenex tissues” when it comes to viewing and monitoring your credit report for free. They also provide you with great personal tips and tools for how you can improve your credit.

Pros

- Free credit report from two of the three credit bureaus

- Updates every 7 days

- They will send you an email with real-time alerts when there are changes to your Equifax, or TransUnion credit report. For example, a new credit inquiry, etc.

Cons

- The free credit score is Vantage 3.0 that is rarely used in credit decisions.

Wallet Hub

Wallet Hub is the only free credit report website that provides updates on your credit report every single day. They will also give you personal tips and tools on how to improve your credit score.

Pros

- Updates every day

- They will send you an email alert and text message alerts when there are changes on your Transunion credit report.

Cons

- They only have your Transunion credit report.

- The free credit score is Vantage 3.0 which is rarely used in credit decisions.

- It’s a bit of an outdated website.

Freecreditscore.com

Freecreditscore.com is part of the Experian Company and you can view your Experian credit report and FICO credit score for free.

Pros

- You will get email alerts whenever there is a change to your Experian credit report for free.

- Free Fico 8 score

Cons

- It’s only updated once in 30 days.

- You can only view your Experian credit report.

Nerd Wallet

Nerd wallet is a very nice and updated website that has very good and advanced tools that will help you improve your credit score.

Pros

- Real-time credit change alerts

- Updates every 7 days

Cons

- They only have your Transunion credit report.

- The free credit score is Vantage 3.0 which is rarely used in credit decisions.

Credit Sesame

Credit Sesame is the only free credit monitoring that also offers a free insurance plan which they claim will refund you up to $100,000 if you’re a victim of identity theft.

- They will send you an email alert on any changes to your Transunion credit report.

- Updates every 7 days

- Free $50,000 identity theft protection is included in the free plan.

- They only have your Transunion credit report.

- The free credit score is Vantage 3.0 which is rarely used in credit decisions.

- Only updates once every 30 days.

I have to disagree. I have pulled Chase and my Experian report. They say they are pulling from Experian. Expeeian is 35 points higher so they aren’t updating something. Now Credit one has monitoring and the credit scores match. So I do not understand why Chase is lagging. I doubt it isn’t because they aren’t updated because any inquiry alerts from them are prompt.

The reason why you are seeing a difference in score is because Chase Credit Journey uses a different scoring model than Experian. Credit Journey uses the Vantage score model 0.3 while Experian gives you several FICO score models. You can check out our p[ost where we discuss the different scoring models here

Chase credit journey is not that accurate. Currently it is showing 1 late payment in my credit report when Experian, transunion, and Equifax all showed no late payment in my account. I know for a fact that I have no late payment.